This is “The Selection of a Cost Flow Assumption for Reporting Purposes”, section 9.2 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

9.2 The Selection of a Cost Flow Assumption for Reporting Purposes

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Appreciate that reported inventory and cost of goods sold balances are not intended to be right or wrong but rather in conformity with U.S. GAAP, which permits the use of several different cost flow assumptions.

- Recognize that three cost flow assumptions (FIFO, LIFO, and averaging) are particularly popular in the United States.

- Understand the meaning of the LIFO conformity rule and realize that use of LIFO in the United States largely stems from the presence of this tax law.

- Know that U.S. companies prepare financial statements according to U.S. GAAP but their income tax returns are based on the Internal Revenue Code so that significant differences often exist.

Presenting Inventory Balances Fairly

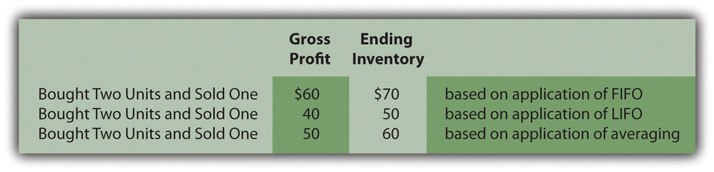

Question: FIFO, LIFO, and averaging can present radically different portraits of identical events. Is the gross profit for this men’s clothing store really $60 (FIFO), $40 (LIFO), or $50 (averaging) following the sale of one blue dress shirt? Analyzing inventory numbers presented by most companies can be difficult if not impossible without understanding the implications of the cost flow assumption that was applied. Which cost flow assumption is viewed as most appropriate in producing fairly presented financial statements?

Answer: Because specific identification reclassifies the cost of the actual unit that was sold, finding theoretical fault with that approach is difficult. Unfortunately, specific identification is nearly impossible to apply unless easily distinguishable differences exist between similar inventory items. For a vast majority of companies, that leaves FIFO, LIFO, and averaging. Arguments over their merits and their problems have raged for decades. Ultimately, information in financial statements must be presented fairly based on the cost flow assumption that is utilized.

In a previous chapter, an important clarification was made about the report of the independent auditor. It never assures decision makers that financial statements are “presented fairly.” That is a hopelessly abstract concept like truth and beauty. Instead, the auditor states that the statements “present fairly…in conformity with accounting principles generally accepted in the United States of America.” That is a substantially more objective standard. Thus, for this men’s clothing store, all the numbers in Figure 9.4 "Results of Possible Cost Flows Assumptions Used by Clothing Store" are presented fairly but only in conformity with the specific cost flow assumption that was applied.

Figure 9.4 Results of Possible Cost Flows Assumptions Used by Clothing Store

Most Popular Cost Flow Assumptions

Question: Since company officials are allowed to select a cost flow assumption, which of these methods is most typically found in the financial reporting of companies operating in the United States?

Answer: To help interested parties gauge the usage of various accounting methods and procedures, a survey is carried out annually of the financial statements of 500 large companies. The resulting information allows accountants, auditors, and decision makers to weigh the validity of a particular presentation. For 2009, this survey found the following frequency for the various cost flow assumptions. Some companies actually use multiple assumptions: one for a particular portion of its inventory and a different one for the remainder. Thus, the total here is above 500 even though 98 of the surveyed companies did not report having inventory or mention a cost flow assumption (inventory was probably an immaterial amount). As will be discussed later in this chapter, applying multiple assumptions is especially common when a U.S. company owns subsidiaries that are located internationally.

| Inventory Cost Flow Assumptions—500 Companies SurveyedMatthew C. Calderisi, senior editor, Doug Bowman, senior technical manager, and David Cohen, developmental editor, Accounting Trends & Techniques, 64th edition (New York: American Institute of Certified Public Accountants, 2010), 169. | |

|---|---|

| First-in, First-out (FIFO) | 325 |

| Last-in, First-out (LIFO) | 176 |

| Averaging | 147 |

| Other | 18 |

Interestingly, individual cost flow assumptions tend to be more prevalent in certain industries. In this same survey, 92 percent of the financial statements issued by food and drug stores made use of LIFO whereas only 11 percent of the companies labeled as “computers, office equipment” had adopted this same approach. This difference is likely caused by the presence of inflation or deflation in those industries. Prices of food and drugs tend to escalate consistently over time while computer prices often fall as technology advances.

The LIFO Conformity Rule

Question: In periods of inflation, FIFO reports a higher gross profit (and, hence, net income) and a higher inventory balance than does LIFO. Averaging presents figures that normally fall between these two extremes. Such results are widely expected by the readers of financial statements who understand the impact of the various cost flow assumptions.

In the United States, all of these methods are permitted for financial reporting. Why is FIFO not the obvious choice for every organization that anticipates inflation in its inventory costs? Officials must prefer to report figures that make the company look stronger and more profitable. With every rise in prices, FIFO shows a higher income because the earlier (cheaper) costs are transferred to cost of goods sold. Likewise, FIFO reports a higher total for ending inventory because the later (higher) cost figures are retained in the inventory T-account. The company is no different physically as a result of this decision but FIFO makes it look better. Why does any company voluntarily choose LIFO, an approach that reduces reported income and total assets when prices rise?

Answer: LIFO might well have faded into oblivion because of its negative impact on key reported figures (during inflationary periods) except for a U.S. income tax requirement known as the LIFO conformity ruleA United States income tax rule that requires LIFO to be used for financial reporting purposes if it is adopted for taxation purposes.. Although this tax regulation is not part of U.S. GAAP and looks rather innocuous, it has a huge impact on the way inventory and cost of goods sold are reported in this country.

If costs are increasing, companies prefer to apply LIFO for tax purposes because this assumption reduces reported income and, hence, required cash payments to the government. In the United States, LIFO has come to be universally equated with the saving of tax dollars. When LIFO was first proposed as a tax method in the 1930s, the United States Treasury Department appointed a panel of three experts to consider its validity. The members of this group were split over a final resolution. They eventually agreed to recommend that LIFO be allowed for income tax purposes but only if the company was also willing to use LIFO for financial reporting. At that point, tax rules bled over into U.S. GAAP.

The rationale behind this compromise was that companies were allowed the option but probably would not choose LIFO for their tax returns because of the potential negative effect on the figures reported to investors, creditors, and others. During inflationary periods, companies that apply LIFO do not look as financially healthy as those that adopt FIFO. Eventually this recommendation was put into law and the LIFO conformity rule was born. It is a federal law and not an accounting principle. If LIFO is used on a company’s income tax return, it must also be applied on the financial statements.

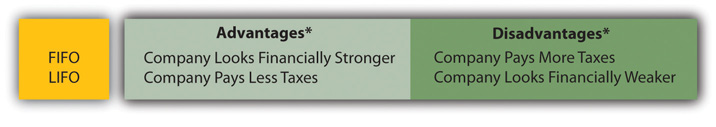

However, as the previous statistics on usage point out, this requirement did not prove to be the deterrent that was anticipated. Actual use of LIFO has remained popular for decades. For many companies, the money saved in income tax dollars more than outweighs the problem of having to report numbers that make the company look weaker. Figure 9.5 "Advantages and Disadvantages of FIFO and LIFO" shows that both methods have advantages and disadvantages. Company officials must weigh the options and make a decision.

As discussed later in this chapter, IFRS does not permit the use of LIFO. Therefore, if IFRS is ever mandated in the United States, a significant tax advantage will be lost unless the LIFO conformity rule is abolished.

Figure 9.5 Advantages and Disadvantages of FIFO and LIFO

*Assumes a rise in prices over time.

Test Yourself

Question:

The Cucina Company buys and sells widgets in a highly inflationary market. Prices tend to go up quickly. An analyst is studying the company and notes that LIFO has been selected as the company’s cost flow assumption. Which of the following is not likely to be true?

- Cost of goods sold will come closest to reflecting current costs.

- The inventory balance will be below market value for the items being held.

- The company will have more cash because tax payments will be lower.

- Net income will be inflated.

Answer:

The correct answer is choice d: Net income will be inflated.

Explanation:

With LIFO, the latest costs are moved to cost of goods sold; thus, this expense is more reflective of current prices. These costs are high during inflation so the resulting gross profit and net income are lower. That allows the company to save tax dollars since payments are reduced. The earliest (cheapest) costs remain in inventory, which means this asset is reported at below its current value. LIFO, during inflation, is known for low inventory costs, low income, and low tax payments.

Two Sets of Books

Question: The LIFO conformity rule requires companies that apply LIFO for income tax purposes to also use that same cost flow assumption in conveying financial information to investors and creditors. Are the balances submitted to the government for income tax purposes not always the same as that presented to decision makers in a set of financial statements? Reporting different numbers to different parties seems unethical.

Answer: In both jokes and editorials, businesses are often derisively accused of “keeping two sets of books.” The implication is that one is skewed toward making the company look good (for external reporting purposes) whereas the other makes the company look bad (for taxation purposes). However, the existence of separate accounting records is a practical necessity. One set is based on applicable tax laws while the other enables the company to prepare financial statements according to U.S. GAAP. With two different sets of rules, the outcomes have to look different.

In filing income taxes with the United States government, a company must follow the regulations of the Internal Revenue Code.Many states and some cities also charge a tax on income. Those governments have their own unique set of laws although they often resemble the tax laws applied by the federal government. Those laws have several underlying objectives that influence their development.

First, income tax laws are designed to raise money for the operation of the federal government. Without adequate funding, the government could not provide hospitals, build roads, maintain a military and the like.

Second, income tax laws enable the government to help regulate the health of the economy. Simply by raising or lowering tax rates, the government can take money out of the economy (and slow public spending) or leave money in the economy (and increase public spending). For example, in a recent year, a significant tax break was passed by Congress to aid first-time home buyers. This move was designed to stimulate the housing market by encouraging individuals to consider making a purchase.

Third, income tax laws enable the government to assist certain members of society who are viewed as deserving help. For example, taxpayers who encounter high medical costs or casualty losses are entitled to a tax break. Donations conveyed to an approved charity can also reduce a taxpayer’s tax bill. The rules and regulations were designed to provide assistance for specified needs.

In contrast, in the United States, external financial reporting is governed by U.S. GAAP, a system designed to achieve the fair presentation of accounting information. That is the reason U.S. GAAP exists. Because the goals are different, financial data reported according to U.S. GAAP will not necessarily correspond to the tax figures submitted by the same company to the Internal Revenue Service (IRS). At places, though, agreement can be found between the two sets of rules. For example, both normally recognize a cash sale of merchandise as revenue at the time of sale. However, many differences do exist between the two. A loss on the sale of an investment in equity securities is just one example of a transaction that is handled quite differently for taxes and financial reporting.

Although separately developed, financial statements and income tax returns are tied together at one significant spot: the LIFO conformity rule. If a company chooses to use LIFO in filing its United States income tax return, it must do the same for financial reporting. Without that legal requirement, many companies would likely use FIFO in creating their financial statements and LIFO for their income tax returns. Much of the popularity of LIFO is undoubtedly derived from this tax requirement rather than from any theoretical merit.

Key Takeaway

Information found in financial statements is required to be presented fairly in conformity with U.S. GAAP. Because several inventory cost flow assumptions are allowed, reported numbers can vary significantly from one company to another and still be appropriate. FIFO, LIFO, and averaging are all popular in the United States. Understanding and comparing financial statements is quite difficult without knowing the implications of the method selected. LIFO, for example, tends to produce low net income figures in a period of inflation. This cost flow assumption probably would not be used extensively except for the LIFO conformity rule. That tax law prohibits the use of LIFO for tax purposes unless also applied on the company’s financial statements. Typically, financial reporting and the preparation of income tax returns are unrelated because two sets of rules are used with radically differing objectives. However, the LIFO conformity rule joins these two at this one key spot.