This is “End-of-Chapter Exercises”, section 8.6 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

8.6 End-of-Chapter Exercises

Questions

- A company reports that it holds inventory with a cost of $397,000. What is meant here by the term “cost?”

- At the end of the current year, the Waxhall Corporation paid $12,400 in connection with the acquisition of several pieces of inventory. This cost was capitalized when it should have been expensed. What is the impact of this misstatement on the company’s financial statement totals?

- What is a cash discount? Why does a company offer a cash discount?

- What is meant by the term “3/10, n/30?”

- When offered a cash discount, why is a buyer likely to take advantage of this opportunity?

- How do cash discounts impact the reported value of inventory?

- What is a perpetual inventory system? What is an advantage of using a perpetual system?

- What is a periodic inventory system? What is an advantage of using a periodic system?

- What is meant by the term “FOB point?”

- The Allen Company sold $4,000 in inventory to the Gracie Company. Unfortunately, the goods were destroyed in a wreck while being delivered. Which company suffered this loss?

- When does ownership transfer if transfer documents specify “FOB shipping point?”

- When does ownership transfer if transfer documents specify “FOB destination?”

- One company records its inventory using a perpetual system. Another company records its inventory using a periodic system. Other than the journal entries that are made, what differences are found between the two systems?

- The Birgini Company buys one unit of inventory for $77 in cash. This item is later sold for $109 on credit. What journal entry or entries are made at the time of sale if a perpetual inventory system is used? What journal entry or entries are made at the time of sale if a periodic inventory system is used?

- The Westmoreland Corporation uses a periodic system for its inventory. The company starts the current year with inventory costing $177,000. During the year, an additional $387,000 is paid for inventory purchases and $17,000 for transportation costs to get those items. A physical count at the end of the year finds $145,000 of ending inventory. How was each of these numbers derived? What is the company’s cost of goods sold?

- In question 15, what year-end adjusting entry is needed?

- The Alberta Corporation maintains a perpetual inventory system but only keeps track of the number of units of inventory. The company actually makes its journal entries as is done in a periodic system. What is the reason for adopting this approach?

- In accounting for inventory, what is meant by purchase value? How can a drop in the purchase value of inventory force the company to change the reported figure?

- In accounting for inventory, what is meant by sales value? How can a drop in the sales value of inventory force the company to change the reported figure?

- What types of companies would be most likely to have reductions to report in connection with the application of lower of cost or market?

- Why would a company that uses a perpetual inventory system still perform a physical inventory count?

- The Sharon Company recently estimated its inventory holdings. What are possible reasons for making this type of estimation?

True or False

- ____ A company should include the amount spent to transport an inventory item to its store when determining the reported cost of that item.

- ____ In a periodic inventory system, an increase is made in the Inventory T-account if money is paid for the transportation to receive the items.

- ____ In a perpetual inventory system, transportation costs to receive inventory is handled in the same manner by a company as delivery costs paid to get the item to a customer.

- ____ Inventory is bought for $600 on terms of 2/10, n/60. Thus, if payment is made in 10 days, the buyer only has to pay $540.

- ____ Buyers frequently choose not to take advantage of purchase (cash) discounts because the amount that is saved is so small.

- ____ In a perpetual system, cost of goods sold is determined and recorded at the time of sale.

- ____ Periodic inventory systems are, in general, less expensive to operate than perpetual systems.

- ____ Periodic inventory systems are more common today because of the prevalence of computer systems.

- ____ The Purchases of Inventory account is not used in a perpetual inventory system.

- ____ If inventory is shipped FOB shipping point, the buyer takes title as soon as the inventory leaves the seller’s warehouse.

- ____ In a periodic system, cost of goods sold is the difference between what a company has available for sale (beginning inventory and purchases) and what they did not sell (ending inventory).

- ____ In a periodic system, the Inventory T-account retains the beginning balance throughout the year.

- ____ Ace Company reports Year One cost of goods sold as $324,000 using a periodic system. One inventory item was not recorded or counted. Ace had bought the item from Zebra for $6,000. Zebra shipped it on December 28, Year One, and Ace received it on January 5, Year Two. It was shipped FOB shipping point. Ace should have reported cost of goods sold as $330,000.

- ____ Lower of cost or market is only used by companies that maintain a periodic inventory system.

- ____ Lower of cost or market is only used by companies that maintain a perpetual inventory system.

- ____ If the market value of a company’s inventory increases after its acquisition, the company should record a gain.

- ____ A company that uses a perpetual inventory system should still perform a physical inventory count.

- ____ An estimation of inventory is most common in connection with companies that have a periodic inventory system.

- ____ The Waynesboro Company always has gross profit equal to 30 percent of sales. This year, the company started with inventory costing $50,000 and made purchases of $100,000 and sales of $120,000. A fire destroyed all of the inventory on hand except for merchandise costing $6,000. The loss is estimated as $60,000.

- ____ A forensic accountant attempts to generate financial information in situations where insufficient physical data might be available.

Multiple Choice

-

Arne Company buys inventory for $400. The seller sends this merchandise to the company FOB destination. The transportation charge was $13. Arne received a discount of $9 for paying quickly. The inventory is sold to a customer for $670. Arne paid another $17 to have the item delivered to the customer’s home. What did Arne report as cost of goods sold?

- $391

- $395

- $400

- $408

-

On February 13, NC Sofa Company purchases three sofas from a manufacturer for $300 each. The terms of the sale are 2/10, n/45. NC Sofa pays the invoice on February 21. How much did the company pay?

- $855

- $882

- $890

- $900

-

Crayson Inc. started the year with $490,000 in inventory. During the year, Crayson purchased an additional $1,060,000 in inventory and paid transportation costs of $30,000 to get this merchandise. At the end of the year, Crayson employees performed a physical count and determined that ending inventory amounted to $450,000. What was Crayson’s cost of goods sold for the year?

- $1,050,000

- $1,060,000

- $1,100,000

- $1,130,000

-

The following account balances were found in the general ledger of the Applewhite Corporation: Purchases = $232,000, Sales = $458,000, Transportation-in = $15,000, Cash Discounts on Purchases = $23,000, Advertising Expense = $30,000. On January 1, a count of inventory showed $90,000, whereas on December 31, a count of inventory showed $123,000. What was cost of goods sold for the period?

- $176,000

- $191,000

- $214,000

- $221,000

-

Raceway Corporation manufactures miniature cars and racetracks for collectors and enthusiasts. Raceway placed an order for new auto supplies and other parts from Delta Inc. on December 1. The sales staff at Delta informed Raceway that the supplies would not be available to ship out until December 22. Raceway accepted this arrangement. The supplies actually shipped, FOB shipping point, on December 26 and arrived at Raceway’s receiving dock on January 2. On which date should Raceway include the supplies in its inventory?

- December 1

- December 22

- December 26

- January 2

-

The Morning Company buys inventory and pays an additional $700 to have those goods shipped to its warehouse. How is the journal entry for this $700 cost recorded?

- In both a perpetual and a periodic system, inventory is debited for $700.

- In both a perpetual and a periodic system, purchases of inventory is debited for $700.

- In a perpetual system, inventory is debited for $700; in a periodic system, purchases of inventory is debited for $700.

- In a perpetual system, purchases of inventory is debited for $700; in a periodic system, inventory is debited for $700.

-

A company makes all of its purchases and sales using FOB shipping point. At the end of the year, the company had the following two transactions that were correctly recorded:

- Purchases. Inventory costing $40,000 is shipped by the seller on December 28 and received by the company on January 4.

- Sales. Inventory costing $30,000 is sold to a customer for $48,000. It is shipped on December 28 to the customer and arrives on January 4.

If this company had chosen to make these transactions FOB destination rather than FOB shipping point, how would that decision have impacted the reported amount of inventory on the year-end balance sheet?

- Reported inventory would have been $10,000 higher.

- Reported inventory would have been $10,000 lower.

- Reported inventory would have been $40,000 higher.

- Reported inventory would have been $40,000 lower.

-

The Charlotte Company made a $9,000 purchase near the end of the current year. The company also made a sale for $11,000 of inventory costing $6,000. Charlotte did not include either the inventory purchased or the inventory sold in its year-end inventory. Ending inventory was reported as $100,000. The purchase was FOB destination and shipped on December 29, Year One, and received by Charlotte on January 3, Year Two. The sale was FOB destination. It was shipped on December 30, Year One, and received by the customer on January 4, Year Two. What was the correct amount of inventory that Charlotte should have reported at the end of Year One?

- $94,000

- $97,000

- $106,000

- $109,000

-

At year-end, the Commonwealth Corporation holds 500 pieces of XY inventory costing $9 each and 700 pieces of AB inventory costing $11 each. XY inventory has flooded the market, and Commonwealth can now buy these same units for $6 each. AB inventory has not proven to be as popular as anticipated, and a unit can only be sold for $12 even after spending $2 extra on painting it a different color. In applying lower of cost or market, what should be reported for inventory by Commonwealth?

- $10,000

- $10,700

- $11,400

- $12,100

-

Which of the following concerning the “lower of cost or market” rule is not true?

- If the replacement cost of an inventory item falls below its historical cost, the value of the item should be written down.

- If the market value of an item exceeds its historical cost, it should be written up and a gain recorded.

- It is possible for an item’s net realizable value to fall below its historical cost.

- Application of lower of cost or market is an example of the practice of conservatism in accounting.

-

Romulus Company sells maps. At the end of the current year, Romulus’s inventory records indicated that it had 2,900 maps of Italy on hand that had originally cost $30 each but were being sold for $52 each. An inventory count showed that only 2,875 were actually present in ending inventory. What journal entry should Romulus make if management believes the discrepancy is due to errors in the accounting process?

-

Figure 8.12

-

Figure 8.13

-

Figure 8.14

-

Figure 8.15

-

-

Real South Products holds $400,000 worth of inventory on January 1. Between January and March 13, Real South purchased an additional $190,000 in inventory. During that period, sales of $530,000 were made. On March 13, Real South’s warehouse flooded and all but $15,000 worth of inventory was ruined. Historical records show that Real South has an average gross profit percentage of 25 percent. What was the approximate value of the inventory destroyed in the flood?

- $177,500

- $207,500

- $240,000

- $275,000

Video Problems

Professor Joe Hoyle discusses the answers to these two problems at the links that are indicated. After formulating your answers, watch each video to see how Professor Hoyle answers these questions.

-

Your roommate is an English major. The roommate’s parents own a chain of ice cream shops throughout Florida. One day, while driving over to the car wash, your roommate poses this question: “My parents are having a problem with their insurance company. As you know, we recently had a hurricane come through the Florida area. It knocked out the electricity at one of their stores for several hours. It was very hot that day, and all the ice cream at that store melted. Luckily, each store is insured. However, they are having a dispute with the insurance company as to the amount of ice cream that was destroyed. It all melted and ran down the drain so there is no proof. The insurance company argues that only half as much ice cream was destroyed as my parents claim. For a big store, that is a lot of money. How will they ever be able to sort out this mess? My parents only want a fair amount.” How would you respond?

-

Your uncle and two friends started a small office supply store several years ago. The company has expanded and now has several large locations. Your uncle knows that you are taking a financial accounting class and asks you the following question: “When we first started, we did not spend much money on monitoring inventory. The stores were small, and a good manager could walk through and see where we needed to buy more goods. Now, however, every year we seem to have to spend more money in order to upgrade our inventory systems. Is this cost really worth what we continue to spend?” How would you respond?

Problems

-

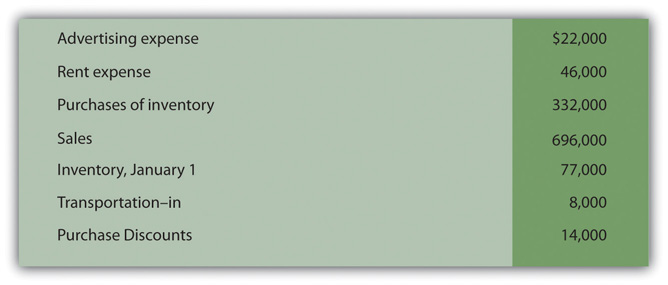

Here are several T-account balances that the Absalom Company has in its ledger at the end of the current year before a physical inventory count is to be taken.

Figure 8.16

- What was the amount of goods available for sale for this company?

- If the company counts its ending inventory and finds merchandise costing $84,000, what should be reported as cost of goods sold for the year?

- What adjusting entry should Absalom make at the end of the current year to record cost of goods sold and ending inventory?

-

The Darth Corporation starts Year Two with 8,000 units of inventory. All inventory costs $1.00 per unit with an additional cost of $0.12 each for transportations costs. These costs continue to be consistent throughout Year Two. Inventory on January 1, Year Two, was reported as 8,000 units times $1.12 or $8,960.

After these 8,000 units were sold, Darth Corporation buys an additional 20,000 units in Year Two. During that year, Darth sells 22,000 units for $2.00 each. No inventory was lost or stolen. During Year Two, the company accountant accidentally expensed all transportation costs incurred that period.

- What amount did the Darth Corporation report as its gross profit for Year Two?

- What amount should the Darth Corporation have reported as its gross profit for Year Two?

-

Overland Inc. starts buying and selling widgets this year. A box of 100 widgets can be bought for $600 on credit. Transportation to receive each box of widgets costs an additional $50 in cash. Overland uses a perpetual inventory system. Make journal entries for the following transactions.

- January 15 – bought 4 boxes of widgets

- February 19 – sold 3 boxes of widgets for cash of $1,100 each

- April 3 – bought 5 boxes of widgets

- June 15 – sold 3 boxes of widgets for cash of $1,200 each

- September 4 – bought 6 boxes of widgets

- October 5 – sold 4 boxes of widgets for cash of $1,250 each

- Do problem 3 again but assume that Overland Inc. uses a periodic inventory system. Also assume that no widgets are lost, broken, or stolen. Include the needed year-end adjusting entry.

-

ConnecTech bought 400 computers in Year Two for $300 each on account. It paid $260 to have them delivered to its store. During January of Year Three, ConnecTech sold 220 of the computers for cash of $550 each. ConnecTech uses a perpetual inventory system.

- Prepare the journal entry or entries to record ConnecTech’s purchase of the computers.

- Prepare the journal entry or entries to record the sale of the computers.

- Determine the balance in ConnecTech’s ending inventory on January 31, Year Three.

-

Montez Muffins and More (MM&M) is a bakery located in New York City. MM&M purchases a great deal of flour in bulk from a wholesaler. The wholesaler offers purchase discounts for fast payment. MM&M purchased 600 pounds of flour for $0.20 per pound on May 1, under terms 2/10, n/30. Determine the amount MM&M should pay under the following scenarios.

- MM&M pays the full balance on May 25.

- MM&M pays the full balance on May 7.

- MM&M pays half the balance on May 7 and half on May 18.

-

Racer’s ATVs sells many makes and models of all-terrain vehicles at its store in Indianapolis, Indiana. Racer’s uses a periodic inventory system because its entire inventory is located in one large room and all employees know what is on hand and what new inventory is needed. On January 1, Racer’s had beginning inventory costing $48,600. On January 14, Racer’s received a new shipment of vehicles with a purchase price of $34,700 and additional transportation costs of $1,200. On May 19, Racers received a second shipment of vehicles with a purchase price of $36,900 and transportation costs of $950. On November 1, Racers received its pre-Christmas shipment of vehicles with a purchase price of $67,800 and transportation costs of $1,750. The company buys vehicles on account but pays cash for transportation.

- Make the necessary journal entries for January 14, May 19, and November 1 to show the purchase of this inventory.

- Assume that a physical inventory count on December 31 showed an ending inventory costing $35,800. Determine the cost of goods sold to be reported for the year.

- If sales for the year were reported as $296,700, what gross profit did Racer’s make?

- Racer’s is considering replacing its periodic inventory system with a perpetual one. Write a memo to Racer’s management giving the pros and cons of this switch.

-

Ace Company counts inventory at the end of the current year and arrives at a cost of $300,000. Assume that each of the following four situations is independent of the others. In each case, assume that the inventory in question was not included in the count that was taken at the end of the year.

- Inventory costing $10,000 was sold by Ace for $16,000 on credit and shipped to the customer on December 29 and arrived on January 3. The shipment was marked FOB destination. If Ace reported $300,000 in inventory on its balance sheet, what amount should have been reported?

- Inventory costing $11,000 was shipped from the seller on December 29 and received by Ace on January 3. The shipment was marked FOB destination. If Ace reported $300,000 in inventory on its balance sheet, what amount should have been reported?

- Inventory costing $12,000 was sold by Ace for $17,000 on credit and shipped to the customer on December 30 and arrived on January 4. The shipment was marked FOB shipping point. If Ace reported $300,000 in inventory on its balance sheet, what amount should have been reported?

- Inventory costing $13,000 was shipped from the seller on December 30 and received by Ace on January 4. The shipment was marked FOB shipping point. If Ace reported $300,000 in inventory on its balance sheet, what amount should have been reported?

-

Magic Carpets Inc. sells a full line of area rugs, from top quality to bargain basement. Economic conditions have hit the textile industry, and the accountant for Magic Carpets is concerned that the rug inventory might not be worth the amount Magic paid. The following is information about three lines of rugs.

Figure 8.17

- Determine lower of cost or market for each type of rug.

- Assume that Magic Carpets applies lower of cost or market to the individual types of rugs rather than to the entire stock of inventory as a whole. Determine if Magic Carpets has suffered a loss of value on its inventory, and if so, the amount of that loss.

-

Costello Corporation uses a perpetual inventory system. At the end of the year, the inventory balance reported by its system is $45,270. Costello performs an inventory count and determines that the actual ending inventory is $39,780.

- Discuss why a company that uses a perpetual inventory system would still go to the trouble to perform a physical inventory count.

- Why might the ending balance differ between the perpetual inventory system and physical inventory count?

- Assume that Costello determines that the difference between the perpetual records and the physical count is due to an accident that occurred during the year. What journal entry should Costello make?

- Assume that Costello believes the difference between the perpetual records and the physical count is due to errors made by the company’s accounting staff. On occasion, the staff fail to transfer inventory to cost of goods sold when a sale were made. What journal entry should Costello make in this case?

-

Fabulous Fay’s is a boutique clothing store in San Diego, California. Fay’s uses a perpetual inventory system. In March, Fay’s purchased a type of swimwear designed to be slimming to the wearer. The company purchased twenty suits of varying sizes for $40 each and priced them at $120 each. They sold out almost immediately, so Fay purchased forty more suits in April for $40 each and sold thirty-eight of them for $130 each. Again in July, Fay made one more purchase of twenty suits at $40 each and sold fifteen of them for $130 each. Fay decided not to put the rest of this inventory on sale at the end of the summer, but to hold onto the items until cruise season started the following winter. She believed she could sell the remainder of this merchandise without having to mark the items down.

- Make the journal entries for the purchases Fay made.

- Make the journal entries for the sales Fay made.

- Determine the balance in ending inventory on December 31.

- Fay performed a physical count on December 31 and determined that three of the swimsuits had been severely damaged due to a leaky pipe. They had to be thrown away. Make the journal entry to show the loss of this inventory.

-

Nakatobi Company has an inventory warehouse in Fargo, North Dakota. The company utilizes a periodic inventory system. At the beginning of the year, the warehouse contained $369,000 worth of inventory. During the first quarter of the year, Nakatobi purchased another $218,000 worth of inventory and made sales of $450,000. On April 1, a flood hit Fargo and destroyed 70 percent of the inventory housed in the warehouse. Nakatobi must estimate the cost of the destroyed inventory for insurance purposes. According to records kept for the past several years, Nakatobi has typically reported its cost of goods sold at 55 percent of sales.

- Determine the value of the inventory on March 31, before the flood hit.

- Determine Nakatobi’s loss on April 1.

Comprehensive Problem

This problem will carry through over several chapters to enable students to build their accounting skills using knowledge gained in previous chapters.

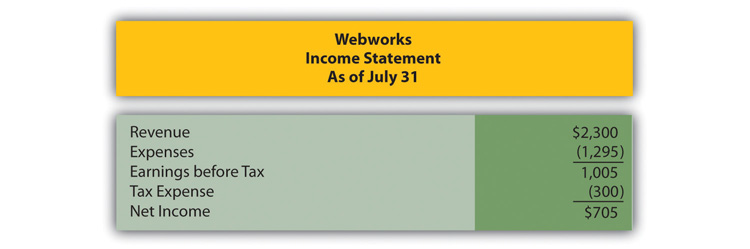

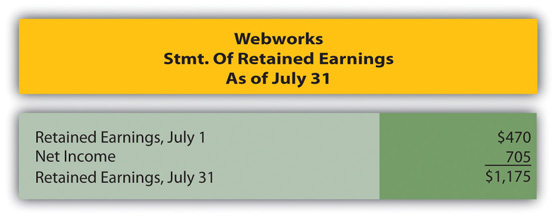

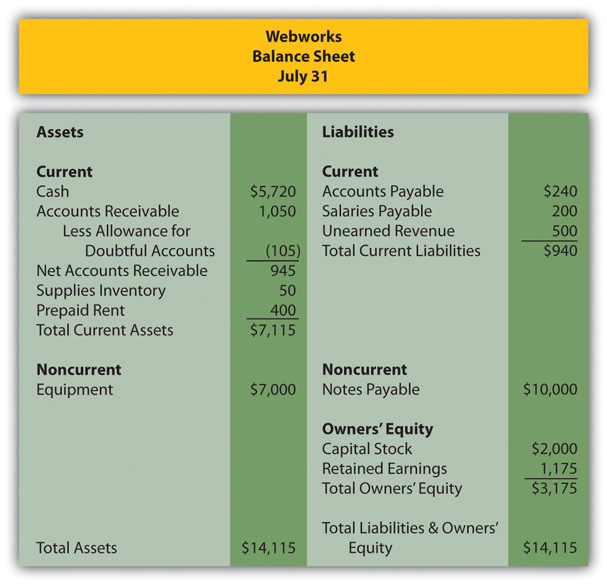

In Chapter 7 "In Financial Reporting, What Information Is Conveyed about Receivables?", financial statements were prepared for Webworks for July 31 and the month then ended. Those financial statements are included here as a starting point for the financial reporting for August.

Here are Webworks financial statements as of July 31.

Figure 8.18

Figure 8.19

Figure 8.20

The following events occur during August:

- Webworks decides to begin selling a limited selection of inventory items related to its business. During August, Webworks purchases several specialty keyboards for $4,900 and flash drives for $3,200 both on account with the hopes of selling them to Web site customers or others who might be interested. Due to the limited quantity of inventory, Webworks will use a periodic system.

- Webworks purchases supplies for $100 on account.

- Webworks starts and completes six more Web sites and bills those clients a total of $2,700.

- In July, Webworks received $500 in advance to design two Web sites. Webworks also completes both of these sites during August.

- Webworks collects $2,400 in accounts receivable.

- Webworks pays Nancy Po (the company employee hired in June) $600 for her work during the first three weeks of August.

- In June, Webworks designed a Web site for Pauline Smith and billed her. Unfortunately, before she paid this bill completely, Ms. Smith’s business folded. Webworks is not likely to collect any of the remaining money and writes off the $100 balance as uncollectible.

- Webworks sells several keyboards for $4,500 and flash drives for $3,000. All of these transactions were for cash.

- Webworks pays the salaries payable from July.

- Webworks pays $6,000 of its accounts payable.

- Webworks receives $100 in advance to work on a Web site for a local dentist. Work will not begin on the Web site until September.

- Webworks pays Leon Jackson (owner of the company) a salary of $2,000 for his work.

-

Webworks pays taxes of $475 in cash.

Required:

- Prepare journal entries for the previous events.

- Post the journal entries to T-accounts.

- Prepare an unadjusted trial balance for Webworks at the end of August.

- Prepare adjusting entries for the following and post them to the appropriate T-accounts.

- Webworks owes Nancy Po $250 for her work during the last week of August.

- Leon’s parents let him know that Webworks owes $250 toward the electricity bill. Webworks will pay them in September.

- Webworks determines that it still has $60 worth of supplies remaining at the end of August.

- Prepaid rent should be adjusted for August’s portion.

- Webworks assumes that 10 percent of its accounts receivable at the end of the month will prove to be uncollectible.

-

Webworks performs a count of ending inventory and determines that $1,900 in keyboards and $1,100 in flash drives remain. Cost of goods sold for the month should be recorded.

- Prepare an adjusted trial balance.

- Prepare financial statements for August 31 and the month then ended.

Research Assignment

Assume that you take a job as a summer employee for an investment advisory service. One of the partners for that firm is currently looking at the possibility of investing in Sears Holdings Corporations. The partner is a bit concerned about the impact of the recession on this company. The partner is especially interested in what has happened to the company’s ability to sell the merchandise inventory that it elects to buy. The partner asks you to look at the 2010 financial statements for Sears by following this path:

- Go to http://www.sears.com.

- At the bottom of this screen, click on “About Sears” and then on “Investor Relations.”

- On the right side of the next screen, click on “Financial Information.”

- On the left side of the next screen, click on “2010 Annual Report” to download.

- Go to page 49 and find the 2008, 2009, and 2010 income statements.

- Go to page 50 and find the balance sheets for the years ended January 30, 2010 and January 29, 2011.

- Using the figures found on these three income statements, subtract the cost of sales, buying, and occupancy from merchandise sales and services to get an approximation of gross profit earned by Sears for each year. Divide that number by the merchandise sales and services figure to derive a gross profit percentage for each year. How has that percentage changed over these three years? What might that signal?

- Using the figures found on the balance sheets, locate the amount reported for merchandise inventories for each year. Divide that figure by the amount reported each year by Sears as its total assets. How did the percentage change from the first year to the second? What might that signal?