This is “Perpetual and Periodic Inventory Systems”, section 8.2 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

8.2 Perpetual and Periodic Inventory Systems

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Identify the attributes as well as the advantages and disadvantages of a perpetual inventory system.

- Identify the attributes as well as the advantages and disadvantages of a periodic inventory system.

- Provide journal entries for a variety of transactions involved in the purchase of inventory using both a perpetual and a periodic inventory system.

Maintaining Inventory Costs in a Perpetual System

Question: In an earlier chapter, differences between a perpetual inventory system and a periodic inventory system were discussed briefly. Because of the availability of modern technology, most companies—but not all—maintain some type of perpetual inventory records. A perpetual system—which frequently relies on bar coding and computer scanning—provides an ongoing record of all items present, both in total and individually. How is the recording of an inventory purchase carried out in a perpetual system?

Answer: When a perpetual inventory systemAccounting system that maintains an ongoing record of all inventory items both in total and individually; records increases and decreases in inventory accounts as they occur as well as the cost of goods sold to date. is in use, all additions and reductions are monitored in the inventory T-account. Thus, theoretically, the balance found in that general ledger account at any point in time is identical to the merchandise physically on hand. In actual practice, recording mistakes as well as losses such as theft and breakage create some (hopefully small) discrepancies. Consequently, even with a perpetual system, inventory records must be reconciled occasionally with the items actually present to reestablish accuracy.

In a perpetual inventory system, the maintenance of a separate subsidiary ledger showing data about the individual items on hand is essential. On February 26, 2011, Best Buy reported inventory totaling $5.897 billion. However, internally the company also needs specific information as to the quantity, type, and location of all televisions, cameras, computers, and the like that make up this sum. That is the significance of a perpetual system; it provides the ability to keep track of the various types of merchandise. The total cost is available in the inventory T-account but detailed data about the composition (the quantity and frequently the cost) of merchandise physically on hand is found in a subsidiary ledger where an individual file can be available for each item as is shown in Figure 8.2 "Cost of Inventory Reduced by Cash Discount—Subsidiary Ledger".

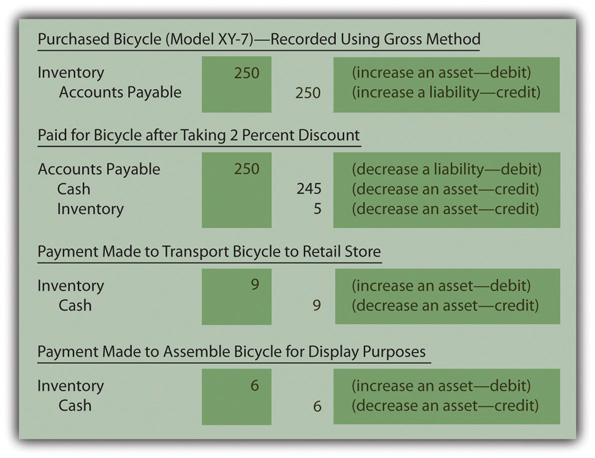

Assume that Rider Inc. (the sporting goods company) uses a perpetual inventory system. In Figure 8.3 "Rider Inc.—Journal Entries—Perpetual Inventory System", journal entries are shown for the purchase of a bicycle to sell (Model XY-7). The bicycle is recorded at the $250 invoice amount and then reduced by $5 at the time the discount is taken. This approach is known as the “gross method of reporting discounts.” As an alternative, companies can choose to anticipate taking the discount and simply make the initial entry for the $245 expected payment. This option is referred to as the “net method of reporting discounts.” Under that approach, if the discount is not actually taken, the additional $5 cost is recorded as a loss or an expense rather than as a capitalized cost of the inventory because it is not normal or necessary to pay the extra amount.

Figure 8.3 Rider Inc.—Journal Entries—Perpetual Inventory System

After posting these entries, the inventory T-account in the general ledger reports a net cost of $260 ($250 − $5 + $9 + $6) and the separate subsidiary ledger shown previously indicates that one Model XY-7 bicycle is on hand with a cost of $260.

Test Yourself

Question:

A grocery store carries cans of tuna fish, salmon, and sardines. The company uses a perpetual inventory system with the general ledger inventory account backed up by a subsidiary ledger. Which of the following statements is most likely to not be true?

- The number of cans of salmon on hand can be found in the subsidiary ledger.

- The cost of all cans of fish can be found in the general ledger.

- The number of cans of tuna fish on hand can be found in the general ledger.

- The cost of the cans of sardines on hand can be found in the subsidiary ledger.

Answer:

The correct answer is choice c: The number of cans of tuna fish on hand can be found in the general ledger.

Explanation:

In a perpetual system, the total cost of all inventory on hand is recorded in the general ledger inventory T-account. The quantity (and frequently the cost) of the individual items is monitored in a subsidiary ledger. Here, the subsidiary ledger maintains the quantity and likely the cost for each type of fish: tuna fish, salmon, and sardines. No information is gained by recording the number of cans of fish in the general ledger since that figure will be available in the subsidiary ledger.

Recording Inventory Purchases in a Periodic System

Question: In a periodic system, no attempt is made to keep an ongoing record of a company’s inventory. Instead, the quantity and cost of merchandise is only determined periodically as a preliminary step in preparing financial statements. How is the actual recording of an inventory purchase carried out in a periodic system?

Answer: If a company uses a periodic inventory systemAccounting system that does not maintain an ongoing record of all inventory items; instead, ending inventory is determined by a physical count so that a formula (beginning inventory plus purchases less ending inventory) can be used to calculate cost of goods sold., neither the cost nor the quantity of the items on hand is monitored. Inventory amounts are unknown both in total and individually. These figures are not viewed by company officials as worth the cost and effort necessary to gather them. However, purchases are still made, and a record must be maintained of the costs incurred. This information is eventually used for financial reporting but also—more immediately—for control purposes. Regardless of the recording system, companies want to avoid spending unnecessary amounts on inventory as well as tangential expenditures such as transportation and assembly. If the accounting system indicates that a particular cost is growing too rapidly, alternatives can be investigated and implemented before the problem becomes serious. Periodic systems are designed to provide such information through the use of separate general ledger T-accounts for each cost incurred.

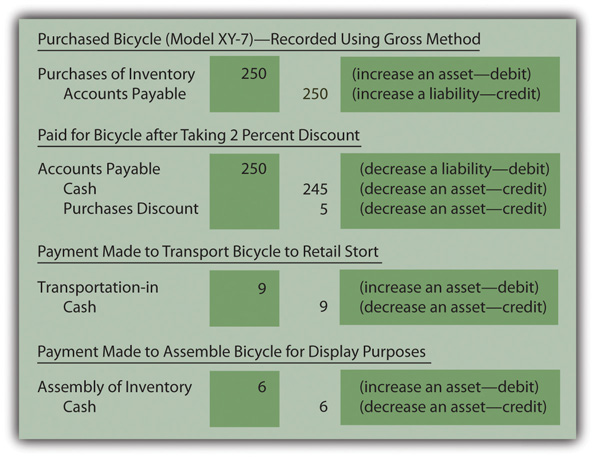

Assume that Rider uses a periodic inventory system. Its journal entries for the acquisition of the Model XY-7 bicycle are as shown in Figure 8.4 "Rider Inc.—Journal Entries—Periodic Inventory System". No separate subsidiary ledger is maintained. The overall cost of this inventory item is not readily available in the accounting records and the quantity (except by visual inspection) is unknown. At any point in time, company officials do have access to the amounts spent for each of the individual costs (such as transportation and assembly) for monitoring purposes.

Because these costs result from the acquisition of an asset that eventually becomes an expense when sold, they follow the same debit and credit rules as those accounts.

Figure 8.4 Rider Inc.—Journal Entries—Periodic Inventory System

In a periodic system, when a sale occurs, the revenue entry is made as always. However, no journal entry is made for cost of goods sold. Because of the lack of information, the dollar amount of the cost is not known at this time so inventory is not reduced and cost of goods sold is not recognized. Instead, when a periodic system is in use, cost of goods sold is only determined and recorded when financial statements are prepared through the use of the following formula:

Cost of goods sold = Beginning inventory + Purchase costs for period − Ending inventoryNote that the choice between using a perpetual and periodic system impacts the following:

- Information available to company officials on a daily basis

- Journal entries to be made

- Cost necessary to operate the accounting system (the technology required by a perpetual system is more expensive)

Regardless of the system in use, Rider holds one piece of inventory with a cost of $260. The decision as to whether to utilize a perpetual or periodic system is based on the added cost of the perpetual system and the difference in the available information generated for use by company officials. The company’s inventory is not physically affected by the method selected.

Test Yourself

Question:

A company starts operations in Year One and buys ten units of inventory for $70 each. The transportation cost for the entire group of items was $110. A few days later, the president of the company checks out the balances in the general ledger. Which of the following is true?

- If a periodic inventory system is in use, no balances will be available in connection with this inventory.

- If a periodic inventory system is in use, an inventory account will be found with a balance of $810.

- If a perpetual inventory system is in use, a transportation-in account will be found with a balance of $110.

- If a perpetual inventory system is in use, an inventory account will be found with a balance of $810.

Answer:

The correct answer is choice d: If a perpetual inventory system is in use, an inventory account will be found with a balance of $810.

Explanation:

If a periodic system is used, a purchases account will report $700 (ten units at $70 each). Transportation-in will be $110. Until the end of the year, these balances are not adjusted to correspond with the inventory on hand or sold. In a perpetual system, the initial journal entries record $810 in the inventory account (invoice price of $700 plus transportation of $110) or $81 for each of the ten units. All costs are recorded within that one T-account and are not divided up by type.

Test Yourself

Question:

A company is started in Year One, and the president and the accountant confer and opt to install a perpetual system to record and monitor inventory. Which of the following is not likely to have been a reason for this decision?

- The president knows that the perpetual system will cost more than the periodic system but did not consider it to be prohibitively expensive.

- The president fears that transportation charges may escalate quickly and wants to monitor that cost.

- The president wants to be aware when any inventory item is reduced to only five units so that the quantity can be replenished.

- The president wants to know the total cost of inventory because she plans to set sales price based on that figure.

Answer:

The correct answer is choice b: The president fears that transportation charges may escalate quickly and wants to monitor that cost.

Explanation:

Perpetual systems maintain updated records as to the cost and quantity of the inventory on hand so that decisions such as pricing and purchasing can be made. However, this benefit can be outweighed if the perpetual system is viewed as too costly. Although the information available in a periodic system is more limited, the various costs (such as transportation) are tracked so that company officials can take action if problems arise.

Actual Use of Periodic Inventory Systems

Question: Given the availability of sophisticated computers at moderate prices, do any companies still use periodic inventory systems? With bar coding and the advanced state of technology, are periodic inventory procedures so antiquated that they are no longer found in actual practice?

Answer: Obviously, in this computer age, perpetual inventory systems have come to dominate because they provide valuable and immediate information to company officials. However, some businesses are unlikely to ever change from the simplicity of a periodic system.

A beauty salon or barber shop, for example, where services are rendered but a small amount of inventory is kept on hand for occasional sales, would certainly not need to absorb the cost of a perpetual system. Visual inspection can alert employees as to the quantity of inventory on hand.

Restaurants, sandwich shops, ice cream stores, and the like might well choose to use a periodic system because customer purchases take place at a small establishment where quantities are easy to observe and manage. In such operations, the information provided by a perpetual system does not necessarily provide additional benefit.

“Dollar stores,” which have become particularly prevalent in recent years, sell huge quantities of low-priced merchandise. Goods tend to be added to a store’s inventory as they become available rather than based on a formal managed inventory strategy. Again, officials must decide whether keeping up with the amount of inventory on hand will improve their decision making. If not, the cost of a perpetual system is unnecessary.

Perhaps, most importantly, some companies use a hybrid system where the units on hand and sold are monitored carefully with a perpetual system. However, to reduce accounting costs, the dollar amounts for inventory and cost of goods sold are determined using a periodic system when financial statements are to be prepared. In that way, the company gains valuable information (the number of units on hand) but still utilizes a cheaper system.

Key Takeaway

Perpetual inventory systems are designed to maintain updated figures (quantity and cost) for inventory as a whole as well as for individual items. The general ledger account reports the total cost of all inventory. At the same time, separate subsidiary ledger accounts provide the balance for each type of inventory so that company officials can know the size, cost, and composition of the merchandise on hand. A periodic system is cheaper to operate because no attempt is made to monitor inventory balances (in total or individually) until financial statements are to be prepared. A periodic system does allow a company to control its costs by keeping track of the individual inventory expenditures as they occur. Small organizations often use a periodic inventory system because the added cost of a perpetual system cannot be justified.