This is “In Financial Reporting, What Information Is Conveyed about Receivables?”, chapter 7 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 7 In Financial Reporting, What Information Is Conveyed about Receivables?

Video Clip

(click to see video)In this video, Professor Joe Hoyle introduces the essential points covered in Chapter 7 "In Financial Reporting, What Information Is Conveyed about Receivables?".

7.1 Accounts Receivable and Net Realizable Value

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Understand that accounts receivable are reported at net realizable value.

- Know that net realizable value is an estimation of the amount of cash to be collected from a particular asset.

- Appreciate the challenge that uncertainty poses in the reporting of accounts receivable.

- List the factors to be considered by officials when estimating the net realizable value of of a company’s accounts receivable.

Reporting Accounts Receivable

Question: The goal of financial accounting is to paint a fairly presented portrait that enables decision makers to make a reasonable assessment of an organization’s financial health and future prospects. This likeness should be communicated based on a set of generally accepted accounting principles (either U.S. GAAP or IFRS) with no material misstatements included. The success of the conveyance is dependent on the ability of the accountants to prepare financial statements that meet this rigorous standard.

Equally as important, every party analyzing the resulting statements must possess the knowledge necessary to understand the multitude of reported figures and explanations. If appropriate decisions are to result based on this information, both the preparer and the reader need an in-depth knowledge of the reporting standards.

For example, the asset section of the balance sheet produced by Dell Inc. as of January 28, 2011, indicates that the company held “accounts receivable, net” amounting to $6.493 billion. What does this figure reflect? What information is communicated to decision makers about a company and its accounts receivable when a single number such as $6.493 billion is reported?

Answer: One of the most satisfying results of mastering the terminology, rules, and principles of financial accounting is the ability to understand the meaning of amounts and disclosures reported about an organization. Such information is presented and analyzed daily in magazines, newspapers, radio, television, and the Internet. As with any language, failure to comprehend elements of the discussion leaves the listener lost and feeling vulnerable. However, with a reasonable amount of study, the informational content begins to make sense and quickly becomes useful in arriving at logical decisions.

In previous chapters, the asset accounts receivableAn asset that reports the amounts generated by credit sales that are still owed to an organization by its customers. was introduced to report monetary amounts owed to a reporting entity by its customers. Individual balances are generated by sales made on credit. Businesses sell on credit, rather than demanding cash, as a way to increase the number of customers and the related revenue. According to U.S. GAAP, the figure presented on a balance sheet for accounts receivable is its net realizable valueThe amount of cash that is expected to be generated by an asset after costs necessary to obtain the cash are removed; as related to accounts receivable, it is the amount an organization estimates will ultimately be collected from customers.—the amount of cash the company estimates will be collected over time from these accounts.

Consequently, officials for Dell Inc. analyzed its accounts receivable as of January 28, 2011, and determined that $6.493 billion was the best guess as to the cash that would be collected. The actual total of receivables was higher than that figure but an estimated amount of doubtful accounts had been subtracted in recognition that a portion of these debts could never be collected. For this reason, the asset is identified on the balance sheet as “accounts receivable, net” or, sometimes, “accounts receivable, net of allowance for doubtful accounts” to explain that future losses have already been anticipated and removed.

Test Yourself

Question:

Hawthorne Corporation operates a local hardware store in Townsville, Louisiana. The company’s accountant recently prepared a set of financial statements to help justify a loan that is being sought from a bank. The balance sheet reports net accounts receivable of $27,342. What does that figure reflect?

- Sales made to customers on account.

- An estimation of the amount that will be collected from the debts now owed by customers.

- The historical cost of the goods that were sold to customers who have not yet made payment.

- The total amount owed by customers as of the balance sheet date.

Answer:

The correct answer is choice b: An estimation of the amount that will be collected from the debts now owed by customers.

Explanation:

According to U.S. GAAP, accounts receivable should be reported at net realizable value, the amount expected to be collected. This approach requires an estimation to be made of the amount of the present balances that will prove to be uncollectible so that the net receivable balance can be established for reporting purposes.

Lack of Exactness in Reporting Receivables

Question: As discussed in previous chapters, many of the figures reported in financial accounting cannot be absolutely correct. Although $6.493 billion is the asset balance shown by Dell, the cash eventually collected will likely be somewhat higher or lower. Should the lack of exactness in reporting receivables cause concern for decision makers?

Answer: No one will ever be able to predict the precise amount of cash to be received from nearly $6.5 billion in accounts receivable. In fact, Note One to Dell’s financial statements specifically states, “The preparation of financial statements in accordance with GAAP requires the use of management’s estimates. These estimates are subjective in nature and involve judgments that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at fiscal year-end, and the reported amounts of revenues and expenses during the fiscal year. Actual results could differ from those estimates.”

Knowledgeable decision makers understand that a degree of uncertainty exists in reporting all such balances. However, a very specific figure does appear on Dell’s balance sheet for accounts receivable. By communicating this one amount, company officials are asserting that they believe sufficient evidence is available to provide reasonable assurance that the amount collected will not be a materially different figure.The independent auditors will also analyze the same available evidence and must agree that it is sufficient to serve as the basis for rendering reasonable assurance that the financial statements are presented fairly before an unqualified opinion can be released.

This is the meaning of any accounts receivable balance presented according to U.S. GAAP. All parties involved should understand what the figure represents. Actual receipts are expected to be so close to $6.493 billion that an interested party can rely on this number in arriving at decisions about the reporting company’s financial health and future prospects. Officials believe that the discrepancy between this balance and the cash collected will be so small that the same decisions would have been made even if the exact outcome had been known. In other words, any difference between reported and actual figures will be inconsequential. Once again, though, absolute assurance is not given for the reported amount but merely reasonable assurance.

Clearly, the reporting of receivables moves the coverage of financial accounting into more complicated territory. In the transactions and events analyzed previously, uncertainty was rarely encountered. The financial impact of signing a bank loan or the payment of a salary can be described to the penny except in unusual situations. Here, the normal reporting of accounts receivable introduces the challenge of preparing statements where the ultimate outcome is literally unknown. The very nature of such uncertainty forces the accounting process to address such problems in some logical fashion.

Determining Net Realizable Value

Question: Inherent uncertainty is associated with the reporting of receivables. No one can know exactly how much cash will be collected. How do company officials obtain sufficient evidence to provide reasonable assurance that the balance is not materially misstated? How does any business ever anticipate the amount of cash that will be collected from what can be a massive number of accounts receivable?

Answer: In accounting, reported balances never represent random guesses. Considerable investigation and analysis goes into arriving at financial statement figures. To determine the net realizable value appropriate for accounts receivable, company officials consider the following relevant factors:

- Historical experience of the company in collecting its receivables

- Efficiency of the company’s credit verification policy

- Current economic conditions

- Industry averages and trends

- Percentage of overdue accounts at present

- Efficiency of company’s collection procedures

Dell Inc. explains this process within the notes to its financial statements by indicating that this estimation “is based on an analysis of historical bad debt experience, current receivables aging, and expected future write-offs, as well as an assessment of specific identifiable customer accounts considered at risk or uncollectible.”

Additional information disclosed by Dell indicates that the company actually held $6.589 billion in accounts receivable, but—at the date of the balance sheet—$96 million of these accounts were anticipated to be uncollectible. Thus, the amount of cash estimated from the receivables is the reported $6.493 billion net balance ($6.589 billion total less $96 million expected to be uncollectible). Quite obviously, decision makers studying the company will be interested in comparing such data to figures disclosed by Dell in previous years as well as the information disseminated by competing organizations such as Hewlett-Packard and Apple. Just determining whether $96 million in uncollectible accounts is a relatively high or low figure is quite significant in evaluating the efficiency of Dell’s current operations.

Test Yourself

Question:

Gerwitz Corporation manufactures and sells shoes. At the end of the current year, the company holds $954,850 in accounts receivable and is presently assessing the amount of uncollectible accounts in that total. Which of the following is least likely to be relevant information in making this estimation?

- A current recession is taking place in the country.

- The company monitors its inventory levels very carefully.

- The company only sells to customers who have undergone an extensive credit check.

- Of the receivables held on the previous balance sheet date, 3 percent were never collected.

Answer:

The correct answer is choice b: The company monitors its inventory levels very carefully.

Explanation:

Companies study as much relevant information as possible in estimating uncollectible accounts. Economic conditions are considered (such as a recession, which might reduce payments) and previous collection trends. In addition, the methods by which the company extends credit and pushes for payment can impact the amount to be received. Although monitoring inventory levels is important because it can reduce theft and breakage, no information is provided as to the collectability of receivables.

Key Takeaway

Because of various uncertainties, many of the figures reported in a set of financial statements represent estimations. Therefore, as discussed previously, such figures cannot be exactly accurate. No one can predict the future with such precision. The accountant only holds that reported balances contain no material misstatements. Accounts receivable is shown at its net realizable value, the amount of cash expected to be collected. Losses from bad accounts are anticipated and removed based on historical trends and other relevant information. Thus, the figure reported in the asset section of the balance sheet is lower than the total amount of receivables held by the company on that date.

7.2 Accounting for Uncollectible Accounts

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Understand the reason for reporting a separate allowance account on the balance sheet in connection with accounts receivable.

- Know that bad debt expenses must be anticipated and recorded in the same time period as the related sales revenue to conform to the matching principle.

- Prepare the adjusting entry to reduce accounts receivable to net realizable value and recognize the resulting bad debt expense.

The Allowance for Doubtful Accounts

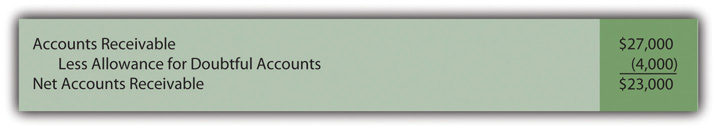

Question: Based on the information provided by Dell Inc., companies seem to maintain two separate ledger accounts in order to report accounts receivables at net realizable value. One is the sum of all accounts outstanding and the other is an estimation of the amount within the total that will never be collected. Interestingly, the first is a fact and the second is an opinion. The two are then combined to arrive at the net realizable value figure shown on the balance sheet. Is the amount reported for accounts receivable actually the net of the total due from customers less the anticipated doubtful accounts?

Answer: Yes, companies do maintain two separate T-accounts for accounts receivables, but that is solely because of the uncertainty involved. If the balance to be collected was known, one account would suffice for reporting purposes. However, that level of certainty is rarely possible.

- An accounts receivable T-account monitors the total due from all of a company’s customers.

- A second account (often called the allowance for doubtful accountsA contra asset account reflecting the amount of accounts receivable that the reporting company estimates will eventually fail to be collected, also referred to as the allowance for uncollectible accounts. or the allowance for uncollectible accounts) reflects the estimated amount that will eventually have to be written off as uncollectible.

Whenever a balance sheet is produced, these two accounts are netted to arrive at net realizable value, the figure to be reported for this particular asset.

The allowance for doubtful accounts is an example of a contra accountAn offset to a reported account that decreases the total balance to a net amount; in this chapter, the allowance for doubtful accounts reduces reported accounts receivable to the amount expected to be collected., one that always appears with another account but as a direct reduction to lower the reported value. Here, the allowance decreases the receivable balance to its estimated net realizable value. As a contra asset account, debit and credit rules are applied that are opposite of the normal asset rules. Thus, the allowance increases with a credit (creating a decrease in the net receivable balance) and decreases with a debit. The more accounts receivable a company expects to be bad, the larger the allowance. This increase, in turn, reduces the net realizable value shown on the balance sheet.

By establishing two T-accounts, Dell can manage a total of $6.589 billion in accounts receivables while setting up a separate allowance balance of $96 million. As a result, the reported figure—as required by U.S. GAAP—is the estimated net realizable value of $6.493 billion.

Anticipating Bad Debt Expense

Question: Accounts receivable and the offsetting allowance for doubtful accounts are netted with the resulting figure reported as an asset on the balance sheet.Some companies include both accounts on the balance sheet to indicate the origin of the reported balance. Others show only the single net figure with explanatory information provided in the notes to the financial statements. How does the existence of doubtful accounts affect the income statement? Sales are made on account, but a portion of the resulting receivables must be reduced because collection is rarely expected to be 100 percent. Does the presence of bad accounts create an expense for the reporting company?

Answer: Previously, an expense was defined as a measure of decreases in or outflows of net assets (assets minus liabilities) incurred in connection with the generation of revenues. If receivables are recorded that will eventually have to be decreased because they cannot be collected, an expense must be recognized. In financial reporting, terms such as bad debt expenseEstimated expense from making sales on account to customers who will never pay; because of the matching principle, the expense is recorded in the same period as the sales revenue., “doubtful accounts expense,” or “the provision for uncollectible accounts” are often encountered for that purpose.

The inherent uncertainty as to the amount of cash that will be received affects the physical recording process. How is a reduction reported if the amount will not be known until sometime in the future?

To illustrate, assume that a company makes sales on account to one hundred different customers late in Year One for $1,000 each. The earning process is substantially complete at the time of sale and the amount of cash to be received can be reasonably estimated. According to the revenue realization principle within accrual accounting, the company should immediately recognize the $100,000 revenue generated by these transactions.Because the focus of the discussion here is on accounts receivable and their collectability, the recognition of cost of goods sold as well as the possible return of any merchandise will be omitted at this time.

Figure 7.1 Journal Entry—Year One—Sales Made on Credit

Assume further that the company’s past history and other relevant information lead officials to estimate that approximately 7 percent of all credit sales will prove to be uncollectible. An expense of $7,000 (7 percent of $100,000) is anticipated because only $93,000 in cash is expected from these receivables rather than the full $100,000 that was recorded.

The specific identity and the actual amount of these bad accounts will probably not be known for many months. No physical evidence exists at the time of sale to indicate which will become worthless (buyers rarely make a purchase and then immediately declare bankruptcy or leave town). For convenience, accountants wait until financial statements are to be produced before making this estimation of net realizable value. The necessary reduction is then recorded by means of an adjusting entry.

In the adjustment, an expense is recognized. This method of presentation has a long history in financial accounting. However, recently FASB has been discussing whether a direct reduction in revenue might not be a more appropriate approach to portray bad debts. Financial accounting rules are under constant scrutiny, which leads to continual evolution.

Bad Debts and the Matching Principle

Question: This company holds $100,000 in accounts receivable but only expects to collect $93,000 based on available evidence. The $7,000 reduction in the asset is an expense. When should the expense be recognized? These sales were made in Year One but the specific identity of the customers who fail to pay and the actual uncollectible amounts will not be determined until Year Two. Should bad debt expense be recognized in the same year as the sales by relying on an estimate or delayed until the actual results are eventually finalized? How is the uncertainty addressed?

Answer: This situation illustrates how accrual accounting plays such a key role within financial reporting. As discussed previously, the timing of expense recognition according to accrual accounting is based on the matching principle. Where possible, expenses are recorded in the same period as the revenues they helped generate. The guidance is clear. Thus, every company should handle uncollectible accounts in the same manner. The expected expense is the result of making sales to customers who ultimately will never pay. Because the revenue was reported at the time of sale in Year One, the related expense is also recognized in that year. This handling is appropriate according to accrual accounting even though the $7,000 is only an estimated figure.

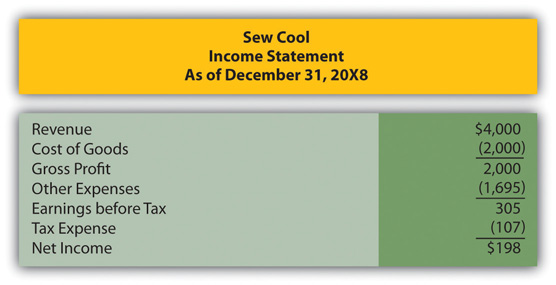

Therefore, as shown in Figure 7.2 "Adjusting Entry—End of Year One—Recognition of Bad Debt Expense for the Period", when the company produces financial statements at the end of Year One, an adjusting entry is made to (1) reduce the receivables balance to its net realizable value and (2) recognize the expense in the same period as the related revenue.

Figure 7.2 Adjusting Entry—End of Year One—Recognition of Bad Debt Expense for the Period

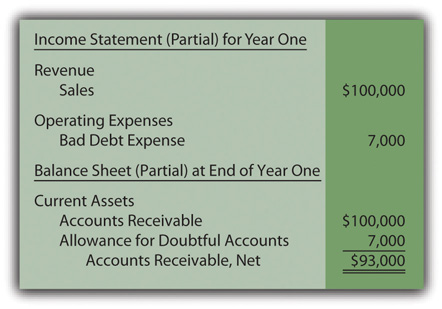

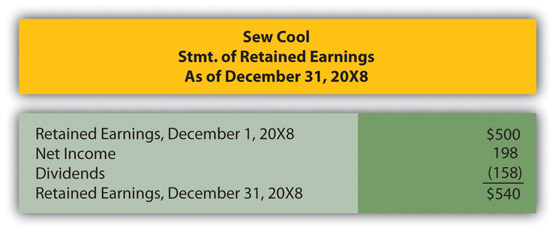

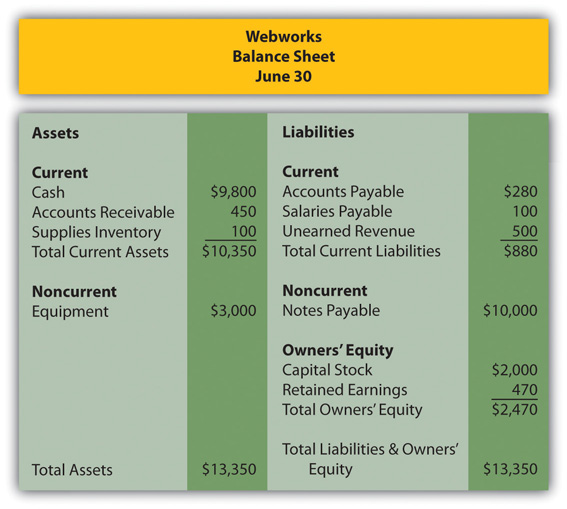

After this entry is made and posted to the ledger, the Year One financial statements contain the information shown in Figure 7.3 "Year One—Financial Statements" based on the adjusted T-account balances (assuming for convenience that no other sales were made during the year):

Figure 7.3 Year One—Financial Statements

From this information, anyone studying these financial statements should understand that an expense estimated at $7,000 was incurred this year because the company made sales of that amount that will never be collected. In addition, year-end accounts receivable total $100,000 but have an anticipated net realizable value of only $93,000. Neither the $7,000 nor the $93,000 figure is expected to be exact but the eventual amounts should not be materially different. With an understanding of financial accounting, the reported information is clear.

Test Yourself

Question:

A company’s general ledger includes a balance for bad debt expense and another for the allowance for doubtful accounts. Which of the following statements is true?

- Both bad debt expense and the allowance for doubtful accounts are reported on the income statement.

- Both bad debt expense and the allowance for doubtful accounts are reported on the balance sheet.

- Bad debt expense is reported on the income statement; the allowance for doubtful accounts is reported on the balance sheet.

- Bad debt expense is reported on the balance sheet; the allowance for doubtful accounts is reported on the income statement.

Answer:

The correct answer is choice c: Bad debt expense is reported on the income statement; the allowance for doubtful accounts is reported on the balance sheet.

Explanation:

Bad debt expense is reported on the income statement to show the amount of sales recognized this year that the company estimates will not be collected. The allowance for doubtful accounts is a contra asset account reported on the balance sheet to reduce accounts receivable to their estimated net realizable value.

The Need for a Separate Allowance Account

Question: When financial statements are prepared, an expense must be recognized and the receivable balance reduced to net realizable value. However, in the previous adjusting entry, why was the accounts receivable account not directly decreased by $7,000 to the anticipated balance of $93,000? This approach is simpler as well as easier to understand. Why was the $7,000 added to this contra asset account? In reporting receivables, why does the accountant go to the trouble of creating a separate allowance for reduction purposes?

Answer: When the company prepares the adjustment in Figure 7.2 "Adjusting Entry—End of Year One—Recognition of Bad Debt Expense for the Period" at the end of Year One, the actual accounts that will not be collected are unknown. Officials are only guessing that $7,000 will prove worthless. Plus, on the balance sheet date, the company does hold $100,000 in accounts receivable. That figure cannot be reduced directly until the specific identity of the accounts to be written off has been established. Utilizing a separate allowance allows the company to communicate the expected amount of cash while still maintaining a record of all balances in the accounts receivable T-account.

Key Takeaway

A sale on account and the eventual decision that the cash will never be collected can happen months, if not years, apart. During the interim, bad debts are estimated and recorded on the income statement as an expense and on the balance sheet by means of an allowance account, a contra asset. Through this process, the receivable balance is shown at net realizable value while expenses are recognized in the same period as the sale to correspond with the matching principle. When financial statements are prepared, an estimation of the uncollectible amounts is made and an adjusting entry recorded. Thus, the expense, the allowance account, and the accounts receivable are all presented according to financial accounting standards.

7.3 The Problem with Estimations

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Record the impact of discovering that a specific receivable is uncollectible.

- Understand the reason an expense is not recognized when a receivable is deemed to be uncollectible.

- Record the collection of a receivable that has previously been written off as uncollectible.

- Recognize that estimated figures often prove to be erroneous, but changes in previous year figures are not made if the reported balance was a reasonable estimate.

The Write-Off of an Uncollectible Account

Question: The company in the above illustration expects to collect cash from its receivables that will not materially differ from $93,000. The $7,000 bad debt expense is recorded in the same period as the revenue through a Year One adjusting entry.

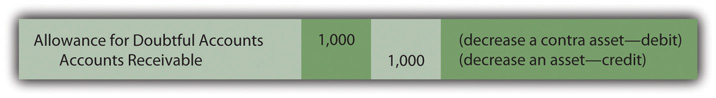

What happens when an actual account is determined to be uncollectible? For example, assume that on March 13, Year Two, a $1,000 balance is judged to be worthless. The customer dies, declares bankruptcy, disappears, or just refuses to make payment. This $1,000 is not a new expense. A total of $7,000 was already anticipated and recognized in Year One. It is merely the first discovery. How does the subsequent write-off of an uncollectible receivable affect the various T-account balances?

Answer: When an account proves to be uncollectible, the receivable T-account is decreased. The $1,000 balance is simply removed. It is not viewed as an asset because it has no future economic benefit. Furthermore, the amount of bad accounts within the receivables is no longer anticipated as $7,000. Because this first worthless receivable has been identified and eliminated, only $6,000 remains in the allowance for doubtful accounts.

In Figure 7.4 "Journal Entry during Year Two—Write-Off of Specific Account as Uncollectible", the journal entry is shown to write off this account. Throughout the year, this entry is repeated whenever a balance is found to be worthless. No additional expense is recognized. The expense was estimated and recorded in the previous period to comply with accrual accounting and the matching principle.

Figure 7.4 Journal Entry during Year Two—Write-Off of Specific Account as Uncollectible

Two basic steps in the recording of doubtful accounts are shown here.

- Reporting of uncollectible accounts in the year of sale based on estimation. The amount of bad accounts is estimated whenever financial statements are to be produced. An adjusting entry then recognizes the expense in the same period as the sales revenue. It also increases the allowance for doubtful accounts (to reduce the reported receivable balance to its anticipated net realizable value).

- Write-off of an account judged to be uncollectible. Subsequently, whenever a specific account is deemed to be worthless, the balance is removed from both the accounts receivable and the allowance-for-doubtful-accounts T-accounts. The related expense has been recognized previously and is not affected by the removal of a specific uncollectible account.

These two steps are followed consistently throughout the reporting of sales made on account and the subsequent collection (or write-off) of the balances.

Test Yourself

Question:

Near the end of Year One, a company is beginning to prepare financial statements. Accounts receivable total $320,000, but the net realizable value is only expected to be $290,000. On the last day of the year, the company realizes that a $3,000 receivable has become worthless and must be written off. The debtor had declared bankruptcy and will never be able to pay. What is the impact of this decision?

- The net amount reported for receivables goes down.

- The net amount reported for receivables stays the same.

- The net amount reported for receivables goes up.

- A company cannot write off an account at the end of the year in this manner.

Answer:

The correct answer is choice b: The net amount reported for receivables stays the same.

Explanation:

The allowance for doubtful accounts is $30,000 ($320,000 total less a net realizable value of $290,000). Writing off a $3,000 account reduces the receivable total from $320,000 to $317,000. In addition, the allowance drops from $30,000 to $27,000. The net balance to be reported remains $290,000 ($317,000 less $27,000). The company still expects to collect $290,000 from its receivables and reports that balance. Writing an account off as uncollectible does not impact the anticipated figure.

Collecting Accounts Previously Written Off

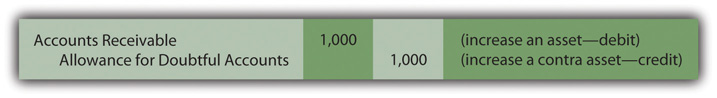

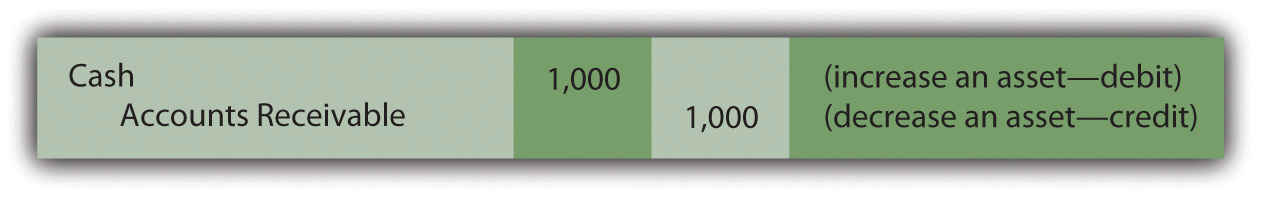

Question: An account receivable is judged as a bad debt and an adjusting entry is prepared to remove it from the ledger accounts. What happens then? After a receivable has been written off as uncollectible, does the company cease in its attempts to collect the amount due from the customer?

Answer: Organizations always make every possible effort to recover money they are owed. Writing off an account simply means that the chances of collection are deemed to be slim. Efforts to force payment will continue, often with increasingly aggressive techniques. If money is ever received from a written off account, the company first reinstates the account by reversing the earlier entry (Figure 7.5 "Journal Entry—Reinstate Account Previously Thought to Be Worthless"). Then, the cash received is recorded in the normal fashion (Figure 7.6 "Journal Entry—Collection of Reinstated Account"). The two entries shown here are appropriate if the above account is eventually collected from this customer. Some companies combine these entries by simply debiting cash and crediting the allowance. That single entry has the same overall impact as Figure 7.5 "Journal Entry—Reinstate Account Previously Thought to Be Worthless" and Figure 7.6 "Journal Entry—Collection of Reinstated Account".

Figure 7.5 Journal Entry—Reinstate Account Previously Thought to Be Worthless

Figure 7.6 Journal Entry—Collection of Reinstated AccountMany companies combine these two entries for convenience. The debit to accounts receivable in the first entry exactly offsets the credit in the second. Thus, the same recording impact is achieved by simply debiting cash and crediting the allowance for doubtful accounts. However, the rationale for that single entry is not always as evident to a beginning student.

Reporting an Incorrect Estimation

Question: In this illustration, at the end of Year One, the company estimated that $7,000 of its accounts receivable will ultimately prove to be uncollectible. However, in Year Two, that figure is likely to be proven wrong. It is merely a calculated guess. The actual amount might be $6,000 or $8,000 or many other numbers. When the precise figure is known, does a company return to its Year One financial statements and adjust them to the correct balance? Should a company continue reporting an estimated figure for a previous year even after it has been shown to be incorrect?

Answer: According to U.S. GAAP, if a number in an earlier year is reported based on a reasonable estimation, any subsequent differences with actual amounts are not handled retroactively (by changing the previously released figures). For example, if uncollectible accounts here prove to be $8,000, the company does not adjust the balance reported as the Year One bad debt expense from $7,000 to $8,000. It continues to report $7,000 on the income statement for that period even though that number is now known to be wrong.

There are several practical reasons for the accountant’s unwillingness to adjust previously reported estimations unless they were clearly unreasonable or fraudulent:

- Most decision makers are well aware that many reported figures represent estimates. Discrepancies are expected and should be taken into consideration when making decisions based on numbers presented in a set of financial statements. In analyzing this company and its financial health, educated investors and creditors anticipate that the total of bad accounts will ultimately turn out to be an amount that is not materially different from $7,000 rather than exactly $7,000.

- Because an extended period of time often exists between issuing statements and determining actual balances, most parties will have already used the original information to make their decisions. Knowing the exact number now does not allow them to undo those prior actions. There is no discernable benefit from having updated figures as long as the original estimate was reasonable.

- Financial statements contain numerous estimations and nearly all will prove to be inaccurate to some degree. If exactness were required, correcting each of these previously reported figures would become virtually a never-ending task for a company and its accountants. Scores of updated statements might have to be issued before a “final” set of financial figures became available after several years. For example, the exact life of a building might not be known for 50 years or more. Decision makers want information that is usable as soon as possible. Speed in reporting is far more important than absolute precision.

- At least theoretically, half of the differences between actual and anticipated results should make the reporting company look better and half make it look worse. If so, the corrections needed to rectify all previous estimation errors will tend to offset and have little overall impact on a company’s reported income and financial condition.

Thus, no change is made in financial figures that have already been released whenever a reasonable estimation proves to be wrong. However, differences that arise should be taken into consideration in creating current and subsequent statements. For example, if the Year One bad debts were expected to be 7 percent, but 8 percent actually proved to be uncollectible, the accountant might well choose to use a higher percentage at the end of Year Two to reflect this new knowledge.

Recording Receivable Transactions in Subsequent Years

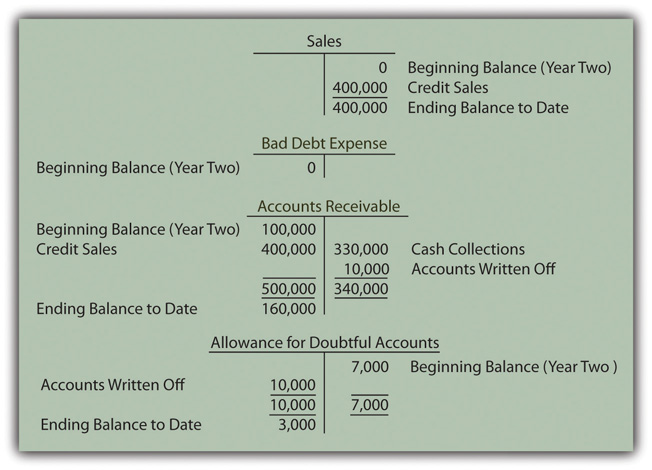

Question: To carry the previous illustration one step further, assume that $400,000 in new credit sales are made during Year Two while cash of $330,000 is collected. Uncollectible receivables totaling $10,000 are written off in that year. What balances appear in the various T-accounts at the end of a subsequent year to reflect sales, collections, and the write-off of uncollectible receivables?

Answer: Sales and bad debt expense were reported previously for Year One. However, as income statement accounts, both were closed out in order to begin Year Two with zero balances. They are temporary accounts. In contrast, accounts receivable and the allowance for doubtful accounts appear on the balance sheet and retain their ending figures going into each subsequent period. They are permanent accounts. Thus, these two T-accounts still show $100,000 and $7,000 respectively at the beginning of Year Two.

Assuming that no adjusting entries have yet been recorded, these four accounts hold the balances shown in Figure 7.7 "End of Year Two—Sales, Receivables, and Bad Debt Balances" at the end of Year Two. Notice that the bad debt expense account remains at zero until the end-of-year estimation is made and recorded.

Figure 7.7 End of Year Two—Sales, Receivables, and Bad Debt Balances

Residual Balance in the Allowance for Doubtful Accounts

Question: In the T-accounts in Figure 7.7 "End of Year Two—Sales, Receivables, and Bad Debt Balances", the balances represent account totals for Year Two prior to year-end adjusting entries. Why does a debit balance of $3,000 appear in the allowance for doubtful accounts before recording the necessary adjustment for the current year? When a debit balance is found in the allowance for doubtful accounts, what does this figure signify?

Answer: When Year One financial statements were produced, $7,000 was estimated as the amount of receivables that would eventually be identified as uncollectible. In Year Two, the actual total written off turned out to be $10,000. The original figure was too low by $3,000. This difference is now reflected by the debit remaining in the allowance account. Until the estimation for the current year is determined and recorded, the balance residing in the allowance account indicates a previous underestimation (an ending debit balance) or overestimation (a credit) of the amount of worthless accounts.The $3,000 debit figure is assumed here for convenience to be solely the result of underestimating uncollectible accounts in Year One. Several other factors may also be present. For example, the balance in the allowance for doubtful accounts will be impacted by credit sales made in the current year that are discovered to be worthless before the end of the period. Such accounts actually reduce the allowance T-account prior to the recognition of an expense. The residual allowance balance is also affected by the collection of accounts that were written off as worthless in an earlier year. As described earlier, the allowance is actually increased by that event. However, the financial reporting is not altered by the actual cause of the final allowance figure.

Key Takeaway

Bad debt expense is estimated and recorded in the period of sale to correspond with the matching principle. Subsequent write-offs of specific accounts do not affect the expense further. Rather, both the asset and the allowance for doubtful accounts are decreased at that time. If a written off account is subsequently collected, the allowance account is increased to reverse the previous impact. Estimation errors are anticipated in financial accounting; perfect predictions are rarely possible. When the amount of uncollectible accounts differs from the original figure recognized, no retroactive adjustment is made to restate earlier figures as long as a reasonable estimate was made. Decisions have already been made by investors and creditors based on the original data and cannot be reversed. These decision makers should have understood that the information they were using could not possibly reflect exact amounts.

7.4 The Actual Estimation of Uncollectible Accounts

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Estimate and record bad debts when the percentage of sales method is applied.

- Estimate and record bad debts when the percentage of receivables method is applied.

- Explain the reason that bad debt expense and the allowance for doubtful accounts normally report different figures.

- Understand the reason for maintaining a subsidiary ledger.

Two Methods for Estimating Uncollectible Accounts

Question: The final step in reporting receivables for Year Two is the estimation of the bad accounts incurred during this period. This calculation enables the preparation of the year-end adjusting entry. According to the ledger balances in Figure 7.7 "End of Year Two—Sales, Receivables, and Bad Debt Balances", sales on credit for the year were $400,000, remaining accounts receivable amount to $160,000, and a $3,000 debit sits in the allowance for doubtful accounts. No recording has yet been made for the Year Two bad debt expense. How does the accountant arrive at the estimation of uncollectible accounts each year?

Answer: Much of financial accounting is quite standardized. However, estimations can be made by any method that is considered logical. After all, it is an estimate. Over the decades, two different approaches have come to predominate when predicting the amount of uncollectible receivables. As long as company officials obtain sufficient evidence to support the reported numbers, either way can be applied.

Percentage of sales methodAn income statement approach for estimating uncollectible accounts that computes bad debt expense by multiplying sales (or just credit sales) by the percentage that are not expected to be collected.. This approach computes the current period expense by anticipating the percentage of sales (or credit sales) that will eventually fail to be collected. The percentage of sales method is sometimes referred to as an income statement approach because the only number being estimated (bad debt expense) appears on the income statement.

Percentage of receivables methodA balance sheet approach for estimating uncollectible accounts that computes the allowance for doubtful accounts by multiplying ending accounts receivable by the percentage that are not expected to be collected.. Here, the proper balance for the allowance for doubtful accounts is determined based on the percentage of ending accounts receivable that are presumed to be uncollectible. This method is identified as a balance sheet approach because the only figure being estimated (the allowance for doubtful accounts) is found on the balance sheet. A common variation applied by many companies is the aging methodA variation of the percentage of receivables method where all receivables are first classified by age; the total of each category is then multiplied by an appropriate percentage and summed to determine the allowance balance to be reported., which first classifies all receivable balances by age and then multiplies each of those individual totals by a different percentage. Normally, a higher rate is used for accounts that are older because they are considered more likely to become uncollectible.

Applying the Percentage of Sales Method

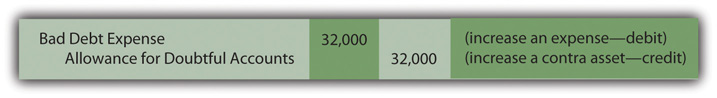

Question: Assume that this company chooses to use the percentage of sales method. All available evidence is studied by officials who come to believe that 8 percent of the credit sales made during Year Two will prove to be worthless. In applying the percentage of sales method, what adjusting entry is made at the end of the year so that financial statements can be prepared and fairly presented?

Answer: According to the ledger account in Figure 7.7 "End of Year Two—Sales, Receivables, and Bad Debt Balances", sales of $400,000 were made during Year Two. If uncollectible accounts are expected to be 8 percent of that amount, the expense for the period is $32,000 ($400,000 × 8 percent). Bad debt expense (the figure being estimated) must be raised from its present zero balance to $32,000. Bad debt expense must be reported as $32,000 when the process is completed.

Figure 7.8 Adjusting Entry for Year Two—Uncollectible Accounts Estimated as a Percentage of Sales

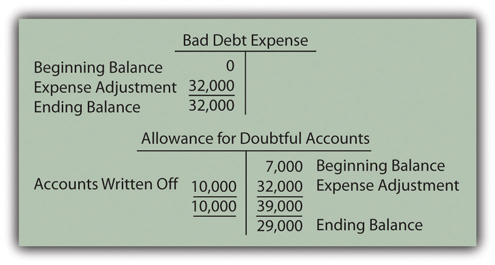

The adjustment in Figure 7.8 "Adjusting Entry for Year Two—Uncollectible Accounts Estimated as a Percentage of Sales" does increase the expense to the $32,000 figure, the proper percentage of the sales figure. However, prior to adjustment, the allowance account held a residual $3,000 debit balance ($7,000 Year One estimation less $10,000 accounts written off). As can be seen in Figure 7.9 "Resulting T-Accounts, Based on Percentage of Sales Method", the $32,000 recorded expense for Year Two results in only a $29,000 balance for the allowance for doubtful accounts.

Figure 7.9 Resulting T-Accounts, Based on Percentage of Sales Method

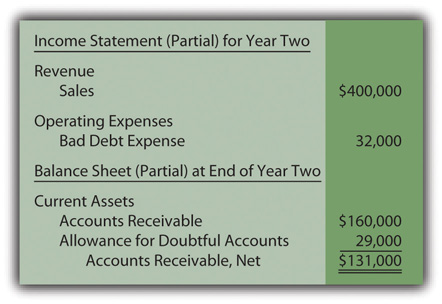

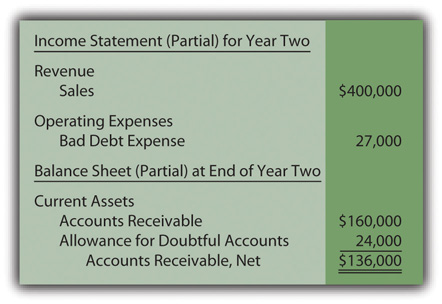

After this adjustment, the figures appearing in the financial statements for Year Two are shown in Figure 7.10 "Uncollectible Accounts Estimated Based on 8 Percent of Sales".

Figure 7.10 Uncollectible Accounts Estimated Based on 8 Percent of Sales

Test Yourself

Question:

The Travers Corporation starts operations in Year One and makes credit sales of $300,000 per year while collecting cash of only $200,000 per year. During each year, $15,000 in accounts are judged to be uncollectible. The company estimates that 8 percent of its credit sales will eventually prove to be worthless. What is reported as the allowance for doubtful accounts on the company’s balance sheet at the end of Year Two?

- $15,000

- $18,000

- $24,000

- $30,000

Answer:

The correct answer is choice b: $18,000.

Explanation:

At the end of Year One, the allowance account will show a $15,000 debit for the accounts written off and a 24,000 credit for the estimated bad debt expense ($300,000 × 8 percent) for a reported total of $9,000. During Year Two, another $15,000 debit is recorded because of the accounts written off and a second $24,000 credit is recorded to recognize the current year’s expense. The allowance balance is now $18,000 ($9,000 − $15,000 + $24,000).

The Difference Between Bad Debt Expense and the Allowance for Doubtful Accounts

Question: Figure 7.10 "Uncollectible Accounts Estimated Based on 8 Percent of Sales" presents the financial statement figures for this company for Year Two. How can bad debt expense be reported on the income statement as $32,000, whereas the allowance for doubtful accounts on the balance sheet shows only $29,000? Should those two numbers not be identical in every set of financial statements?

Answer: The difference in these two accounts is caused by the failure of previous estimations to be accurate. In Year One, bad debt expense for this company was reported as $7,000 but accounts with balances totaling $10,000 actually proved to be uncollectible in Year Two. That caused an additional $3,000 reduction in the allowance as can be seen in Figure 7.7 "End of Year Two—Sales, Receivables, and Bad Debt Balances". This amount carries through and causes the allowance for doubtful account to be $3,000 lower at the end of Year Two. The reported expense is the estimated amount ($32,000), but the allowance ($29,000) is $3,000 less because of the difference in the actual and expected amounts for Year One.

Students are often concerned because these two reported numbers differ. However, both are merely estimates. The actual amount of worthless accounts is quite likely to be a number entirely different from either $29,000 or $32,000. Therefore, the lingering impact of the $3,000 Year One underestimation should not be an issue as long as company officials believe that neither of the two reported balances is materially misstated.

Applying the Percentage of Receivables Method

Question: The percentage of receivables method handles the calculation of bad debts a bit differently. Assume that the Year Two adjusting entry has not yet been made so that bad debt expense remains at zero and the allowance for doubtful accounts still holds a $3,000 debit balance as shown in Figure 7.7 "End of Year Two—Sales, Receivables, and Bad Debt Balances". Also assume that the company has now chosen to use the percentage of receivables method rather than the percentage of sales method. Officials have looked at all available evidence and come to the conclusion that 15 percent of ending accounts receivable ($160,000 × 15 percent or $24,000) are likely to prove uncollectible. How does application of the percentage of receivables method affect the recording of doubtful accounts?

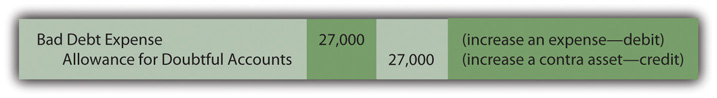

Answer: The percentage of receivables method (or the aging method if that variation is used) views the estimated figure of $24,000 as the proper total for the allowance for doubtful accounts. Thus, the accountant must turn the $3,000 debit balance residing in that contra asset account into the proper $24,000 credit. That change can only be accomplished by recognizing an expense of $27,000 as shown in Figure 7.11 "Adjusting Entry for Year Two—Uncollectible Accounts Estimated as a Percentage of Receivables". Under the percentage of receivables method, after the adjustment has been recorded, the allowance balance will equal the estimate ($24,000). The bad debt expense is not computed directly; it is the amount needed to arrive at this allowance figure.

Figure 7.11 Adjusting Entry for Year Two—Uncollectible Accounts Estimated as a Percentage of Receivables

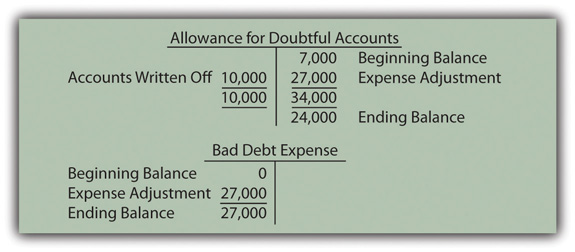

As shown in Figure 7.12 "Resulting T-Accounts, Based on Percentage of Receivables Method", this entry successfully changes the allowance from a $3,000 debit balance to the desired $24,000 credit. Because bad debt expense had a zero balance prior to this entry, it now reports the $27,000 amount needed to establish the proper allowance.

Figure 7.12 Resulting T-Accounts, Based on Percentage of Receivables Method

After this adjusting entry has been posted, the balances appearing in Figure 7.13 "Uncollectible Accounts Estimated Based on 15 Percent of Receivables" appear in the financial statements for Year Two.

Figure 7.13 Uncollectible Accounts Estimated Based on 15 Percent of Receivables

Once again, the reported expense ($27,000) is $3,000 higher than the allowance ($24,000). As before, the difference is the result of the estimation being too low in the prior year. The additional write-offs led to this lower balance in the allowance T-account.

Either approach can be used as long as adequate support is gathered for the numbers reported. They are just two alternatives to arrive at an estimate. However, financial accounting does stress the importance of consistency to help make numbers comparable from year to year. Once a method is selected, it normally must continue to be applied in all subsequent periods.

- Under the percentage of sales method, the expense account is aligned with the volume of sales.

- In applying the percentage of receivables method, the uncollectible portion of ending receivables is determined and reported as the allowance for doubtful accounts.

Regardless of the approach, both bad debt expense and the allowance for doubtful accounts are simply the result of estimating the final outcome of an uncertain event—the collection of accounts receivable.

Test Yourself

Question:

The Yarrow Corporation starts operations in Year One and makes credit sales of $400,000 per year while collecting cash of only $300,000 per year. During each year, $12,000 in accounts are judged to be uncollectible. The company estimates that 10 percent of its ending accounts receivable each year will eventually prove to be worthless. What is reported as bad debt expense on the company’s income statement for Year Two?

- $17,600

- $20,800

- $28,800

- $32,000

Answer:

The correct answer is choice b: $20,800.

Explanation:

In Year One, accounts receivable total $88,000 ($400,000 sales less $300,000 collections and $12,000 accounts written off). The allowance is $8,800 or 10 percent of the total. In Year Two, receivables rise to $176,000 ($88,000 plus $400,000 less $300,000 and $12,000). The allowance holds a debit of $3,200 ($8,800 beginning balance less $12,000 in write-offs). The allowance needs to be $17,600 (10 percent). To turn the $3,200 debit into a $17,600 credit, an expense of $20,800 is recognized.

The Purpose of a Subsidiary Ledger

Question: A company such as Dell Inc. must have thousands or even hundreds of thousands of separate receivables. The accounts receivable T-account in the ledger maintains the total of all amounts owed to a company but does not indicate the balance due from each individual customer. How does an accounting system monitor all the specific receivable amounts? Those balances must be essential information for any organization for billing and collection purposes.

Answer: As indicated, a ledger account only reflects a single total at the present time. In many cases, as with accounts receivable, the composition of that balance is also essential information. For those T-accounts, the accounting system can be expanded to include a subsidiary ledgerA group of individual accounts whose sum agrees with (and, therefore, explains) a general ledger account balance. to maintain data about the various individual components making up the account total.

In the previous illustration, the company reports $160,000 as the total of its accounts receivable at the end of Year Two. A separate subsidiary ledger should also be in place to monitor the amounts owed by each customer (Mr. A, Ms. B, and so on). The general ledger figure is used whenever financial statements are to be produced. The subsidiary ledger allows the company to access individual balances so that appropriate action can be taken when collection is received or if specific receivables grow too large or become overdue.

When a subsidiary ledger is maintained, the accounting system can be programmed so that each entry into the general ledger T-account requires an immediate parallel increase or decrease to the appropriate individual account. Thus, a $75 sale on credit to Mr. A raises the accounts receivable T-account total by that amount while also increasing the balance listed specifically for Mr. A in the subsidiary ledger.

Subsidiary ledgers can be established in connection with any general ledger account where the availability of component information is helpful. Other than accounts receivable, subsidiary ledgers are commonly set up for inventory, equipment, and accounts payable. As might be imagined, large enterprises maintain additional records for virtually every T-account, whereas small companies are likely to limit use to accounts receivable and—possibly—a few other significant balances.

Before computer systems became common, manually keeping the total of thousands of individual accounts in a subsidiary ledger in agreement with the corresponding general ledger T-account balance was an arduous task. Mechanical errors (mathematical problems as well as debit and credit mistakes) tended to abound. However, current electronic systems are typically designed so that the totals reconcile automatically.

Key Takeaway

Each year, an estimation of uncollectible accounts must be made as a preliminary step in the preparation of financial statements. Some companies use the percentage of sales method, which calculates the reported expense, an amount that is also added to the allowance for doubtful accounts. Other companies use the percentage of receivable method (or a variation known as the aging method). It determines the ending balance for the allowance. Bad debt expense is the amount required to adjust the allowance balance to this ending total. Both methods provide no more than an approximation of net realizable value based on the validity of the numerical percentages that are applied. Because actual and expected uncollectible amounts will differ, the expense and the allowance almost always report different balances. Regardless of the method employed, virtually all companies maintain a subsidiary ledger to provide the individual balances that comprise the total found in the general ledger T-account.

7.5 Reporting Foreign Currency Balances

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Recognize that transactions denominated in a foreign currency have become extremely common.

- Understand the necessity of remeasuring the value of foreign currency balances into a company’s functional currency prior to the preparation of financial statements.

- Appreciate the problem that fluctuations in exchange rates cause when foreign currency balances are reported in a set of financial statements.

- Know which foreign currency balances are reported using a historical exchange rate and which balances are reported using the currency exchange rate in effect on the date of the balance sheet.

- Understand that gains and losses are reported on a company’s income statement when foreign currency balances are remeasured using current exchange rates.

Reporting Balances Denominated in a Foreign Currency

Question: In today’s global economy, many U.S. companies make a sizable portion of their sales internationally. The Coca-Cola Company, for example, generated 69.7 percent of its revenues in 2010 outside of the United States. For McDonald’s Corporation, foreign revenues were 66.4 percent of the reported total.

In such cases, U.S. dollars might still be the currency received. However, U.S. companies frequently make sales that will be settled in a foreign currency such as the Mexican peso or the Japanese yen. For example, a sale made today might call for the transfer of 20,000 pesos in two months. What reporting problems are created when a credit sale is denominated in a foreign currency?

Answer: This situation is a perfect example of why authoritative standards, such as U.S. GAAP, are so important in financial accounting. Foreign currency balances are common in today’s world. Although a company will have a functional currency in which it normally operates (probably the U.S. dollar for a U.S. company), transactions often involve a number of currencies. For many companies, sales, purchases, expenses, and the like can be denominated in dozens of different currencies. A company’s financial statements may report U.S. dollars because that is its functional currency, but underlying amounts to be paid or received might be set in another currency such as the euro or the pound. Mechanically, many methods of reporting such foreign balances have been developed, each with a significantly different type of impact.

Without standardization, a decision maker would likely face a daunting task trying to analyze similar companies if they employed different approaches for reporting foreign currency figures. Assessing the comparative financial health and future prospects of organizations that do not use the same accounting always poses a difficult challenge for investors and creditors. That problem would be especially serious if optional approaches were allowed in connection with foreign currencies. Therefore, U.S. GAAP has long had an authoritative standard for this reporting.

The basic problem with reporting foreign currency balances is that exchange rates are constantly in flux. The price of one euro in terms of U.S. dollars changes many times each day. If these rates remained constant, a single conversion value could be determined at the time of the initial transaction and then used consistently for reporting purposes. However, currency exchange rates are rarely fixed; they often change moment by moment. For example, if a sale is made on account by a U.S. company with the money to be received in a foreign currency in 60 days, the relative worth of that balance in terms of U.S. dollars will probably move up and down countless times before collection. Because such values float, the reporting of these foreign currency amounts poses a challenge with no easy resolution.

Accounting for Changes in Currency Exchange Rates

Question: Exchange rates that vary over time create a reporting problem for companies operating in international markets. To illustrate, assume a U.S. company makes a sale of a service to a Mexican company on December 9, Year One, for 100,000 Mexican pesos that will be paid at a later date. Assume also that the exchange rate on the day when the sale was made was 1 peso equal to $0.08. However, by the end of Year One when financial statements are produced, the exchange rate is different: 1 peso is now worth $0.09. What reporting does a U.S. company make of transactions that are denominated in a foreign currency if the exchange rate changes as time passes?As has been stated previously, this is an introductory textbook. Thus, a more in-depth examination of many important topics, such as foreign currency balances, can be found in upper-level accounting texts. The coverage here of foreign currency balances is only designed to introduce students to basic reporting problems and their resolutions.

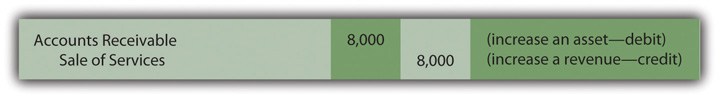

Answer: At the time of the sale, reporting is easy. The 100,000 pesos has an equivalent value of $8,000 (100,000 pesos × $0.08); thus, the journal entry in Figure 7.14 "Journal Entry—December 9, Year One—Sale of Services Made for 100,000 Pesos" is appropriate. Even though 100,000 pesos will be received, $8,000 is reported so that all balances on the seller’s financial statements are stated in terms of U.S. dollars.

Figure 7.14 Journal Entry—December 9, Year One—Sale of Services Made for 100,000 Pesos

By the end of the year, the exchange rate has changed so that 1 peso is equal to $0.09. The Mexican peso is worth a penny more in terms of the U.S. dollar. Thus, 100,000 pesos are more valuable and can now be exchanged for $9,000 (100,000 × $0.09). There are numerous reasons why the relative value of these two currencies might have changed, but the cause is not important from an accounting perspective.

When adjusting entries are prepared in connection with the production of financial statements at the end of Year One, one or both of the account balances (accounts receivable and sales of services) could remain at $8,000 or be updated to $9,000. The sale took place when the exchange rate was $0.08 but, now, before the money is collected, the peso has risen in value to $0.09. Accounting needs a standard rule as to whether the historical rate ($0.08) or the current rate ($0.09) is appropriate for reporting such foreign currency balances. Communication is difficult without that type of structure. Plus, the standard needs to be logical. It needs to make sense.

For over 25 years, U.S. GAAP has required that monetary assets and liabilitiesAmounts that are held by an organization as either cash or balances that will provide receipts or payments of a specified amount of cash in the future. denominated in a foreign currency be reported at the current exchange rate as of the balance sheet date. All other balances continue to be shown at the historical exchange rate in effect on the date of the original transaction. That is the approach that all organizations adhering to U.S. GAAP follow. Both the individuals who produce financial statements as well as the decision makers who use this information should understand the rule that is applied to resolve this reporting issue.

Monetary assets and liabilities are amounts currently held as cash or that will require a future transfer of a specified amount of cash. In the coverage here, for convenience, such monetary accounts will be limited to cash, receivables, and payables. Because these balances reflect current or future cash amounts, the current exchange rate is viewed as most relevant. In this illustration, the value of the receivable (a monetary asset) has changed in terms of U.S. dollars. The 100,000 pesos that will be collected have an equivalent value now of $0.09 each rather than $0.08. The reported receivable is updated to a value of $9,000 (100,000 pesos × $0.09).

Cash, receivables, and payables denominated in a foreign currency must be adjusted for reporting purposes whenever exchange rates fluctuate. All other account balances (equipment, sales, rent expense, dividends, and the like) reflect historical events and not future cash flows. Thus, they retain the rate in effect at the time of the original transaction and no further changes are ever needed. Because the sales figure is not a monetary asset or liability, the $8,000 balance continues to be reported regardless of the relative value of the peso.

The Income Effect of a Change in Currency Exchange Rates

Question: Changes in exchange rates affect the reporting of monetary assets and liabilities. Those amounts are literally worth more or less U.S. dollars as the relative value of the currency fluctuates over time. For the two balances above, the account receivable has to be remeasured on the date of the balance sheet because it is a monetary asset whereas the sales balance remains reported as $8,000 permanently. How is this change in the receivable accomplished? When monetary assets and liabilities denominated in a foreign currency are remeasured for reporting purposes, how is the increase or decrease in value reflected?

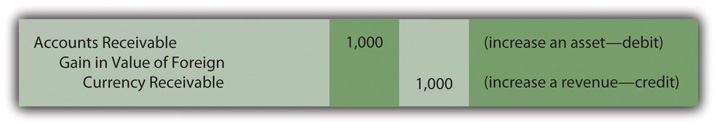

Answer: In this example, the value of the 100,000-peso receivable is raised from $8,000 to $9,000. When the amount reported for monetary assets and liabilities increases or decreases because of changes in currency exchange rates, a gain or loss is recognized on the income statement. Here, the reported receivable is now $1,000 higher. The company’s financial condition has improved and a gain is recognized. If the opposite occurs and the reported value of monetary assets declines (or the value of monetary liabilities increases), a loss is recognized. The adjusting entry shown in Figure 7.15 "Adjusting Entry at December 31, Year One—Remeasurement of 100,000 Pesos Receivable" is appropriate to reflect this change.

Figure 7.15 Adjusting Entry at December 31, Year One—Remeasurement of 100,000 Pesos Receivable

On its balance sheet, this company now reports a receivable as of December 31, Year One, of $9,000 while its income statement for that year shows sales revenue of $8,000 as well as the above gain of $1,000. Although the transaction was actually for 100,000 Mexican pesos, the company records these events in terms of its functional currency (the U.S. dollar) according to the provisions of U.S. GAAP.

Test Yourself

Question:

The Hamerstein Company is considering opening a retail store in Kyoto, Japan. In April of Year One, the company buys an acre of land in Kyoto by signing a note for ninety million Japanese yen to be paid in ten years. On that date, one yen can be exchanged for $0.012. By the end of Year One, one yen can be exchanged for $0.01. In connection with the company’s Year One financial statements, which of the following statements is not true?

- The company should report a loss because it held land during a time when the exchange rates changed.

- The company should report the note payable as $900,000 on its year-end balance sheet.

- The company should report the land as $1.08 million on its year-end balance sheet.

- The company should report a $180,000 gain because it held the note payable during this time.

Answer:

The correct answer is choice d: The company should report a $180,000 gain because it held the note payable during this time.

Explanation:

Because land is not a monetary account, it is initially recorded at $1.08 million (90 million yen × $0.012). That figure is never changed by future currency exchange rate fluctuations. Thus, no gain or loss is created by the land account. As a monetary account, the note payable is initially recorded at the same $1.08 million but is adjusted to $900,000 at the end of the year (90 million yen × $0.01). That $180,000 drop in the reported liability creates a reported gain of that amount.

Key Takeaway

Foreign currency balances are prevalent because many companies buy and sell products and services internationally. Although these transactions are frequently denominated in foreign currencies, they are reported in U.S. dollars when financial statements are produced for distribution in this country. Because exchange rates often change rapidly, many equivalent values could be calculated for these balances. According to U.S. GAAP, monetary assets and liabilities (cash as well as receivables and payables to be settled in cash) are updated for reporting purposes using the exchange rate at the current date. Changes in these balances create gains or losses to be recognized on the income statement. All other foreign currency balances (land, buildings, sales, expenses, and the like) continue to be shown at the historical exchange rate in effect at the time of the original transaction.

7.6 A Company’s Vital Signs—Accounts Receivable

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Compute the current ratio, the amount of working capital, and other figures pertinent to the reporting of accounts receivable.

- Describe the implications of a company’s current ratio.

- Describe the implications of a company’s working capital balance.

- Calculate the amount of time that passes before the average accounts receivable is collected and explain the importance of this information.

- List techniques that a business can implement to speed up collection of its accounts receivable.

Current Ratio and Working Capital

Question: Individuals analyze financial statements to make logical and appropriate decisions about a company’s financial health and well being. This process is somewhat similar to a medical doctor performing a physical examination on a patient. The doctor often begins by checking various vital signs, such as heart rate, blood pressure, weight, cholesterol level, and body temperature, looking for any signs of a serious change or problem. For example, if a person’s heart rate is higher than expected or if blood pressure has increased significantly since the last visit, the doctor will investigate with special care. In analyzing the financial statements of a business or other organization, are there vital signs that should be measured and studied by a decision maker?

Answer: Financial statements are extremely complex and most analysts have certain preferred figures or ratios that they believe are especially significant when investigating a company. For example, in a previous chapter, both the current ratioFormula measuring an organization’s liquidity (the ability to pay debts as they come due); calculated by dividing current assets by current liabilities. and the amount of working capitalFormula measuring an organization’s liquidity (the ability to pay debts as they come due); calculated by subtracting current liabilities from current assets. were computed using the balances reported for current assets (those that will be used or consumed within one year) and current liabilities (those that will be paid within one year):

current ratio = current assets/current liabilities working capital = current assets – current liabilitiesThese figures reflect a company’s liquidity, or its ability to pay its debts as they come due and still have enough monetary resources available to generate profits in the near future. Both investors and creditors frequently calculate, study, and analyze these two amounts. They are vital signs that help indicate the financial health of a business and its future prospects.

For example, on December 31, 2010, Avon Products reported a current ratio of 1.42 to 1.00 (current assets of $4.184 billion divided by current liabilities of $2.956 billion), which was down from 1.84 to 1.00 at the end of 2009. On the same date at the end of 2010, Caterpillar disclosed working capital of $9.790 billion (current assets of $31.810 billion less current liabilities of $22.020 billion). Caterpillar’s working capital increased by over $1.5 billion from the previous year when it was reported as $8.242 billion.

Whether these numbers are impressive or worrisome almost always depends on a careful comparison with other similar companies and results from prior years.

Test Yourself

Question:

The Winsolie Corporation reports the following asset balances: cash—$4,000, accounts receivable, net—$17,000, inventory—$13,000, and land—$22,000. The company also has the following liabilities: salaries payable—$6,000, accounts payable—$4,000, note payable, due in seven months—$5,000, and note payable, due in five years—$14,000. What is the company’s current ratio?

- 1.400 to 1.000

- 1.931 to 1.000

- 2.267 to 1.000

- 3.733 to 1.000

Answer:

The correct answer is choice c: 2.267 to 1.000.

Explanation:

Current assets are usually those that will be used or consumed within one year. For this company, that is cash, accounts receivable, and inventory that total to $34,000. Current liabilities are debts that will be paid within one year: salaries payable of $6,000, accounts payable of $4,000, and note payable due in seven months of $5,000. The current liability total for this company is $15,000. Thus, the current ratio is $34,000 divided by $15,000 or 2.267 to 1.000.

Computing the Age of Accounts Receivable

Question: This chapter deals with the financial reporting of accounts receivable. What other vital signs might be studied in connection with a company’s receivable balance?

Answer: One indication of a company’s financial health is its ability to collect receivables in a timely fashion. Money cannot be put to productive use until it is received. For that reason, companies work to encourage customers to make payments as quickly as possible. Furthermore, as stated previously in this chapter, the older a receivable becomes, the more likely it is to prove worthless.

Thus, interested parties (both inside a company as well as external) frequently monitor the time taken to collect receivables. Quick collection is normally viewed as desirable, whereas a slower rate can be a warning sign of possible problems. However, as with most generalizations, exceptions do exist so further investigation is always advised.

The age of a company’s receivables is determined by dividing the receivable balance by the average sales made per day. Credit sales are used in this computation if known, but the total sales figure often has to serve as a substitute because of availability. The sales balance is first divided by 365 to derive the amount of sales per day. This daily balance is then divided into the reported receivable to arrive at the average number of days that the company waits to collect its money. A significant change in the age of receivables will be quickly noted by almost any interested party.

age of receivables = receivables/sales per dayFor example, if a company reports sales for the current year of $7,665,000 and currently holds $609,000 in receivables, it requires 29 days on the average to collect a receivable.

sales per day = $7,665,000/365 or $21,000 age of receivables = $609,000/$21,000 or 29 daysAs a practical illustration, for the year ended January 28, 2011, Dell Inc. reported net revenue of $61.494 billion. The January 28, 2011, net accounts receivable balance for the company was $6.493 billion, which was up from $5.837 billion the year before. The daily sales figure is $168.5 million ($61.494 billion/365 days). Thus, the average age of Dell’s ending receivable balance at this time was 38.5 days ($6.493 billion/$168.5 million). By itself, this figure is neither good nor bad. An assessment depends on the terms given to customers, the time of collection in other recent years, and comparable figures for companies in the same industry as Dell.

A similar figure is referred to as the receivables turnoverFormula measuring speed of an organization’s collection of its accounts receivable; calculated by dividing sales by the average accounts receivable balance for the period. and is computed by the following formula:

receivables turnover = sales/average receivables.For Dell Inc., the average receivable balance for this year was $6.165 billion ([$6.493 billion + $5.837]/2). The receivables turnover for Dell for this period of time was 9.97 times:

receivables turnover = $61.494 billion/$6.165 billion = 9.97.The higher the receivable turnover, the faster collections are being received.

Test Yourself

Question:

The Yang Corporation recently extended the time that customers are given to pay their accounts receivable. Investors are interested in the impact of that decision. In Year One, the company had $730,000 in sales with $58,000 in accounts receivable on hand at the end of the year. In Year Two, sales grew to $1,095,000 but accounts receivable also rose to $114,000. Which of the following statements is true?

- The receivables turnover for Year Two was 9.61 times.

- The age of the receivables at the end of Year Two was thirty-three days.

- The receivables turnover for Year Two was 10.18 times.

- The age of the receivables at the end of Year Two was thirty-eight days.

Answer:

The correct answer is choice d: The age of the receivables at the end of Year Two was thirty-eight days.

Explanation:

The receivables turnover for Year Two is the sales for the year ($1,095,000) divided by the average receivable balance of $86,000 ([$58,000 + $114,000] divided by 2). The receivables turnover is 12.73 ($1,095,000/$86,000). Computing the age of receivables begins by calculating the average sales per day as $3,000 ($1,095,000/365 days). That figure is divided into the ending receivable of $114,000 to arrive at thirty-eight days. On average, that is the time between a sale being made and cash collected.

Reducing the Time It Takes to Collect Receivables

Question: If members of management notice that the average age of accounts receivable Formula measuring the average length of time it takes to collect cash from sales; calculated by dividing either accounts receivable at a point in time or the average accounts receivable for the period by the average sales made per day. for their company is getting older, what type of remedial actions can be taken? How does a company reduce the average number of days that are required to collect receivables so that cash is available more quickly?