This is “End-of-Chapter Exercises”, section 7.7 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

7.7 End-of-Chapter Exercises

Questions

- A company reports a balance of $3.6 million for its “accounts receivable.” What is meant by accounts receivable? How are accounts receivable reported in a set of financial statements?

- How is the net realizable value of a company’s accounts receivable determined?

- The Sylvester Corporation has accounts receivable that total $4.5 million. However, the company does not expect to collect that much cash. Identify several factors that a company might consider when trying to determine the amount of these accounts receivable that will ultimately be collected.

- What does the account “allowance for doubtful accounts” represent?

- In financial reporting, what is the purpose of a “contra account?”

- According to the matching principle, when should bad debt expense be reported?

- Why do companies set up an allowance for doubtful accounts instead of just decreasing accounts receivable for the expected amount of uncollectible balances?

- The Abrahim Corporation discovered that one of its customers went into bankruptcy and will not be able to pay the $8,700 balance that it owes. What entry does a company like Abrahim make to write off a specific account receivable that has proven to be uncollectible?

- A company writes off a $12,000 receivable as uncollectible. How does that entry change the amount reported by the company as its net receivable balance?

- A company writes off a $2,200 receivable as uncollectible. How does that entry impact the reported net income of this company at that time?

- In Year One, Jordan Company writes off nine accounts with a total balance of $11,675 as uncollectible. During Year Two, one of these accounts is paid because the debtor company has received financing and grown in strength. What entry does Jordan make when this cash is received?

- In Year One, the Castagna Company reported bad debt expense of $37,000. However, in Year Two, the economy was weak and the company actually wrote off $43,000 in accounts as uncollectible. The $37,000 figure continued to be reported in the Year One financial statements. Why did Castagna not change the balance reported for Year One now that the actual number is known?

- The Nagano Corporation is preparing financial statements for the latest year. The company sells on credit and, thus, must anticipate the amount of its bad accounts. What are the most common methods for making this estimation?

- At the end of Year Two, before making adjusting entries and preparing financial statements, a company’s allowance-for-doubtful-accounts T-account usually has a balance in it. What does that balance reflect?

- In its Year Two financial statements, the Heather Company reported bad debt expense of $35,000 and an allowance for doubtful accounts of $34,000. Why are these figures not identical?

- What is the purpose of a company maintaining an accounts receivable subsidiary ledger?

- Why does the reporting of balances denominated in a foreign currency create challenges for the accountant when producing financial statements?

- What are monetary assets and monetary liabilities?

- The Lenoir Corporation has 47 T-accounts in its general ledger. Most of these balances are denominated in U.S. dollars, its functional currency. Some of the balances are dominated in a foreign currency. Which of these foreign currency balances are remeasured at historical exchange rates and which are remeasured at the current exchange rate for reporting purposes?

- How is the current ratio calculated? How is the amount of working capital determined? What do these two computed amounts indicate about a company’s financial health?

- How do decision makers determine the average age of a reporting entity’s accounts receivable?

- How do decision makers determine the receivables turnover based on the information reported by a company?

- The Pierce Company sells its merchandise on credit. At the end of Year One, company customers took an average of 23.3 days to pay for their goods. However, recently, that period has jumped to 27.5 days which concerns company officials. What actions could they take to reduce the number of days back to 23.3?

True or False

- ____ Companies use two separate T-accounts in order to monitor and report accounts receivable at its net realizable value.

- ____ Bad debt expense is reported on the balance sheet as a contra account to reduce accounts receivable.

- ____ Bad debt expense should be reported in the same period as related revenue regardless of when the receivable is determined to be uncollectible.

- ____ A company has been in business for several years. In the current year, prior to preparing adjusting entries so that financial statements can be prepared, the bad expense T-account should report a zero balance.

- ____ A company has been in business for several years. At the end of the current year, prior to any adjusting entries being prepared, the allowance for doubtful accounts holds a credit balance of $5,000. The previous year estimation of uncollectible accounts was too low.

- ____ According to U.S. GAAP, all companies are required to perform their estimation of uncollectible accounts in the same manner.

- ____ On a set of financial statements, the amount of bad debt expense and the ending balance in the allowance for doubtful accounts will frequently differ.

- ____ A company ends the current year with sales of $600,000, accounts receivable of $100,000, and an allowance for doubtful accounts with a $1,000 debit balance. Bad debts are estimated to be 3 percent of sales. On financial statements, the allowance for doubtful accounts will be reported as having an $18,000 credit balance.

- ____ A company ends the current year with sales of $600,000, accounts receivable of $100,000, and an allowance for doubtful accounts with a $1,000 credit balance. Bad debts are estimated to be 3 percent of sales. On financial statements, bad debt expense will be reported as having an $18,000 debit balance.

- ____ A company ends the current year with sales of $600,000, accounts receivable of $100,000, and an allowance for doubtful accounts with a $1,000 debit balance. Uncollectible accounts at the end of the year are estimated to be 6 percent of receivables. Bad debt expense will be reported on the income statement as $7,000.

- ____ A company ends the current year with sales of $600,000, accounts receivable of $100,000, and an allowance for doubtful accounts with a $1,000 credit balance. Uncollectible accounts at the end of the year are estimated to be 6 percent of receivables. Bad debt expense will be reported on the income statement as $5,000.

- ____ A company ends Year Two with bad debt expense of $29,000 and an allowance for doubtful accounts of $27,000. On April 8, Year Three, a $1,900 receivable is written off as uncollectible. Net income is reduced by $1,900 on that date.

- ____ A company ends Year Two with bad debt expense of $35,000 and an allowance for doubtful accounts of $34,000. On April 12, Year Three, a $2,300 receivable is written off as uncollectible. The net amount reported for accounts receivable is reduced by $2,300 on that date.

- ____ A U.S. company with the U.S. dollar as its functional currency makes a sale in a foreign country and agrees to receive 20,000 vilsecks, the local currency. A vilseck is worth $0.42 on that date but is worth only $0.39 later on the balance sheet date. The company should report a loss on its income statement of $600 as a result of the change in the exchange rate.

- ____ A U.S. company with the U.S. dollar as its functional currency makes a sale in a foreign country and agrees to receive 20,000 vilsecks, the local currency. A vilseck is worth $0.42 on that date but is worth only $0.39 later on the balance sheet date. On its income statement, the company should report a sale of $7,800.

- ____ A company makes sales of $730,000 in Year Three. At the end of Year Three, the receivable balance is $48,000. The average customer at that time is taking 27 days to make payment to the company.

- ____ A company has a current ratio of 3.0:1.0. An account receivable of $3,800 is collected. That transaction will cause an increase in the current ratio.

- ____ A company has receivables of $300,000 on the first day of the year. During the year the company makes sales of $800,000 but only collects cash of $600,000. No bad debts were expected or uncovered during the year. The receivables turnover for the period was 2.

Multiple Choice

-

Which of the following would not be used to help a company determine the net realizable value of its accounts receivable?

- Industry averages and trends

- The company’s ability to pay its own debts

- Current economic conditions

- Efficiency of the company’s collection procedures

-

Which accounting principle guides the timing of the reporting of bad debt expense?

- Matching principle

- Going concern principle

- Cost/benefit analysis

- Measurement principle

-

SunFun Company manufactures lawn furniture that is sold to retail stores. During October, Year One, SunFun sold furniture to Home Place on account in the amount of $40,000. At the end of Year One, the balance was still outstanding. In March, Year Two, SunFun decided to write off this particular account as it did not appear that the balance would ever be collected. Choose the correct journal entry for this write off.

-

Figure 7.16

-

Figure 7.17

-

Figure 7.18

-

Figure 7.19

-

-

A company is preparing to produce a set of financial statements. The balance sheet being created shows a total for assets of $800,000 and a total for liabilities of $600,000. Just prior to the end of the year, one account receivable is determined to be uncollectible and is written off. Another receivable for $5,000 is collected. No other event or adjustment is made. What should the company now report as the total of its assets after recording these final two events?

- $784,000

- $789,000

- $800,000

- $805,000

-

Gladson Corporation reports bad debt expense using the percentage of sales method. At the end of the year, Gladson has $450,000 in accounts receivable and a $4,000 credit in its allowance for doubtful accounts before any entry is made for bad debts. Sales for the year were $1.9 million. The percentage that Gladson has historically used to calculate bad debts is 1 percent of sales. Which of the following is true?

- Gladson’s bad debt expense for the year is $15,000.

- Gladson’s bad debt expense for the year is $23,000.

- Gladson would report an allowance for doubtful accounts of $23,000.

- Gladson would report an allowance for doubtful accounts of $19,000.

-

On the first day of Year Two, the Raleigh Corporation holds accounts receivable of $500,000 and an allowance for doubtful accounts of $25,000 for a net realizable value of $475,000. During the year, credit sales were $520,000, and cash collections amounted to $440,000. In addition, $28,000 in receivables were written off as uncollectible. If 8 percent of sales is estimated as uncollectible each year, what is the net accounts receivable balance reported at the end of Year Two on Raleigh’s balance sheet?

- $510,400

- $513,400

- $516,400

- $519,400

-

On the first day of Year Two, the Richmond Corporation holds accounts receivable of $400,000 and an allowance for doubtful accounts of $23,000 for a net realizable value of $377,000. During the year, credit sales were $450,000 and cash collections amounted to $380,000. In addition, $25,000 in receivables were written off as uncollectible. If 6 percent of ending accounts receivable is estimated as uncollectible, what bad debt expense is reported for Year Two on Richmond’s income statement?

- $24,700

- $25,000

- $28,700

- $30,200

-

In Year One, the Simon Company wrote off a $14,000 receivable as uncollectible. However, on May 17, Year Two, the customer returned and paid Simon the entire amount. Which of the following is correct as a result of this payment?

- Accounts receivable goes down, but the allowance-for-doubtful-accounts account is not changed.

- Accounts receivable goes down, and the allowance-for-doubtful-accounts account also goes down.

- Accounts receivable stays the same, but the allowance for doubtful accounts goes up.

- Accounts receivable stays the same, and the allowance for doubtful accounts also stays the same.

-

A company ends Year Three with accounts receivable of $300,000, an allowance for doubtful accounts of $15,000, sales of $900,000, and bad debt expense of $27,000. In Year Four, sales of $1 million more are made. Cash collections are $800,000, and an additional $13,000 in receivables are written off as uncollectible. The company always estimates that 5 percent of its ending accounts receivable will prove to be bad. On December 31, Year Four, company officials find another $6,000 in receivables that might well be uncollectible. However, after further review, these receivables were not written off at this time. By how much did that decision not to write off these accounts change reported net income for Year Four?

- Reported net income was not affected.

- The decision made reported net income $300 higher.

- The decision made reported net income $5,700 higher.

- The decision made reported net income $6,000 higher.

-

A company ends Year Three with accounts receivable of $300,000, an allowance for doubtful accounts of $15,000, sales of $900,000, and bad debt expense of $27,000. In Year Four, sales of $1 million more are made. Cash collections are $800,000 and an additional $13,000 in receivables are written off as uncollectible. The company always estimates that 3 percent of its sales each year will eventually prove to be bad. On December 31, Year Four, company officials find another $6,000 in receivables that might well be uncollectible. However, after further review, these receivables were not written off at this time. By how much did that decision not to write off these accounts change reported net income for Year Four?

- Reported net income was not affected.

- The decision made reported net income $300 higher.

- The decision made reported net income $5,700 higher.

- The decision made reported net income $6,000 higher.

-

A U.S. company (with the U.S. dollar as its functional currency) buys inventory and immediately sells it to a customer in France on November 28, Year One, for 10,000 euros. The inventory had cost 6,000 euros several days before, an amount which had been paid on the day of purchase. This merchandise is sold on account with the money to be paid by the customer on January 19, Year Two. On November 28, Year One, 1 euro was worth $2.00 whereas on December 31, Year One, 1 euro is worth $1.90. What is the impact on net income of the change in the exchange rate?

- $600 gain

- $600 loss

- $1,000 gain

- $1,000 loss

-

On December 1, Year One, a company sells a service for 10,000 scoobies (the currency of the country where the sale was made) to be collected in six months. On that same day, the company pays 10,000 scoobies in cash for some inventory. This inventory was still held at year-end. On December 1, Year One, one scoobie is worth $0.61. By December 31, Year One, one scoobie is worth $0.73. The company is located in Ohio and is preparing to produce financial statements for Year One in terms of U.S. dollars. Which of the following will be reported on its balance sheet?

- Accounts receivable will be reported at $6,100, and inventory will also be reported as $6,100.

- Accounts receivable will be reported at $7,300, but inventory will be reported as $6,100.

- Accounts receivable will be reported at $6,100, but inventory will be reported as $7,300.

- Accounts receivable will be reported at $7,300, and inventory will also be reported as $7,300.

-

The New Orleans Company has more current assets than current liabilities. Near the end of the current year, the company pays off its rent payable for $5,000. What is the impact of this payment on the company current ratio?

- No change occurs in the current ratio

- Current ratio goes up

- Current ratio goes down

- The impact on the current ratio cannot be determined based on the information provided.

-

Darlene Corporation has $300,000 in assets, 30 percent of which are current, and $100,000 in liabilities, 40 percent of which are current. Which of the following is true?

- Darlene’s current ratio is 3 to 1.

- Darlene’s working capital is $200,000.

- Darlene’s working capital is $50,000.

- The current ratio and working capital are measures of a company’s profitability.

-

Fifer Inc. began the current year with $450,000 in accounts receivable and ended the year with $590,000 in accounts receivable and $4 million in sales. Last year Fifer’s age of ending receivables was forty-six days and its receivables turnover was six times. Which of the following is not true?

- Fifer’s age of ending receivables is 54 days.

- Fifer’s receivables turnover is 7.69 times.

- Fifer’s age of ending receivables is less than it was last year.

- External decision makers monitor the time it takes a company to collect its receivables.

-

Company A made sales this year of $400,000 and has ending accounts receivable of $120,000. Company Z made sales this year of $900,000 and has ending accounts receivable of $280,000. Which of the following is true?

- It takes Company Z approximately 4 days longer to collect its accounts receivable than it takes Company A.

- It takes Company A approximately 4 days longer to collect its accounts receivable than it takes Company Z.

- It takes Company Z approximately 13 days longer to collect its accounts receivable than it takes Company A.

- It takes Company A approximately 13 days longer to collect its accounts receivable than it takes Company Z.

Video Problems

Professor Joe Hoyle discusses the answers to these two problems at the links that are indicated. After formulating your answers, watch each video to see how Professor Hoyle answers these questions.

-

Your roommate is an English major. The roommate’s parents own a chain of ice cream shops throughout Florida. One day, while sitting in a restaurant waiting for a pizza, your roommate poses this question: “This year, my parents began to furnish ice cream for a number of local restaurants. It was an easy way for them to expand their business. But, for the first time, they were making sales on credit. This seems to have caused some confusion when they started to produce financial statements. In the past, all sales were made for cash. However, this year they made $300,000 in sales to these restaurants on credit and they are still owed $90,000. I know they are worried about some of those accounts proving to be bad because of the economic times. In fact, one restaurant that owed them $2,000 filed for bankruptcy last fall and they didn’t get a penny of what they were owed. How in the world do they report money that they have not received yet and might never receive?” How would you respond?

-

Your uncle and two friends started a small office supply store several years ago. The company has expanded and now has several large locations. All sales to other companies are made on credit. Your uncle knows that you are taking a financial accounting class and asks you the following question: “When we sell on credit, we give customers 30 days to pay. We monitor our customers very carefully and, consequently, we have very few bad debts. Our accountant came to us last week and said that our average customer used to pay us in 22 days but recently that has changed to 27 days. How did he figure that out? And, so what? As long as we get paid, why should I care? All I want is to make sure we get our money. But, if we do need to get paid faster, what am I supposed to do? The customers are still paying within the 30 days that we allow them so why should this make any difference?” How would you respond?

Problems

-

Nuance Company had net credit sales for the year of $500,000. Nuance estimates that 2 percent of its net credit sales will never be collected.

- Prepare the entry to record Nuance’s bad debt expense for the year.

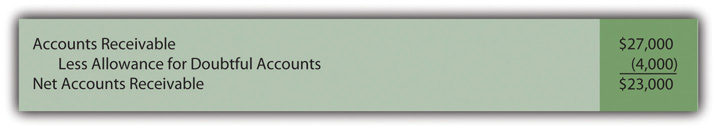

- Nuance had accounts receivable of $100,000 at the end of the year. Show how the net accounts receivable balance would be reported on the balance sheet. Assume that the allowance for doubtful accounts had an unadjusted credit balance at the end of the year of $1,000.

- Why is the accounts receivable balance shown at net rather than just showing the full amount?

-

Assume that Nuance in number 1 used the percentage of receivables method to estimate uncollectible accounts instead of the percentage of sales method. Nuance assumes that 5 percent of accounts receivable will never be collected.

- Prepare the entry to record Nuance’s bad debt expense for the year.

- Show how the net accounts receivable balance would be reported on the balance sheet.

- Why are companies allowed to choose between the percentage of sales and the percentage of receivables method?

- The Alfonso Corporation begins operations in Year One. The company makes credit sales of $800,000 each year while collecting cash of $430,000. Every year, receivables of $31,000 are written off as being doubtful. Company officials estimate that 5 percent of all credit sales will eventually prove to be uncollectible. What figures will be reported in the company’s Year Two financial statements in connection with these credit sales?

- The Fallston Corporation begins operations in Year One. The company makes credit sales of $1.2 million each year while collecting cash of $800,000. Every year, receivables of $30,000 are written off as being doubtful. Company officials estimate that 5 percent of ending accounts receivable will eventually prove to be uncollectible. What figures will be reported in the company’s Year Two financial statements in connection with these credit sales?

-

Ray’s GamePlace sells all the hottest gear and video games. On January 1, Year Three, Ray’s had the following account balances:

Figure 7.20

- During Year Three, Ray’s wrote off $6,000 in uncollectible accounts. Make this journal entry.

- One account in the amount of $500 that had been written off in (a) above was later collected during the year. Make the journal entries to reinstate the account and show its collection.

- During Year Three, Ray’s made credit sales of $145,000 and collected $115,000 of accounts receivable. Record these journal entries.

- At the end of the year, Ray’s determines that approximately 7 percent of its ending accounts receivable balance will not be collected. Make the necessary journal entry.

-

The Lawndale Company starts the current year with the following T-account balances:

- Accounts receivable = $300,000 debit

-

Allowance for doubtful accounts = $15,000 credit

During the year, the following events take place:

- $18,000 in receivables are written off as uncollectible.

- Credit sales of $800,000 are made

- Cash of $680,000 is collected from the receivables

-

A $2,000 receivable written off above is collected (amount is not included in the $680,000 figure).

Company officials believe that 5 percent of the ending accounts receivable will eventually prove to be uncollectible.

- On its balance sheet, what is reported as the net accounts receivable balance?

- On its income statement, what is reported for bad debt expense?

- Company A begins Year Two with accounts receivable of $200,000 and an allowance for doubtful accounts of $10,000 (credit balance). Company Z had the exact same balances. During Year Two, Company A made credit sales of $700,000 and cash collections on those accounts of $500,000. Uncollectible accounts of $19,000 were written off during the year. However, one of these accounts ($5,000) was actually collected later in the year (for convenience, that $5,000 collection was not included in the $500,000 figure above). Company Z has exactly the same transactions. In fact, the operations of these two companies are exactly the same. Officials for Company A anticipate that 2 percent of credit sales will prove uncollectible. As a result of this information (and other transactions), Company A reported net income of $100,000. Officials for Company Z believe that 5 percent of ending accounts receivable will prove to be uncollectible. What net income will Company Z report?

- The Springs Corporation started Year Four with $200,000 in its accounts receivable T-account and an allowance for doubtful accounts of $10,000 (credit balance). During that year, the company made additional sales of $500,000 while collecting cash of $400,000. In addition, $7,000 in accounts were written off as uncollectible. Company officials for Springs estimated that 3 percent of sales would eventually prove to be uncollectible based on past history and current economic conditions. The adjusting entry was prepared and preliminary financial statements were created. These statements showed net income of $80,000 and a total for all reported assets of $460,000. At the last moment, on December 31, Year Four, company officials discovered another receivable of $1,000 that needed to be written off because the debtor went bankrupt and was liquidated. What should the company report as its net income for the year and as its total for all reported assets as of the end of that year?

- The Wallace Corporation started Year Four with $500,000 in its accounts receivable T-account and an allowance for doubtful accounts of $20,000 (credit balance). During that year, the company made additional sales of $1.6 million while collecting cash of $1.3 million. In addition, $24,000 in accounts were written off as uncollectible. Company officials for Wallace estimated that 4 percent of ending receivables would eventually prove to be uncollectible based on past history and current economic conditions. The adjusting entry was prepared and preliminary financial statements were created. These statements showed net income of $220,000 and a total for all reported assets of $1.1 million. At the last moment, on December 31, Year Four, company officials discovered another receivable of $1,000 that needed to be written off because the debtor went bankrupt and was liquidated. What should the company report as its net income for the year and as its total for all reported assets as of the end of that year?

- On November 1, Year One, a U.S. company acquires 1,000 widgets from a company in France for 8,000 euros on credit. The company still holds all of this inventory on December 31. The debt has not yet been paid. The company is getting ready to prepare its Year One financial statements in its functional currency, the U.S. dollar. On November 1, 1 euro was worth $1.72, but on December 31, 1 euro is worth only $1.61. What is reported on the company’s Year One income statement? What is reported on the company’s balance sheet as of December 31, Year One?

-

Medwear Corporation is a multinational dealer of uniforms for medical personnel. Medwear is headquartered in the United States and uses U.S. dollars as its functional currency. On March 17, Medwear sells a large quantity of uniforms to a hospital in Brussels, Belgium for exactly 267,000 euros to be paid in 45 days. On the date of the sale, the exchange rate was $1.32 for every euro.

- Record this transaction for Medwear on March 17 assuming that the uniforms are purchased on account.

- On March 31, Medwear prepares financial statements. On this date, the exchange rate is $1.27 per euro. Record the necessary adjusting entry for Medwear on this date.

-

The Boezi Corporation is beginning to report its financial statements at the end of Year Six. Preliminary information indicates that the company holds $90,000 in current assets and $210,000 in noncurrent assets. The company also plans to report current liabilities of $40,000 and noncurrent liabilities of $160,000. However, at the very end of the year, two final transactions take place. First, a $12,000 payment is made on an account payable. Second, a $21,000 collection is received from an account receivable.

- After recording these two transactions, what should the company report as the amount of its working capital?

- After recording these two transactions, what should the company report as its current ratio?

- On January 1, Year Two, a company reports accounts receivable of $83,000. During Year Two, the company makes new credit sales of $511,000 while collecting cash of $437,000. No uncollectible accounts are expected or discovered. At the end of Year Two, how long does the average customer take to pay an account receivable balance?

- On January 1, Year Two, a company reports accounts receivable of $83,000. During Year Two, the company makes new credit sales of $511,000 while collecting cash of $437,000. No uncollectible accounts are expected or discovered. What is the receivable turnover for Year Two?

-

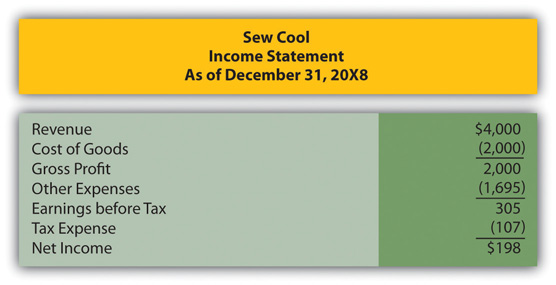

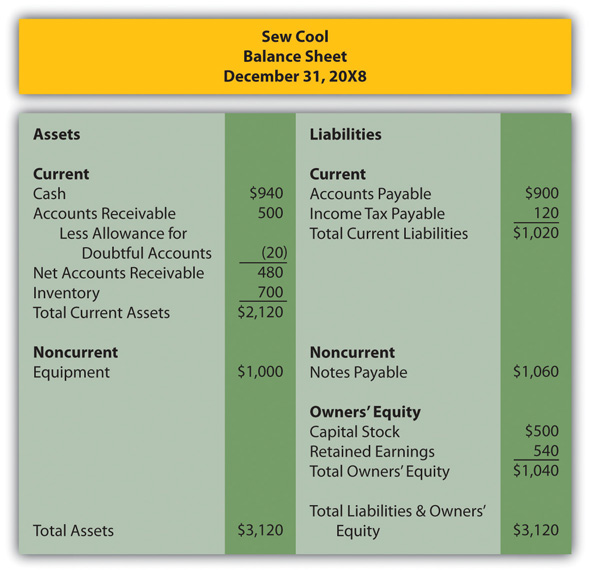

In Chapter 4 "How Does an Organization Accumulate and Organize the Information Necessary to Create Financial Statements?", Heather Miller started her own business, Sew Cool. The financial statements for December are shown next.

Figure 7.21

Figure 7.22

Figure 7.23

Based on the financial statements determine the following:

- Current ratio

- Working capital

- Age of receivables

- Receivables turnover—assuming that accounts receivable on January 1, 20X8 were $460.

Comprehensive Problem

This problem will carry through over several chapters to enable students to build their accounting skills using knowledge gained in previous chapters.

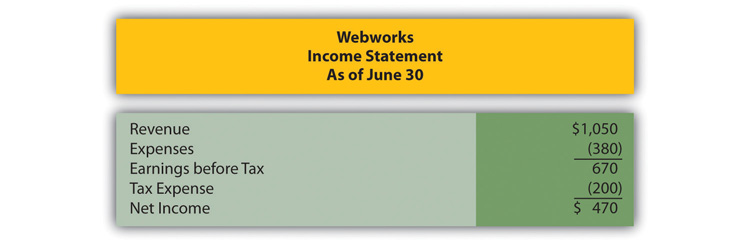

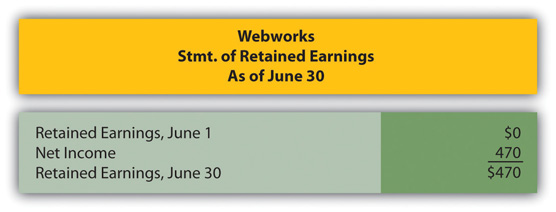

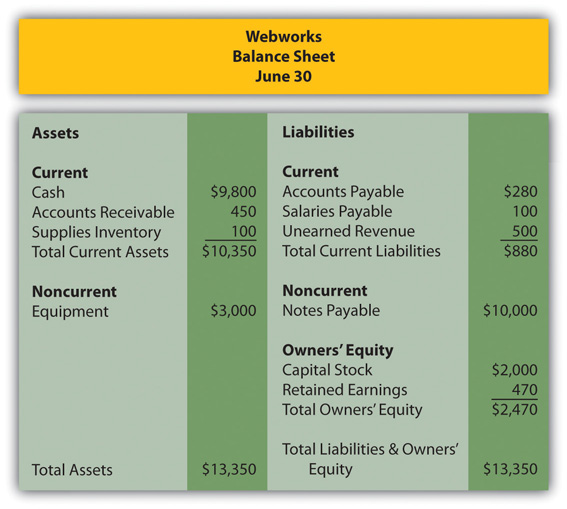

In Chapter 5 "Why Is Financial Information Adjusted Prior to the Production of Financial Statements?", Leon Jackson started Webworks, a Web site design and maintenance firm. At that time, an adjusted trial balance was prepared for June.

Here are Webworks financial statements as of June 30.

Figure 7.24

Figure 7.25

Figure 7.26

The following events occur during July:

- Webworks purchases additional equipment for $4,000 cash.

- Webworks purchases supplies worth $90 on account.

- Webworks pays off accounts payable and salaries payable from June.

- Webworks starts and completes four more sites and bills clients for $1,800.

- In June, Webworks received $500 in advance to design a restaurant Web site. Webworks completes this site during July.

- Webworks collects $1,200 in accounts receivable.

- Webworks pays Nancy Po (the company employee hired in June) $500 for her work during the first three weeks of July.

- Webworks receives $200 in advance to work on a Web site for a local dry cleaner and $300 in advance to work on a Web site for a local animal hospital. Work will not begin on these Web sites until August.

- Leon’s parents decide to charge rent after seeing how successful the business is and how much space it is taking up in their house. They all agree that rent will be $200 per month. Webworks pays $600 for July, August, and September.

-

Webworks pays taxes of $300 in cash.

Required:

- Prepare journal entries for the previous events.

- Post the journal entries to T-accounts.

- Prepare an unadjusted trial balance for Webworks for July.

- Prepare adjusting entries for the following and post them to T-accounts.

- Webworks owes Nancy Po $200 for her work during the last week of July.

- Leon’s parents let him know that Webworks owes $150 toward the electricity bill. Webworks will pay them in August.

- Webworks determines that it has $50 worth of supplies remaining at the end of July.

- Prepaid rent should be adjusted for July’s rent.

-

Leon now believes that the company may not be able to collect all of its accounts receivable. A local CPA helps Leon determine that similar businesses report an allowance for bad debt at an average of 10 percent of their accounts receivable. Webworks will use this same approach.

- Prepare an adjusted trial balance.

- Prepare financial statements for July.

Research Assignment

Assume that you take a job as a summer employee for an investment advisory service. One of the partners for that firm is currently looking at the possibility of investing in eBay Inc. The partner is a bit concerned about the impact of the recession on this company, especially its accounts receivable. The partner asks you to look at the 2010 financial statements for eBay Inc. by following this path:

- Go to http://www.ebay.com.

- At the bottom of this screen, click on “Company Info.”

- On the left side of the next screen, click on “Investors.”

- On the left side of the next screen, click on “Annual Reports & Proxy.”

- In the center of the next screen, click on “2010 Annual Report” to download.

- Go to page 86 and find the December 31, 2009, and December 31, 2010, balance sheets.

- Go to page 87 and find the income statement for the year ended December 31, 2010.

- Go to page 94 and read the note about the composition of the allowance for doubtful accounts.

- Using the figures found on the balance sheet and the income statement, determine the number of days eBay takes to collect its receivables at the end of 2010.

- Using the figures found on the balance sheet and the income statement, determine the receivables turnover for eBay during 2010.

- Using the figures found in the balance sheet and the information in the notes, determine the percentage of receivables as of December 31, 2010 that are expected to be uncollectible.