This is “Why Is Financial Information Adjusted Prior to the Production of Financial Statements?”, chapter 5 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 5 Why Is Financial Information Adjusted Prior to the Production of Financial Statements?

Video Clip

(click to see video)In this video, Professor Joe Hoyle introduces the essential points covered in Chapter 5 "Why Is Financial Information Adjusted Prior to the Production of Financial Statements?".

5.1 The Need for Adjusting Entries

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Explain the purpose and necessity of adjusting entries.

- List examples of several typical accounts that require adjusting entries.

- Provide examples of adjusting entries for various accrued expenses.

Accounting for the Passage of Time

Question: The first two steps of the accounting process were identified in Chapter 4 "How Does an Organization Accumulate and Organize the Information Necessary to Create Financial Statements?" as “analyze” and “record.” A transaction occurs and the resulting financial effects are ascertained through careful analysis. Once determined, the monetary impact on specific accounts is recorded in the form of a journal entry. Each of the debits and credits is then posted to the corresponding T-accounts located in the ledger. As needed, current balances can be determined for any of these accounts by netting the debits and credits. It is a system as old as the painting of the Mona Lisa.

The third step in this process was listed as “adjust.” Why do ledger account balances require adjustment? Why are the T-account totals found in the trial balance at the end of Chapter 4 "How Does an Organization Accumulate and Organize the Information Necessary to Create Financial Statements?" (Figure 4.21 "Lawndale Company Trial Balance (after all journal entries have been posted)—December 31, Year Four") not simply used by the accountant to produce Year Four financial statements for that business (Lawndale Company)?

Answer: Financial events take place throughout the year. As indicated, journal entries record the individual debit and credit effects that are then entered into the proper T-accounts. However, not all changes in these balances occur as the result of physical events. Some accounts increase or decrease because of the passage of time. The impact can be so gradual that producing individual journal entries is not reasonable.

For example, salary is earned by employees every day (actually every minute), but payment is not made until the end of the week or month. Many other expenses, such as utilities, rent, and interest, are incurred over time in much the same way. Accounting for supplies such as pens and envelopes is only slightly different. This asset is slowly depleted because of usage rather than time, but the impact on accounts is basically the same. As indicated in Chapter 4 "How Does an Organization Accumulate and Organize the Information Necessary to Create Financial Statements?", unless an accounting system is programmed to record tiny incremental changes, none of these financial effects is captured as they occur.

Following each day of work, few companies take the trouble to record the equivalent amount of salary, rent, or other expense along with the related liability. When a pad of paper is consumed within an organization, debiting supplies expense for a dollar and crediting supplies for the same amount hardly seems worth the effort.

Therefore, prior to producing financial statements, the accountant must search for any such changes that have not yet been recognized. These incremental increases or decreases must also be recorded in a debit and credit format (called adjusting entriesChanges in account balances recorded prior to preparing financial statements to update T-accounts because some amounts have increased or decreased over time but have not been recorded through a journal entry. rather than journal entries) with the impact then posted to the appropriate ledger accounts. The updating process continues until all balances are presented fairly. These adjustments are a prerequisite step in the preparation of financial statements. They are physically identical to the journal entries recorded for transactions, but they occur at a different time and for a different reason.

Test Yourself

Question:

On Monday morning, a company hires a person and promises to pay $300 per day for working Monday through Friday. The first payment of $1,500 is made at the end of the workday on Friday. The person quits on Saturday. Which of the following statements is true?

- An adjusting entry is needed when the person is hired if financial statements are prepared at that time.

- An adjusting entry is needed at the end of work on Monday if financial statements are prepared at that time.

- An adjusting entry is needed at the end of work on Friday when payment is made if financial statements are prepared at that time.

- An adjusting entry is needed on Saturday when the person quits if financial statements are prepared at that time.

Answer:

The correct answer is choice b: An adjusting entry is needed at the end of work on Monday if financial statements are prepared at that time.

Explanation:

When financial statements are prepared, adjusting entries recognize changes created by the passage of time. Hiring an employee creates no change; money has not been earned. Payment is an actual transaction recorded by a journal entry. The person quitting requires no entry because further work was not done after Friday’s payment. When an employee works on Monday, salary is owed for that day. The amount is probably not recorded by the accounting system, so an adjusting entry is needed.

Examples of Adjusting Entries

Question: Adjusting entries update ledger accounts for any financial changes that occur gradually over time so that they are not recorded through a journal entry. Large companies will make hundreds, if not thousands, of adjustments at the end of each fiscal period. What kinds of adjustments are normally needed before a set of financial statements is prepared?

Answer: A variety of adjusting entries will be examined throughout the remainder of this textbook. One of the accountant’s primary responsibilities is the careful study of all financial information to ensure that it is presented fairly before being released. Such investigation can lead to the preparation of numerous adjusting entries. Here, in Chapter 5 "Why Is Financial Information Adjusted Prior to the Production of Financial Statements?", only the following four general types of adjustments are introduced to demonstrate the process and also reflect the importance of the revenue recognition principle and the matching principle. In later chapters, additional examples will be described and analyzed.

- Accrued expenses (also referred to as accrued liabilities)

- Prepaid expenses (including supplies)

- Accrued revenue

- Unearned revenue (also referred to as deferred revenue)

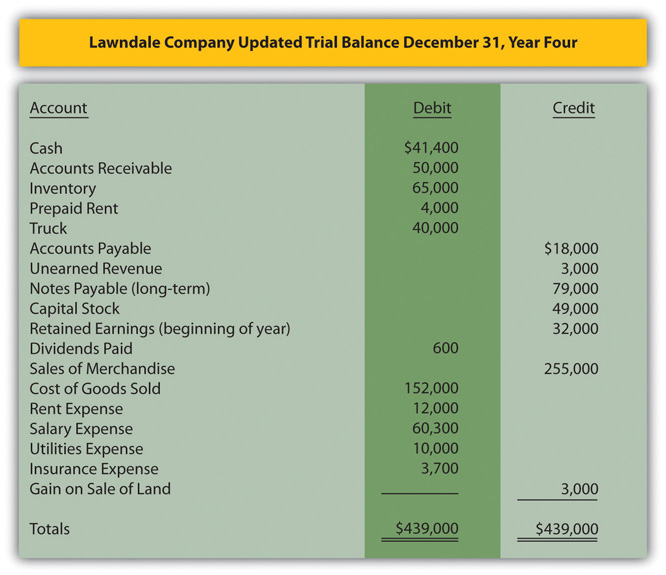

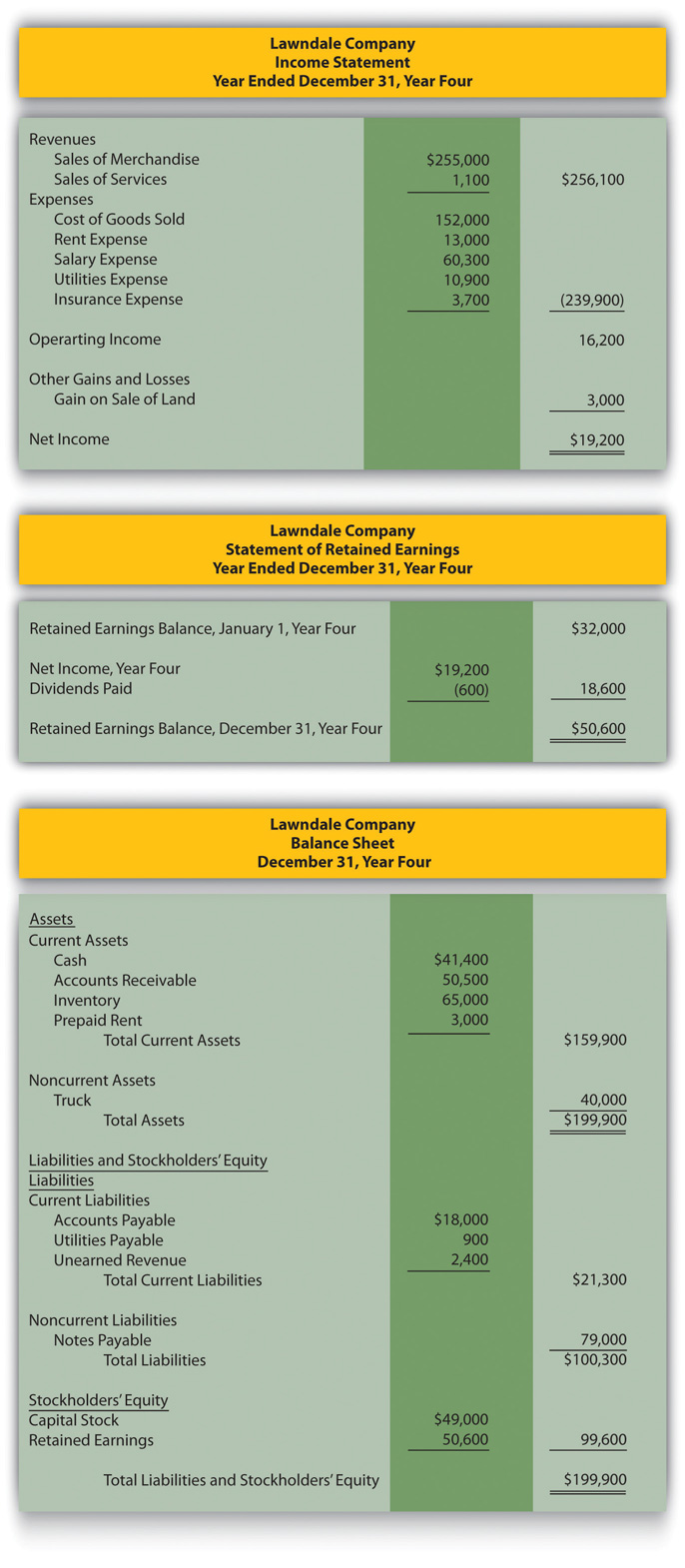

Usually, at the start of the adjustment process, the accountant prepares an updated trial balance to provide a visual, organized representation of all ledger account balances. This listing aids the accountant in spotting figures that might need adjusting in order to be fairly presented. Therefore, Figure 4.21 "Lawndale Company Trial Balance (after all journal entries have been posted)—December 31, Year Four" is replicated here in Figure 5.1 "Updated Trial Balance for the Lawndale Company" because this trial balance holds the December 31, Year Four, account balances for the Lawndale Company determined at the end of Chapter 4 "How Does an Organization Accumulate and Organize the Information Necessary to Create Financial Statements?". All transactions have been recorded and posted, but no adjustments have yet been made.

Figure 5.1 Updated Trial Balance for the Lawndale Company

Adjusting Entry to Recognize an Accrued Expense

Question: The first type of adjustment listed is an accrued expenseExpenses (and related liabilities) that grow gradually over time; if not recognized automatically by the accounting system, the monetary impact is recorded prior to preparing the company’s financial statements by means of an adjusting entry.. Previously, the word “accrue” was defined as “to grow.” Thus, an accrued expense is one that increases gradually over time. As has been indicated, some companies program their accounting systems to record such expenses as incurred. This accrual process eliminates the need for subsequent adjusting entries. Other companies make few, if any, accruals and update all balances through numerous adjustments when financial statements are to be prepared.

The mechanical recording process for such expenses should be designed to meet the informational needs of company officials. Some prefer to have updated balances readily available in the ledger at all times while others are inclined to wait for periodic financial reports to be issued. What are some typical accrued expenses, and what is the appropriate adjusting entry if they are not recorded as incurred by the accounting system?

Answer: If a reporting company’s accounting system recognizes an expense as it grows, no adjustment is necessary. The balances are recorded properly. They are ready to be included in financial statements. Thus, when statements are prepared, the accountant only needs to search for accrued expenses that have not yet been recognized.

Numerous expenses get slightly larger each day until paid, including salary, rent, insurance, utilities, interest, advertising, income taxes, and the like. For example, on its December 31, 2010, balance sheet, The Hershey Company reported accrued liabilities of approximately $593 million. In the notes to the financial statements, this amount was explained as debts owed by the company on that day for payroll, compensation and benefits ($219 million), advertising and promotion ($211 million), and other accrued expenses ($163 million).

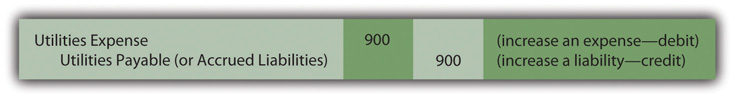

Assume, for illustration purposes, that the accountant reviews the trial balance presented in Figure 5.1 "Updated Trial Balance for the Lawndale Company" and realizes that utility expenses (such as electricity and water) have not been recorded since the most recent payment early in December of Year Four. Assume that Lawndale Company currently owes $900 for those utilities. The following adjustment is needed before financial statements can be created. It is an adjusting entry because no physical event took place. This liability simply grew over time and has not yet been paid.

Figure 5.2 Adjusting Entry 1: Amount Owed for Utilities

Test Yourself

Question:

A company owes its employees $7,300 at the end of Year One, which it pays on January 8, Year Two. This balance was not accrued by the company’s accounting system in Year One, nor was it recorded as an adjusting entry on December 31, Year One. Which of the following is not true for the Year One financial statements?

- Reported expenses are too low by $7,300.

- Reported net income is too high by $7,300.

- Reported total assets are too high by $7,300.

- Reported total liabilities are too low by $7,300.

Answer:

The correct answer is choice c: Reported total assets are too high by $7,300.

Explanation:

Neither the expense nor the payable was recorded in Year One, and those reported balances are too low. Because the expense was too low, reported net income will be overstated by $7,300. This accrual does not impact an asset until paid in Year Two. Therefore, the Year One asset balance is properly stated.

Key Takeaway

Adjusting entries are often necessary to update account balances before financial statements can be prepared. These adjustments are not the result of physical events or transactions but are caused by the passage of time or small changes in account balances. The accountant examines all current account balances as listed in the trial balance to identify amounts that need to be changed prior to the preparation of financial statements. Although numerous adjustments are studied in this textbook, four general types are especially common: accrued expenses, prepaid expenses, accrued revenues, and unearned revenues. Any expense (such as salary, interest, or rent) that grows gradually over time but has not yet been paid is known as an accrued expense (or accrued liability). If not automatically recorded by the accounting system as incurred, the amount due must be entered into the records by adjustment prior to producing financial statements.

5.2 Preparing Various Adjusting Entries

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Explain the need for an adjusting entry in the reporting of prepaid expenses and be able to prepare that adjustment.

- Explain the need for an adjusting entry in the reporting of accrued revenue and be able to prepare that adjustment.

- Describe the challenge of determining when the earning process for revenue is substantially complete and discuss possible resolutions.

- Explain the need for an adjusting entry in the reporting of unearned revenue and be able to prepare that adjustment.

Recording and Adjusting Prepaid Expenses

Question: The second adjustment to be considered here involves the handling of prepaid expensesA future economic benefit created when an expense is paid in advance; reported as an asset initially and then gradually reassigned to expense over time through adjusting entries.. For example, as of May 29, 2011, General Mills Inc. reported “prepaid expenses and other current assets” of $483.5 million. A decision maker studying this business needs to understand what information is conveyed by such balances.

In the transactions that were recorded in the previous chapter, Journal Entry 10 reported a $4,000 payment made by the Lawndale Company for four months of rent to use a building. An asset—prepaid rent—was recorded at that time through the normal accounting process. The resulting account is listed on the trial balance in Figure 5.1 "Updated Trial Balance for the Lawndale Company". Such costs are common and often include payments for insurance and supplies.

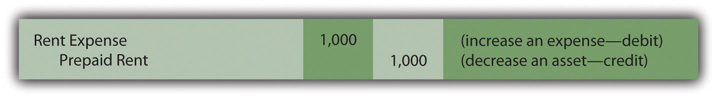

Assume, at the end of Year Four, the company’s accountant examines the invoice that was paid and determines that this $4,000 in rent covered the period from December 1, Year Four, until March 31, Year Five. As a result, an adjusting entry is now necessary so that all balances are presented fairly. Why is a year-end adjusting entry often needed in connection with a prepaid expense?

Answer: During these four months, the Lawndale Company will use the rented facility to help generate revenue. Over that time, the future economic benefit established by the payment gradually becomes a past benefit. The asset literally changes into an expense day by day. In this example, one month of the rent from this payment has now been consumed. The benefit provided by using this building during December to gain revenue no longer exists. That portion of the rent ($1,000 or $4,000/four months) reflects a past benefit and should be reported as an expense in Year Four in accordance with the matching principle. Expenses are recognized in the same period as the revenue they help to generate.

As a preliminary step in preparing financial statements, an adjusting entry is needed to reclassify $1,000 from the asset (prepaid rent) into an expense (rent expense). This adjustment leaves $3,000 in the asset (for the remaining three months of rent on the building) while $1,000 is now reported as an expense (for the previous one month of rent).

Figure 5.3 Adjusting Entry 2 (Version 1): Use Is Made of a Rented Facility (Original Entry to Prepaid Rent)

Adjusting entries are created to take whatever amounts reside in the ledger and align them with the requirements of U.S. GAAP (or IFRS, if those standards are being applied). For this illustration, the original $4,000 payment was classified as a prepaid rent and the adjustment was created in response to that initial entry. After $1,000 is moved from asset to expense, the balances are presented fairly: an asset of $3,000 for the future benefit and an expense of $1,000 for the past.

In recording transactions, some accounting systems mechanically handle events in a different manner than others. Thus, construction of each adjusting entry depends on the recording that previously took place. To illustrate, assume that when this $4,000 payment was made, the company entered the debit to rent expense rather than prepaid rent. Perhaps an error was made or, more likely, a computerized accounting system was programmed to record all money spent for rent as an expense. For convenience, many companies prefer to automate the recording process wherever possible knowing that adjusting entries can then be made to arrive at proper balances. The initial accounting has no impact on the figures to be reported but does alter the adjustment process.

If a $4,000 expense was recorded here initially rather than a prepayment, an adjusting entry is still needed. The expense appearing on the income statement should be $1,000 (for the past one month) while the appropriate asset on the balance sheet should be $3,000 (for the subsequent three months). If the entire cost of $4,000 is located in rent expense, the following alternative is necessary to arrive at proper balances. This adjustment shifts $3,000 out of the expense and into the asset.

Figure 5.4 Adjusting Entry 2A (Version 2): Use Is Made of a Rented Facility (Original Entry to Rent Expense)

This adjusting entry leaves the appropriate $1,000 in expense and puts $3,000 into the asset account. Those are the proper balances as of the end of the year. Regardless of the account, the accountant first determines the balance that is present in the ledger and then creates the specific adjustment needed to arrive at fairly presented figures.

Test Yourself

Question:

A company pays $4,000 to rent a building on October 1, Year One, for four months. The amount was recorded as prepaid rent, and no further change was made in the balance. When preparing to produce Year One financial statements, the accountant erroneously believed that the entire $4,000 was originally recorded as a rent expense and made an adjustment based on that assumption. Which of the following is a result of the accountant’s action?

- The prepaid rent is overstated on the balance sheet by $4,000.

- The rent expense is overstated on the income statement by $4,000.

- The prepaid rent is overstated on the balance sheet by $1,000.

- The rent expense is overstated on the income statement by $1,000.

Answer:

The correct answer is choice a: The prepaid rent is overstated on the balance sheet by $4,000.

Explanation:

Rent was $1,000 per month. Three months have passed. The rent expense should be reported as $3,000 with the prepaid rent as $1,000. All $4,000 was recorded as prepaid rent. The accountant thought the rent expense was recorded as $4,000, so $1,000 was moved from expense to prepaid rent. That entry raised the prepaid rent to $5,000 ($4,000 plus $1,000) and dropped the expense to a negative $1,000. The prepaid rent is overstated by $4,000 ($5,000 rather than $1,000); the rent expense is understated by $4,000.

Recognizing Accrued Revenue

Question: The third general type of adjustment to be covered here is accrued revenue. As the title implies, this revenue is one that grows gradually over time. If not recorded by a company’s accounting system as earned, an adjusting entry to update the balances is necessary before financial statements are prepared. This process mirrors that of accrued expenses. What adjustment is used by a reporting organization to recognize any accrued revenue that has not previously been recorded?

Answer: Various types of revenue are earned as time passes rather than through a physical event such as the sale of inventory. To illustrate, assume that a customer visited the Lawndale Company five days before the end of Year Four to ask for assistance. The customer must be away from his ranch for thirty days and wanted company employees to feed, water, and care for his horses during the period of absence. Everything needed for the job is available in the customer’s barn. The Lawndale Company just provides the service. The parties agreed that the company will receive $100 per day for this work with payment to be made upon the person’s return.

No asset changes hands at the start of this task. Thus, the company’s accounting system is not likely to make any entry until payment is eventually received. However, after the first five days of this work, the Lawndale Company is ready to prepare Year Four financial statements. For that reason, the company needs to recognize all revenue earned to date. Service to this customer has been carried out for five days at a rate of $100 per day. The company has performed the work to earn $500 although the money will not be received until later. Consequently, a receivable and revenue for this amount should be recognized through an adjusting entry. The earning process for the $500 occurred in Year Four and should be recorded in this year.

Figure 5.5 Adjusting Entry 3: Revenue Earned for Work Done

The $500 receivable will be removed in the subsequent period when the customer eventually pays Lawndale for the services rendered. No recognition is needed in this adjusting entry for cost of goods sold because a service, rather than inventory, is being sold.

The Earning Process

Question: As discussed in a previous chapter, the revenue realization principle (within accrual accounting) provides formal guidance for the timing of revenue reporting. It states in part that the earning process must be substantially complete before revenue is recognized. That seems reasonable. In the previous example, the work has been performed for only five days out of a total of thirty. That does not appear to qualify as substantially complete. Is accrued revenue recognized if the earning process is not substantially complete?

Answer: This example draws attention to one of the most challenging questions that accountants face in creating a fair portrait of a business. When should revenue be recognized? The revenue realization principle is established by U.S. GAAP, but practical issues remain. For example, when does an earning process become substantially complete? Here, the simplest way to resolve this accounting issue is to consider the nature of the task to be performed by the Lawndale Company.

Is the job of caring for the horses a single task to be carried out by the company over thirty days or is it thirty distinct tasks to be performed each day over this period of time?

If the work is viewed as one large task like painting a house, then the earning process here is only one-sixth of the way finished and not substantially complete. No revenue should be recognized until the remainder of the work has been performed. In that case, the adjusting entry is not warranted.

Conversely, if this assignment is actually thirty separate tasks, then five of them are substantially complete at the end of the year, and revenue of $500 is properly recorded by the previous adjustment. Unfortunately, the distinction is not always clear. Because accounting is conservative, revenue should never be recognized unless evidence predominates that the individual tasks are clearly separate events.

Test Yourself

Question:

The Acme Company paints houses in and around San Antonio, Texas. In December of Year One, the company was hired to paint the outside of a five-story apartment building for $100,000. All money was to be paid when the work was finished. By December 31, Year One, the company had painted the first three floors of the building and recognized accrued revenue of $60,000 ($100,000 × 3/5). Which of the following is not true?

- The reported net income is overstated in Year One.

- The reported assets are overstated at the end of Year One.

- The reported liabilities are overstated at the end of Year One.

- The reported revenue is overstated in Year One.

Answer:

The correct answer is choice c: The reported liabilities are overstated at the end of Year One.

Explanation:

Through the entry that was made, Acme recognized a receivable and revenue. The revenue increases net income. However, painting this building is a single job that is only 3/5 complete. That is not the same as “substantially complete.” Individual floors do not represent separate jobs. Based on accrual accounting, no justification exists for recognizing revenue. The receivable, revenue, and net income are all too high. This job does not impact liabilities, which continue to be reported properly.

The Revenue Recognition Principle

Question: In practice, how does an accountant determine whether a specific job is substantially complete? Because of the direct impact on net income, this judgment must be critical in financial reporting.

Answer: Accountants spend a lot of time searching for credible evidence as to the true nature of the events they encounter and report. Their goal is to ensure that all information included in financial statements is presented fairly according to U.S. GAAP (or IFRS). The timing of revenue recognition can be a special challenge that requires analysis and expertise.

Is a job substantially complete so that revenue should be recognized or not?

That question can often be difficult to answer. Here is one technique that might be applied in analyzing this particular example. Assume that after five days, Lawndale had to quit feeding the customer’s horses for some legitimate reason. Should the company be able to demand and collect $500 for the work done to that point? If so, then those five days are distinct tasks that have been completed. However, if no money would be due based on working just five days, substantial completion has not been achieved by the services performed to date. Thus, revenue recognition would be inappropriate.

In Adjusting Entry 3 (Figure 5.5 "Adjusting Entry 3: Revenue Earned for Work Done"), the assumption is made that the daily tasks are separate and that the company could collect for the work accomplished to date. However, this type of judgment can be extremely difficult in the real world. It is often the product of much thought and discussion. The impact on the financial statements can be material, which increases pressure on the accountant. Even with standard rules, painting a fairly presented portrait is not always easy.

Students frequently enroll in a financial accounting course believing that little is required other than learning set rules and then following them mechanically. As will be demonstrated many times in this textbook, nothing ever replaces the need for experienced judgment on the part of the accountant.

Unearned Revenue

Question: The last adjusting entry to be covered at this time is unearned (or deferred) revenue. Some companies operate in industries where money is received first and then earned gradually over time. Newspaper and magazine businesses, for example, are paid in advance by their subscribers and advertisers. The earning process becomes substantially complete by the subsequent issuance of their products.

For example, the January 2, 2011, balance sheet of The Washington Post Company reported deferred revenues as a liability of over $379 million. The notes to the company’s financial statement provided clear information about the accounting process: “Amounts received from customers in advance are deferred as liabilities” or “Revenues from newspaper subscriptions and retail sales are recognized upon the later delivery or publication date.”

In Journal Entry 13 in Chapter 4 "How Does an Organization Accumulate and Organize the Information Necessary to Create Financial Statements?", the Lawndale Company reported receiving $3,000 in cash for services to be rendered at a later date. An unearned revenue account was recorded as a liability for that amount and appears in the trial balance in Figure 5.1 "Updated Trial Balance for the Lawndale Company". When is an adjusting entry needed in connection with the recognition of previously unearned revenue?

Answer: As indicated by The Washington Post Company, unearned revenue represents a liability recognized when money is received before work is done. After the required service is carried out so that the earning process is substantially complete, an appropriate amount is reclassified from unearned revenue on the balance sheet to revenue on the income statement. For example, in connection with the $3,000 payment collected by Lawndale, assume that all the work necessary to recognize the first $600 was performed by the end of Year Four. Prior to preparing financial statements, an adjusting entry reduces the liability and recognizes the earned revenue.

Figure 5.6 Adjusting Entry 4: Money Previously Received Has Now Been Earned

Test Yourself

Question:

The Midlothian Trash Company of Richmond, Virginia, charges customers $100 per month to pick up trash for one month. Money is due on the first day of each month. By the beginning of the current month, the company has received $49,000. If financial statements are made immediately, what reporting is appropriate for the company?

- Assets increase and liabilities increase

- Assets increase and revenues increase

- Expenses increase and revenues increase

- Expenses increase and liabilities increase

Answer:

The correct answer is choice a: Assets increase and liabilities increase.

Explanation:

The company receives cash, so reported assets are higher. However, the earning process at the first day of the month is not substantially complete, so no revenue can be recognized yet. Instead, an unearned revenue is recorded that increases the company’s liabilities. The company owes the service to its customers, or it owes them their money back.

Key Takeaway

To align reported balances with the rules of accrual accounting, adjusting entries are created as a step just prior to the preparation of financial statements. Prepaid expenses are normally recorded first as assets when paid and then reclassified to expense as time passes to satisfy the matching principle. The mechanics of this process can vary somewhat based on the initial recording of the payment, but the reported figures should be the same regardless of the company’s accounting system. Accrued revenue and the corresponding receivable are recognized when the earning process is deemed to be substantially complete even though cash is not yet received. The time at which this benchmark is achieved can depend on whether a single job or a collection of independent tasks is under way. As with many areas of financial reporting, this decision by the accountant often relies heavily on professional judgment rather than absolute rules. Companies occasionally receive money for services or goods before they are provided. In such cases, unearned revenue is recorded as a liability to indicate the obligation to the customer. Over time, as the earning process becomes substantially complete, the unearned revenue is reclassified as revenue.

5.3 Preparation of Financial Statements

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Prepare an income statement, statement of retained earnings, and balance sheet based on the balances in an adjusted trial balance.

- Explain the purpose and construction of closing entries.

Preparing Financial Statements

Question: The accounting process is clearly a series of defined steps that take a multitude of monetary transactions and eventually turn them into fairly presented financial statements. After all adjusting entries have been recorded in the journal and posted to the appropriate T-accounts in the ledger, what happens next in the accounting process?

Answer: After the adjusting entries are posted, the accountant should believe that all material misstatements have been removed from the accounts. Thus, they are presented fairly according to U.S. GAAP (or IFRS) and can be used by decision makers. As one final check, an adjusted trial balance is produced for a last, careful review. Assuming that no additional concerns are uncovered, the accountant prepares an income statement, a statement of retained earnings, and a balance sheet.

The basic financial statements are then completed by the production of a statement of cash flows. In contrast to the previous three, this statement does not report ending ledger account balances but rather discloses and organizes all of the changes that took place during the period in the composition of the cash account. As indicated in Chapter 3 "How Is Financial Information Delivered to Decision Makers Such as Investors and Creditors?", cash flows are classified as resulting from operating activities, investing activities, or financing activities.

The reporting process is then finalized by the preparation of explanatory notes that accompany a set of financial statements.

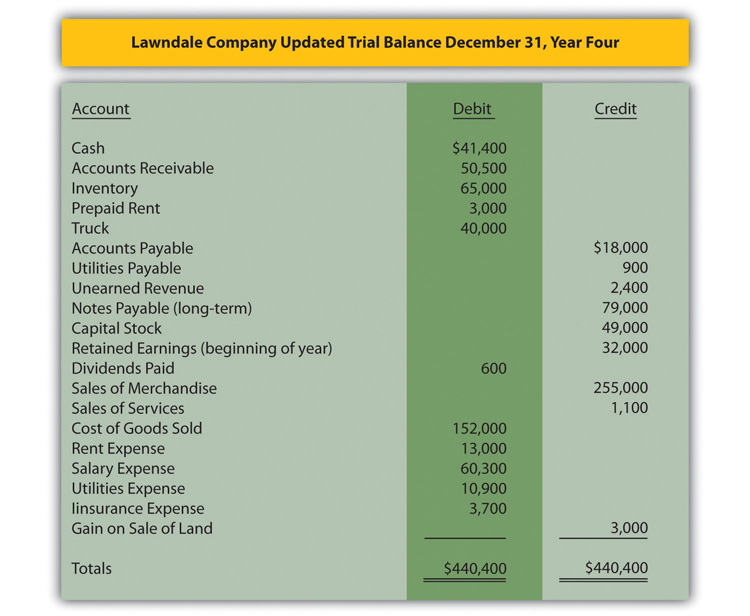

The final trial balance for the Lawndale Company (including the four adjusting entries produced earlier) is presented in Figure 5.7 "Updated Trial Balance for Lawndale Company—December 31, Year Four (after posting four adjusting entries to ". The original trial balance in Figure 5.1 "Updated Trial Balance for the Lawndale Company" has been updated by the four adjusting entries that were discussed in this chapter.

Adjusting Entry 1

- Utilities expense increases by $900

- Utilities payable increases by $900

Adjusting Entry 2 (Version 1)

- Rent expense increases by $1,000

- Prepaid rent decreases by $1,000

Adjusting Entry 3

- Accounts receivable increases by $500

- Sales of services increases by $500

Adjusting Entry 4

- Unearned revenue decreases by $600

- Sales of services increases by $600

These changes are entered into Figure 5.1 "Updated Trial Balance for the Lawndale Company" to bring about the totals presented in Figure 5.7 "Updated Trial Balance for Lawndale Company—December 31, Year Four (after posting four adjusting entries to ".

Figure 5.7 Updated Trial Balance for Lawndale Company—December 31, Year Four (after posting four adjusting entries to Figure 5.1 "Updated Trial Balance for the Lawndale Company")

After that, each of the final figures is appropriately placed within the first three financial statements. Revenues and expenses appear in the income statement, assets and liabilities in the balance sheet, and so on. The resulting statements for the Lawndale Company are exhibited in Figure 5.8 "Year Four Financial Statements for Lawndale Company".

Figure 5.8 Year Four Financial Statements for Lawndale Company

To keep this initial illustration reasonably simple, no attempt has been made to record all possible accounts or adjusting entries. For example, no accrued expenses have been recognized for either income taxes or interest expense owed in connection with the notes payable. One example of an accrued expense is sufficient in this early coverage because both income taxes and interest expense will be described in depth in a later chapter. Likewise, depreciation expense of noncurrent assets with finite lives (such as the truck shown on the company’s trial balance) will be discussed subsequently. However, the creation of financial statements for the Lawndale Company should demonstrate the functioning of the accounting process as well as the basic structure of the income statement, statement of retained earnings, and balance sheet.

Several aspects of this process should be noted:

- The statements are properly identified by name of company, name of statement, and date. The balance sheet is for a particular day (December 31, Year Four) and the other statements cover a period of time (Year ending December 31, Year Four).

- Each account in the trial balance in Figure 5.7 "Updated Trial Balance for Lawndale Company—December 31, Year Four (after posting four adjusting entries to " appears within only one statement. Accounts receivable is an asset on the balance sheet. Cost of goods sold is an expense on the income statement. Dividends paid is a reduction shown on the statement of retained earnings. Each account serves one purpose and appears on only one financial statement.

- There is no T-account for net income. Net income is a composition of all revenues, gains, expenses, and losses for the year. The net income figure computed in the income statements is then used in the statement of retained earnings. In the same manner, there is no T-account for the ending retained earnings balance. Ending retained earnings is a composition of the beginning retained earnings balance, net income, and dividends paid. The ending retained earnings balance computed in the statement of retained earnings is then used in the balance sheet.

- The balance sheet does balance. The total of the assets is equal to the total of all liabilities and stockholders’ equity (capital stock and retained earnings). Assets must always have a source.

The statement of cash flows for the Lawndale Company cannot be created based solely on the limited information available in this chapter concerning the changes in the cash account. Thus, it has been omitted. Complete coverage of the preparation of a statement of cash flows will be presented in Chapter 17 "In a Set of Financial Statements, What Information Is Conveyed by the Statement of Cash Flows?".

The Purpose of Closing Entries

Question: Analyze, record, adjust, and report—the four basic steps in the accounting process. Is the work year complete for the accountant after financial statements are prepared?

Answer: One last mechanical process needs to be mentioned. Whether a business is as big as Microsoft or as small as the local convenience store, the final action performed each year by the accountant is the preparation of closing entriesEntries made to reduce all temporary ledger accounts (revenues, expenses, gains, losses, and dividends paid) to zero at the end of an accounting period so that a new measurement for the subsequent period can begin; the net effect of this process is transferred into the retained earnings account to update the beginning balance to the year-end figure.. Five types of accounts—revenues, expenses, gains, losses, and dividends paid—reflect the various increases and decreases that occur in a company’s net assets in the current period. These accounts are often deemed “temporary” because they only include changes for one year at a time. Consequently, the figure reported by Microsoft as its revenue for the year ended June 30, 2011, measures only sales during that year. T-accounts for rent expense, insurance expense, and the like reflect just the current decreases in net assets.

In order for the accounting system to start measuring the effects for each new year, these specific T-accounts must all be returned to a zero balance after annual financial statements are produced. Consequently, all of the revenue T-accounts maintained by Microsoft show a total at the end of its fiscal year (June 30, 2011) of $69.9 billion but contain a zero balance at the start of the very next day.

- Final credit totals existing in every revenue and gain account are closed out by recording equal and off-setting debits.

- Likewise, ending debit balances for expenses, losses, and dividends paid require a credit entry of the same amount to return each of these T-accounts to zero.

After these accounts are closed at year’s end, the resulting single figure is the equivalent of net income reported for the year (revenues and gains less expenses and losses) reduced by any dividends paid. This net effect is recorded in the retained earnings T-account. The closing process effectively moves the balance for every revenue, expense, gain, loss, and dividend paid into retained earnings. In the same manner as journal entries and adjusting entries, closing entries are recorded initially in the journal and then posted to the ledger. As a result, the beginning retained earnings balance for the year is updated to arrive at the ending total reported on the balance sheet.

Assets, liabilities, capital stock, and retained earnings all start out each year with a balance that is the same as the ending figure reported on the previous balance sheet. Those accounts are permanent; they are not designed to report an impact occurring during the current year. In contrast, revenues, expenses, gains, losses, and dividends paid all begin the first day of each year with a zero balance—ready to record the events of this new period.

Key Takeaway

After all adjustments are prepared and recorded, an adjusted trial balance is created, and those figures are used to produce financial statements. The income statement is prepared first, followed by the statement of retained earnings and then the balance sheet. The statement of cash flows is constructed separately because its figures do not come from ending T-account balances. Net income is determined on the income statement and also reported on the statement of retained earnings. Ending retained earnings is computed there and carried over to provide a year-end figure for the balance sheet. Finally, closing entries are prepared for revenues, expenses, gains, losses, and dividends paid. Through this process, all of these T-accounts are returned to zero balances so that recording for the new year can begin. The various amounts in these temporary accounts are moved to retained earnings. In this way, the beginning retained earnings balance for the year is increased to equal the ending total reported on the company’s balance sheet.

Talking with a Real Investing Pro (Continued)

Following is a continuation of our interview with Kevin G. Burns.

Question: Large business organizations such as PepsiCo and IBM have millions of transactions to analyze, classify, and record so that they can produce financial statements. That has to be a relatively expensive process that produces no revenue for the company. From your experience in analyzing financial statements and investment opportunities, do you think companies should spend more money on their accounting systems or would they be wise to spend less and save their resources?

Kevin Burns: Given the situations of the last decade ranging from the accounting scandals of Enron and WorldCom to recent troubles in the major investment banks, the credibility of financial statements and financial officers has eroded significantly. My view is that—particularly today—transparency is absolutely paramount and the more detail the better. Along those lines, I think any amounts spent by corporate officials to increase transparency in their financial reporting, and therefore improve investor confidence, is money well spent.

Video Clip

(click to see video)Professor Joe Hoyle talks about the five most important points in Chapter 5 "Why Is Financial Information Adjusted Prior to the Production of Financial Statements?".

5.4 End-of-Chapter Exercises

Questions

- What is the purpose of adjusting entries?

- Name the four general types of adjustments.

- Give three examples of accrued expenses.

- If a company’s employees earn $2,000 each day, seven days per week, and they are last paid on December 25, what adjusting entry is required at the end of the period?

- Briefly explain why accountants can find it difficult to determine whether revenue has been earned or not.

- A company buys $9,000 in supplies on December 11, Year One. On the last day of that year, only $1,000 of these supplies remains with the company. The company’s year-end trial balance shows a Supplies account of $9,000. What adjusting entry is needed?

- A company buys $9,000 in supplies on December 11, Year One. On the last day of that year, only $1,000 of these supplies remains with the company. The company’s year-end trial balance shows a Supplies Expense account of $9,000. What adjusting entry is needed?

- A company owns a building that it rents for $3,000 per month. No payment was received for November or December although company officials do expect payment to be collected. If nothing has yet been recorded, what adjusting entry is needed at the end of the year?

- Give an example of a business or industry where customers usually pay for the product or service in advance.

- What type of account is unearned revenue? Why is that classification appropriate?

- When should a company reclassify unearned revenue to revenue?

- How often does a company produce a trial balance?

- In preparing financial statements, what accounts are reported on the income statement, and what accounts are reported on the balance sheet?

- Why do accountants prepare closing entries?

- Into which account are revenues and expenses closed?

True or False

- ____ Determining when to recognize revenue can be difficult for accountants.

- ____ Only permanent accounts are closed at the end of the financial accounting process each year.

- ____ According to U.S. GAAP, revenue cannot be recorded until cash is collected.

- ____ Some changes to account balances occur because of the passage of time.

- ____ Accounting is a profession where judgment is rarely needed because so many rules exist that must be followed.

- ____ Assets, liabilities and stockholders’ equity accounts will all start each new accounting period with the same balance they had at the end of the previous period.

- ____ An accrued revenue is one that is earned gradually over time.

- ____ Companies have some discretion in how and when they record accruals such as rent expense or interest expense.

- ____ The purpose of adjusting entries is to reduce the balance in temporary accounts to zero at the end of the reporting cycle.

- ____ Only one trial balance is prepared during each separate accounting period.

- ____ Employees for the Saginaw Corporation earn a salary of $8,000 per day, an amount that the accounting system recognizes automatically at the end of each day. If no salary is paid for the last nine days of the year, an adjusting entry is required before financial statements can be prepared.

- ____ In producing financial statements for the Night Corporation, rent expense is accidentally reported as an asset rather than an expense. As a result, reported net income will be overstated for that period.

- ____ In producing financial statements for the Day Corporation, rent expense is accidentally reported as an asset rather than an expense. As a result, the balance sheet will not balance.

- ____ A company owes $9,000 in interest on a note payable at the end of the current year. The accountant accidentally overlooks that information and no adjusting entry is made. As a result, the balance sheet will not balance.

- ____ A company owes $9,000 in interest on a note payable at the end of the current year. The accountant accidentally overlooks that information and no adjusting entry is made. As a result, reported net income will be overstated for that period.

Multiple Choice

-

Which of the following accounts is closed at the end of the year after financial statements are produced?

- Accounts receivable

- Accounts payable

- Cost of goods sold

- Unearned revenue

-

Jenkins Company received $600 from a client in December for work to be performed by Jenkins over the following months. That cash collection was properly recorded at that time. The accountant for Jenkins believes that this work is really three separate jobs. What adjusting entry is recorded by this accountant on December 31 if one of these jobs is substantially completed by that time?

-

Figure 5.9

-

Figure 5.10

-

Figure 5.11

-

Figure 5.12

-

-

Which of the following accounts increases retained earnings when closing entries are prepared?

- Dividends

- Sales revenue

- Loss of sale of land

- Rent expense

-

Which of the following is the sequence of the accounting process?

- Analyze, Record, Adjust, Report

- Record, Report, Adjust, Analyze

- Adjust, Report, Record, Analyze

- Report, Analyze, Record, Adjust

-

On September 1, Year Three, the LaToya Corporation paid $42,000 for insurance for the next six months. The appropriate journal entry was made at that time. On December 31, LaToya’s accountant forgot to make the adjusting entry that was needed. Which of the following is true about the Year Three financial statements?

- Assets are understated by $42,000.

- Net income is understated by $14,000.

- Expenses are overstated by $42,000.

- Net income is overstated by $28,000.

-

Starting on December 21, Year One, the Shakespeare Corporation begins to incur an expense of $1,000 per day. On January 21, Year Two, the company makes a payment of $31,000 for the previous thirty-one days. Assume the company failed to make an adjusting entry at December 31, Year One. Which of the following is true for the Year One financial statements?

- Net income is understated, and the total of the liabilities is understated.

- Net income is overstated, and the total of the liabilities is understated.

- Net income is understated, and the total of the liabilities is overstated.

- Net income is overstated, and the total of the liabilities is overstated.

-

Starting on December 21, Year One, the Shakespeare Corporation begins to incur an expense of $1,000 per day. On January 21, Year Two, the company makes a payment of $31,000. The company made the proper adjusting entry at December 31. When the payment was eventually made, what account or accounts were debited?

- Expense was debited for $31,000.

- A liability was debited for $31,000.

- Expense was debited for $11,000, and a liability was debited for $20,000.

- Expense was debited for $20,000, and a liability was debited for $11,000.

-

Starting on December 21, Year One, the Shakespeare Corporation begins to incur an expense of $1,000 per day. On January 21, Year Two, the company makes a payment of $31,000 for the previous thirty-one days. Assume the company failed to make the proper year-end adjusting entry. However, when payment was made, the journal entry was prepared as if the adjusting entry had been made (the accountant did not realize the adjusting entry was not made). After recording the erroneous journal entry, which of the following is true?

- Recorded expense in Year Two is too low.

- Recorded expense in Year Two is too high.

- Recorded liability balance is now too low.

- Recorded liability balance is now too high.

-

The Cone Company has prepared a trial balance that includes the following: accounts receivable—$19,000, inventory—$30,000, cost of goods sold—$72,000, sales revenue—$191,000, prepaid rent—$8,000, salary payable—$12,000, rent expense—$23,000, salary expense—$34,000, and dividends paid—$7,000. What should be reported as net income for the period?

- $50,000

- $55,000

- $62,000

- $70,000

-

A company pays $40,000 to rent a building for forty days. After nineteen days, financial statements are to be prepared. If the company originally recorded the $40,000 payment in rent expense, which of the following adjusting entries should be made prior to producing financial statements.

- Debit rent expense $19,000, and credit prepaid rent $19,000.

- Debit prepaid rent $21,000, and credit rent expense $21,000.

- Debit prepaid rent $19,000, and credit rent expense $19,000.

- Debit rent expense $21,000, and credit prepaid rent $21,000.

Video Problems

Professor Joe Hoyle discusses the answers to these two problems at the links that are indicated. After formulating your answers, watch each video to see how Professor Hoyle answers these questions.

-

Your roommate is an English major. The roommate’s parents own an ice cream shop in a resort community in Florida. One day, on the way to the local shopping center, your roommate blurts out this question: “My parents write down every penny they get and spend in their business. They are meticulous in their record keeping. However, at the end of each year, they pay money to hire an accountant. If they keep such perfect records every day, why could they possibly need an accountant after they have done all the work?” How would you respond?

-

Your uncle and two friends started a small office supply store at the beginning of the current year. Your uncle knows that you are taking a financial accounting class and asks you the following question: “We keep very careful records of all our transactions. At the end of the year, we will prepare financial statements to help us file our income taxes. We will also show the statements to the officers at the bank that gave us the loan that got us started. I know that we will need to make some changes in our records before we produce those financial statements, but I do not know what kinds of changes I should be making. Can you give me some suggestions on what kinds of changes I should think about making?” How would you respond?

Problems

-

Determine if the following adjusting entries involve the following:

- Accrued expense (AE)

- Prepaid expense (PE)

- Accrued revenue (AR)

- Unearned revenue (UR)

- _____ Atlas Magazine had previously collected $400,000 from its subscribers but has now delivered half of the magazines that were ordered.

- _____ Several weeks ago, the Hornsby Company agreed to provide 1,000 units of its product to Michaels Inc. and has now substantially completed that agreement with payment to be received in thirty days.

- _____ Nancy and Sons owes its employees $30,000 for work done over the past two weeks with payment to be made within the next ten days.

- _____ Replay Inc. advertised on television Channel 44 during the past month but has not yet made an entry to record the event because no payment has been made.

- _____ Four months ago, the Centurion Company paid Reliable Insurance Company $54,000 for insurance for the subsequent twelve months.

- _____ Four months ago, Reliable Insurance Company received a payment of $54,000 for insurance for the subsequent twelve months from Centurion Company.

-

For each of the following adjusting entries, describe what has probably taken place that necessitated these entries.

-

Figure 5.13

-

Figure 5.14

-

Figure 5.15

-

Figure 5.16

-

Figure 5.17

-

Figure 5.18

-

-

For each of the following transactions of the Marlin Corporation determine if an adjusting entry is now needed. If an adjustment is required, provide that entry. Assume each journal entry was made properly.

- At the beginning of the month, Marlin agreed to perform services for the subsequent three months for Catsui Corporation for $30,000 per month. Catsui paid Marlin all $90,000 in advance. One month has now passed. Each month is viewed as an independent job.

- Marlin pays its employees every two weeks. At the end of the month, Marlin owes its employees $480,000, but will not pay them until the following week.

- Marlin paid $300,000 for rent at the beginning of the month by debiting prepaid rent and crediting cash. The $300,000 covered six months of occupancy, but only one month has passed.

- At the beginning of the month, Marlin agreed to perform services for Ryland Company for $16,000 per month for the next six months. Ryland has not yet paid any cash to Marlin, and no part of the work is yet viewed as being substantially complete.

-

Keating Inc. rents its headquarters from Starling Enterprises for $10,000 per month. On September 1, 20XX, Keating pays Starling $60,000 for six months worth of rent.

- Record the entry that Keating Inc. would make on September 1 when the payment is made to Starling.

- Record the entry that Starling Enterprises would make on September 1 when they receive the rent payment from Keating.

- Record the adjusting entry that Keating should make on December 31, when the company begins to prepare its annual financial statements.

- Record the adjusting entry that Starling should make on December 31, when the company begins to prepare its annual financial statements.

-

The accountant for the Osgood Company is preparing to produce financial statements for December 31, Year One, and the year then ended. The accountant has uncovered several interesting figures within the company’s trial balance at the end of the year:

Figure 5.19 Financial Figures Reported by the Osgood Company

Other information:

- The company collected $32,000 from a customer during the early part of November. The amount was recorded as revenue at that time although very little of the work has yet to be accomplished.

- The company paid $36,000 for nine months of rent on a building on January 1, Year One, and then paid $20,000 on October 1, Year One, for five additional months.

- A count of all supplies at the end of the year showed $2,000 on hand.

- An interest payment was made at the end of December. Although no previous recognition had been made of this amount, the accountant debited interest payable.

- On January 1, Year One, the company paid $24,000 for insurance coverage for the following six months. On July 1, Year One, the company paid another $27,000 for an additional nine months of coverage.

-

The company did work for a customer throughout December and finished on December 30. Because it was so late in the year, no journal entry was recorded, and no part of the $17,000 payment has been received.

Required:

- Prepare any necessary entries as of December 31, Year One.

- Provide the appropriate account balances for each account impacted by these adjusting entries.

-

The Warsaw Corporation began business operations on December 1, Year One. The company had the following transactions during the time when it was starting:

- An employee was hired on December 1 for $4,000 per month with the first payment to be made on January 1.

- The company made an $18,000 payment on December 1 to rent a building for the following six months.

- Supplies were bought on account for $10,000 on December 1. Supplies are counted at the end of the year and $3,600 is still on hand.

- The company receives $9,000 for a service that it had expected to provide immediately. However, a problem arises because of a series of delays and the parties agree that the service will be performed on January 9.

-

A job was completed near the end of the year, and the customer will pay Warsaw all $8,000 early in the following year. Because of the late date, no entry was made at that time.

Required:

- Prepare the proper journal entries for each of these transactions as well as the year-end adjustment (if needed) for each.

-

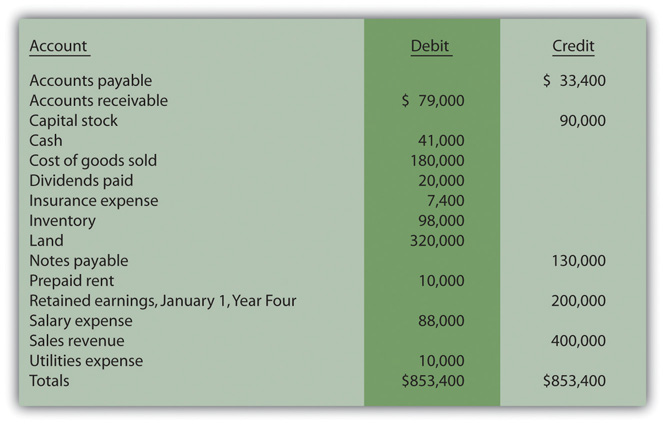

The Rohrbach Company has the following trial balance at the end of Year Four before adjusting entries are prepared. During the year, all cash transactions were recorded, but no other journal entries were made.

Figure 5.20 Rohrbach Company Unadjusted Trial Balance, December 31, Year Four

Other Information:

- Utilities were not paid for or recorded for the months of November and December at a total of $2,000.

- On January 1, Year Four, insurance for six months was obtained for $2,000 in cash. On July 1, Year Four, insurance for another eighteen months was obtained for $5,400 in cash.

- On January 1, Year Four, the company paid $2,000 to rent a building for four months. On May 1, Year Four, the company paid another $8,000 to rent the same building for an additional sixteen months.

-

Employees are paid $8,000 for each month with payments seven days after the end of the month.

Required:

- Prepare the needed adjusting entries.

- Prepare an updated trial balance.

-

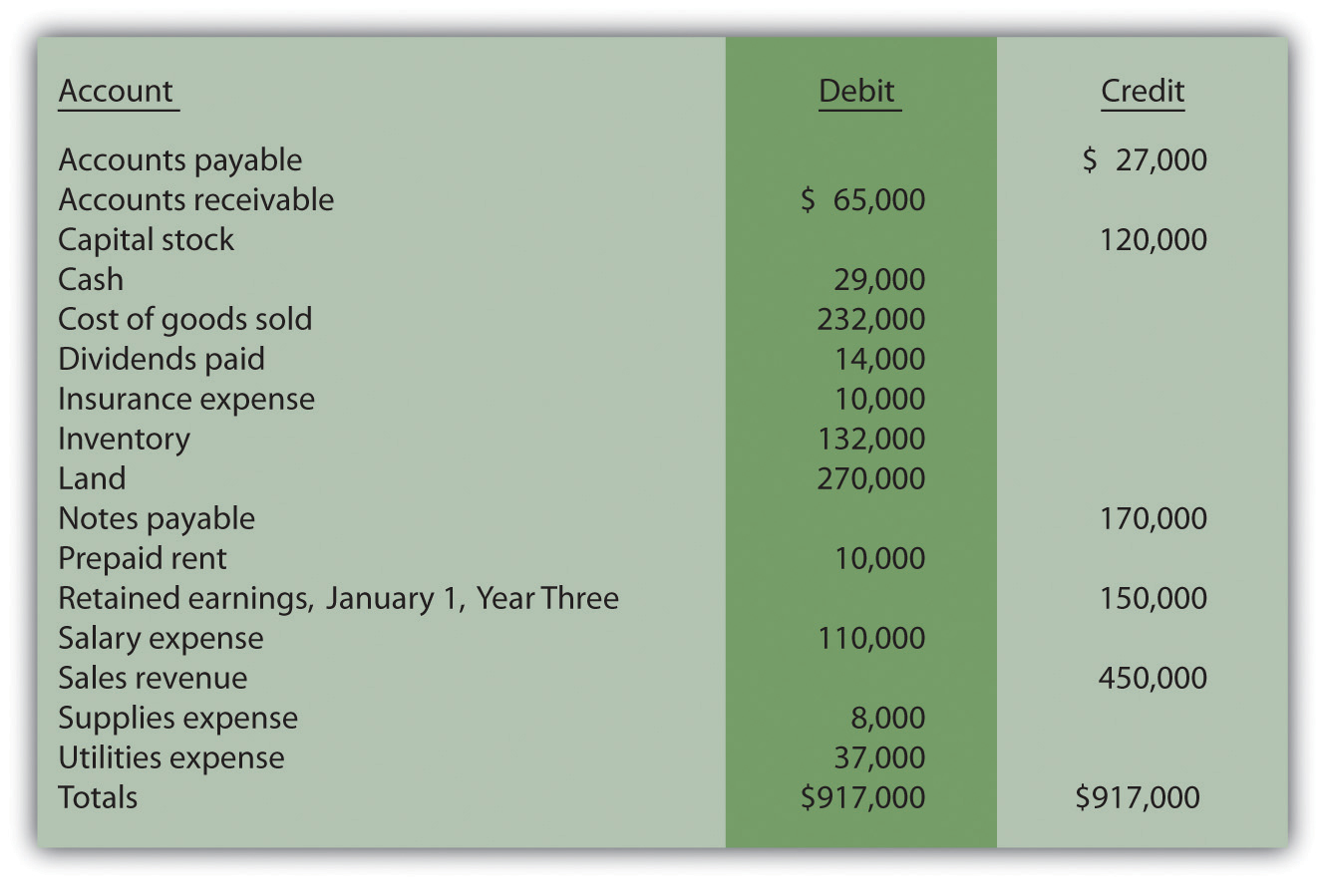

The following trial balance (at the end of Year Three) was produced by an accountant working for the Washburn Company. No adjusting entries have yet been made. During the year, all cash transactions were recorded, but no other journal entries were prepared.

Figure 5.21 Washburn Company Unadjusted Trial Balance, December 31, Year Three

Other Information:

- Income taxes of $9,000 will have to be paid for Year Three early in Year Four.

- Supplies were bought for $8,000 early in the year, but $3,000 of that amount is still on hand at the end of the year.

- On January 1, Year Three, insurance for eight months was obtained for $4,000 in cash. On September 1, Year Three, insurance for another fifteen months was obtained for $6,000 in cash.

- During November, a payment of $5,000 was made for advertising during that month. By accident, the debit was made to utilities expense.

- On January 1, Year Three, the company paid $2,000 to rent a building for four months. On May 1, Year Three, the company paid another $8,000 to rent the same building for an addition sixteen months.

-

Employees are paid $10,000 for each month with payments two weeks after the end of the month.

Required:

- Prepare the needed adjusting entries.

- Prepare an income statement, statement of retained earnings, and a balance sheet for the Washburn Company.

-

Leon Jackson is an entrepreneur who plans to start a Web site design and maintenance business called Webworks. The First National Bank just approved a loan so he is now ready to purchase needed equipment, hire administrative help, and begin designing sites. During June, his first month of business, the following events occur.

- Webworks signs a note at the bank and is given $10,000 cash.

- Jackson deposits $2,000 of his own money into the company checking account as his capital contribution.

- Webworks purchases a new computer and other additional equipment for $3,000 in cash.

- Webworks purchases supplies worth $200 on account that should last Webworks two months.

- Webworks hires Nancy Po to assist with administrative tasks. She will charge $100 per Web site for her assistance.

- Webworks begins working on its first two Web sites, one for Juan Sanchez (a friend of Jackson’s dad) and the other for Pauline Smith, a local businessperson.

- Webworks completes the site for Mr. Sanchez and sends him a bill for $600.

- Webworks completes the site for Ms. Smith and sends her a bill for $450.

- Webworks collects $600 in cash from Mr. Sanchez.

- Webworks pays Nancy Po $100 for her work on Sanchez’s Web site.

- Webworks receives $500 in advance to work on a Web site for a local restaurant. Work on the site will not begin until July.

-

Webworks pays taxes of $200 in cash.

Required:

- Prepare journal entries for the previous events if needed.

- Post the journal entries to T-accounts.

- Prepare an unadjusted trial balance for Webworks for June.

- Prepare adjusting entries for the following events and post them to the proper T-accounts, adding any additional T-accounts as necessary.

- Webworks owes Nancy Po another $100 for her work on Smith’s Web site.

- The business is being operated in the house owned by Jackson’s parents. They let him know that Webworks owes $80 toward the electricity bill for June. Webworks will pay them in July.

-

Webworks only used half of the supplies purchased in (d) above.

- Prepare an adjusted trial balance for Webworks for June.

-

Jan Haley owns and operates Haley’s Dry Cleaners. The ledger for this company is presented in the next figure with balances as of December 1, Year Two. The following occurred during that month.

- On December 1, Haley prepaid rent on her store for December and January for $2,000 in cash.

- On December 1, Haley purchased insurance with cash in the amount of $2,400. The coverage will last for six months.

- Haley paid $900 of her accounts payable balance.

- Haley paid off all of her salaries payable balance.

- Haley purchased supplies on account in the amount of $2,400.

- Haley paid a salary to her assistant of $1,000 in cash for work done in the first two weeks of December.

- Haley dry-cleaned clothes for customers on account in the amount of $8,000.

- Haley collected $6,300 of her accounts receivable balance.

-

Haley paid tax of $750 in cash.

Required:

- Prepare the journal entry for each of these transactions.

-

Prepare all necessary T-accounts with opening balances for the month of December.

Figure 5.22 Opening T-Account Balances for Haley’s Dry Cleaners

- Prepare a trial balance dated December 31, Year Two.

- Make the following adjusting entries for the month of December and post them to the T-accounts:

- Rent expense:

- Insurance expense:

- Haley owes her assistant $1,000 for work done during the last two weeks of December.

-

An inventory of supplies shows $400 in supplies remaining on December 31.

- Prepare an adjusted trial balance dated December 31, Year Two.

- Prepare an income statement, statement of retained earnings, and balance sheet.

-

On January 1, Kevin Reynolds, a student at State U, decides to start a business. Kevin has noticed that various student organizations around campus are having more and more need for mass produced copies of programs on CDs. While a lot of students have a CD drive on their computers that can write to CDs, it is a slow process when a high volume of CDs is needed.

Kevin believes that with a beginning investment in specialty equipment, he can provide a valuable product to the college community and earn some profit. On January 1, Year One, Kevin officially begins “Kevin’s CD Kopies.”

Part 1

The following occur during January:

- Kevin deposits $500 of his own money into the company’s checking account as his capital contribution.

- As president of the company, Kevin signs a note payable in the amount of $1,000 from Neighborhood Bank. The note is due from the company in one year.

- KCDK (Kevin’s CD Kopies) purchases a CD duplicator (a piece of equipment), which can copy seven CDs at one time. The cost is $1,300, and he pays cash.

- KCDK purchases 500 blank CDs for $150 on account.

- KCDK pays $20 cash for flyers that are used as advertising.

- KCDK quickly catches on with the student groups on campus. KCDK sells 400 CDs to various groups for $0.80 per CD. KCDK receives cash payment for 300 of the CDs, and the student groups owe for the other 100 CDs.

- KCDK pays $100 on its accounts payable.

- KCDK receives $40 in advance to copy 50 CDs for a student group. He will not begin work on the project until February.

-

KCDK incurs $40 in tax expense. The taxes will be paid in February.

Required:

- Prepare journal entries for the previous events as needed.

- Post the journal entries to T-accounts.

- Prepare an unadjusted trial balance for KCDK for January.

- Prepare adjusting entries for the following and post them to the company’s T-accounts.

- Kevin’s roommate, Mark, helps with copying and delivering the CDs. KCDK pays Mark a salary of $50 per month. Mark will get his first check on February 1.

-

KCDK incurs $10 in interest expense. The interest will be paid with the note at the end of the year.

- Prepare an adjusted trial balance for KCDK for January.

- Prepare financial statements for KCDK for January.

- Prepare closing entries for the month of January.

Part 2

The following occur in February:

- Kevin decides to expand outside the college community. On the first day of the month, KCDK pays $20 in advance for advertising in the local newspaper. The advertisements will run during February and March.

- The student groups paid for the 100 CDs not paid for in January.

- KCDK paid off its remaining accounts payable, salaries payable, taxes payable and interest payable.

- KCDK purchases 450 CDs for $135 on account.

- KCDK sells 500 CDs during the month for $0.80 each. KCDK receives cash for 450 of them and is owed for the other 50.

- KCDK completes and delivers the advanced order of 50 CDs described in number 11.8.

-

KCDK incurs $80 in tax expense. The taxes will be paid in March.

Required:

- Prepare journal entries for the previous events if needed.

- Post the journal entries to the T-accounts.

- Prepare an unadjusted trial balance for KCDK for February.

- Prepare adjusting entries at the end of February for the following and post them to your T-accounts.

- Mark continues to earn his salary of $50, and the next payment will be made on March 1.

- An adjustment is made for advertising in number 11.12.

-

KCDK incurs $10 in interest expense. The interest will be paid with the note.

- Prepare an adjusted trial balance for KCDK for February.

- Prepare the financial statements for February.

Research Assignment

A company places an ad in a newspaper late in Year Five. Is this an expense or an asset? When unsure, companies often investigate how other companies handle such costs.

Go to http://www.jnj.com/. At the Johnson & Johnson Web site, click on “Our Company” at the top right side. Scroll down and under “Company Publications,” click on “2010 Annual Report On-Line.” Click on “Financial Results” at the top of the next page.

Next, click on “Consolidated Balance Sheets.” Under assets, what amount is reported by the company as “prepaid expenses and other receivables?”

Assume the question has been raised whether any amount of advertising is included in the prepaid expense figure reported by Johnson & Johnson. Close down the balance sheet page to get back to the “Financial Results” page. Click on “Notes to Consolidated Financial Statements.” Scroll to page 47 and find the section for “Advertising.” What does the first sentence tell decision makers about the handling of these costs?