This is “Connecting the Journal to the Ledger”, section 4.5 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

4.5 Connecting the Journal to the Ledger

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Prepare journal entries for basic transactions such as the payment of insurance, the acquisition of a long-lived asset, the contribution of capital by owners, the distribution of a dividend, and the like.

- Explain the recording of a gain or loss.

- Describe the recording of an unearned revenue.

- Understand the purpose within an accounting system of both the journal and the ledger.

- Discuss the posting of journal entries to T-accounts in the ledger and describe the purpose of that process.

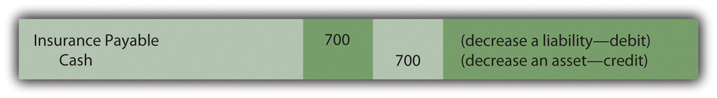

Payment of a Previously Recognized Expense

Question: In Transaction 5, the Lawndale Company pays $700 for insurance coverage received over the past few months. Here, though, the amount has already been recognized. Both the insurance expense and an insurance payable were recorded as incurred. That information was provided in Figure 4.1 "Transactions Frequently Encountered by a Business", and both amounts can be seen on the trial balance in Figure 4.3 "Balances From T-accounts in Ledger". Apparently, Lawndale’s accounting system was programmed to recognize this particular expense as it grew over time. When an expense has already been recorded, what journal entry is appropriate at the time payment is made?

Answer: Because of the previous recognition, the expense should not now be recorded a second time. Instead, this payment eliminates the liability that was established by the accounting system. Cash—an asset—is decreased, which is shown in accounting by means of a credit. At the same time, the previously recorded payable is removed. Any reduction of a liability is communicated by a debit. To reiterate, no expense is included in this entry because that amount has already been recognized as incurred.

Figure 4.9 Journal Entry 5: Payment of Liability for Insurance Coverage

Note that Journal Entries 2 and 5 differ although the events are similar. As discussed previously, specific recording techniques are influenced by the manner in which the accounting system has handled earlier events. In Journal Entry 2, neither the expense nor the payable had yet been recorded. Thus, the expense was recognized at the time of payment. Conversely, in Journal Entry 5, both the expense and payable had already been entered into the records as the amount gradually grew over time. Hence, when paid, the liability is settled, but no further expense is recognized. The proper amount is already present in the insurance expense T-account.

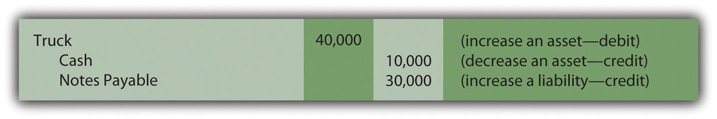

Acquisition of an Asset

Question: In Transaction 6, a new truck is acquired by the Lawndale Company for $40,000. Cash of $10,000 is paid at the time of purchase but a note payable—due in several years—is signed for the remaining $30,000. This transaction impacts three accounts rather than just two. How is a journal entry constructed when more than two accounts are affected?

Answer: As has been discussed, every transaction changes at least two accounts because of the cause-and-effect relationship underlying all financial events. However, beyond that limit, any number of accounts can be impacted. Complex transactions often touch numerous balances. Here, the truck account (an asset) is increased and must be debited. Part of the acquisition was funded by paying cash (an asset) with that decrease recorded as a credit. The remainder of the cost was covered by signing a note payable (a liability). Any increase in a liability is recorded by means of a credit. Note that the debits do equal the credits even when more than two accounts are affected by a transaction.

Figure 4.10 Journal Entry 6: Truck Acquired for Cash and by Signing a Note

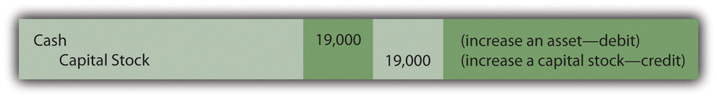

Issuance of Capital Stock

Question: In Transaction 7, the Lawndale Company needs additional financing so officials go to current or potential shareholders and convince them to contribute cash of $19,000 in exchange for new shares of the company’s capital stock. These individuals invest their money in order to join the ownership or increase the number of shares they already hold. What journal entry does a business record when capital stock is issued?

Answer: The asset cash is increased in this transaction, a change that is always shown as a debit. Capital stock also goes up because new shares are issued to company owners. As indicated in the debit and credit rules, the capital stock account increases by means of a credit.

Figure 4.11 Journal Entry 7: Capital Stock Issued for Cash

Test Yourself

Question:

A corporation issues a balance sheet on December 31, Year Ten. Within stockholders’ equity, a balance of $89,000 is reported in the capital stock account. What does this figure represent?

- The current market value of the company’s own stock.

- The current market value of stocks the company holds in other companies.

- The amount of assets contributed to the business by its owners since the company was created.

- The amount of assets contributed to the business by its owners in the current year.

Answer:

The correct answer is choice c: The amount of assets contributed to the business by its owners since the company was created.

Explanation:

The stockholders’ equity balances indicate the source of the company’s net assets (the amount by which assets exceed liabilities). Normally, the net assets come either from the owners or from the operations of the business (total net income minus all dividends). The capital stock account (sometimes shown as contributed capital) is the amount of net assets put into the company by the owners since the company was started.

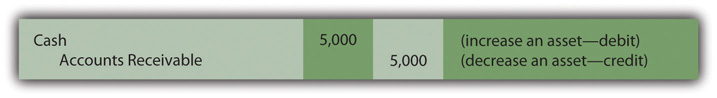

Collection Made on Account Receivable

Question: In Journal Entry 4A, a sale was made on credit. An account receivable was established at that time for $5,000. Assume that the customer now pays this amount to the Lawndale Company. How does the collection of an amount from an earlier sales transaction affect the account balances?

Answer: When a customer makes payment on a previous sale, the cash balance increases while accounts receivable decrease. Both are assets; one balance goes up (by a debit) while the other is reduced (by a credit).

Figure 4.12 Journal Entry 8: Money Collected on Account

Note that cash is collected here, but no additional revenue is recorded. Based on the requirements of accrual accounting, revenue of $5,000 was recognized previously in Journal Entry 4A. Apparently, the revenue realization principle was met at that time, the earning process was substantially complete, and a reasonable estimation could be made of the amount to be received. Recognizing the revenue again at the current date would incorrectly inflate reported net income. Instead, the previously created receivable balance is removed.

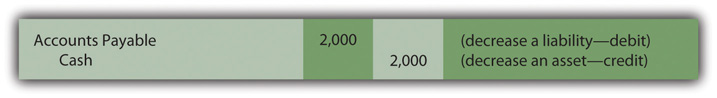

Paying for a Previous Purchase

Question: In Journal Entry 1, inventory was purchased on credit for $2,000. Assume, now, in Transaction 9, that Lawndale makes payment of the entire amount that is due. How is a cash outflow to pay for inventory previously acquired shown in a company’s journal?

Answer: Inventory was bought at an earlier time, and payment is now being made. The inventory was properly recorded when acquired and should not be entered again. The merchandise was only obtained that one time. Here, cash is reduced (a credit). The liability set up in Journal Entry 1 (accounts payable) is removed by means of a debit.

Figure 4.13 Journal Entry 9: Money Paid for Previous Purchase

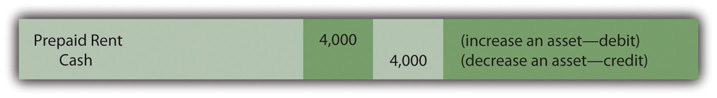

Prepayment of an Expense

Question: Company officials like the building that is being used for operations and decide to rent it for four additional months at a rate of $1,000 per month. An immediate payment of $4,000 is made. This cost provides a future economic benefit rather than a past value. Recognition of an expense is not yet appropriate. What recording is appropriate when rent or other costs such as insurance or advertising are paid in advance?

Answer: Cash is decreased by the payment made here to rent this building. As an asset, a reduction in cash is reported by means of a credit. However, this rent provides a future value for Lawndale Company. The cost is not for past usage of the building but rather for the upcoming months. Therefore, the amount paid creates an asset. The probable economic benefit is the ability to make use of this facility over the next four months to generate new revenue. When the $4,000 is paid, an asset—normally called prepaid rent—is recorded through a debit.

Figure 4.14 Journal Entry 10: Money Paid for Future Rent

Note that Lawndale does not record the building itself because the company does not gain ownership or control (beyond these four months). The payment only provides the right to make use of the building for the specified period in the future so that a prepaid rent balance is appropriate.

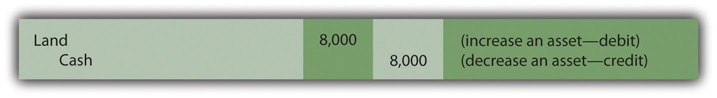

Acquisition of Land

Question: Before this illustration of typical journal entries is completed, four additional transactions will be examined. In total, these fourteen provide an excellent cross-section of basic events encountered by most businesses and the journal entries created to capture that information. An understanding of the recording of these transactions is of paramount importance in mastering the mechanical rules for debits and credits.

Officials of the Lawndale Company decide to purchase a small tract of land by paying $8,000 in cash. Perhaps they think the space might be used sometime in the future as a parking lot. What recording is made to reflect the cash purchase of a plot of land?

Answer: The transaction here is straightforward. As an asset, land increases with a debit. The company’s cash balance goes down because of the acquisition. That drop is recorded using a credit. As stated earlier in this section, Venetian merchants would probably have made the same recording five hundred years ago (although not in U.S. dollars).

Figure 4.15 Journal Entry 11: Land Acquired for Cash

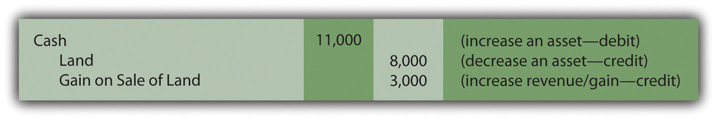

Sale of an Asset Other Than Inventory

Question: Now, assume that—for demonstration purposes—this same piece of land is sold almost immediately to an outside party for cash of $11,000. A sale occurs but the land is not inventory. It was not bought specifically to be resold within the normal course of business. As a farm supply store, selling land is not the primary operation of the Lawndale Company. Should revenue be recorded along with cost of goods sold when land rather than inventory is sold? These two accounts are used in journalizing the sale of inventory. Does the same reporting apply to the sale of other assets such as land or equipment?

Answer: Because the sale of land is not viewed as a central portion of this company’s operations, neither revenue nor cost of goods sold is reported as in the sale of inventory. An $11,000 increase in cash is recorded along with the removal of the $8,000 cost of the land that was conveyed to the new owner. However, to alert decision makers that a tangential or incidental event has taken place, a gain (if the sales price is more than the cost of the land) or a loss (if sales price is less than cost) is recognized for the difference. The effect on net income is the same (a net increase of $3,000), but the method of reporting has changed.

The resulting gain or loss is then separated from revenues and expenses on the income statement to more clearly communicate information as to the nature of the transaction. The decision maker can see the operating income earned by the reporting company from the normal sale of goods and services distinct from any other gains and losses. For example, if an investor or creditor is looking at the financial statements produced by an Italian restaurant, the amount of income from selling pizzas, spaghetti, and the like is important information apart from any gains and losses that were not part of typical operations. Consequently, neither revenue nor cost of goods sold is found in the following entry as was demonstrated in Journal Entries 4A and 4B.

Figure 4.16 Journal Entry 12: Land Sold for Cash in Excess of Cost

Test Yourself

Question:

A company buys and sells pots and pans for the kitchen. This same company bought land for a possible warehouse for $43,000. Several years later, the land was sold for $54,000 cash when the decision was made not to construct the new warehouse. In its accounting system, the company increased revenues by $54,000 (along with cash). Cost of goods sold was also recorded as $43,000 (along with a decrease in the land account). Which of the following statements is true?

- Net income is correctly reported.

- Gross profit is correctly reported.

- The reported total for assets is overstated.

- The journal entry was properly made.

Answer:

The correct answer is choice a: Net income is correctly reported.

Explanation:

The company’s entry increased revenues and the cost of goods sold so that the gross profit was raised by $11,000 ($54,000 minus $43,000). However, a gain of $11,000 should have been reported instead. Thus, the components of net income are wrong, but the total impact of $11,000 is properly shown. The balance sheet accounts (cash and land) were recorded in an appropriate fashion.

Receiving Cash before the Earning Process Is Complete

Question: Accrual accounting, as specified in the revenue realization principle, mandates that revenues should not be recognized until the earning process is substantially complete. Assume a customer gives the Lawndale Company $3,000 in cash for some type of service to be performed at a future date. The work has not yet begun. Thus, Lawndale cannot report revenue of $3,000. How is a cash inflow recorded if received for work before the earning process is substantially complete?

Answer: Although cash is received, accrual accounting dictates that revenue cannot be recognized until the earning process is substantially complete. Here, the earning process will not take place for some time in the future. As an asset, the cash account is increased (debit) but no revenue can yet be recorded. Instead, an unearned revenue account is established for the $3,000 credit. This balance is reported by the Lawndale Company as a liability. Because the money has been accepted, the company is obliged to provide the service or return the $3,000 to the customer. Recording this liability mirrors that responsibility.

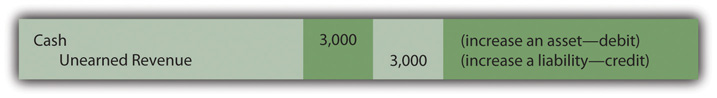

Figure 4.17 Journal Entry 13: Money Received for Work to Be Done Later

Distribution of a Dividend

Question: Here is one final transaction to provide a full range of basic examples at this preliminary stage of coverage. Many additional transactions and their journal entries will be introduced throughout this textbook, but these fourteen form a strong core of the typical events encountered by most businesses.

Assume that the Lawndale Company has been profitable. As a result, at the end of the year, the board of directors votes to distribute a cash dividend to all owners, a reward that totals $600. Payment is made immediately. What recording is appropriate when a dividend is distributed to the owners of a corporation?

Answer: Cash is reduced by this payment to the company’s owners. As an asset, a credit is appropriate. The cause of the decrease in cash was a dividend. Hence, a “dividends paid” account is established to measure this particular outflow of net assets. According to the debit and credit rules, an increase in this account is shown through a debit. Thus, the recording of this last illustration is as follows.

Figure 4.18 Journal Entry 14: Dividend Distributed to Owners

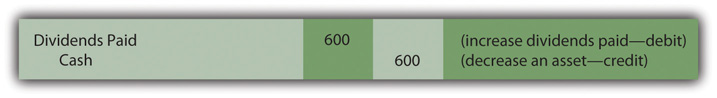

To help visualize the components of an accounting system, all of the journal entries presented here have been gathered into an actual journal in Figure 4.19 "Lawndale Company Journal—Final Days of Year Four" as the accountant for the Lawndale Company might have kept. Normally, a date for each entry is included for reference purposes, but that has been omitted here.

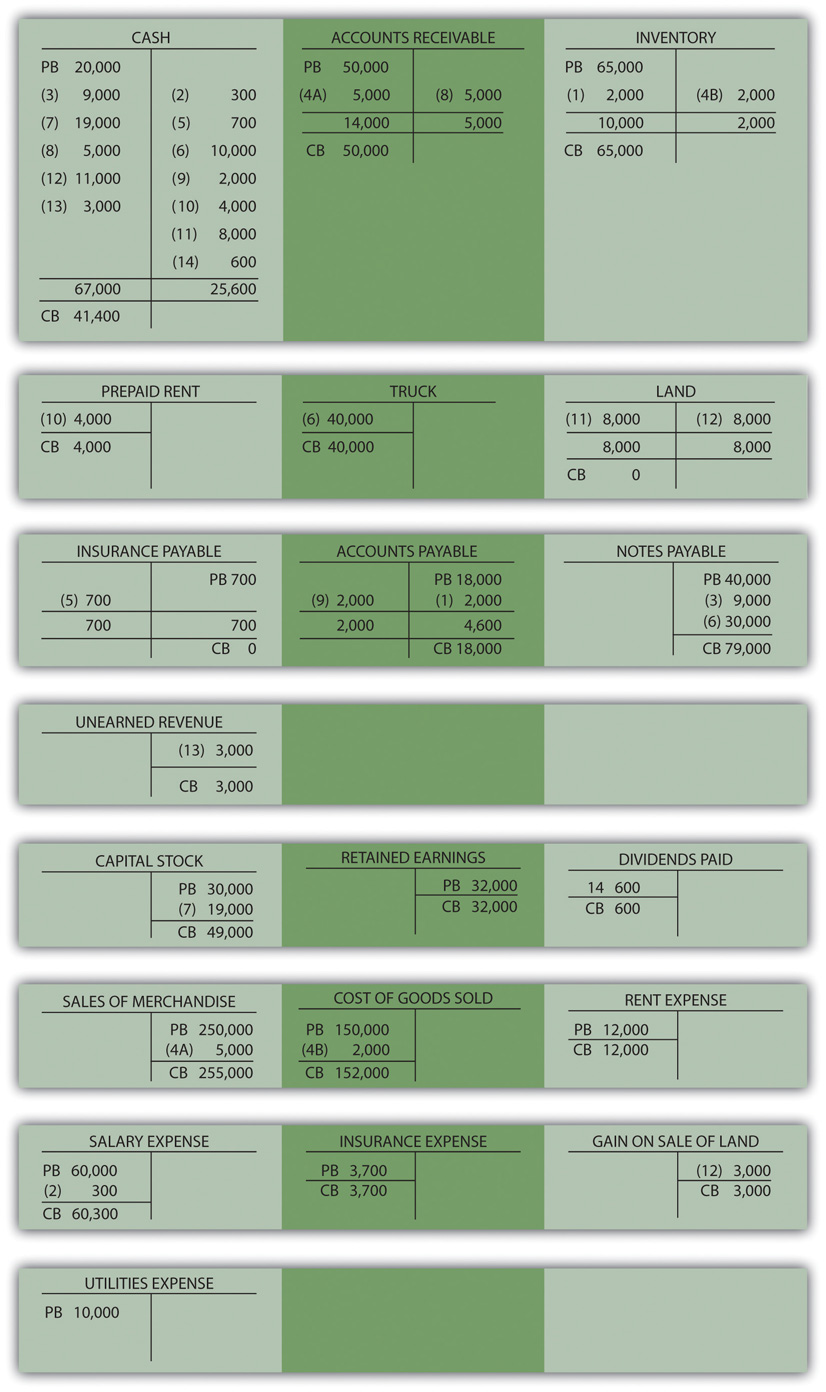

Figure 4.19 Lawndale Company Journal—Final Days of Year Four

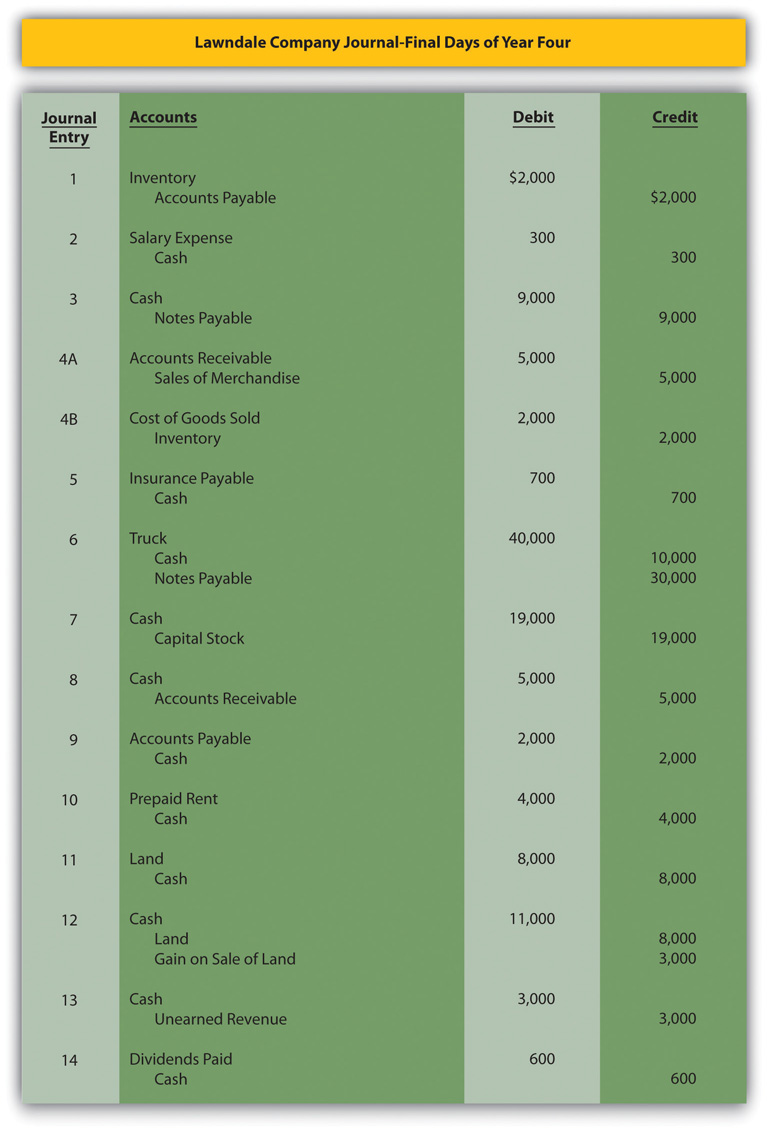

Current T-Account Balances

Question: With adequate practice, obtaining an understanding of the rules for debits and credits is a reasonable goal. However, these journal entries do not provide the current balance of any account. They record the effect of each transaction but not the updated account totals, figures that could change many times every day. How does an accountant keep track of the current balance of cash, inventory, rent expense, or the myriad other accounts that appear on a set of financial statements?

Answer: In an accounting system, the recording process is composed of two distinct steps.

- After analyzing the financial impact of a transaction, a journal entry is created to reflect the monetary impact on relevant accounts.

- Then, each individual debit and credit is added to the specific T-account being altered, a process known as “posting.” A debit to cash in a journal entry is listed as a debit in the cash T-account. A credit made to notes payable is recorded as a credit within the corresponding T-account. After all entries are posted, the current balance for any account can be determined by adding the debit and the credit sides of the T-account and netting the two.

Historically, posting the individual changes shown in each journal entry to the specific T-accounts was a tedious and slow process performed manually. Today, automated systems are designed so that the impact of each entry is simultaneously recorded in the proper T-accounts found in the ledger.

For illustration purposes, all of the journal entries recorded earlier have been posted into the ledger T-accounts shown in Figure 4.19 "Lawndale Company Journal—Final Days of Year Four". Each account includes the previous balance (PB) found in the trial balance in Figure 4.3 "Balances From T-accounts in Ledger". The new debits and credits are then posted for each of the fourteen sample transactions. For cross-referencing purposes, the number of the corresponding journal entry is included. The debit and credit sides of each account are summed and netted to determine the current balance (CB). For example, the cash T-account has $67,000 as the total of all debits and $25,600 for all credits, which net to a current balance of $41,400.

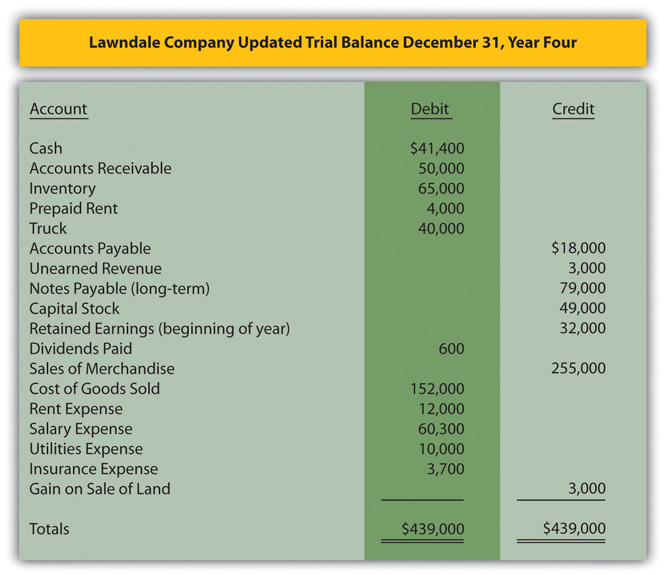

After all of the additional journal entries have been posted into the ledger, an updated trial balance can be drawn from the individual T-account balances. No change is created by this process, but, as can be seen in Figure 4.21 "Lawndale Company Trial Balance (after all journal entries have been posted)—December 31, Year Four", the accounts and their current balances are much easier to see. Simply the clarity of the information can help accountants spot accounts that may contain errors because of unusual or unexpected totals.

Figure 4.20 Lawndale Company Ledger—December 31, Year Four

Figure 4.21 Lawndale Company Trial Balance (after all journal entries have been posted)—December 31, Year Four

Key Takeaway

Initial coverage of the recording of basic transactions is concluded here through analysis of the payment of insurance, the contribution of capital, the purchase and sale of land, the receipt of cash prior to work being performed, the payment of dividends to owners, and the like. After the impact of each event is ascertained, debits and credits are used to record these changes within the journal. These journal entries are then posted to the appropriate T-accounts to monitor the ever-changing account balances. All T-accounts are physically located in a ledger, which is also known as a general ledger. Journal entries document the effect of transactions. T-accounts maintain the current balance of every account.

Talking with a Real Investing Pro (Continued)

Following is a continuation of our interview with Kevin G. Burns.

Question: When you were a college student majoring in accounting, you learned all the debit and credit rules as well as about the role of journal entries and the general ledger. In your years as an investment advisor, has this knowledge ever proven to be helpful to you and your career?

Kevin Burns: Although I never planned to be an accountant when I was in college, I found the internal logic of the debit and credit rules quite fascinating. Thinking through transactions and figuring out the proper recording process was a great introduction to business operations. In all honesty, as an investment advisor, I pay more attention to asset values and other balance sheet information than the accounting process that is used to gather this information. However, I also happen to own a restaurant and I always find it interesting when I dig through the specific expense accounts looking for ways to be more efficient.

For instance, recently when I saw that we had spent a lot of money last year on building maintenance, I could not imagine how that was possible. I dug through the T-account myself and found a recording error that needed to be fixed that changed our net income. My background allowed me to understand the entire process. Frequently, as I study the various debits within our expenses, I am able to spot areas where the restaurant can save money. I am always amazed that some business owners seem almost scared to look into their own financial information. I think they are afraid of feeling stupid. But, the more information you have, the more likely it is that you will make money.

Video Clip

(click to see video)Professor Joe Hoyle talks about the five most important points in Chapter 4 "How Does an Organization Accumulate and Organize the Information Necessary to Create Financial Statements?".