This is “How Is Financial Information Delivered to Decision Makers Such as Investors and Creditors?”, chapter 3 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 3 How Is Financial Information Delivered to Decision Makers Such as Investors and Creditors?

Video Clip

(click to see video)In this video, Professor Joe Hoyle introduces the essential points covered in Chapter 3 "How Is Financial Information Delivered to Decision Makers Such as Investors and Creditors?".

3.1 Construction of Financial Statements Beginning with the Income Statement

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Understand that financial statements provide the physical structure for the financial information reported to decision makers by businesses and other organizations.

- Identify each of the four financial statements typically produced by a reporting entity.

- List the normal contents of an income statement.

- Define “gains” and “losses” and explain how they differ from “revenues” and “expenses.”

- Explain the term “cost of goods sold.”

- Compute gross profit and the gross profit percentage.

Financial Statements Provide Physical Structure for Financial Reporting

Question: The revenues, expenses, assets, and liabilities reported by an organization provide essential data for decision making. These figures and related information enable a thorough analysis and evaluation of the organization’s financial health and future prospects. How do outsiders learn of these amounts? How do decision makers obtain this data? How is financial information actually conveyed to interested parties?

For example, a company such as Marriott International Inc. (the hotel chain) has millions of current and potential shareholders, creditors, and employees. How does such a business communicate vital financial information to all of the groups and individuals that might want to make some type of evaluation?

Answer: Businesses and other organizations periodically produce financial statements that provide a formal structure for conveying financial information to decision makers. Smaller organizations distribute such statements each year, frequently as part of an annual report prepared by management. Larger companies, like Marriott International, issue yearly statements but also prepare interim statements, usually on a quarterly basis.Financial statements for many of the businesses that have their capital stock traded publicly on stock exchanges are readily available on corporate Web sites. For example, the statements released by Marriott International can be located through the following path. The financial statements issued by most large companies will be found by using similar steps.•

Regardless of the frequency, financial statements serve as the vehicle to report all monetary balances and explanatory information required according to the rules and principles of U.S. GAAP (or IFRS, if applicable). When based on these standards, such statements create a fairly presented portrait of the organization—one that contains no material misstatements. In simple terms, an organization’s revenues, expenses, assets, liabilities, and other balances are reported to outsiders by means of financial statements.

Typically, a complete set of financial statements produced by a business includes four separate statements along with pages of comprehensive notes. When financial statements and the related notes are studied with knowledge and understanding, a vast array of information is available to decision makers who want to predict future stock prices, cash dividend payments, and cash flows.

Financial Statements and Accompanying Notes

Because final figures shown on the income statement and the statement of retained earnings are necessary to produce subsequent statements, the preparation of financial statements is carried out in the sequential order shown here.

- Income statementA listing of all revenues earned and expenses incurred during a specific period of time as well as all gains and losses; also called statement of operations or statement of earnings. (also called a statement of operations or a statement or earnings)As will be discussed in a later chapter of this textbook, a statement of comprehensive income is also sometimes attached to or presented with an income statement.

- Statement of retained earningsA financial statement that reports the change in a corporation’s retained earnings account from the beginning of a period to the end; the account is increased by net income and decreased by a reported net loss and/or any dividends declared. (or the more inclusive statement of stockholders’ equity)

- Balance sheetA listing of all asset, liability, and stockholders’ equity accounts at a specific point in time; also called statement of financial position. (also called a statement of financial position)

- Statement of cash flowsA listing of all cash inflows (sources) and cash outflows (uses) during a specific period of time categorized as operating activities, investing activities, and financing activities.

- Notes to clarify and explain specified information further

The financial statements prepared by Marriott International as of December 31, 2010, and the year then ended were presented in just five pages of its annual report (pages 45 through 49) whereas the notes accompanying those statements made up the next twenty-eight pages. Although decision makers often focus, almost obsessively, on a few individual figures easily located in a set of financial statements, the vast wealth of information provided by the notes should never be ignored.

Test Yourself

Question:

The Winston Corporation has prepared an annual report for the past year that includes a complete set of financial statements. Which of the following is not likely to be included?

- Statement of changes in liabilities

- Balance sheet

- Income statement

- Statement of cash flows

Answer:

The correct answer is choice a: Statement of changes in liabilities.

Explanation:

The balance sheet reports assets and liabilities at the end of the year. The income statement shows the revenues and expenses incurred during the year. The statement of retained earnings explains the change in the reported retained earnings figure for the year. The statement of cash flows indicates how the organization gained cash during this period and how it was used. There is no statement of changes in liabilities, although information about liabilities is available on the balance sheet.

Reporting Revenues and Expenses on an Income Statement

Question: Assume that an individual is analyzing the most recent income statement prepared by a business in hopes of deciding whether to buy its capital stock or, possibly, grant a loan application. Or, perhaps, this person is a current employee who must decide whether to stay with the company or take a job offer from another organization. Regardless of the reason, the decision maker wants to assess the company’s financial health and future prospects. Certainly, all of the available financial statements need to be studied but, initially, this individual is looking at the income statement. What types of financial data will be available on a typical income statement such as might be produced by a business like IBM, Apple, Papa John’s, or Pizza Hut?

Answer: The main contents of an income statement are rather straightforward: a listing of all revenues earned and expenses incurred by the reporting organization during the period specified. As indicated previously in Chapter 2 "What Should Decision Makers Know in Order to Make Good Decisions about an Organization?", revenue figures disclose increases in net assets (assets minus liabilities) that were created by the sale of goods or services. For IBM, revenues are derived from the sale and servicing of computers (a total of $99.9 billion in 2010) while, for Papa John’s International, the reported revenue figure for 2010 (a bit over $1.1 billion) measures the increase in net assets created by the sale of pizzas and related items.

Conversely, expenses are decreases in net assets incurred by a reporting organization in hopes of generating revenues. For example, salaries paid to sales people for the work they have done constitute an expense. The cost of facilities that have been rented is also an expense as is money paid for utilities, such as electricity, heat, and water.

For example, IBM reported selling, general, and administrative expenses during 2010 of $21.8 billion. That was just one category of expenses disclosed within the company’s income statement for this period.Financial information reported by large publicly traded companies tends to be highly aggregated. Thus, the expense figure shown by IBM is a summation of several somewhat related expenses. Those individual balances would be available within the company for internal decision making. During the same year, Papa John’s reported salaries and benefits as an expense for its domestic company-owned restaurants of $137.8 million. Financial accounting focuses on providing useful information about an organization, and both of these figures will help decision makers begin to glimpse a portrait of the underlying business.

Accounting is often said to provide transparency—the ability to see straight through the words and numbers to gain a vision of the actual company and its operations.

Reporting Gains and Losses

Question: Is nothing else presented on an income statement other than revenues and expenses?

Answer: An income statement also reports gains and losses for the same period of time. A gain is an increase in the net assets of an organization created by an occurrence that is outside its primary or central operations. A loss is a decrease in net assets from a similar type of incidental event.

When Apple sells or repairs a computer, it reports revenue because that is the sale of a good or service provided by this company. However, if Apple disposes of a piece of land adjacent to a warehouse, a gain is reported (if sold above cost) or a loss (if sold below cost). Selling computers falls within Apple’s primary operations whereas selling land does not.

If Pizza Hut sells a pepperoni pizza, the transaction increases net assets. Revenue has been earned and should be reported. If the company disposes of one of its old ovens, the result is reflected as either a gain or loss. Pizza Hut is not in the business of selling appliances. This classification split between revenues/expenses and gains/losses helps provide decision makers with a clearer portrait of what actually happened during the reporting period.

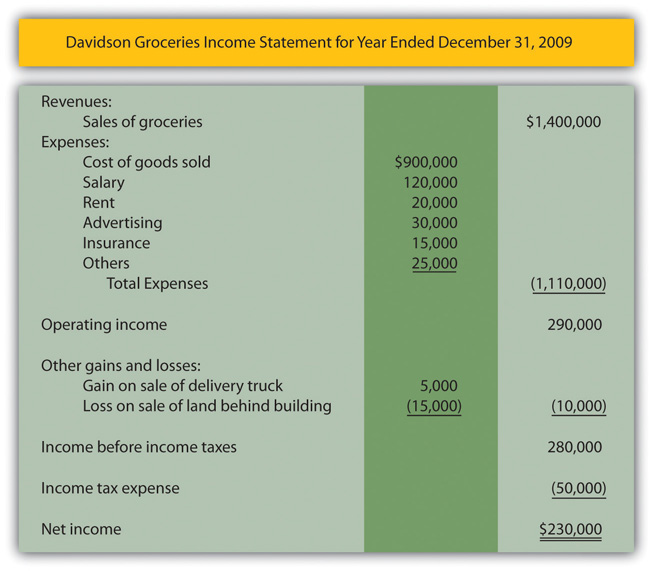

An example of an income statement for a small convenience store (Davidson Groceries) is shown in Figure 3.1 "Income Statement". Note that the name of the company, the identity of the statement, and the period of time reflected are apparent. Although this is an illustration, it is quite similar structurally to the income statements created by virtually all business organizations in the United States and most other countries.

Figure 3.1 Income Statement

Test Yourself

Question:

The Bartolini Company has recently issued a set of financial statements. The company owns several restaurants that serve coffee and donuts. Each of the following balances appears in the company’s financial statements. Which was not included in the company’s reported income statement?

- Loss from fire in warehouse—$4,000

- Rent expense—$13,000

- Cash—$9,000

- Gain on sale of refrigerator—$1,000

Answer:

The correct answer is choice c: Cash—$9,000.

Explanation:

Revenues, expenses, gains, and losses all appear in a company’s income statement. Cash is an asset, and assets are shown on the balance sheet.

Cost of Goods Sold and Gross Profit

Question: A review of the sample income statement in Figure 3.1 "Income Statement" raises a number of questions. The meaning of balances such as salary expense, rent expense, advertising expense, and the like are relatively clear. These figures measure specific outflows or decreases in net assets that were incurred in attempting to generate revenue. However, the largest expense reported on this income statement is referred to as cost of goods sold. What does the cost of goods sold figure represent? What information is communicated by this $900,000 balance?

Answer: This convenience store generated sales of $1.4 million in Year 2XX4. Customers came in during that period and purchased merchandise for that amount. That is the first step in the sale and is reflected within the revenue balance. The customers then take their goods and leave the store. This merchandise no longer belongs to Davidson Groceries. In this second step, a decrease occurred in the company’s net assets; the goods were removed. Thus, an expense has occurred. As the title implies, “cost of goods sold” (sometimes referred to as “cost of sales”) is an expense reflecting the cost of the merchandise that customers purchased during the period. It is the amount that Davidson paid for inventory items—such as apples, bread, soap, tuna fish, and cheese—that were then sold. In the language of accounting, that is the meaning of “cost of goods sold.”

Note that the timing of expense recognition is not tied to the payment of cash but rather to the loss of the asset. As a simple illustration, assume Davidson Groceries pays $2 in cash for a box of cookies on Monday and then sells it to a customer for $3 on Friday. The income statement will recognize revenue of $3 (the increase in the net assets created by the sale) and cost of goods sold of $2 (the decrease in net assets resulting from the sale). Both the revenue and the related expense are recorded on Friday when the sale took place and the inventory was removed. That is when the change in net assets occurred. Apple, Pizza Hut, and thousands of other American businesses report the sale of merchandise in this manner because they all follow the same set of rules: U.S. GAAP.

The difference in revenue and cost of goods sold is often referred to as the company’s gross profitDifference between sales and cost of goods sold; also called gross margin or markup., gross marginDifference between sales price and cost of goods sold; also called gross profit or markup., or markupDifference between sales price and cost of goods sold on an item of inventory; also called gross profit or gross margin.. It is one of the reported figures studied carefully by decision makers. If a business buys inventory for $50 or $5,000, how much revenue can be generated by its sale? That difference is the gross profit.

As an example, assume that an investor or creditor is comparing two large home improvement companies: Lowe’s and Home Depot. For the year ended January 28, 2011, Lowe’s reported net sales revenues of $48.8 billion along with cost of goods sold of $31.7 billion. Thus, Lowe’s earned gross profit during that period of $17.1 billion. Sales of merchandise and services ($48.8 billion) exceeded the cost of those goods ($31.7 billion) by that amount. Lowe’s reported a gross profit that was 35.0 percent of sales ($17.1 million/$48.8 million). Thus, on the average, when a customer bought goods at Lowe’s for $100 during this period the markup above cost earned by the company was $35.00 (35.0 percent of $100 sales price). Any decision maker will find such numbers highly informative especially when compared with the company’s prior years or with competing enterprises.

For the year ended January 30, 2011, Home Depot reported net sales of $68.0 billion, cost of sales of $44.7 billion, and gross profit of $23.3 billion. Its gross profit percentage was 34.3 percent ($23.3 million/$68.0 million). On the average, when a customer bought goods at Home Depot for $100 during this period the markup above cost earned by the company was $34.30 (34.3 percent of $100 sales price). Home Depot is clearly a bigger business than Lowe’s, but during this year it earned a slightly smaller profit on each sales dollar than did its competitor.

Such reported information is studied carefully and allows decision makers to compare these two companies and their operations.

Test Yourself

Question:

The Hayes Corporation is a car dealer. A new car is received from the manufacturer during September at a cost of $33,000. This vehicle is sold in October to a customer for $42,000. In connection with this transaction, which of the following statements is correct?

- The company will report cost of goods sold of $42,000.

- The company will report gross profit of $42,000.

- The company will report cost of goods sold of $33,000.

- The company will report gross profit of $33,000.

Answer:

The correct answer is choice c: The company will report cost of goods sold of $33,000.

Explanation:

On the company’s income statement, revenue of $42,000 (the sales price) and cost of goods sold of $33,000 (the cost paid to acquire the inventory) will be reported. Gross profit is the difference in these two figures, or $9,000.

Placement of Income Taxes on an Income Statement

Question: In Figure 3.1 "Income Statement", revenues and expenses are listed first to arrive at an operating income figure. That is followed by gains and losses. This sequencing is appropriate since revenues and expenses relate to the primary or central operations of the business and gains and losses are created by more incidental events. Why then is income tax expense listed last, by itself, on the bottom of the income statement and not with the other expenses?

Answer: State, federal, and international income taxes cost businesses considerable sums of money each year. Exxon Mobil Corp. reported income taxes of $21.6 billion at the bottom of its 2010 income statement. The income tax figure is segregated in this manner because it is not an expense in a traditional sense. As previously described, an expense—like cost of goods sold, advertising, or rent—is incurred in order to generate revenues. Income taxes do not create revenues. Instead, they are caused by a company’s revenues and related profitability.

Because the financial impact is the same as an expense (an outflow or decrease in net assets), “income tax expense” is often used for labeling purposes. A more appropriate title would be something like “income taxes assessed by government.” Because the nature of this “expense” is different, the income tax figure is frequently isolated at the bottom of the income statement, separate from true expenses.

Key Takeaway

Financial information is gathered about an organization, but the resulting figures must then be structured in some usable fashion that can be conveyed to interested decision makers. Financial statements serve this purpose. A typical set of financial statements is made up of an income statement, statement of retained earnings, balance sheet, statement of cash flows, and explanatory notes. The income statement reports revenues from the sale of goods and services as well as expenses such as rent and advertising. Gains and losses that arise from incidental activities are also included on the income statement but separately so that the income generated from primary operations is apparent. Cost of goods sold is an expense that reflects the cost of all inventory items acquired by customers. Income tax expense is reported at the bottom of the income statement because it is actually a government assessment rather than a true expense.

3.2 Reported Profitability and the Impact of Conservatism

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Describe the method used to differentiate assets from expenses.

- Discuss the rationale for the practice of conservatism and its effect on financial reporting.

- Explain the reason dividend distributions are not reported as expenses within net income.

- Discuss the need for decision makers to study an entire set of financial statements rather than focus exclusively on one or two numbers such as net income or gross profit.

Differentiating between an Asset and an Expense

Question: Previously, the term “asset” was defined as a probable future economic benefit owned or controlled by a reporting entity. On an income statement, items such as rent and advertising are listed as expenses. Why are such costs not grouped with the assets on the balance sheet? For example, rent paid for a building could provide a probable future economic benefit but it is included in Figure 3.1 "Income Statement" as an expense. The same is true for advertising. How does an organization determine whether a cost represents an asset or an expense?

Answer: Deciding whether a particular cost should be classified as an asset or an expense is not always easy for an accountant. If a business makes a $10,000 rent payment, an expense might have been incurred because an outflow of an asset (cash) has taken place. However, the cost of this rent could also be reported as an asset if it provides probable future economic benefit.

A cost is identified as an asset if the benefit clearly has value in generating future revenues whereas an expense is a cost that has already helped earn revenues in the past. With an asset, the utility associated with a cost is yet to be consumed completely. With an expense, the utility has already been consumed. To illustrate, assume that on December 31, Year One, a business pays $10,000 for rent on a building that was used during the previous month as a retail outlet. The benefit gained from occupying that space has already occurred. Use of the building helped the business make sales during December. The reduction in net assets to pay for the rent is reflected on the income statement as a rent expense. The benefit is in the past.

If on that same day, another $10,000 is paid to rent this building again during the upcoming month of January Year Two, the acquired benefit relates directly to the future. The building will be occupied in January in hopes of creating additional revenue. Until consumed, this second cost is shown as a $10,000 asset (referred to as “prepaid rent”).

- Expense. A cost that helped a business generate revenue in the past.

- Asset. A cost expected to help generate additional revenue in the future.

When a cost is incurred, the accountant must investigate its purpose to determine when the related benefit is expected. This timing—as guided by U.S. GAAP or IFRS—indicates whether an asset should be recognized or an expense.

Test Yourself

Question:

In a set of financial statements, a company reports an account balance of $19,000 labeled as “prepaid insurance.” Which of the following is not true in connection with this account?

- The account appears on the company’s income statement.

- The money was paid in the past but will provide benefit in the future.

- The account is an asset.

- The cost is expected to help generate future revenue.

Answer:

The correct answer is choice a: The account appears on the company’s income statement.

Explanation:

The account title implies a benefit to the company in the future. A payment has been made for insurance coverage on assets such as buildings and equipment over the next few months or years. Because the benefits are yet to be derived, this cost cannot be reported on the income statement; rather, it must be reported as an asset on the balance sheet.

Conservatism in Financial Accounting

Question: A business or other organization can face many complicated situations. Determining fair presentation is often not easy. For example, at times, the decision whether a cost will generate revenue in the future (and be reported as an asset) or has already helped create revenue in the past (and is, thus, an expense) is difficult. When an accountant encounters a case that is “too close to call,” what reporting is appropriate? To illustrate, assume that a business agrees to pay $24,000 but corporate officials cannot ascertain the amount of the related benefit that has already occurred versus the amount that will take place in the future. When clear delineation of a cost between asset and expense appears to be impossible, what reporting is made?

Answer: Working as an accountant is a relatively easy job when financial events are distinct and easily understood. Unfortunately, in real life, situations often arise where two or more outcomes seem equally likely. The distinction raised in this question between an asset and an expense is simply one of numerous possibilities where multiple portraits could be envisioned. At such times, financial accounting has a long history of following the practice of conservatismPreference of accountants to avoid making an organization look overly good; when faced with multiple reporting options that are equally likely, the worse possible outcome is reported to help protect the decision maker from information that is too optimistic..

The conservative nature of accounting influences many elements of U.S. GAAP and must be understood in order to appreciate the meaning of financial information conveyed about an organization. Simply put, conservatism holds that whenever an accountant faces two or more equally likely possibilities, the one that makes the reporting company look worse should be selected. In other words, financial accounting attempts to ensure that an organization never looks significantly better than it actually is.

Differentiating between an asset and an expense provides a perfect illustration of conservatism. If a cost is incurred that might have either a future value (an asset) or a past value (an expense), the accountant always reports the most likely possibility. That is the only appropriate way to paint a portrait of an organization that is the fairest representation. However, if neither scenario appears more likely to occur, the cost is classified as an expense rather than an asset because of conservatism. Reporting a past benefit rather than a future benefit has a detrimental impact on the company’s appearance to a decision maker. This handling reduces reported income as well as the amount shown as the total of the assets.

Conservatism can be seen throughout financial accounting. When the chance of two possibilities is the same, accounting prefers that the more optimistic approach be avoided.

The Reason for Conservatism

Question: Why does conservatism exist in financial accounting? Every organization must want to look as successful as possible. Why does a bias exist for reporting outcomes in a negative way?

Answer: Accountants are well aware that the financial statements they produce are relied on by decision makers around the world to determine future actions that will place significant amounts of money at risk. For example, if a company appears to be prosperous, an investor might decide to allocate scarce cash resources to obtain shares of its capital stock. Similarly, a creditor is more willing to make a loan to a business that seems to be doing well economically.

Such decision makers face potential losses that can be substantial. Accountants take their role in this process quite seriously. As a result, financial accounting has traditionally held that the users of financial statements are best protected if the reporting process is never overly optimistic in picturing an organization’s financial health and future prospects. Money is less likely to be lost if the accountant paints a portrait that is no more rosy than necessary. The practice of conservatism is simply an attempt by financial accounting to help safeguard the public.

The problem that can occur when a business appears excessively profitable can be seen in the downfall of WorldCom where investors and creditors lost billions of dollars. A major cause of this accounting scandal, one of the biggest in history, was the fraudulent decision by members of the company’s management to record a cost of nearly $4 billion as an asset rather than as an expense. Although any future benefit resulting from those expenditures was highly doubtful, the cost was reported to outsiders as an asset. Conservatism was clearly not followed.

Consequently, in its financial statements, WorldCom appeared to have $4 billion more in assets and be that much more profitable than was actually true. At the same time that its two chief rivals were reporting declines, WorldCom seemed to be prospering. Investors and creditors risked incredible amounts of their money based on the incorrect information they had received. Later, in 2002, when the misstatement was uncovered, the stock price plummeted, and WorldCom went bankrupt. Conservatism is designed to help prevent such unnecessary losses. If no outcome is viewed as most likely, the accountant should always work to prevent an overly optimistic picture of the reporting entity and its financial health.

Test Yourself

Question:

Which of the following is not an example of the effect of the practice of conservatism?

- A company has revenue, but the revenue is not reported because of some uncertainty.

- A company has a liability, but the liability is not reported because of some uncertainty.

- A company has an asset, but the asset is not reported because of some uncertainty.

- A company has a cost that is reported as expense because of an uncertainty about the future benefit.

Answer:

The correct answer is choice b: A company has a liability, but the liability is not reported because of some uncertainty.

Explanation:

The practice of conservatism holds that when outcomes are equally likely, the option that makes the reporting entity look worse should be reported. Delaying the revenue in A and the asset in C are both examples of conservative reporting. Recognizing an expense in D rather than an asset also reduces reported income and total assets. However, delaying the reporting of the liability in B improves the way the company’s financial position appears. Reporting fewer debts makes the company look better.

Reporting Dividend Distributions

Question: Previously, the term “dividends” was introduced and discussed. Dividend distributions made to owners reduce the net assets held by an organization. In Figure 3.1 "Income Statement", a number of expenses are listed, but no dividends are mentioned. Why are dividend payments not included as expenses of a corporation on its income statement?

Answer: Dividends are not expenses and, therefore, are omitted in preparing an income statement. Such distributions obviously reduce the amount of net assets owned or controlled by a company. However, they are not related in any way to generating revenues. A dividend is a reward paid by a corporation (through the decision of its board of directors) to the owners of its capital stock. A dividend is a sharing of profits and not a cost incurred to create revenue.

In Figure 3.1 "Income Statement", Davidson Groceries reports net income for the year of $230,000. The board of directors might look at that figure and opt to make a cash dividend distribution to company owners. That is one of the most important decisions for any board. Such payments usually please the owners but reduce the size of the company and—possibly—its future profitability.

An income statement reports revenues, expenses, gains, and losses. Dividend distributions do not qualify and must be reported elsewhere in the company’s financial statements.

Test Yourself

Question:

A company has the following reported balances at the end of the current year: revenues—$100,000, rent expense—$40,000, dividends paid—$12,000, loss on sale of truck—$2,000, salary expense—$19,000, gain on sale of land—$9,000, and prepaid insurance—$8,000. What should be reported by this company as its net income for the year?

- $28,000

- $36,000

- $40,000

- $48,000

Answer:

The correct answer is choice d: $48,000.

Explanation:

Net income is made up of revenues ($100,000) less expenses ($40,000 plus $19,000, or $59,000) plus gains ($9,000) less losses ($2,000), or $48,000. Dividends paid is not an expense, and prepaid insurance is an asset.

The Significance of Reported Net Income

Question: The final figure presented on the income statement is net income. This balance reflects the growth in an organization’s net assets during the period resulting from all revenues, expenses, gains, and losses. More specifically, it is the revenues and gains less the expenses and losses. For example, in 2010, the income statement reported by the Kellogg Company indicated that the size of that company’s net assets grew in that one year by $1.24 billion as a result of net income (revenues and gains less expenses and losses). In evaluating the operations of any business, this figure seems to be incredibly significant. It reflects the profitability for the period. Is net income the most important number to be found in a set of financial statements?

Answer: The net income figure reported for any business is an eagerly anticipated and carefully analyzed piece of financial information. It is the most discussed number disclosed by virtually any company. It is reported in newspapers and television, on the Internet and the radio.

However, financial statements present a vast array of data and the importance of any one balance should never be overemphasized. A portrait painted by an artist is not judged solely by the small section displaying the model’s ear or mouth but rather by the representation made of the entire person. Likewise, only the analysis of all information conveyed by a set of financial statements enables an interested party to arrive at the most appropriate decisions about an organization.

Some creditors and investors seek shortcuts when making business decisions rather than doing the detailed analysis that is appropriate. Those individuals often spend an exorbitant amount of time focusing on reported net income. Such a narrow view shows a fundamental misunderstanding of financial reporting and the depth and breadth of the information being conveyed. In judging a company’s financial health and future prospects, an evaluation should be carried out on the entity as a whole. Predicting stock prices, dividends, and cash flows requires a complete investigation. That is only possible by developing the capacity to work with all the data presented in a set of financial statements. If a single figure such as net income could be used reliably to evaluate a business organization, creditors and investors would never incur losses.

Key Takeaway

Conservatism is an often misunderstood term in financial reporting. Despite a reputation to the contrary, financial accounting is not radically conservative. However, when two reporting options are equally likely, the one that makes the company look best is avoided. The portrait that results is less likely to be overly optimistic. In this way, decision makers are protected. Their chance of incurring losses is reduced. For example, expenses refer to costs that helped generate revenue in the past while assets reflect costs that provide future economic benefits. If the timing of these benefits cannot be ascertained, the cost should be recognized as an expense. This assignment reduces both reported income and total assets. The resulting net income figure (revenues and gains less expenses and losses) is useful in evaluating the financial health and prospects of a company but no single figure should be the sole source of information for a decision maker. Dividend distributions are not included in this computation of net income because they reflect a sharing of profits with owners and not a cost incurred to generate revenue.

3.3 Increasing the Net Assets of a Company

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Define “retained earnings” and explain its composition.

- Define “capital stock” and explain the meaning of its reported account balance.

- Explain the lack of financial impact that the exchange of ownership shares between investors has on a corporation.

The Meaning of Retained Earnings

Question: The second financial statement is known as the statement of retained earnings.As indicated earlier, many businesses actually report a broader statement of changes in stockholders’ equity. At this initial point in the coverage, focusing solely on retained earnings makes the learning process easier. The term retained earnings has not yet been introduced. What information does a retained earnings balance communicate to an outside decision maker? For example, on May 1, 2010, Barnes & Noble reported retained earnings of aproximately $681.1 million, one of the largest amounts found in the company’s financial statements. What does that figure tell decision makers about this bookstore chain?

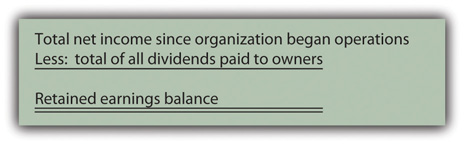

Answer: The retained earnings account (sometimes referred to as “reinvested earnings”) is one of the most misunderstood figures in all of financial reporting. As shown in Figure 3.2, this balance is the total amount of all net income earned by a business since it first began operations, less all dividends paid to stockholders during that same period of time. Retained earnings is a measure of the profits left in a business throughout its existence to create growth. For an organization like The Coca-Cola Company with a long history of profitability, much of its enormous expansion over the years has come from its own operations. That growth is reflected by the retained earnings balance, which is $49.2 billion for Coca-Cola as of December 31, 2010.

Figure 3.2

When a business earns income, it becomes larger because net assets have increased. Even if a portion of the profits is distributed to shareholders as a dividend, the company has grown in size as a result of its own operations. The retained earnings figure informs decision makers of the amount of that internally generated expansion. This reported balance answers the question: How much of the company’s net assets have been derived from operations during its life?

If a company reports an annual net income of $10,000 and then pays a $2,000 dividend to its owners each year, it is growing in size at the rate of $8,000 per year. After four years, for example, $32,000 ($8,000 × four years) of its net assets will have been generated by its own operating activities. That information is communicated through the retained earnings balance.

As of May 1, 2010, Barnes & Noble reported total assets of $3.7 billion and liabilities of $2.8 billion. Thus, the company had net assets of $900 million. Assets exceeded liabilities by that amount. Those additional assets did not appear by magic. They had to come from some source. One of the primary ways to increase the net assets of a business is through profitable operations. The balance for retained earnings shown by Barnes & Noble lets decision makers know that approximately $681 million of its net assets were generated by the total net income earned since the company’s inception, after all dividend distributions to shareholders were subtracted.

Test Yourself

Question:

On January 1, Year One, the Green River Company was started when owners contributed $100,000 cash to start operations. During the first year, the company earned a reported net income of $23,000 and paid a $2,000 dividend. During the second year, the company earned another $31,000 and paid a $5,000 dividend. What is reported on the company’s balance sheet as the total retained earnings at the end of Year Two?

- $47,000

- $54,000

- $147,000

- $154,000

Answer:

The correct answer is choice a: $47,000.

Explanation:

Retained earnings are a measure of a company’s growth in net assets because of its operations. Since its beginning, Green River made a total profit of $54,000 ($23,000 plus $31,000) and paid a total dividend of $7,000 ($2,000 plus $5,000). As a result, net assets rose by $47,000 ($54,000 less $7,000). This balance is reported as retained earnings. The increase from the money the owners put into the business is known as contributed capital (or capital stock), which is a separately reported figure.

The Reporting of Retained Earnings

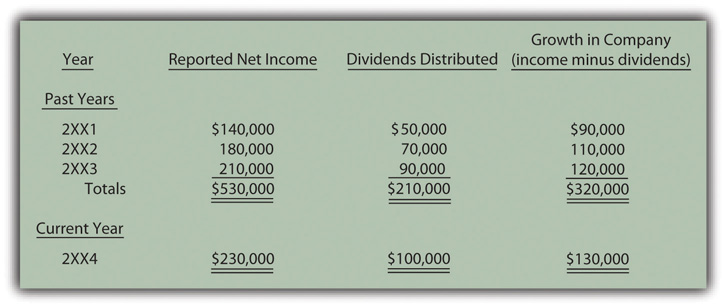

Question: In Figure 3.2, Davidson Groceries calculated its net income for 2XX4 as $230,000. Assume that this company began operations on January 1, 2XX1, and reported the balances shown in Figure 3.3 over the years:

Figure 3.3

How is the growth of this company’s net assets reported? What is the structure of the statement of retained earnings as it appears within a set of financial statements?

Answer: In the three prior years of its existence, Davidson Groceries’ net assets increased by $320,000 as a result of operating activities. As can be seen in Figure 3.3, the company generated total profit during this earlier period of $530,000 while distributing dividends to shareholders of $210,000, a net increase of $320,000. During the current year (2XX4), net assets continued to rise as Davidson Groceries made an additional profit (see also Figure 3.1 "Income Statement") of $230,000 but distributed another $100,000 in dividends. Thus, the net assets of Davidson Groceries increased in 2XX4 by $130,000 ($230,000 less $100,000) as a result of business operations. For all four years combined, net assets went up by $450,000 ($320,000 + $130,000), all net income for these years minus all dividends.

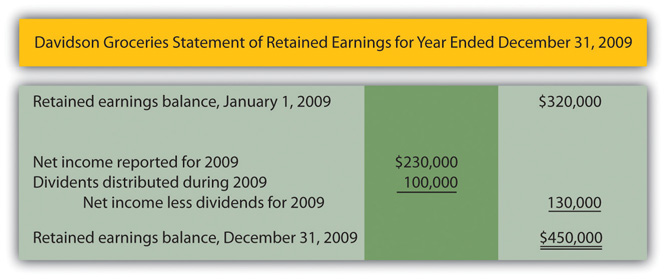

Figure 3.4 "Statement of Retained Earnings" shows the format by which this retained earnings information is conveyed to the decision makers who are evaluating Davidson Groceries. As can be seen here, this structure first presents the previous growth in net assets ($320,000) followed by the net income ($230,000) and dividends ($100,000) for just the current year.

Figure 3.4 Statement of Retained Earnings

Test Yourself

Question:

The London Corporation has just produced a set of financial statements at the end of its fifth year of operations. On its balance sheet, it shows assets of $700,000 and liabilities of $200,000. The retained earnings balance within stockholders’ equity is $100,000. Net income for the current year was reported as $90,000 with dividends of $50,000 distributed to the company’s owners. Which of the following statements is true?

- The company’s net income for the previous four years can be determined from this information.

- The company’s dividend payments for the previous four years can be determined from this information.

- The company’s retained earnings balance at the beginning of its fifth year was $10,000.

- Total income less dividends paid during the previous four years was $60,000.

Answer:

The correct answer is choice d: Total income less dividends paid during the previous four years was $60,000.

Explanation:

Retained earnings at the end of the fifth year was reported as $100,000. Of that, $40,000 is the growth in net assets during the current year from net income ($90,000) less dividends ($50,000). Retained earnings at the beginning of the year must have been $60,000 ($100,000 total less $40,000 increase). That represents the growth in net assets in all prior years from net income less dividends. The exact amount of income during this earlier period or the total dividends cannot be derived, only the net figure.

Assets Contributed to Gain Ownership Shares

Question: In the information provided, Barnes & Noble reported holding net assets of $900 million, but only $681 million of that amount was generated through operations as shown by the retained earnings balance. That raises an obvious question: How did Barnes & Noble get the rest of its net assets? Clearly, additional sources must have enabled the company to attain the $900 million reported total. Increases in net assets are not the result of magic or miracles. Other than through operations, how does a company derive net assets?

Answer: Beyond operations (as reflected by the retained earnings balance), a business accumulates net assets by receiving contributions from investors who become owners through the acquisition of capital stock.Other events can also impact the reported total of a company’s net assets. They will be discussed in other chapters. The two sources described here—capital stock and retained earnings—are shown by all corporations and are normally significantly large amounts. This is the other major method that an organization like Barnes & Noble uses to gather millions in net assets. In financial statements, the measure of this inflow is usually labeled something like capital stockOwnership (equity) shares of stock in a corporation that are issued to raise monetary financing for capital expenditures and operations., common stockA type of capital stock that is issued by every corporation; it provides rights to the owner that are specified by the laws of the state in which the organization is incorporated., or contributed capitalAmounts invested in a corporation by individuals or groups in order to attain ownership interests; balance indicates the amount of the corporation’s net assets that came directly from the owners.. Regardless of the exact title, the reported amount indicates the portion of the net assets that came into the business directly from stockholders who made the contribution to obtain an ownership interest.

The amount of a company’s net assets is the excess of its assets over its liabilities. For most businesses, two accounting balances indicate the primary sources of those net assets.

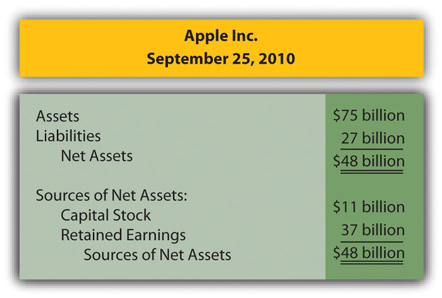

- Capital stock (or contributed capital). This is the amount invested in the business by individuals and groups in order to become owners. For example, as of September 25, 2010, Apple Inc. reported assets of $75 billion and liabilities of $27 billion. Thus, the company was holding $48 billion in net assets ($75 billion less $27 billion). How did Apple get that amount of net assets? That is a question that should interest virtually any investor or creditor analyzing this business. A reported capital stock balance of nearly $11 billion shows that this portion of the $48 billion came from owners contributing assets in order to purchase shares of the company’s stock directly from Apple.

- Retained earningsAccumulated total of the net income earned by an organization during its existence in excess of dividends distributed to the owners; indicates the amount of the net assets currently held that came from operations over the life of the organization.. This figure is the total net income earned by the organization over its life less amounts distributed as dividends to owners. On September 25, 2010, Apple Inc. reported a retained earnings balance of approximately $37 billion (see Figure 3.5 "Apple Inc."). A growth in net assets of that amount resulted from the operating activities since the day Apple first got started.

Figure 3.5 Apple Inc.

These numbers reconcile because the total amount of net assets ($48 billion) must have a source of the same amount ($48 billion).

The Trading of Shares of Capital Stock

Question: A corporation issues (sells) ownership shares to investors to raise money. The source of the resulting inflow of assets into the business is reflected in financial accounting by the reporting of a capital stock (or contributed capital) balance. Thus, over its life, Apple has received assets of $11 billion in exchange for shares of capital stock. Does a company receive money when its shares are sold each day on the New York Stock Exchange, NASDAQ (National Association of Securities Dealers Automated Quotations), or other stock exchanges?

Answer: No, purchases and sales on stock markets normally occur between two investors and not directly with the company. Only the initial issuance of the ownership shares to a stockholder creates the inflow of assets reported by a capital stock or contributed capital account.

To illustrate, assume that Investor A buys one thousand shares of capital stock shares directly from Business B for $179,000 in cash. This transaction increases the net assets of Business B by that amount. The source of the increase is communicated to decision makers by adding $179,000 to the capital stock balance reported by the company. Business B is bigger by $179,000, and the capital stock account provides information about that growth.

Subsequently, these shares may be exchanged between investors numerous times without any additional financial impact on Business B. For example, assume Investor A later sells the 1,000 shares to Investor Z for $200,000 using a stock market such as the New York Stock Exchange. Investor A earns a $21,000 gain ($200,000 received less $179,000 cost), and Investor Z has replaced Investor A as an owner of Business B. However, the financial condition of the company has not been affected by this new exchange. Business B did not receive anything. From its perspective, nothing happened except for a change in the identity of an owner. Thus, a corporation’s capital stock balance only measures the initial investment contributed directly to the business.

Key Takeaway

The source of a company’s net assets (assets minus liabilities) is of interest to outside decision makers. The reported retained earnings figure indicates the amount of these net assets that came from the operations of the company. This growth in size was internally generated. The reported retained earnings balance is all the net income earned since operations began less all dividend distributions. Net assets can also be derived from contributions made by parties seeking to become owners. The capital stock (or contributed capital) balance measures this source of net assets. There is no reported impact unless these assets go directly from the owners to the company. Hence, exchanges between investors using a stock exchange do not affect a business’s net assets or its financial reporting.

3.4 Reporting a Balance Sheet and a Statement of Cash Flows

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- List the types of accounts presented on a balance sheet.

- Explain the difference between current assets and liabilities and noncurrent assets and liabilities.

- Calculate working capital and the current ratio.

- Provide the reason for a balance sheet to always balance.

- Identify the three sections of a statement of cash flows and explain the types of events included in each.

Information Reported on a Balance Sheet

Question: The third financial statement is the balance sheet. If a decision maker studies a company’s balance sheet (on its Web site, for example), what information can be discovered?

Answer: The primary purpose of a balance sheet is to report a company’s assets and liabilities at a particular point in time. The format is quite simple. All assets are listed first—usually in order of liquidityLiquidity refers to the ease with which assets can be converted into cash. Thus, cash is normally reported first followed by investments in stock that are expected to be sold soon, accounts receivable, inventory, and so on.—followed by all liabilities. A portrait is provided of each future economic benefit owned or controlled by the company (its assets) as well as its debts (liabilities).

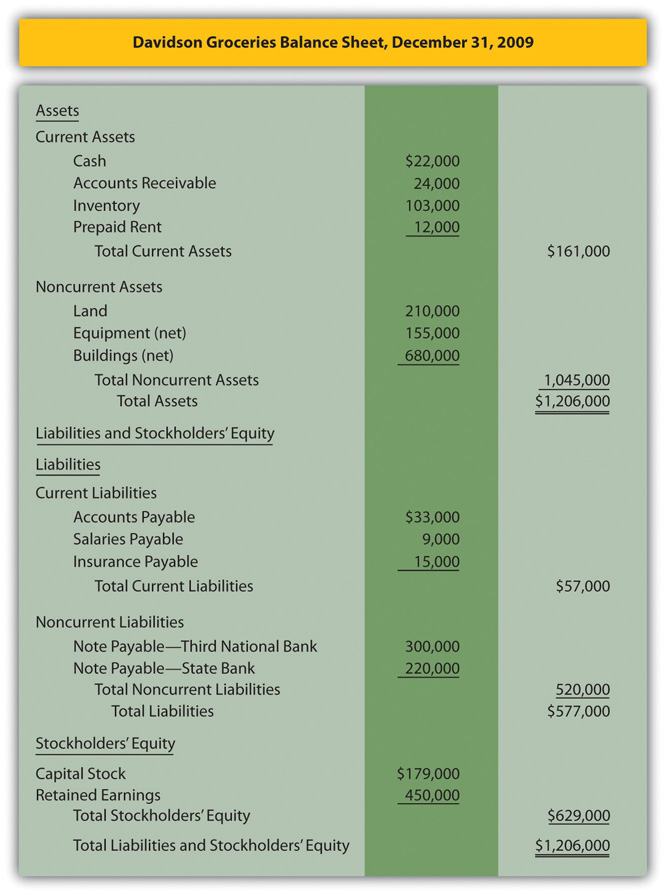

Figure 3.6 Balance SheetAs will be discussed in detail later in this textbook, noncurrent assets such as buildings and equipment are initially recorded at cost. This figure is then systematically reduced as the amount is moved gradually each period into an expense account over the life of the asset. Thus, balance sheet figures for these accounts are reported as “net” to show that only a portion of the original cost still remains recorded as an asset. This shift of the cost from asset to expense is known as depreciation and mirrors the using up of the utility of the property.

A typical balance sheet is reported in Figure 3.6 "Balance Sheet" for Davidson Groceries. Note that the assets are divided between current (those expected to be used or consumed within the following year) and noncurrent (those expected to remain with Davidson for longer than a year). Likewise, liabilities are split between current (to be paid during the upcoming year) and noncurrent (not to be paid until after the next year). This labeling is common and aids financial analysis. Davidson Groceries’ current liabilities ($57,000) can be subtracted from its current assets ($161,000) to arrive at a figure often studied by interested parties known as working capitalFormula measuring an organization’s liquidity (the ability to pay debts as they come due); calculated by subtracting current liabilities from current assets. ($104,000 in this example). It reflects short-term financial strength, the ability of a business or other organization to generate sufficient cash to pay debts as they come due.

Current assets can also be divided by current liabilities ($161,000/$57,000) to determine the company’s current ratioFormula measuring an organization’s liquidity (the ability to pay debts as they come due); calculated by dividing current assets by current liabilities. (2.82 to 1.00), another figure calculated by many decision makers as a useful measure of short-term operating strength.

The balance sheet shows the company’s financial condition on one specific date. All of the other financial statements report events occurring over a period of time (often a year or a quarter). However, the balance sheet discloses all assets and liabilities as of the one specified point in time.

Test Yourself

Question:

Which of the following statements is true?

- Rent payable appears on a company’s income statement.

- Capital stock appears on a company’s balance sheet.

- Gain on the sale of equipment appears on a company’s balance sheet.

- Accounts receivable appears on a company’s income statement.

Answer:

The correct answer is choice b: Capital stock appears on a company’s balance sheet.

Explanation:

Assets and liabilities such as accounts receivable and rent payable are shown on a company’s balance sheet at a particular point in time. Revenues, expenses, gains, and losses are shown on an income statement for a specified period of time. Capital stock, a measure of the amount of net assets put into the business by its owners, is reported within stockholders’ equity on the balance sheet.

The Accounting Equation

Question: Considerable information is included on the balance sheet presented in Figure 3.6 "Balance Sheet". Assets such as cash, inventory, and land provide future economic benefits for the reporting entity. Liabilities for salaries, insurance, and the like reflect debts that are owed at the end of the fiscal period. The $179,000 capital stock figure indicates the amount of assets that the original owners contributed to the business. The retained earnings balance of $450,000 was computed earlier in Figure 3.4 "Statement of Retained Earnings" and identifies the portion of the net assets generated by the company’s own operations over the years. For convenience, a general term such as “stockholders’ equity” or “shareholders’ equity” usually encompasses the capital stock and the retained earnings balances.

Why does the balance sheet balance? This agreement cannot be an accident. The asset total of $1,206,000 is exactly the same as the liabilities ($577,000) plus the two stockholders’ equity accounts ($629,000—the total of capital stock and retained earnings). Thus, assets equal liabilities plus stockholders’ equity. What creates this monetary equilibrium?

Answer: The balance sheet will always balance unless a mistake is made. This is known as the accounting equationAssets = liabilities + stockholders’ equity. The equation balances because all assets must have a source: a liability, a contribution from an owner (contributed capital), or from operations (retained earnings)..

Accounting Equation (Version 1):

assets = liabilities + stockholders’ equity.Or, if the stockholders’ equity account is broken down into its component parts:

Accounting Equation (Version 2):

assets = liabilities + capital stock + retained earnings.As discussed previously, this equation stays in balance for one simple reason: assets must have a source. If a business or other organization has an increase in its total assets, that change can only be caused by (a) an increase in liabilities such as money being borrowed, (b) an increase in capital stock such as additional money being contributed by stockholders, or (c) an increase created by operations such as a sale that generates a rise in net income. No other increases occur.

One way to understand the accounting equation is that the left side (the assets) presents a picture of the future economic benefits that the reporting company holds. The right side provides information to show how those assets were derived (from liabilities, from investors, or from operations). Because no assets are held by a company without a source, the equation (and, hence, the balance sheet) must balance.

Accounting Equation (Version 3):

assets = the total source of those assets.The Statement of Cash Flows

Question: The fourth and final financial statement is the statement of cash flows. Cash is so important to an organization and its financial health that a complete statement is devoted to presenting the changes that took place in this one asset. As can be inferred from the title, this statement provides a portrait of the various ways the reporting company generated cash during the year and the uses that were made of it. How is the statement of cash flows structured?

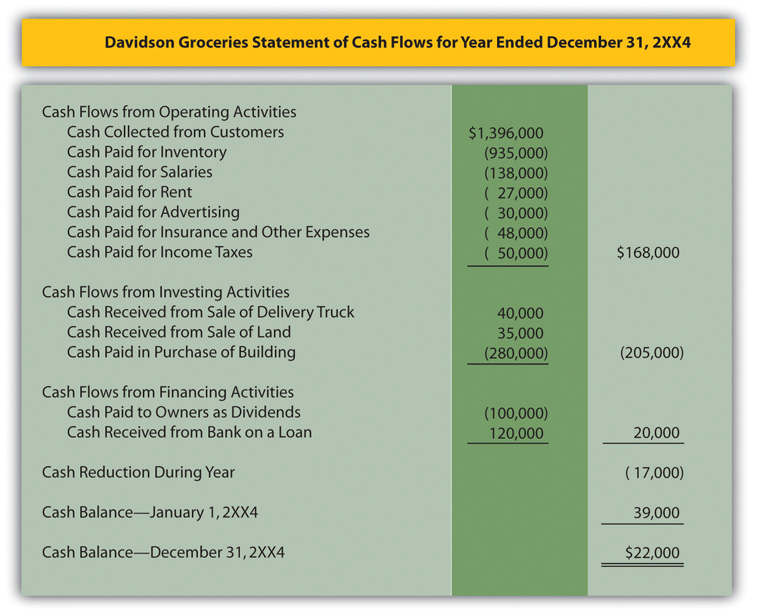

Answer: Decision makers place considerable emphasis on a company’s ability to generate significant cash inflows and then make wise use of that money. Figure 3.7 "Statement of Cash Flows" presents an example of that information in a statement of cash flows for Davidson Groceries for the year ended December 31, 2XX4. Note that all the cash changes are divided into three specific sections:

- Operating activitiesA statement of cash flow category relating to cash receipts and disbursements arising from the primary activities of the organization.

- Investing activitiesA statement of cash flow category relating to cash receipts and disbursements arising from an asset transaction other than one related to the primary activities of the organization.

- Financing activitiesA statement of cash flow category relating to cash receipts and disbursements arising from a liability or stockholders’ equity transaction other than one related to the primary activities of the organization.

Figure 3.7 Statement of Cash FlowsThe cash flows resulting from operating activities are being shown here using the direct method, an approach recommended by the FASB. This format shows the actual amount of cash flows created by individual operating activities such as sales to customers and purchases of inventory. In the business world, an alternative known as the indirect method is more commonly encountered. This indirect method will be demonstrated in detail in Chapter 17 "In a Set of Financial Statements, What Information Is Conveyed by the Statement of Cash Flows?".

Classification of Cash Flows

Question: In studying the statement of cash flows, a company’s individual cash flows relating to selling inventory, advertising, selling land, buying a building, paying dividends and the like can be readily understood. For example, when the statement indicates that $120,000 was the “cash received from bank on a loan,” a decision maker should have a clear picture of what happened. There is no mystery.

All cash flows are divided into one of the three categories:

- Operating activities

- Investing activities

- Financing activities

How are these distinctions drawn? On a statement of cash flows, what is the difference in an operating activity, an investing activity, and a financing activity?

Answer: Cash flows listed as the result of operating activities relate to receipts and disbursements that arose in connection with the central activity of the organization. For Davidson Groceries, these cash changes were created by daily operations and include selling goods to customers, buying merchandise, paying salaries to employees, and the like. This section of the statement shows how much cash the primary business function generated during this period of time, a figure that is watched closely by virtually all financial analysts. Ultimately, a business is only worth the cash that it can create from its normal operations.

Investing activities report cash flows created by events that (1) are separate from the central or daily operations of the business and (2) involve an asset. Thus, the amount of cash collected when either equipment or land is sold is reported within this section. A convenience store does not participate in such transactions as a regular part of operations and both deal with an asset. Cash paid to buy a building or machinery will also be disclosed in this same category. Such purchases do not happen on a daily operating basis and an asset is involved.

Like investing activities, the third section of this statement—cash flows from financing activities—is unrelated to daily business operations but, here, the transactions relate to either a liability or a stockholders’ equity balance. Borrowing money from a bank meets these criteria as does distributing a dividend to shareholders. Issuing stock to new owners for cash is another financing activity as is payment of a noncurrent liability.

Any decision maker can study the cash flows of a business within these three separate sections to receive a picture of how company officials managed to generate cash during the period and what use was made of it.

Test Yourself

Question:

In reviewing a statement of cash flows, which one of the following statements is not true?

- Cash paid for rent is reported as an operating activity.

- Cash contributed to the business by an owner is an investing activity.

- Cash paid on a long-term note payable is a financing activity.

- Cash received from the sale of inventory is an operating activity.

Answer:

The correct answer is choice b: Cash contributed to the business by an owner is an investing activity.

Explanation:

Cash transactions such as the payment of rent or the sale of inventory that are incurred as part of daily operations are included within operating activities. Events that do not take place as part of daily operations are either investing or financing activities. Investing activities are carried out in connection with an asset such as a building or land. Financing activities impact either a liability (such as a note payable) or a stockholders’ equity account (such as contributed capital).

Key Takeaway

The balance sheet is the only one of the four financial statements that is created for a specific point in time. It reports the company’s assets as well as the source of those assets: liabilities, capital stock, and retained earnings. Assets and liabilities are divided between current and noncurrent. This classification system permits the reporting company’s working capital and current ratio to be computed for analysis purposes. The statement of cash flows explains how the cash balance changed during the year. All cash transactions are classified as falling within operating activities (daily activities), investing activities (nonoperating activities that affect an asset), or financing activities (nonoperating activities that affect either a liability or a stockholders’ equity account).

Talking with a Real Investing Pro (Continued)

Following is a continuation of our interview with Kevin G. Burns.

Question: Warren Buffett is one of the most celebrated investors in history and ranks high on any list of the richest people in the world. When asked how he became so successful at investing, Buffett answered quite simply: “We read hundreds and hundreds of annual reports every year.”See http://www.minterest.com/warren-buffet-quotes-quotations-on-investing/.

Annual reports, as you well know, are the documents that companies produce each year containing their latest financial statements. You are an investor yourself, one who provides expert investment analysis for your clients. What is your opinion of Mr. Buffett’s advice?

Kevin Burns: Warren Buffet—who is much richer and smarter than I am—is correct about the importance of annual reports. Once you get past the artwork and the slick photographs and into the “meat” of these reports, the financial statements are a treasure trove of information. Are sales going up or down? Are expenses (such as cost of goods sold) increasing or decreasing as a percentage of sales? Is the company making money? How much cash is the business generating? How are the officers compensated? Do they own stock in the company?

I actually worry when there are too many pages of notes. I prefer companies that don’t need so many pages to explain what is happening. I like companies that are able to keep their operations simple. Certainly, a great amount of important information can be gleaned from a careful study of the financial statements in any company’s annual report.

One of the great things about our current state of technology is that an investor can find a company’s annual report on the Internet in a matter of seconds. You can download information provided by two or three companies and make instant comparisons. That is so helpful for analysis purposes.

Video Clip

(click to see video)Professor Joe Hoyle talks about the five most important points in Chapter 3 "How Is Financial Information Delivered to Decision Makers Such as Investors and Creditors?".

3.5 End-of-Chapter Exercises

Questions

- Why do businesses produce financial statements?

- What are the four financial statements that are typically prepared and distributed by a business or other organization?

- What is the purpose of the notes that are attached to financial statements?

- On which financial statement are revenues and expenses reported?

- How does a gain differ from a revenue?

- What is a loss?

- The Bestron Corporation has a loss of $32,000 and an expense of $74,000. How does a loss differ from an expense?

- In producing an income statement, why are revenues and expenses reported separately from gains and losses?

- What three pieces of information are typically listed at the top of a financial statement?

- Define “cost of goods sold.”

- The Amherst Company reported a “gross profit” of $743,800. What is the meaning of this term?

- The Algernon Corporation incurs a cost of $327,000. The company’s accountant is now trying to decide whether to report this balance as an asset or an expense. How do companies determine if a cost is an expense or an asset?

- From an accounting perspective, define “conservatism.”

- A company has experienced a situation where it is going to incur a loss. Officials believe the chances are 60 percent that the loss will be $13,000. However, there is also a 40 percent chance that the loss might be $98,000. What reporting should be made?

- Explain why dividends are not reported on the income statement.

- What are retained earnings?

- A business has been in operation for nine years and is now reporting a retained earnings balance of $127,000. What makes up that figure?

- The Olson Company reports a $116,000 figure that is labeled “capital stock” on its balance sheet. What information is being communicated?

- On which financial statement would assets and liabilities be reported?

- What differentiates a current asset from a noncurrent asset?

- What is the accounting equation, and explain why it is true.

- What are the three categories of cash flows that are reported on the statement of cash flow?

- On its statement of cash flows, the Jackson Company reported a total cash inflow of $226,000 from operating activities. It also reported a cash outflow of $142,000 from investing activities and a cash inflow of $34,000 from financing activities. How do operating, investing, and financing cash flows differ from one another?

True or False

- ____ The income statement reports a company’s revenues and expenses for one particular day of the year.

- ____ An increase in the net assets of a business that results from the sale of inventory is reported as a gain.

- ____ A business reports a retained earnings balance of $156,000. This figure represents the monetary amounts contributed to the business by its owners.

- ____ Assets and liabilities can be broken down into the categories of current and noncurrent.

- ____ Income tax expense is typically reported separately from other expenses.

- ____ Conservatism helps reporting companies look better to potential investors.

- ____ The dividends paid balance is reported on the balance sheet.

- ____ Companies receive money each time their stock is sold on a stock exchange such as the New York Stock Exchange.

- ____ A balance sheet must always balance.

- ____ The statement of cash flows is broken up into operating, investing, and financing activities.

- ____ If a business reports current assets of $300,000 and current liabilities of $200,000, it has working capital of $500,000.

- ____ Sales revenue less cost of goods sold is referred to as net income.

- ____ A gain is the amount of net income earned by a company over its life less any dividends it has paid.

- ____ The purpose of the balance sheet is to report the assets and liabilities of a company on a specific date.

- ____ The accounting equation identifies how retained earnings are calculated.

- ____ If a company has a possible loss, conservatism requires that this loss must always be reported.

- ____ A company buys merchandise for $175,000 and sells it to various customers for $240,000. The gross profit is $65,000.

- _____The Bagranoff Company has a current ratio of 3:1. The company collects a $20,000 accounts receivable. The current ratio will rise as a result of this collection.

- _____ The Clikeman Company has been in business for several years. The company starts the current year with net assets of $300,000 and ends the year with net assets of $430,000. For the current year, the company’s net income less its dividends must have been $130,000.

- _____ The Richmond Company has been in business for five years and now reports contributed capital as $310,000. This figure means that the owners put $310,000 worth of assets (probably cash) into the business five years ago when it was created.

- ______ A company needs money to build a new warehouse. Near the end of the current year (Year One), the company borrows $900,000 in cash from a bank on a ten-year loan. The company does not start the construction project until the next year (Year Two). On a statement of cash flows for Year One, a cash inflow of $900,000 should be reported as a financing activity.

- ______ Near the end of the current year, a company spent $27,000 in cash on a project that the accountant believed had future economic benefit. The accountant reported it in that manner. In truth, the project only had past economic benefit. The company went on to report net income of $200,000 for the current year along with total assets of $800,000. The company should have reported net income of $227,000 for the year and total assets of $773,000.

- ______ Assume the Albemarle Company buys inventory for $9,000. It pays 60 percent immediately and will pay the rest next year. The company then spends $900 in cash on advertising in order to sell 70 percent of the inventory for $14,000. Of that amount, it collects 80 percent immediately and will collect the remainder next year. The company pays a cash dividend this year of $2,000. As a result of just the operating activities, the company will report that its cash increased by $4,900 during the period.

- ______ A company is being sued because a product it made has apparently injured a few people. The company believes that it will win the lawsuit, but there is uncertainty. There is some chance (a 33 percent chance) that the company might lose $20,000. To arrive at fairly presented financial statements in connection with this uncertainty, this lawsuit should be reported on the income statement of this year as a $6,600 loss.

- ______ A company has the following account balances: revenues—$120,000, salary payable—$7,000, cost of goods sold—$50,000, dividends paid—$3,000, rent expense—$12,000, gain on sale of land—$4,000, accounts receivable—$13,000, cash—$15,000, and advertising expense—$8,000. Reported net income for the period is $54,000.

- ______ A company gets $10,000 cash from its owners when it is started at the beginning of Year One. It gets another $15,000 from a bank loan. Revenues for that year were $70,000, expenses were $39,000, and dividends paid to the owners were $3,000. The retained earnings balance at the start of Year Two was $38,000.

- ______ The Watson Corporation reported net income of $334,000. During the year, a $10,000 expenditure was erroneously recorded by this business as an asset when it should have been reported as an expense. For an error, $10,000 is not viewed as material by this company. Therefore, net income is fairly presented as reported at $334,000.

Multiple Choice

-

You are the chief executive officer of Fisher Corporation. You are very concerned with presenting the best financial picture possible to the owners so you can get a big bonus at the end of this year. Unfortunately, Fisher has a lawsuit pending that could result in the company having to pay a large sum of money. Lawyers believe the company will win and pay nothing. However, they believe there is a 20 percent chance of a $100,000 loss and a 10 percent chance of a $300,000 loss. What amount should be reported?

- Zero

- $50,000

- $100,000

- $300,000

-

Henderson Inc. reports the following: assets of $500,000, liabilities of $350,000 and capital stock of $100,000. What is the balance reported as retained earnings?

- $50,000

- $250,000

- $450,000

- $750,000

-

Giles Corporation borrowed $675,000 from Midwest Bank during the year. Where is this event be reported on Giles’s statement of cash flows?

- Operating activities

- Investing activities

- Financing activities

- It would not be reported on the statement of cash flows

-

You are considering investing in the stock of Mogul Corporation. On which of the following statements would you find information about what the company holds in inventory at the end of the most recent year?

- Income statement

- Statement of retained earnings

- Balance sheet

- Statement of cash flows

-

You are considering investing in the stock of the Maintland Corporation. On which of the following statements would you find information about the cost of the merchandise that the company sold to its customers this past year?

- Income statement

- Statement of retained earnings

- Balance sheet

- Statement of cash flows

-

The Drexel Company began operations on January 1, Year One. In Year One, the company reported net income of $23,000 and, in Year Two, reported net income of another $31,000. In the current year of Year Three, the company reported net income of $37,000. Drexel paid no dividends in Year One but paid $10,000 in Year Two and $12,000 in Year Three. On the December 31, Year Three, balance sheet, what is reported as retained earnings?

- $22,000

- $25,000

- $69,000

- $91,000

-

The Shelby Corporation has been in business now for six years. At the end of its latest fiscal year, the company reported $560,000 in assets, $320,000 in liabilities, $100,000 in contributed capital, and $140,000 in retained earnings. What is the total of stockholders’ equity?

- $140,000

- $240,000

- $420,000

- $560,000

-

The Valdese Corporation operates a restaurant and has sales revenue of $300,000, cost of goods sold of $170,000, other expenses of $50,000, and a gain on the sale of a truck of $14,000. Which of the following statements is true?

- Gross profit is $80,000, and net income is $80,000.

- Gross profit is $80,000, and net income is $94,000.

- Gross profit is $130,000, and net income is $94,000.

- Gross profit is $144,000, and net income is $80,000.

-

Which of the following is true about the usual reporting of income taxes?

- They are reported within cost of goods sold.

- They are reported the same as any other expense.

- They are netted against sales revenue.

- They are reported separately at the bottom of the income statement.

-

A company had a number of cash transactions this year. It paid $22,000 in dividends to its owners, borrowed $100,000 from a bank on a long-term loan, bought a building for $288,000, sold equipment for $23,000, sold inventory for $16,000, and issued capital stock to an investor for $35,000. On a statement of cash flows, what is the net amount to be reported as financing activities?

- Cash inflow of $78,000

- Cash inflow of $113,000

- Cash inflow of $157,000

- Cash inflow of $265,000

-

A company had a number of cash transactions this year. It paid $43,000 in dividends to its owners, borrowed $200,000 from a bank on a long-term loan, bought a building for $312,000, sold equipment for $51,000, sold inventory for $25,000, and issued capital stock to an investor for $85,000. On a statement of cash flows, what is the net amount to be reported as investing activities?

- Cash outflow of $112,000

- Cash outflow of $176,000

- Cash outflow of $242,000

- Cash outflow of $261,000

-