This is “Incorporation and the Trading of Capital Shares”, section 1.2 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

1.2 Incorporation and the Trading of Capital Shares

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Define incorporation.

- Explain the popularity of investing in the capital stock of a corporation.

- Discuss the necessity and purpose of a board of directors.

- List the potential benefits gained from acquiring capital stock.

The Ownership Shares of an Incorporated Business

Question: In discussing possible decisions that could be made about a business organization, ownership shares were mentioned. Virtually every day, on television, in newspapers, or on the Internet, mention is made that the shares of one company or another have gone up or down in price because of trading on one of the stock markets. Why does a person acquire ownership shares of a business such as Capital One or Intel?

Answer: In the United States, as well as in many other countries, owners of a business can apply to the state government to become identified as an entity legally set apart from its owners. This process is referred to as incorporationLegal process by which owners of an organization apply to a state government to have it identified as an entity legally separate from its owners (a corporation); corporations are the legal form of most businesses of any size in the United States.. Therefore, a corporationAn organization that has been formally recognized by the state government as a separate legal entity so that it can sell ownership shares to raise money for capital expenditures and operations. is an organization that has been formally recognized by the state government as a separate legal entity that can act independently of its owners. A business that has not been incorporated is either a sole proprietorshipAn unincorporated business created, owned, and operated by a single individual; the business is not legally separate from its owner. (one owner) or a partnershipAn unincorporated business created, owned, and operated by more than one individual; the business is not legally separate from its owners. (more than one owner). These businesses are not separate from their ownership.

As will be discussed in detail in a later chapter, several advantages are gained from incorporation. One is especially important in connection with the study of financial accounting. A corporation has the ability to obtain monetary resources by selling (also known as issuing) capital shares that allow investors to become owners. They are then known as stockholdersIndividuals or organizations that hold the ownership shares of capital stock of a corporation; same as shareholders. or shareholdersIndividuals or organizations that hold the ownership shares of capital stock of a corporation; same as stockholders..

Millions of corporations operate in the United States. The Walt Disney Company and General Electric are just two well-known examples of corporations. They exist as legal entities completely distinct from the multitude of individuals and organizations that possess their ownership shares (also known as equity or capital stockOwnership (equity) shares of stock in a corporation that are issued to raise monetary financing for capital expenditures and operations.).

Any investor who acquires one or more shares of the capital stock of a corporation becomes an owner and has all of the rights that are specified by the state government or on the stock certificate. The number of shares and owners can be staggering. At the end of 2010, stockholders held over 2.3 billion shares of The Coca-Cola Company. Thus, possession of one share of the capital stock of The Coca-Cola Company provided a person with approximately a 1/2,300,000,000th part of the ownership.

One of the great advantages of incorporation is the ease by which most capital stock can be exchanged. For most companies, investors are able to buy or sell ownership shares on stock exchanges in a matter of moments. In contrast, sole proprietorships and partnerships rarely sell capital shares. Without the separation provided by incorporation, a clear distinction between owner and business does not exist. For example, debts incurred by a business that is a sole proprietorship or partnership may ultimately have to be satisfied by the owner personally. Thus, individuals tend to avoid making investments in unincorporated businesses unless they can be involved directly in the management. However, partnerships and sole proprietorships still remain popular because they are easy to create and offer possible income tax benefits as will be described in a later chapter.

If traded on a stock exchange, shares of the capital stock of a corporation continually go up and down in value based on myriad factors, including the perceived financial health and future prospects of the organization. As an example, during trading on July 1, 2011, the price of an ownership share of Intel rose by $0.37 to $22.53, while a share of Capital One went up by $0.98 to $52.65.

For countless individuals and groups around the world, the most popular method of investment is through the purchase and sell of these capital shares of corporate ownership. Although many other types of investment opportunities are available (such as the acquisition of gold or land), few come close to evoking the level of interest of capital stock.The most prevalent form of capital stock is common stock so that these two terms have come to be used somewhat interchangeably. As will be discussed in a later chapter, the capital stock of some corporations is made up of both common stock and preferred stock. On the New York Stock ExchangeOrganized stock market that efficiently matches buyers and sellers of capital stock at a mutually agreed-upon price allowing ownership in companies to change hands easily. The New York Stock Exchange is the largest stock exchange in the world followed by NASDAQ, the London Stock Exchange, the Tokyo Stock Exchange, and the Shanghai Stock Exchange. alone, billions of shares are bought and sold every business day at a wide range of prices. As of June 30, 2011, an ownership share of Sprint Nextel was trading for $5.39, while a single share of Berkshire Hathaway sold for $116,105.00.

Test Yourself

Question:

Ray Nesbitt owns a store in his hometown of Charlotte, North Carolina, that sells food and a variety of other goods. He has always operated this store as a sole proprietorship because he was the only owner. Recently, he went to his lawyer and began the legal process of turning his business into a corporation. Which of the following is the most likely reason for this action?

- He can sell a wider variety of goods as a corporation.

- He has plans to build a second, and maybe a third, store in the area.

- The store has reached a size where incorporation has become mandatory.

- He hopes his son will one day decide to become a member of the management.

Answer:

The correct answer is choice b: He has plans to build a second, and maybe a third, store in the area.

Explanation:

One of the most important reasons to incorporate a business is that additional sources of capital can be tapped by issuing stock. Nesbitt may be planning to get the money needed to build the new stores by encouraging others to acquire stock and become owners. There is no size limit for incorporation, and the decision has little or nothing to do with operations. Neither the selection of goods nor the members of the management team is affected by the legal form of the business.

The Operational Structure of a Corporation

Question: The owners of most small corporations can operate their businesses effectively as both stockholders and managers. For example, two friends might each own half of the capital stock of a bakery or a retail clothing store. Those individuals probably work together to manage this business on a day-to-day basis.

Because of the number of people who can be involved, large corporations offer a significantly different challenge. How do millions of investors possessing billions of capital shares of a corporation ever serve in any reasonable capacity as the owners and managers of that business?

Answer: Obviously, a great many corporations like The Coca-Cola Company have an enormous quantity of capital shares held by tens of thousands of investors. Virtually none of these owners can expect to have any impact on the daily operations of the business. A different operational structure is needed. In a vast number of such organizations, stockholders vote to elect a representative group to oversee operations. This body—called the board of directorsA group that oversees the management of a corporation; the members are voted to this position by stockholders; it hires the management to run the company on a daily basis and then meets periodically to review operating, investing, and financing results and also to approve policy and strategy.A story produced by National Public Radio on the roles played by a board of directors can be found at http://www.npr.org/templates/story/story.php?storyId=105576374.—is made up of approximately ten to twenty-five knowledgeable individuals.

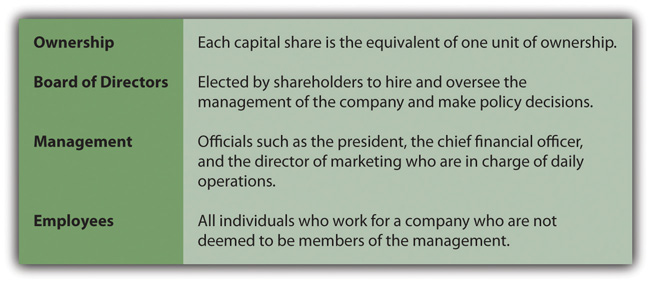

As shown in Figure 1.1 "Company Operational Structure", the board of directors hires the members of management who run the business on a daily basis. The board then meets periodically (often quarterly) to review operating, investing, and financing results as well as to approve strategic policy initiatives.

Figure 1.1 Company Operational Structure

Occasionally, the original founders of a business (or their descendants) continue to hold enough shares to influence or actually control operating and other significant decisions of a business. Or wealthy outside investors might acquire enough shares to gain this same level of power. Such owners have genuine authority within the corporation. Even that degree of control, though, is normally carried out through membership on the board of directors. For example, at the end of 2010, the Ford Motor Company had fifteen members on its board of directors, three of whom were named Ford. Except in rare circumstances, the hierarchy of owners, board of directors, management, and employees remains intact. Thus, most stockholders are not involved with the operating decisions of any large corporation.

Predicting the Appreciation of Capital Stock Values

Question: The acquisition of capital shares of a corporation is an extremely popular investment strategy for a wide range of the population. A buyer becomes one of the owners of the business. Why spend money in this way especially since very few stockholders can ever hope to hold enough shares to participate in managing or influencing operations? Ownership shares sometimes cost small amounts but can also require hundreds if not thousands of dollars. What is the potential benefit of buying capital stock issued by a business organization such as PepsiCo or Chevron?

Answer: Capital shares of thousands of corporations trade each day on markets around the world such as the New York Stock Exchange or NASDAQ (National Association of Securities Dealers Automated Quotations)An electronic market that allows for the trading of capital shares in approximately three thousand companies, providing instantaneous price quotations to efficiently match buyers and sellers allowing ownership in companies to change hands.. One party is looking to sell shares whereas another is seeking shares to buy. Stock markets match up these buyers and sellers so that a mutually agreed-upon price can be negotiated. This bargaining process allows the ownership interests of these companies to change hands with relative ease.

When investors believe a business is financially healthy and its future is bright, they expect prosperity and growth to continue. If that happens, the negotiated price for the capital shares of the corporation should rise over time. Investors around the world attempt to anticipate such movements in order to buy the stock at a low price and sell later at a higher one. Conversely, if predictions are not optimistic, then a business’s share price is likely to drop so that owners will experience losses in the value of their investments.

Financial accounting information plays an invaluable role in this market process as millions of investors attempt to assess the financial condition and prospects of various business organizations on an ongoing basis. Being able to understand and make use of reported financial data helps improve the investor’s knowledge of a corporation and, thus, the chance of making wise decisions about the buying and selling of capital shares. Ignorance often leads to poor decisions and much less lucrative outcomes.

In the United States, such investment gains—if successfully generated—are especially appealing to individuals when ownership shares are held for over twelve months before being sold. For income tax purposes, the difference between the buy and sale prices for such investments is referred to as a long-term capital gain or loss. Under certain circumstances, significant tax reductions are attributed to long-term capital gains.This same tax benefit is not available to corporate taxpayers, only individuals. The U.S. Congress created this tax incentive to encourage additional investment so that businesses could more easily obtain money for growth purposes. When businesses prosper and expand, the entire economy tends to do better.

Test Yourself

Question:

Mr. and Mrs. Randolph Ostar buy one thousand shares of a well-known company at $25 per share on July 1, Year One. They hold no other investments. The stock is traded on the New York Stock Exchange, and the price goes up over time to $36 per share. On June 27, Year Two, the couple is considering the sale of these shares so that they can buy a new car. At the last moment, they postpone these transactions for one week. What is the most likely reason for this delay?

- Automobile prices tend to go down after July 1 each year.

- It normally takes several weeks to sell the shares of a large corporation.

- Laws delay the immediate use of money from the sale of investments for several weeks.

- They are hoping to reduce the amount of income taxes to be paid.

Answer:

The correct answer is choice d: They are hoping to reduce the amount of income taxes to be paid.

Explanation:

For individuals who own stock, gains on the sale of capital assets (such as these shares) are taxed at low rates, but only if long-term (held for over one year). The Ostars anticipate making an $11,000 profit ($36 − $25 × 1,000 shares). Currently, the shares have been held for slightly less than one year. If sold in June, the gain is short-term and taxed at a higher rate. By holding them for just one more week, the gain becomes long-term, and a significant amount of tax money is saved.

The Receipt of Dividends

Question: Investors acquire ownership shares of selected corporations hoping that the stock price will rise over time. This investment strategy is especially tempting because long-term capital gains are often taxed at a relatively low rate. Is the possibility for appreciation in value the only reason that investors choose to acquire capital shares?

Answer: Many corporations—although certainly not all—pay cash dividendsDistributions made by a corporation to its shareholders as a reward when income has been earned; decision to pay is made by the board of directors; shareholders often receive favorable tax treatment when cash dividends are collected. to their stockholders periodically. A dividend is a reward for being an owner of a business that is prospering. It is not a required payment; it is a sharing of profits with the stockholders. As an example, for 2010, Duke Energy reported earning profits (net income) of $1.32 billion. During that same period, the corporation distributed total cash dividends of approximately $1.28 billion to the owners of its capital stock.The receipt of cash dividends is additionally appealing to stockholders because, in most cases, they are taxed at the same reduced rates as are applied to net long-term capital gains.

The board of directors determines whether to pay dividends. Some boards prefer to leave money within the business to stimulate future growth and additional profits. For example, Google Inc. reported profits (net income) for 2010 of $8.51 billion but distributed no dividends to its owners. Newer companies often choose to pay less dividends than older companies as they try to grow quickly to a desired size.

Not surprisingly, a variety of investing strategies abound. Many investors acquire ownership shares almost exclusively in hopes of benefiting from an anticipated appreciation of stock prices. Another large segment of the investing public is more likely to be drawn to the possibility of dividend payments. Unless an owner has the chance to influence or control the operations of a business, only these two potential benefits can accrue from the ownership of capital shares: appreciation in the value of the stock price and cash dividends.

Annual Rate of Return on an Investment in Capital Stock

Question: An investor can put money into a savings account at a bank and earn a small but relatively risk-free profit. For example, $100 could be invested on January 1 and then be worth $102 at the end of the year because interest is added to the balance. The extra $2 means that the investor earned an annual return of 2 percent ($2 increase/$100 investment). This computation helps in comparing one possible investment opportunity against another. How is the annual rate of return computed when the capital stock of a corporation is acquired as an investment and then held for a period of time?

Answer: Capital stock investments are certainly not risk free. Profits can be high, but losses always loom as a possibility. The annual rate of return measures those profits and losses in the past and is often anticipated for the future as a way of making investment decisions.

To illustrate, assume that on January 1, Year One, an investor spends $100 for one ownership share of the Ace Company and another $100 for a share of the Base Company. During the year, Ace distributes a dividend of $1.00 per share to each of its owners while Base pays a dividend of $5.00 per share. On December 31, the capital stock of the Ace Company is selling on a stock market for $108 per share whereas the stock of the Base Company has a price of only $91 per share.

This investor now holds a total value of $109 as a result of the purchase of the share of the Ace Company: the cash dividend of $1 and a share of capital stock worth $108. In one year, the total value has risen by $9 ($109 less $100) so that the annual rate return was 9 percent ($9 increase/$100 investment).

The shares of the Base Company did not perform as well. At the end of the year, the total value of this investment is only $96: the cash dividend of $5 plus one share of stock worth $91. That is a drop of $4 during the year ($96 less $100). The annual rate of return on this investment is a negative 4 percent ($4 decrease/$100 investment).

As a result of this first year, buying a share of Ace obviously proved to be a better investment than buying a share of Base because of the higher annual rate of return. However, a careful analysis of the financial accounting data available at the start of the year might have helped this investor realize in advance that the rate of return on the investment in Ace would be higher. An assessment of the financial health and future prospects of both businesses could have shown that a higher return was expected in connection with the investment in Ace.

Therefore, estimating the annual rate of return is important for investors because it helps them select from among multiple investment opportunities. This computation provides a method for quantifying the financial benefit earned in the past and expected in the future. Logically, investors should simply choose the investment that provides the highest anticipated rate of return. However, as with all predictions, the risk that actual actions will not follow the expected course must be taken into consideration. Investing often breaks down to anticipating profits while measuring the likelihood and amount of potential losses.

Key Takeaway

Incorporation allows an organization to be viewed legally as a separate entity apart from its ownership. In most large corporations, few owners are able to be involved in the operational decision making. Instead, stockholders elect a board of directors to oversee the business and direct the work of management. Corporations can issue shares of capital stock that give the holder an ownership right and enables the business to raise monetary funds. If the organization is financially healthy and prospering, these shares can increase in value over time—possibly by a significant amount. In addition, a profitable organization may well share its good fortune with its ownership through the distribution of cash dividends. Investors often attempt to estimate the annual rate of return that can be expected from an investment as a way of comparing it to other investment alternatives. This computation takes the profit for the year (stock appreciation and dividends) and divides it by the amount of the investment at the start of the period.