This is “Personal Finances”, chapter 14 from the book An Introduction to Business (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 14 Personal Finances

Carefully managing your personal finances makes it possible for you to buy a new car, go on a vacation, or afford your dream home.

© 2010 Jupiterimages Corporation

Do you wonder where your money goes? Do you have trouble controlling your spending? Have you run up the balances on your credit cards or gotten behind in your payments and hurt your credit rating? Do you worry about how you’ll pay off your student loans? Would you like to buy a new car or even a home someday and you’re not sure where the money will come from? If you do have extra money, do you know how to invest it? Do you know how to find the right job for you, land an offer, and evaluate the company’s benefits? If these questions seem familiar to you, you could benefit from help in managing your personal finances. This chapter will provide that help.

Where Does Your Money Go?

Learning Objectives

- Offer advice to someone who is burdened with debt.

- Offer advice to someone whose monthly bills are too high.

Let’s say that you’re single and twenty-eight. You have a good education and a good job—you’re pulling down $60K working with a local accounting firm. You have $6,000 in a retirement savings account, and you carry three credit cards. You plan to buy a house (maybe a condo) in two or three years, and you want to take your dream trip to the world’s hottest surfing spots within five years (or, at the most, ten). Your only big worry is the fact that you’re $70,000 in debt, mostly from student loans, your car loan, and credit card debt. In fact, even though you’ve been gainfully employed for a total of six years now, you haven’t been able to make a dent in that $70,000. You can afford the necessities of life and then some, but you’ve occasionally wondered if you’re ever going to have enough income to put something toward that debt.This vignette is adapted from a series titled USA TODAY’s Financial Diet, which ran in USA Today in 2005 (accessed November 10, 2011). Go to http://www.usatoday.com/money/perfi/basics/2005-04-14-financial-diet-excercise1_x.htm and use the embedded links to follow the entire series.

Now let’s suppose that while browsing through a magazine in the doctor’s office, you run across a short personal-finances self-help quiz. There are two sets of three statements each, and you’re asked to check off each statement with which you agree:

- Part 1

- If I didn’t have a credit card in my pocket, I’d probably buy a lot less stuff.

- My credit card balance usually goes up at the holidays.

- If I really want something that I can’t afford, I put it on my credit card or sign up for a payment plan.

- Part 2

- I can barely afford my apartment.

- Whenever something goes wrong (car repairs, doctors’ bills), I have to use my credit card.

- I almost never spend money on stuff I don’t need, but I always seem to owe a balance on my credit card bill.

At the bottom of the page, you’re asked whether you agreed with any of the statements in Part 1 and any of the statements in Part 2. It turns out that you answered yes in both cases and are thereby informed that you’re probably jeopardizing your entire financial future.

Unfortunately, personal-finances experts tend to support the author of the quiz: if you agreed with any statement in Part 1, you have a problem with splurging; if you agreed with any statement in Part 2, your monthly bills are too high for your income.

Building a Good Credit Rating

So, you have a financial problem: according to the quick test you took, you’re a splurger and your bills are too high for your income. How does this put you at risk? If you get in over your head and can’t make your loan or rent payments on time, you risk hurting your credit—your ability to borrow in the future.

Let’s talk about your credit. How do potential lenders decide whether you’re a good or bad credit risk? If you’re a poor credit risk, how does this affect your ability to borrow, or the rate of interest you have to pay, or both? Here’s the story. Whenever you use credit, those you borrow from (retailers, credit card companies, banks) provide information on your debt and payment habits to three national credit bureaus: Equifax, Experian, and TransUnion. The credit bureaus use the information to compile a numerical credit score, generally called a FICO score; it ranges from 300 to 900, with the majority of people falling in the 600–700 range. (Here’s a bit of trivia to bring up at a dull party: FICO stands for Fair Isaac Company—the company that developed the score.) In compiling the score, the credit bureaus consider five criteria: payment history—do you pay your bills on time? (the most important), total amount owed, length of your credit history, amount of new credit you have, and types of credit you use. The credit bureaus share their score and other information about your credit history with their subscribers.

So what does this do for you? It depends. If you paid your bills on time, carried only a reasonable amount of debt, didn’t max out your credit cards, had a history of borrowing, hadn’t applied for a bunch of new loans, and borrowed from a mix of lenders, you’d be in good shape. Your FICO score would be high and lenders would like you. Because of your high credit score, they’d give you the loans you asked for at reasonable interest rates. But if your FICO score is low (perhaps you weren’t so good at paying your bills on time), lenders won’t like you and won’t lend you money (or would lend it to you at high interest rates). A low FICO score can raise the amount you have to pay for auto insurance and cell phone plans and can even affect your chances of renting an apartment or landing a particular job. So it’s very, very, very (the last “very” is for emphasis) important that you do everything possible to earn a high credit score. If you don’t know your score, here is what you should do: go to https://www.quizzle.com/ and request a free copy of your credit report.

As a young person, though, how do you build a credit history that will give you a high FICO score? Your means for doing this changed in 2009 with the passage of the Credit CARD Act, federal legislation designed to stop credit card issuers from treating its customers unfairly.LaToya Irby, “10 Key Changes of the New Credit Card Rules,” About.com, http://credit.about.com/od/consumercreditlaws/tp/new-credit-card-rules.htm (accessed November 10, 2011). Based on feedback from several financial experts, Emily Starbuck Gerson and Jeremy Simon of CreditCards.com compiled the following list of ways students can build good credit.Emily Starbuck Gerson and Jeremy M. Simon, “10 Ways Students Can Build Good Credit,” CreditCards.com, http://www.creditcards.com/credit-card-news/help/10-ways-students-get-good-credit-6000.php (accessed November 10, 2011).

- Become an authorized user on your parents’ account. According to the rules set by the Credit CARD Act, if you are under age twenty-one and do not have independent income, you can get a credit card in your own name only if you have a cosigner (who is over twenty-one and does have an income). This is a time when a parent can come in handy. Your parent could add you to his or her credit card account as an authorized user. Of course, this means your parent will know what you’re spending your money on (which could make for some interesting conversations). But, on the plus side, by piggybacking on your parent’s card you are building good credit (assuming, of course, that your parent pays the bill on time).

- Obtain your own credit card. If you can show the credit card company that you have sufficient income to pay your credit card bill, you might be able to get your own card. It isn’t as easy to get a card as it was before the passage of the Credit CARD Act, and you won’t get a lot of goodies for signing up (as was true before), but you stand a chance.

- Get the right card for you. If you meet the qualifications to get a credit card on your own, look for the best card for you. Although it sounds enticing to get a credit card that gives you frequent flyer miles for every dollar you spend, the added cost for this type of card, including higher interest charges and annual fees, might not be worth it. Look for a card with a low interest rate and no annual fee. As another option, you might consider applying for a retail credit card, such as a Target or Macy’s card.

- Use the credit card for occasional, small purchases. If you do get a credit card or a retail card, limit your charges to things you can afford. But don’t go in the other direction and put the card in a drawer and never use it. Your goal is to build a good credit history by showing the credit reporting agencies that you can handle credit and pay your bill on time. To accomplish this, you need to use the card.

- Avoid big-ticket buys, except in case of emergency. Don’t run up the balance on your credit card by charging high-cost, discretionary items, such as a trip to Europe during summer break, which will take a long time to pay off. Leave some of your credit line accessible in case you run into an emergency, such as a major car repair.

- Pay off your balance each month. If you cannot pay off the balance on your credit card each month, this is likely a signal that you’re living beyond your means. Quit using the card until you bring the balance down to zero. When you’re first building credit, it’s important to pay off the balance on your card at the end of each month. Not only will this improve your credit history, but it will save you a lot in interest charges.

- Pay all your other bills on time. Don’t be fooled into thinking that the only information collected by the credit agencies is credit card related. They also collect information on other payments including phone plans, Internet service, rental payments, traffic fines, and even library overdue fees.

- Don’t cosign for your friends. If you are twenty-one and have an income, a nonworking, under-age-twenty-one friend might beg you to cosign his credit card application. Don’t do it! As a cosigner, the credit card company can make you pay your friend’s balance (plus interest and fees) if he fails to meet his obligation. And this can blemish your own credit history and lower your credit rating.

- Do not apply for several credit cards at one time. Just because you can get several credit cards, this doesn’t mean that you should. When you’re establishing credit, applying for several cards over a short period of time can lower your credit rating. Stick with one card.

- Use student loans for education expenses only, and pay on time. For many, student loans are necessary. But avoid using student loans for noneducational purposes. All this does is run up your debt. When your loans become due, consolidate them if appropriate and don’t miss a payment.

What if you’ve already damaged your credit score—what can you do to raise it? Do what you should have done in the first place: pay your bills on time, pay more than the minimum balance due on your credit cards and charge cards, keep your card balances low, and pay your debts off as quickly as possible. Also, scan your credit report for any errors. If you find any, work with the credit bureau to get them corrected.

Understand the Cost of Borrowing

Because your financial problem was brought on, in part, because you have too much debt, you should stop borrowing. But, what if your car keeps breaking down and you’re afraid of getting stuck on the road some night? So, you’re thinking of replacing it with a used car that costs $10,000. Before you make a final decision to incur the debt, you should understand its costs. The rate of interest matters a lot. Let’s compare three loans at varying interest rates: 6, 10, and 14 percent. We’ll look at the monthly payment, as well as the total interest paid over the life of the loan.

| $10,000 Loan for 4 Years at Various Interest Rates | |||

|---|---|---|---|

| Interest Rate | 6% | 10% | 14% |

| Monthly Payment | $235 | $254 | $273 |

| Total Interest Paid | $1,272 | $2,172 | $3,114 |

If your borrowing interest rate is 14 percent, rather than 6 percent, you’ll end up paying an additional $1,842 in interest over the life of the loan. Your borrowing cost at 14 percent is more than twice as much as it is at 6 percent. The conclusion: search for the best interest rates and add the cost of interest to the cost of whatever you’re buying before deciding whether you want it and can afford it. If you have to borrow the money for the car at the 14 percent interest rate, then the true cost of the car isn’t $10,000, but rather $13,114.

Now, let’s explore the complex world of credit cards. First extremely important piece of information: not all credit cards are equal. Second extremely important piece of information: watch out for credit card fees! Credit cards are a way of life for most of us. But they can be very costly. Before picking a credit card, do your homework. A little research can save you a good deal of money. There are a number of costs you need to consider:

- Finance charge. The interest rate charged to you often depends on your credit history; those with good credit get the best rates. Some cards offer low “introductory” rates—but watch out; these rates generally go up after six months.

- Annual fee. Many credit cards charge an annual fee: a yearly charge for using the card. You can avoid annual fees by shopping around (though there can be trade-offs: you might end up paying a higher interest rate to avoid an annual fee).

- Over-limit fee. This fee is charged whenever you exceed your credit line.

- Late payment fee. Pretty self-explanatory, but also annoying. Late payment fees are common for students; a study found students account for 6 percent of all overdraft fees.Harriet Johnson Brackey, “Students Burdened by Overdraft Charges, Group Says,” Wisdom of the Rich Dad, http://www.richdadwisdom.com/2007/12/students-burdened-by-overdraft-charges/ (accessed November 11, 2001). One way to decrease the chance of paying late is to call the credit card company and ask them to set your payment due date for a time that works well for you. For example, if you get paid at the end of the month, ask for a payment date around the 10th of the month. Then you can pay your bill when you get paid and avoid a late fee.

- Cash advance fee. While it’s tempting to get cash from your credit card, it’s pretty expensive. You’ll end up paying a fee (around 3 percent of the advance), and the interest rate charged on the amount borrowed can be fairly high.

An alternative to a credit card is a debit cardPulls money out of your checking account whenever you use the card to buy something or get cash from an ATM., which pulls money out of your checking account whenever you use the card to buy something or get cash from an ATM. These cards don’t create a loan when used. So, are they better than credit cards? It depends—each has its advantages and disadvantages. A big advantage of a credit card is that it helps you build credit. A disadvantage is that you can get in over your head in debt and possibly miss payments (thereby incurring a late payment fee). Debit cards help control spending. Theoretically, you can’t spend more than you have in your checking account. But be careful—if you don’t keep track of your checking account balance, it’s easy to overdraft your account when using your debit card. Prior to July 2010, most banks just accepted purchases or ATM withdrawals even if a customer didn’t have enough money in his or her account to cover the transaction. The banks didn’t do this to be nice, and they didn’t ask customers if they wanted this done—they just overdrafted the customer’s account and charged the customer a hefty overdraft fee of around $35 through what they call an “overdraft protection program.”Kathy Chu,” Debit Card Overdraft Fees Hit Record Highs,” USA Today, January 24, 2007, http://www.usatoday.com/money/perfi/credit/2007-01-24-debit-card-fees_x.htm (accessed November 11, 2011). Overdraft fees can be quite expensive, particularly if you used the card to purchase a hamburger and soda at a fast-food restaurant.

The Federal Reserve changed the debit card rules in 2010, and now banks must get your permission before they enroll you in an overdraft protection program.“What You Need to Know: Bank Account Overdraft Fees,” Board of Governors of the Federal Reserve System, http://www.federalreserve.gov/consumerinfo/wyntk_overdraft.htm (accessed November 10, 2011).If you opt in (agree), things work as before: You can spend or take out more money through an ATM machine than you have in your account, and the bank lets you do this. But it charges you a fee of about $30 plus additional fees of $5 per day if you don’t cover the overdraft in five days. If you don’t opt in, the bank will not let you overdraft your account. The downside is that you could get embarrassed at the cash register when your purchase is rejected or at a restaurant when trying to pay for a meal. Obviously, you want to avoid being charged an overdraft fee or being embarrassed when paying for a purchase. Here are some things you can do to decrease the likelihood that either would happen:Connie Prater, “Consumers to Fed: Stop Debit Card Overdraft Opt-In ‘Scare’ Tactics: New Debit Card Overdraft Rules Slated to Start July 1, 2010,” CreditCards.com, http://www.creditcards.com/credit-card-news/debit-card-overdraft-fee-opt-in-rules-1282.php (accessed November 10, 2011).

- Ask your bank to e-mail or text you when your account balance is low.

- Have your bank link your debit card account to a savings account. If more money is needed to cover a purchase, the bank will transfer the needed funds from your savings to your checking account.

- Use the online banking feature offered by most banks to check your checking account activity.

A Few More Words about Debt

What should you do now to turn things around—to start getting out of debt? According to many experts, you need to take two steps:

- Cut up your credit cards and start living on a cash-only basis.

- Do whatever you can to bring down your monthly bills.

Figure 14.1

Living on a cash-only basis is the first step in getting debt under control.

© 2010 Jupiterimages Corporation

Step 1 in this abbreviated two-step personal-finances “plan” is probably the easier of the two, but taking even this step can be hard enough. In fact, a lot of people would find it painful to give up their credit cards, and there’s a perfectly logical reason for their reluctance: the degree of pain that one would suffer from destroying one’s credit cards probably stands in direct proportion to one’s reliance on them.

As of May 2011, total credit card debt in the United States is about $780 billion, out of $2.5 trillion in total consumer debt. Closer to home, one recent report puts average credit card debt per U.S. household at $16,000 (up 100 percent since 2000). The 600 million credit cards held by U.S. consumers carry an average interest rate on these cards of 15 percent.“Credit Card Statistics, Industry Facts, Debt Statistics,” CreditCards.com, http://www.creditcards.com/credit-card-news/credit-card-industry-facts-personal-debt-statistics-1276.php (accessed November 10, 2011). Why are these numbers important? Primarily because, on average, too many consumers have debt that they simply can’t handle. “Credit card debt,” says one expert on the problem, “is clobbering millions of Americans like a wrecking ball,”U.S. Senator Ron Wyden, quoted in “Avoiding the Pitfalls of Credit Card Debt” (Center for American Progress Action Fund, 2008), http://www.americanprogressaction.org/issues/2008/avoiding_pitfalls.html (accessed September 13, 2008). and if you’re like most of us, you’d probably like to know whether your personal-finances habits are setting you up to become one of the clobbered.

If, for example, you’re worried that your credit card debt may be overextended, the American Bankers Association suggests that you ask yourself a few questions:Joshua Lipton, “Choking On Credit Card Debt,” Forbes.com, September 12, 2008, http://www.forbes.com/finance/2008/09/12/credit-card-debt-pf-ii-in_jl_0911creditcards_inl.html (accessed November 11, 2011).

- Do I pay only the minimum month after month?

- Do I run out of cash all the time?

- Am I late on critical payments like my rent or my mortgage?

- Am I taking longer and longer to pay off my balance(s)?

- Do I borrow from one credit card to pay another?

If such habits as these have helped you dig yourself into a hole that’s steadily getting deeper and steeper, experts recommend that you take three steps as quickly as possible:Joshua Lipton, “Choking On Credit Card Debt,” Forbes.com, September 12, 2008, http://www.forbes.com/finance/2008/09/12/credit-card-debt-pf-ii-in_jl_0911creditcards_inl.html (accessed November 11, 2011).

- Get to know the enemy. You may not want to know, but you should collect all your financial statements and figure out exactly how much credit card debt you’ve piled up.

- Don’t compound the problem with late fees. List each card, along with interest rates, monthly minimums, and due dates. Bear in mind that paying late fees is the same thing as tossing what money you have left out the window.

- Now cut up your credit cards (or at least stop using them). Pay cash for everyday expenses, and remember: swiping a piece of plastic is one thing (a little too easy), while giving up your hard-earned cash is another (a little harder).

And, if you find you’re unable to pay your debts, don’t hide from the problem, as it will not go away. Call your lenders and explain the situation. They should be willing to work with you in setting up a payment plan. If you need additional help, contact a nonprofit credit assistance group such as the National Foundation for Credit Counseling (http://www.nfcc.org).

Why You Owe It to Yourself to Manage Your Debts

Now, it’s time to tackle step 2 of our recommended personal-finances miniplan: do whatever you can to bring down your monthly bills. As we said, many people may find this step easier than step 1—cutting up your credit cards and starting to live on a cash-only basis.

If you want to take a gradual approach to step 2, one financial planner suggests that you perform the following “exercises” for one week:Financial planner Elissa Buie helped to develop USA TODAY’s Financial Diet.

- Keep a written record of everything you spend and total it at week’s end.

- Keep all your ATM receipts and count up the fees.

- Take $100 out of the bank and don’t spend a penny more.

- Avoid gourmet coffee shops.

Among other things, you’ll probably be surprised at how much of your money can become somebody else’s money on a week-by-week basis. If, for example, you spend $3 every day for one cup of coffee at a coffee shop, you’re laying out nearly $1,100 a year. If you use your ATM card at a bank other than your own, you’ll probably be charged a fee that can be as high as $3. The average person pays more than $60 a year in ATM fees, and if you withdraw cash from an ATM twice a week, you could be racking up $300 in annual fees. As for your ATM receipts, they’ll tell you whether, on top of the fee that you’re charged by that other bank’s ATM, your own bank is also tacking on a surcharge.Sun Trust Banks, “Money Management” (2008), http://www.suntrusteducation.com/toolbox/moneymgt_spendless.asp (accessed September 16, 2008); “Reduce ATM Fees—Daily Financial Tip,” SavingAdvice.com, April 5, 2006, http://www.savingadvice.com/blog/2006/04/05/10533_reduce-atm-fees-daily-financial-tip.html; Marshall Loeb, “Four Ways to Keep ATM Fees from Draining Your Bank Account,” MarketWatch (June 14, 2007), http://www.marketwatch.com/news/story/four-ways-keep-atm-fees/story.aspx?guid=%7BEFB2C425-B7F8-40C4-8720-D684A838DBDA%7D (accessed November 11 2011); Kate Rosenberger, “How to Avoid ATM Fees,” Helium (2008), http://www.helium.com/items/1100945-how-to-avoid-atm-fees (accessed November 11, 2011).

If this little exercise proves enlightening—or if, on the other hand, it apparently fails to highlight any potential pitfalls in your spending habits—you might devote the next week to another exercise:

- Put all your credit cards in a drawer and get by on cash.

- Take your lunch to work.

- Buy nothing but groceries and gasoline.

- Use coupons whenever you go to the grocery store (but don’t buy anything just because you happen to have a coupon).

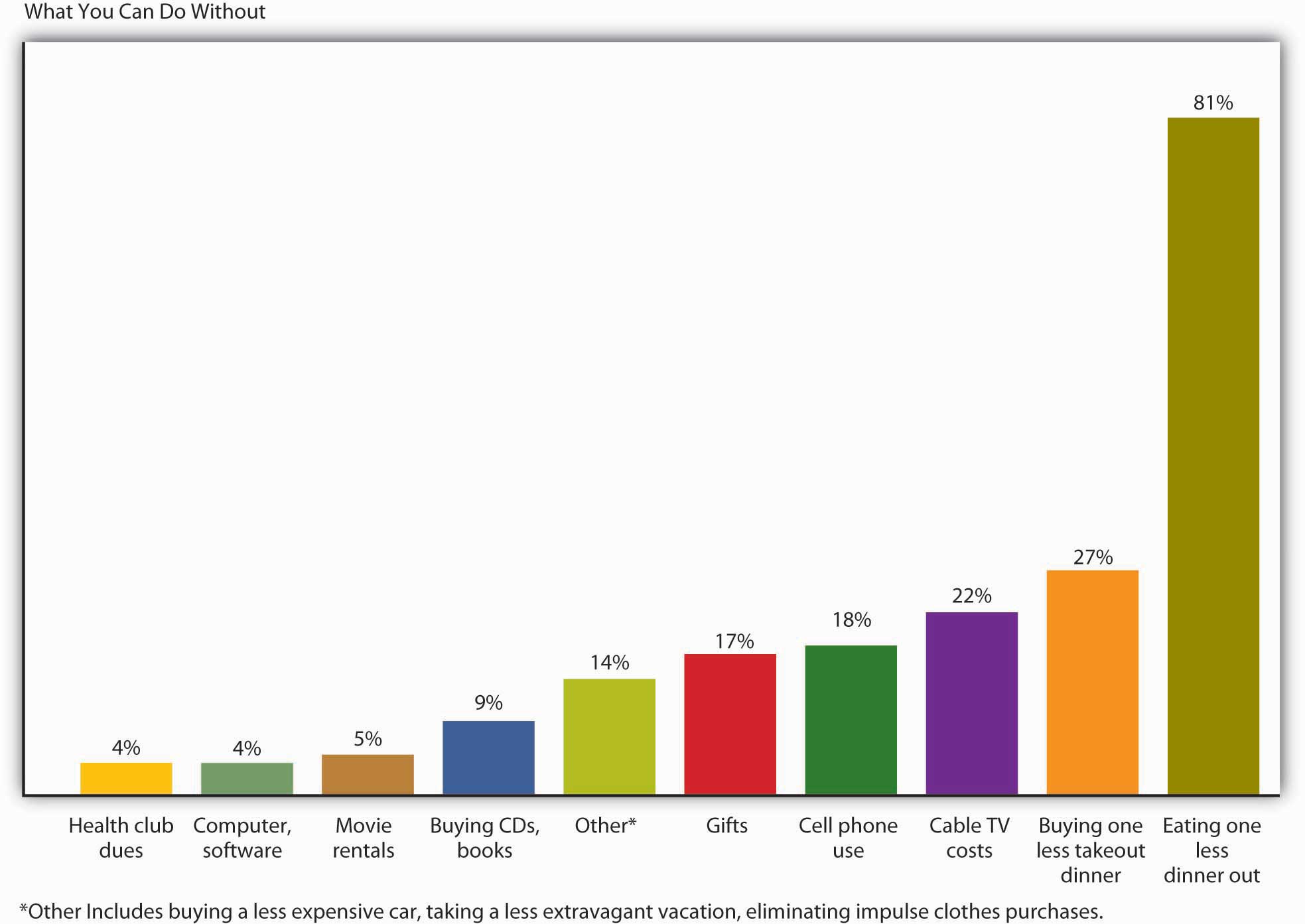

The obvious question that you need to ask yourself at the end of week 2 is, “how much did I save?” An equally interesting question, however, is, “what can I do without?” One survey asked five thousand financial planners to name the two expenses that most consumers should find easiest to cut back on. Figure 14.2 "Reducible Expenses" shows the results.

Figure 14.2 Reducible Expenses

You may or may not be among the American consumers who buy thirty-five million cans of Bud Light each and every day, or 150,000 pounds of Starbucks coffee, or 2.4 million Burger King hamburgers, or 628 Toyota Camrys. Yours may not be one of the 70 percent of U.S. households with an unopened consumer-electronics product lying around.Michael Arrington, “eBay Survey Says Americans Buy Crap They Don’t Want,” TechCrunch, August 21, 2008, http://techcrunch.com/2008/08/21/ebay-survey-says-americans-buy-crap-they-dont-want/ (accessed November 11, 2011). And you may or may not be ready to make some major adjustments in your personal-spending habits, but if, at age twenty-eight, you have a good education and a good job, a $60,000 income, and a $70,000 debt—by no means an implausible scenario—there’s a very good reason why you should think hard about controlling your modest share of that $2.5 trillion in U.S. consumer debt: your level of indebtedness will be a key factor in your ability—or inability—to reach your longer-term financial goals, such as home ownership, a dream trip, and, perhaps most important, a reasonably comfortable retirement.

The great English writer Samuel Johnson once warned, “Do not accustom yourself to consider debt only as an inconvenience; you will find it a calamity.” In Johnson’s day, you could be locked up for failing to pay your debts; there were even so-called debtors’ prisons for the purpose, and we may suppose that the prospect of doing time for owing money was one of the things that Johnson had in mind when he spoke of debt as a potential “calamity.” We don’t expect that you’ll ever go to prison on account of indebtedness, and we won’t suggest that, say, having to retire to a condo in the city instead of a tropical island is a “calamity.” We’ll simply say that you’re more likely to meet your lifetime financial goals—whatever they are—if you plan for them. What you need to know about planning for and reaching those goals is the subject of this chapter.

Key Takeaways

- Before buying something on credit, ask yourself whether you really need the goods or services, can afford them, and are willing to pay interest on the purchase.

- Whenever you use credit, those you borrow from provide information on your debt and payment habits to three national credit bureaus.

- The credit bureaus use the information to compile a numerical credit score, called a FICO score, which they share with subscribers.

- The credit bureaus consider five criteria in compiling the score: payment history, total amount owed, length of your credit history, amount of new credit you have, and types of credit you use.

-

As a young person, you should do the following to build a good credit history that will give you a high FICO score.

- Become an authorized user on your parents’ account.

- Obtain your own credit card

- Get the right card for you.

- Use the credit card for occasional, small purchases

- Avoid big-ticket buys, except in case of emergency.

- Pay off your balance each month.

- Pay all your other bills on time.

- Don’t cosign for your friends.

- Do not apply for several credit cards at one time.

- Use student loans for education expenses only, and pay on time.

- To raise your credit score, you should pay your bills on time, pay more than the minimum balance due, keep your card balances low, and pay your debts off as quickly as possible. Also, scan your credit report for any errors and get any errors fixed.

- If you can’t pay your debt, explain your situation to your lenders and see a credit assistance counselor.

- Before you incur a debt, you should understand its costs. The interest rate charged by the lender makes a big difference in the overall cost of the loan.

- The costs associated with credit cards include finance charges, annual fees, over-limit fees, late payment fees, and cash advance fees.

- The Federal Reserve changed the debit card rules in 2010 and now banks must get your permission before they enroll you in an overdraft protection program.

- If you have a problem with splurging, cut up your credit cards and start living on a cash-only basis.

- If your monthly bills are too high for your income, do whatever you can to bring down those bills.

Exercise

(AACSB) Analysis

There are a number of costs associated with the use of a credit card, including finance charges, annual fee, over-limit fee, late payment fee, and cash advance fee. Identify these costs for a credit card you now hold. If you don’t presently have a credit card, go online and find an offer for one. Check out these costs for the card being offered.