This is “Nonfinancial Performance Measures: The Balanced Scorecard”, section 13.5 from the book Accounting for Managers (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

13.5 Nonfinancial Performance Measures: The Balanced Scorecard

Learning Objective

- Develop and analyze nonfinancial performance measures using a balanced scorecard.

Question: Although financial measures are important for evaluation purposes, many organizations use a mix of financial and nonfinancial measures to evaluate performance. For example, airlines track on-time arrival percentages carefully, and delivery companies like Federal Express (FedEx) and United Parcel Service (UPS) monitor percentages of on-time deliveries. The balanced scorecard uses several alternative measures to evaluate performance. What is a balanced scorecard and how does it help companies to evaluate performance?

Answer: The balanced scorecardA balanced set of financial and nonfinancial measures used by organizations to motivate employees and evaluate performance. is a balanced set of measures that organizations use to motivate employees and evaluate performance. These measures are typically separated into four perspectives outlined in the following. (Dr. Robert S. Kaplan and Dr. David P. Norton created the balanced scorecard, and it is actively promoted through their company, Balanced Scorecard Collaborative. More information can be found at the company’s Web site at http://www.bscol.com.)

- Financial. Measures that shareholders, creditors, and other stakeholders use to evaluate financial performance.

- Internal business process. Measures that management uses to evaluate efficiency of existing business processes.

- Learning and growth. Measures that management uses to evaluate effectiveness of employee training.

- Customer. Measures that management uses to evaluate whether the organization is meeting customer expectations.

The goal is to link these four perspectives to the company’s strategies and goals. For example, a high percentage of on-time arrivals is likely an important goal from the perspective of the customer of an airline. A high percentage of defect-free computer chips is likely an important goal from the internal business process perspective of a computer chip maker. A high number of continuing education hours is likely an important goal from the learning and growth perspective for tax personnel at an accounting firm. Measures from a financial perspective were covered earlier in this chapter.

Companies that use the balanced scorecard typically establish several measures for each perspective. Table 13.4 "Balanced Scorecard Measures" lists several examples of these measures.

Table 13.4 Balanced Scorecard Measures

| Financial | Internal Business Process | Learning and Growth | Customer |

|---|---|---|---|

| Gross margin ratio | Defect-free rate | Hours of employee training | Customer satisfaction (survey) |

| Return on assets | Customer response time | Employee satisfaction (survey) | Number of customer complaints |

| Receivables turnover | Capacity utilization | Employee turnover | Market share |

| Inventory turnover | New product development time | Number of employee accidents | Number of returned products |

Measures established across the four perspectives of the balanced scorecard are linked in a way that motivates employees to achieve company goals. For example, if the company wants to increase the defect-free rate and reduce product returns, effective employee training and low employee turnover will help in achieving this goal. The idea is to establish company goals first, then create measures that motivate employees to reach company goals.

Key Takeaway

- Most organizations use a mix of financial and nonfinancial measures to evaluate performance. The balanced scorecard approach uses a balanced set of measures separated into four perspectives—financial, internal business process, learning and growth, and customer. The last three perspectives tend to include nonfinancial measures, such as hours of employee training or number of customer complaints, to evaluate performance. The goal is to link financial and nonfinancial measures to the company’s strategies and goals.

Review Problem 13.7

Assume Chicken Deluxe, the fast-food restaurant franchise featured in this chapter, uses a balanced scorecard. Provide at least two examples of measures that Chicken Deluxe might use for each of the following perspectives of the balanced scorecard:

- Financial

- Internal business process

- Learning and growth

- Customer

Solution to Review Problem 13.7

-

Answers will vary. Several examples of financial measures are as follows:

- Gross margin ratio

- Profit margin ratio

- Return on assets

- Receivables turnover

- Inventory turnover

-

Answers will vary. Several examples of internal business process measures are as follows:

- Capacity utilization

- Amount of food spoilage

- Order response time

-

Answers will vary. Several examples of learning and growth measures are as follows:

- Hours of employee training

- Employee satisfaction

- Employee turnover

- Number of employee accidents

-

Answers will vary. Several examples of customer perspective measures are as follows:

- Customer satisfaction

- Number of customer complaints

- Market share

- Amount of food returned

End-of-Chapter Exercises

Questions

- What is trend analysis? Explain how the percent change from one period to the next is calculated.

- What is common-size analysis? How is common-size analysis information used?

- Explain the difference between trend analysis and common-size analysis.

- Name the ratios used to evaluate profitability. Explain what the statement “evaluate profitability” means.

- Coca-Cola’s return on assets was 19.4 percent, and return on common shareholders’ equity was 41.7 percent. Briefly explain why these two percentages are different.

- Coca-Cola had earnings per share of $5.12, and PepsiCo had earnings per share of $3.97. Is it accurate to conclude PepsiCo was more profitable? Explain your reasoning.

- Name the ratios used to evaluate short-term liquidity. Explain what the statement “evaluate short-term liquidity” means.

- Explain the difference between the current ratio and the quick ratio.

- Coca-Cola had an inventory turnover ratio of 5.07 times (every 71.99 days), and PepsiCo had an inventory turnover ratio of 8.87 times (every 41.15 days). Which company had the best inventory turnover? Explain your reasoning.

- Name the ratios used to evaluate long-term solvency. Explain what the term “long-term solvency” means.

- Name the measures used to determine and evaluate the market value of a company. Briefly describe the meaning of each measure.

- What is the balanced scorecard? Briefly describe the four perspectives of the balanced scorecard.

Brief Exercises

-

Evaluating Suppliers at Chicken Deluxe. Refer to the dialogue at Chicken Deluxe presented at the beginning of the chapter and the follow-up dialogue immediately following Note 13.58 "Review Problem 13.6".

Required:

- What is the big decision that Chicken Deluxe is facing?

- Briefly describe the results of Dave’s analysis of the two suppliers.

-

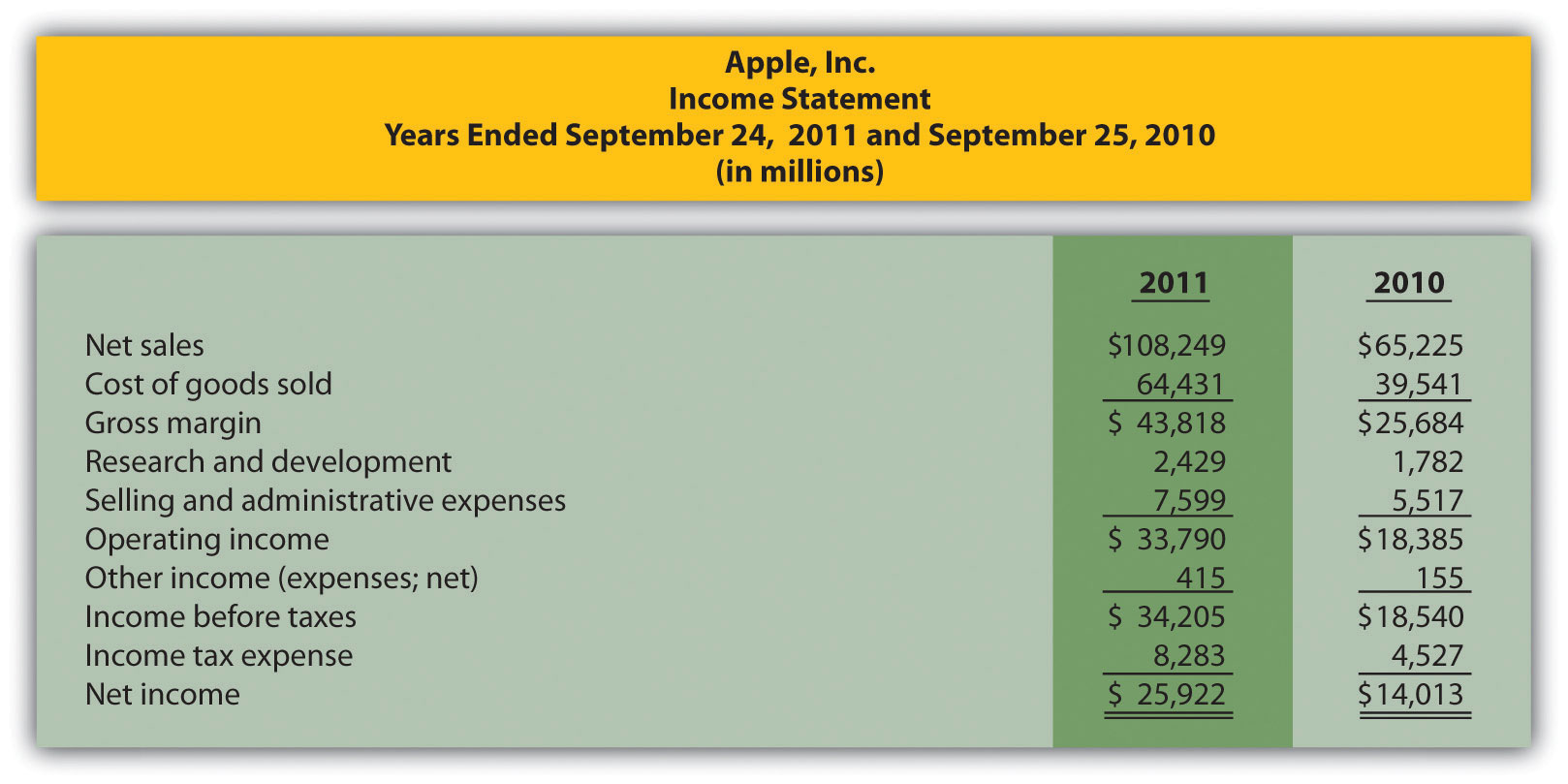

Trend Analysis. The following condensed income statement is for Apple, Inc.

Required:

Prepare a trend analysis of the income statements from 2010 to 2011. Use the format shown in Figure 13.1 "Income Statement Trend Analysis for " as a guide. (Round percent computations to one decimal place.)

-

Common-Size Analysis. Refer to the condensed income statement for Apple, Inc., in Brief Exercise 14.

Required:

Prepare a common-size analysis of the income statements for 2010 and 2011. Use the format shown in Figure 13.5 "Common-Size Income Statement Analysis for " as a guide. (Round percent computations to one decimal place.)

-

Gross Margin and Profit Margin Ratios. Refer to the condensed income statement for Apple, Inc., in Brief Exercise 14.

Required:

Compute the following profitability ratios for 2011, and provide a brief explanation after each ratio (round computations to one decimal place):

- Gross margin ratio

- Profit margin ratio

-

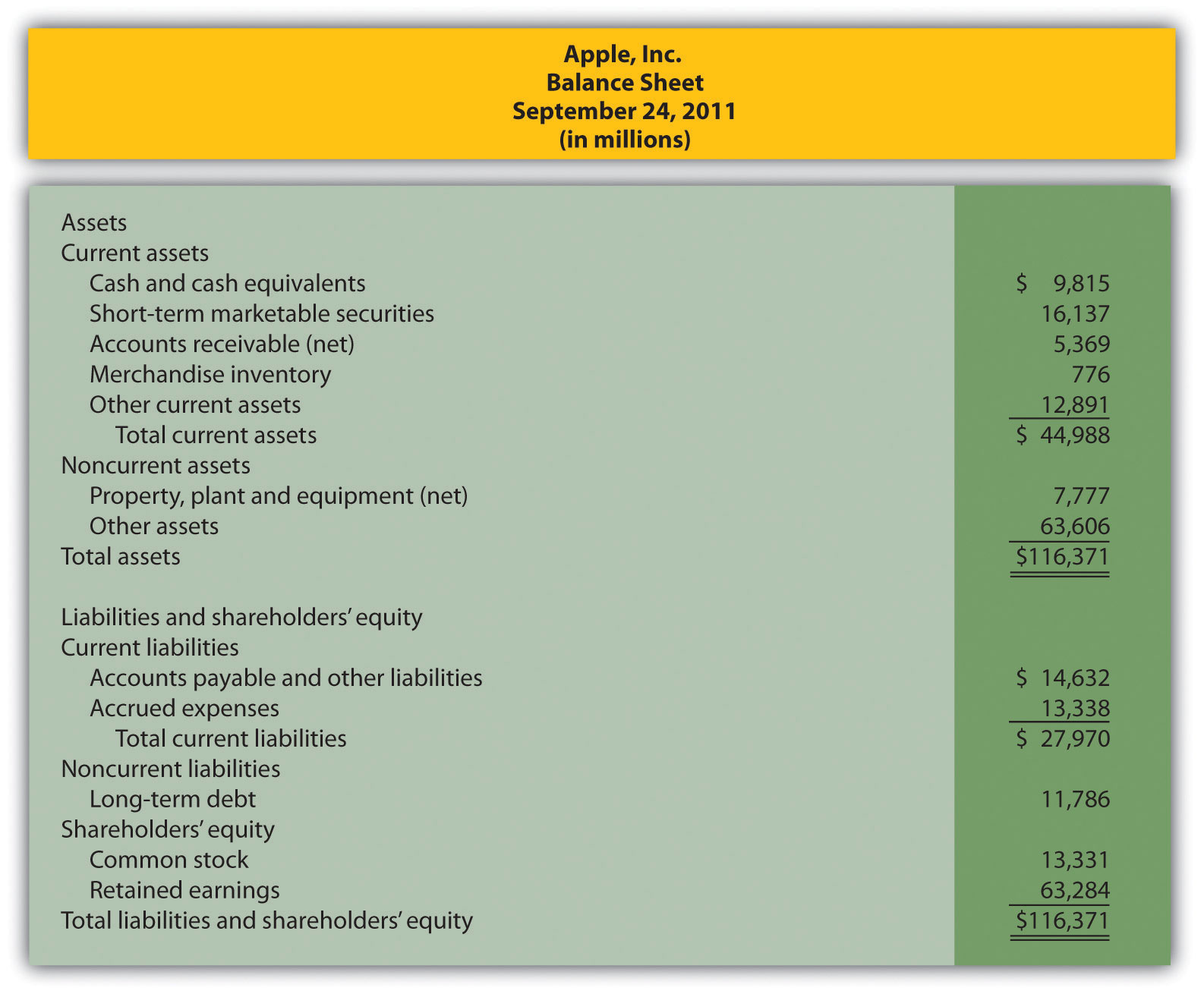

Current and Quick Ratios. A condensed balance sheet for Apple, Inc., appears in the following.

Required:

Compute the following short-term liquidity ratios for 2011, and provide a brief explanation after each ratio (round computations to two decimal places):

- Current ratio

- Quick ratio

-

Long-Term Solvency Ratios. Refer to the condensed balance sheet for Apple, Inc., in Brief Exercise 17.

Required:

Compute the following long-term solvency ratios for 2011, and provide a brief explanation after each ratio (round computations to two decimal places):

- Debt to assets

- Debt to equity

-

Market Capitalization. On September 24, 2011, Apple, Inc., had 929,277,000 shares of common stock issued and outstanding, and the market price per share on that date was $403.33.

Required:

Compute Apple’s market capitalization at September 24, 2011, and provide a brief explanation of what this measures represents (state the answer in billions).

- Balanced Scorecard. Provide two nonfinancial measures likely used by delivery companies like FedEx and UPS.

Exercises: Set A

-

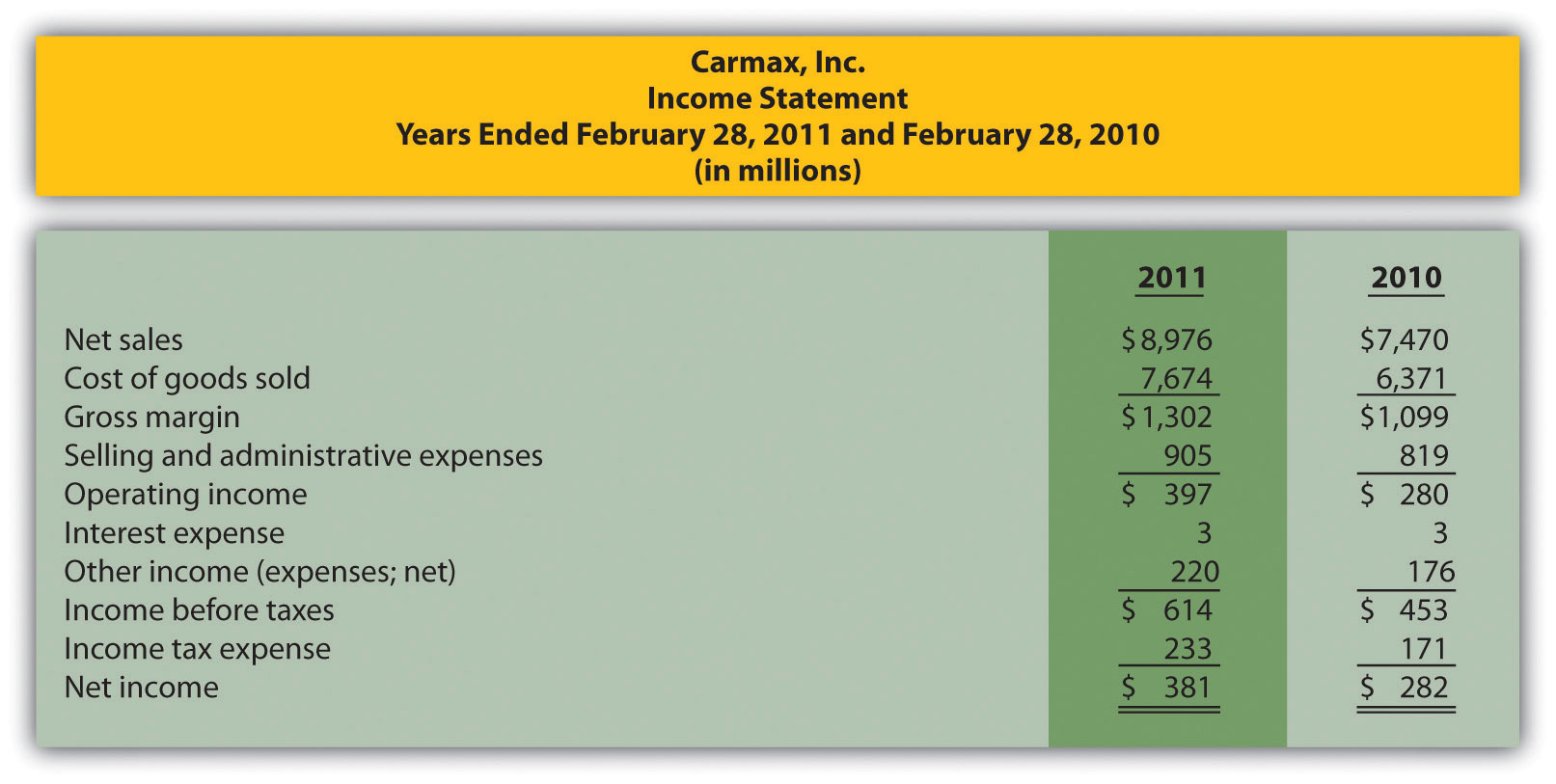

Trend Analysis. The following condensed income statement is for CarMax, Inc., a large retailer of used vehicles.

Required:

- Prepare a trend analysis of the income statements from 2010 to 2011. Use the format shown in Figure 13.1 "Income Statement Trend Analysis for " as a guide. (Round computations to one decimal place.)

- What does the trend analysis prepared in requirement a tell you about the company?

-

Common-Size Analysis. Refer to the condensed income statement for CarMax, Inc., in Exercise 21.

Required:

- Prepare a common-size analysis of the income statements for 2011 and 2010. Use the format shown in Figure 13.5 "Common-Size Income Statement Analysis for " as a guide. (Round computations to one decimal place.)

- What does the common-size analysis in requirement a tell you about the company?

-

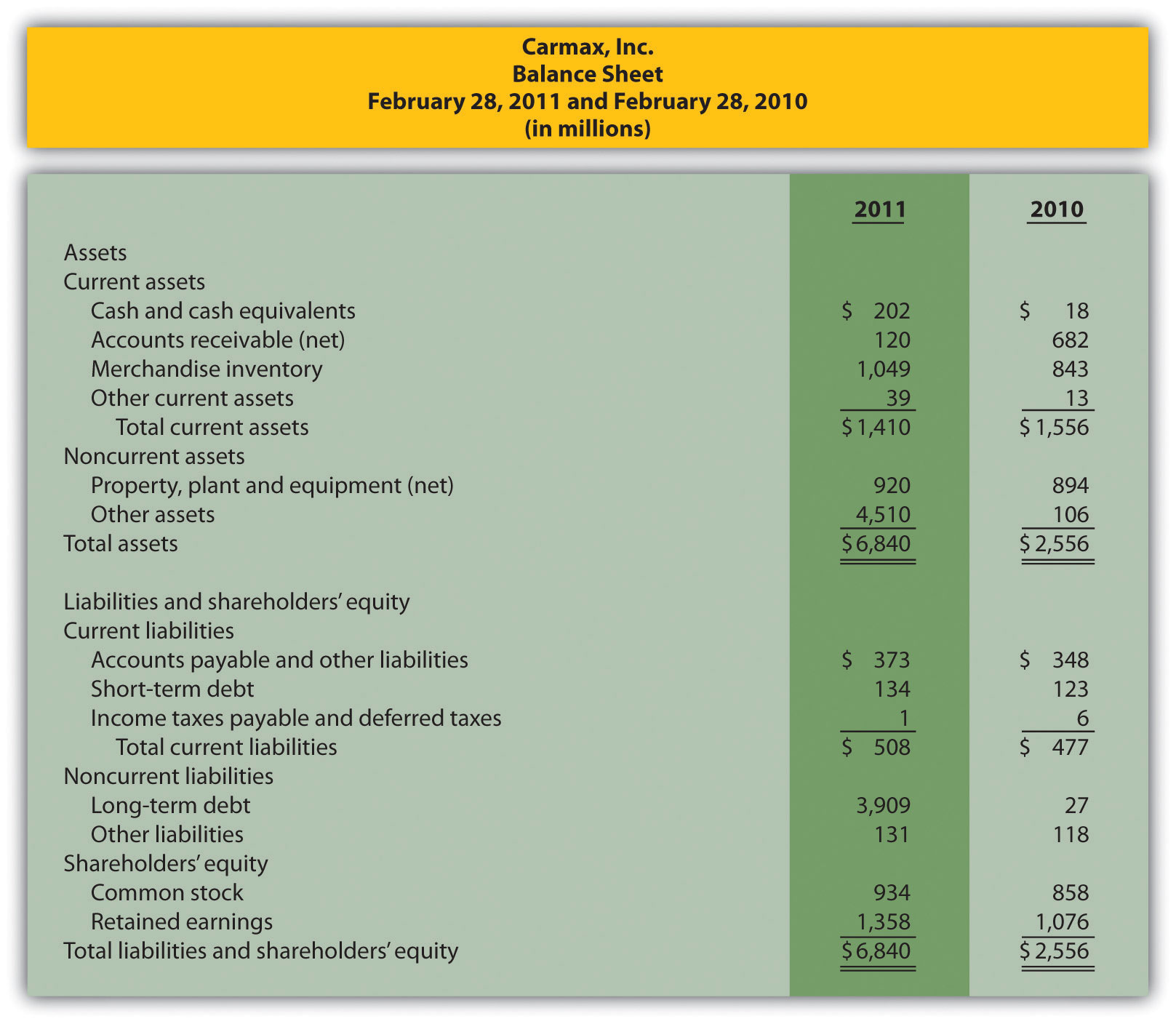

Profitability Ratios. Refer to the condensed income statement for CarMax, Inc., in Exercise 21 and to the company’s balance sheet shown as follows.

Required:

Compute the following profitability ratios for 2011, and provide a brief explanation after each ratio (round percentage computations to one decimal place and earnings per share to two decimal places):

- Gross margin ratio

- Profit margin ratio

- Return on assets

- Return on common shareholders’ equity

- Earnings per share (assume weighted average shares outstanding totaled 223,449,000 shares)

-

Short-Term Liquidity Ratios. Refer to the condensed income statement for CarMax, Inc., in Exercise 21 and to the company’s balance sheet in Exercise 23.

Required:

Compute the following short-term liquidity ratios for 2011, and provide a brief explanation after each ratio (round computations to two decimal places):

- Current ratio

- Quick ratio

- Receivables turnover ratio and average collection period (assume all sales are on account)

- Inventory turnover ratio and average sale period

-

Long-Term Solvency Ratios. Refer to the condensed income statement for CarMax, Inc., in Exercise 21 and to the company’s balance sheet in Exercise 23.

Required:

Compute the following long-term solvency ratios for 2011, and provide a brief explanation after each ratio (round computations to two decimal places):

- Debt to assets

- Debt to equity

- Times interest earned

-

Market Valuation Measures. The following requirements are for CarMax, Inc., as of February 28, 2011.

Required:

-

Compute the following market valuation measures for 2011, and provide a brief explanation after each measure (state market capitalization in billions, and round price-earnings ratio to two decimal places):

- Market capitalization (assume 225,885,693 shares were issued and outstanding at February 28, 2011, and the market price was $35.37 per share)

- Price-earnings ratio (assume earnings per share was $1.71)

- Refer to Note 13.54 "Business in Action 13.6" In which category does CarMax belong? Explain.

-

-

Balanced Scorecard Customer Measures. Tech University has more than 10,000 students enrolling in courses each term. The management would like to develop a balanced scorecard to assess performance.

Required:

Provide at least three customer measures Tech University can use on its balanced scorecard. Assume students are the customers.

Exercises: Set B

-

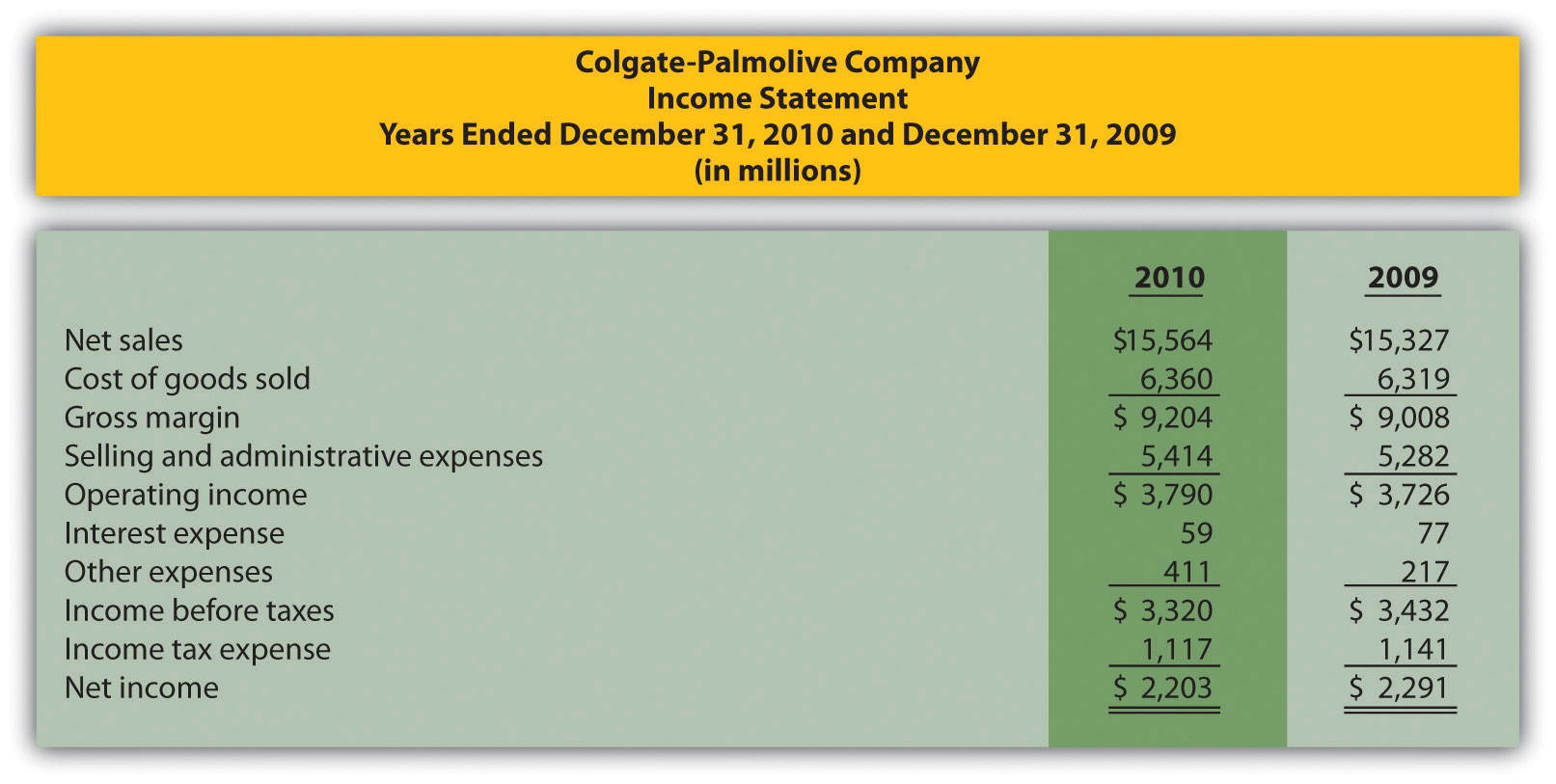

Trend Analysis. The following condensed income statement is for Colgate-Palmolive Company, a large retailer of personal and home care products.

Required:

- Prepare a trend analysis of the income statements from 2009 to 2010. Use the format shown in Figure 13.1 "Income Statement Trend Analysis for " as a guide. (Round computations to one decimal place.)

- What does the trend analysis prepared in requirement a tell you about the company?

-

Common-Size Analysis. Refer to the condensed income statement for Colgate-Palmolive Company in Exercise 28.

Required:

- Prepare a common-size analysis of the income statements for 2010 and 2009. Use the format shown in Figure 13.5 "Common-Size Income Statement Analysis for " as a guide. (Round computations to one decimal place.)

- What does the common-size analysis in requirement a tell you about the company?

-

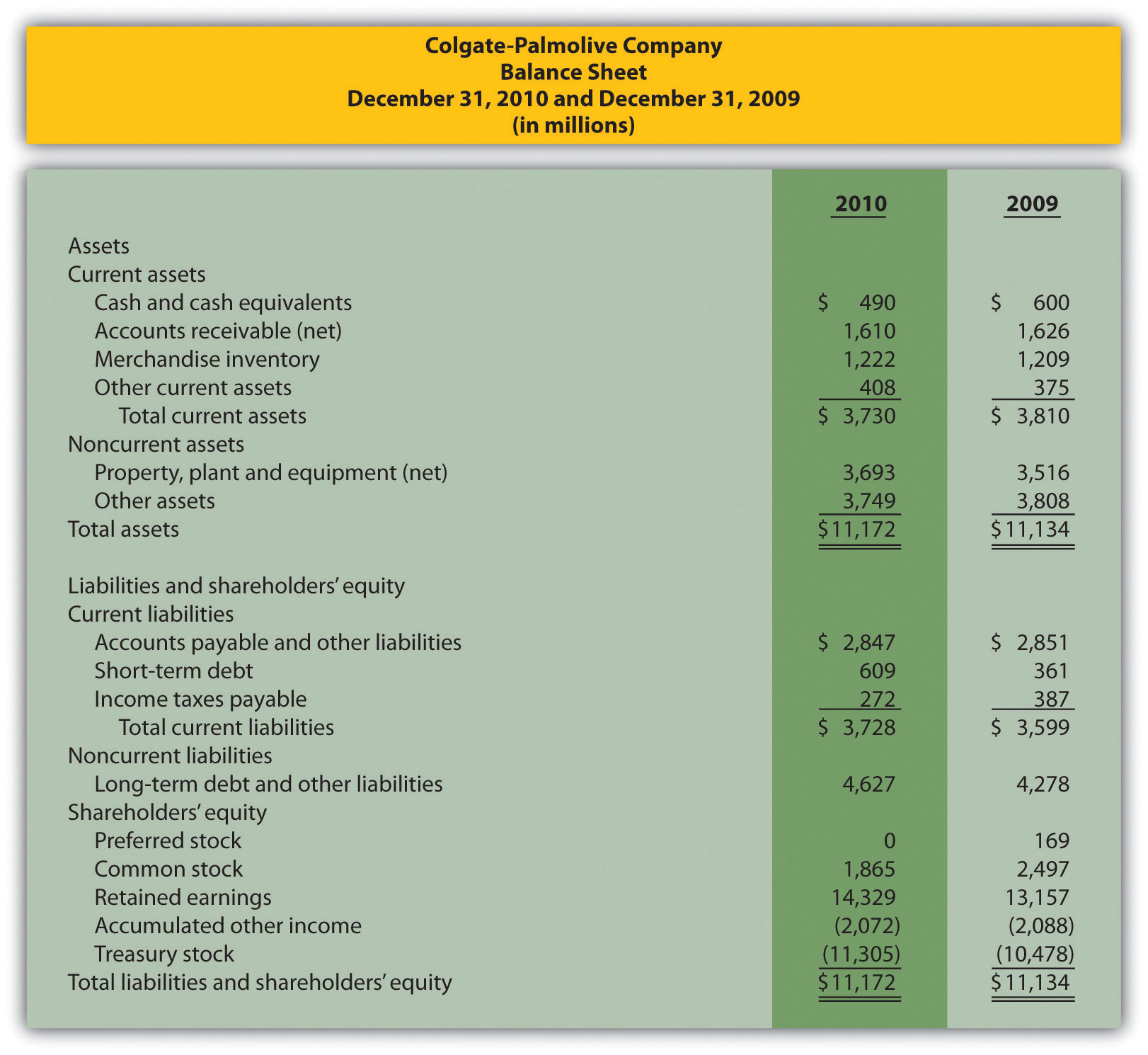

Profitability Ratios. Refer to the condensed income statement for Colgate-Palmolive Company in Exercise 28. Assume the company paid preferred dividends totaling $34,000,000 during 2010. (The company had preferred stock outstanding during 2010, but eliminated all preferred stock by the end of 2010. This is why preferred stock has a zero balance as of December 31, 2010.)

Required:

Compute the following profitability ratios for 2010, and provide a brief explanation after each ratio (round percentage computations to one decimal place and earnings per share to two decimal places):

- Gross margin ratio

- Profit margin ratio

- Return on assets

- Return on common shareholders’ equity

- Earnings per share (assume weighted average shares outstanding totaled 487,800,000 shares)

-

Short-Term Liquidity Ratios. Refer to the condensed income statement for Colgate-Palmolive Company in Exercise 28 and to the company’s balance sheet in Exercise 30.

Required:

Compute the following short-term liquidity ratios for 2010, and provide a brief explanation after each ratio (round computations to two decimal places):

- Current ratio

- Quick ratio

- Receivables turnover ratio and average collection period (assume all sales are on account)

- Inventory turnover ratio and average sale period

-

Long-Term Solvency Ratios. Refer to the condensed income statement for Colgate-Palmolive Company in Exercise 28 and to the company’s balance sheet in Exercise 30.

Required:

Compute the following long-term solvency ratios for 2010, and provide a brief explanation after each ratio (round computations to two decimal places):

- Debt to assets

- Debt to equity

- Times interest earned

-

Market Valuation Measures. The following requirements are for Colgate-Palmolive Company as of December 31, 2010.

Required:

-

Compute the following market valuation measures for 2010, and provide a brief explanation after each measure (state market capitalization in billions, and round price-earnings ratio to two decimal places):

- Market capitalization (assume 494,850,467 shares were issued and outstanding at December 31, 2010, and the market price was $77.74 per share)

- Price-earnings ratio (assume earnings per share was $4.45)

- Refer to Note 13.54 "Business in Action 13.6" In which category does Colgate-Palmolive belong? Explain.

-

-

Balanced Scorecard Internal Business Process Measures. Tony’s Pizzeria serves pizzas at its restaurants and provides delivery services to customers. The management would like to develop a balanced scorecard to assess performance.

Required:

Provide at least three internal business process measures Tony’s Pizzeria can use on its balanced scorecard.

Problems

-

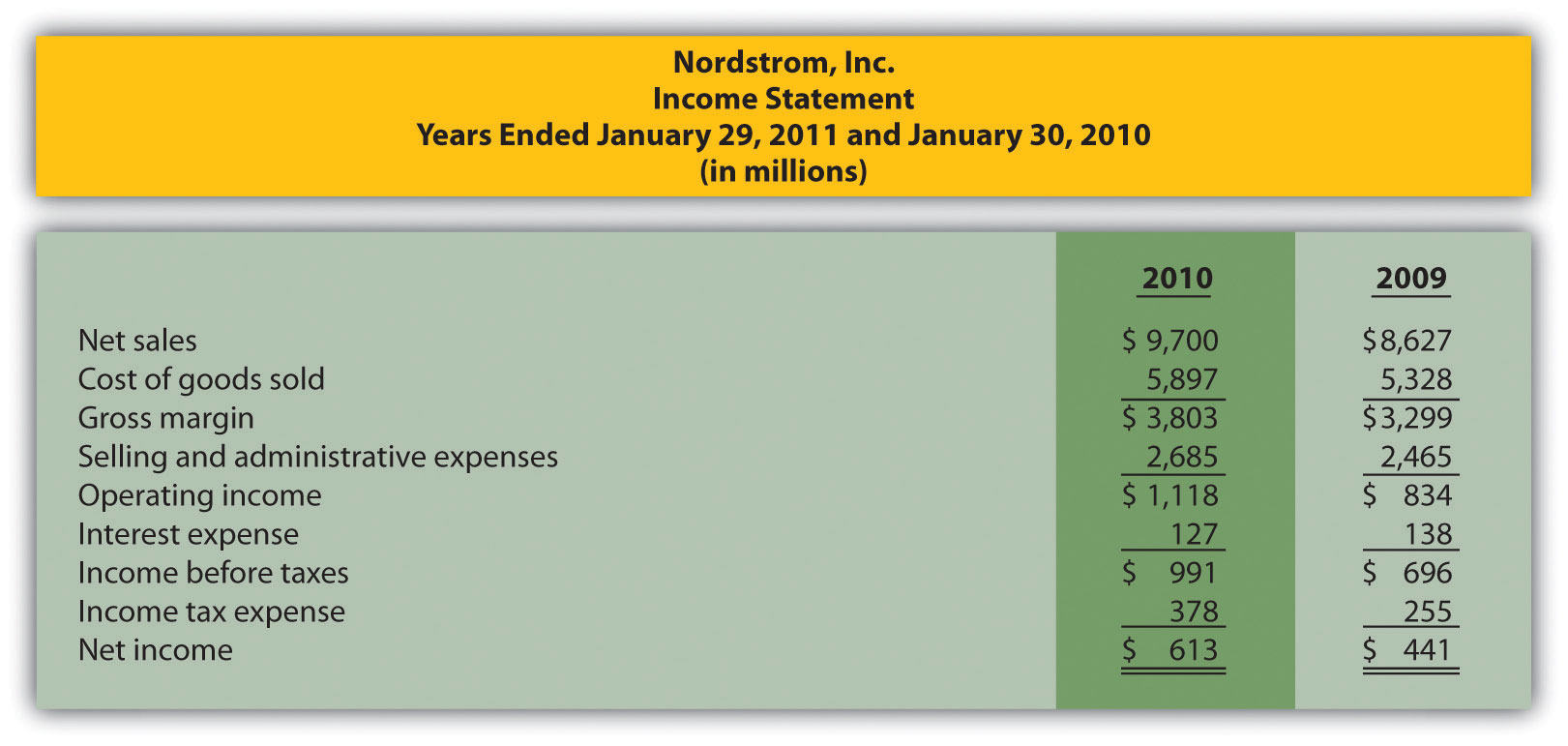

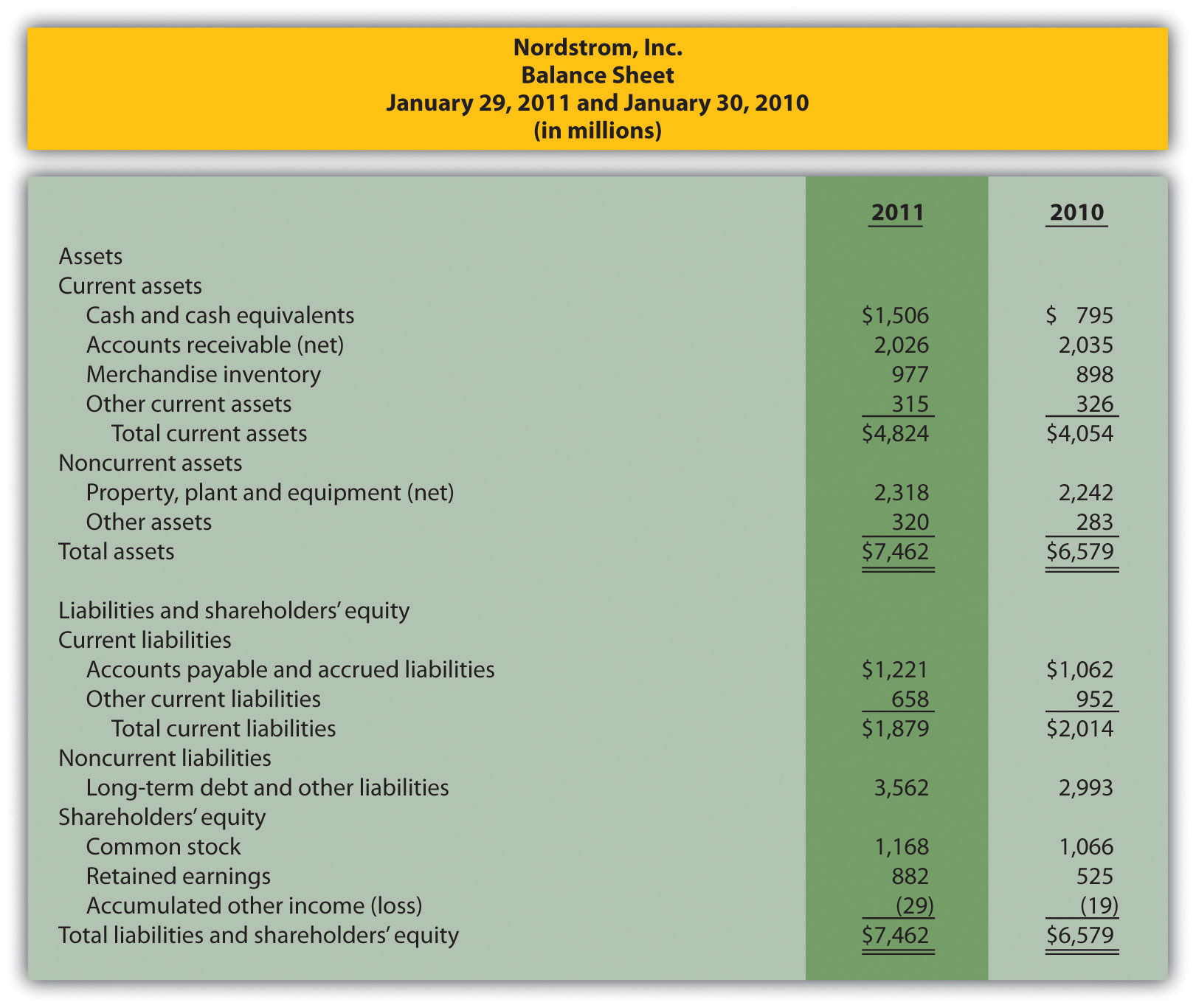

Trend Analysis and Common-Size Analysis. The following condensed income statement and balance sheet are for Nordstrom, Inc., a large retailer of apparel. (Note that Nordstrom’s 2010 fiscal year ends on January 29, 2011. This is called the 2010 fiscal year because only one month is in 2011, the other 11 months of the fiscal year are in 2010, and the company has chosen to refer to this as the 2010 fiscal year. This same concept applies to fiscal year 2009.)

Required:

- Prepare a trend analysis of the income statements from 2009 to 2010. Use the format shown in Figure 13.1 "Income Statement Trend Analysis for " as a guide. (Round computations to one decimal place.)

- Prepare a trend analysis of the balance sheets from 2009 to 2010. Use the format shown in Figure 13.2 "Balance Sheet Trend Analysis for " as a guide. (Round computations to one decimal place.)

- Identify all items that changed by more than 20 percent in the trend analyses prepared in requirements a and b, and briefly comment on the results.

- Prepare a common-size analysis of the income statements for 2010 and 2009. Use the format shown in Figure 13.5 "Common-Size Income Statement Analysis for " as a guide. (Round computations to one decimal place.)

- Prepare a common-size analysis of the balance sheets for 2010 and 2009. Use the format shown in Figure 13.6 "Common-Size Balance Sheet Analysis for " as a guide. (Round computations to one decimal place.)

- What does the common-size analysis prepared in requirements d and e tell you about the company?

-

Profitability and Short-Term Liquidity Ratios. Refer to the information presented in Problem 35 for Nordstrom.

Required:

-

Compute the following profitability ratios for 2010, and provide a brief explanation after each ratio (round percentage computations to one decimal place and earnings per share to two decimal places):

- Gross margin ratio

- Profit margin ratio

- Return on assets

- Return on common shareholders’ equity

- Earnings per share (weighted average shares outstanding totaled 218,800,000 shares)

-

Compute the following short-term liquidity ratios for 2010, and provide a brief explanation after each ratio (round computations to two decimal places):

- Current ratio

- Quick ratio

- Receivables turnover ratio and average collection period (assume all sales are on account)

- Inventory turnover ratio and average sale period

-

-

Long-Term Solvency Ratios and Market Valuation Measures. Refer to the information presented in Problem 35 for Nordstrom.

Required:

-

Compute the following long-term solvency ratios for 2010, and provide a brief explanation after each ratio (round computations to two decimal places):

- Debt to assets

- Debt to equity

- Times interest earned

-

Compute the following market valuation measures for 2010, and provide a brief explanation after each measure (state market capitalization in billions, and round price-earnings ratio to two decimal places):

- Market capitalization (assume 218,000,000 shares were issued and outstanding at January 29, 2011, and the market price was $40.08 per share)

- Price-earnings ratio (assume the earnings per share amount was $2.80)

-

-

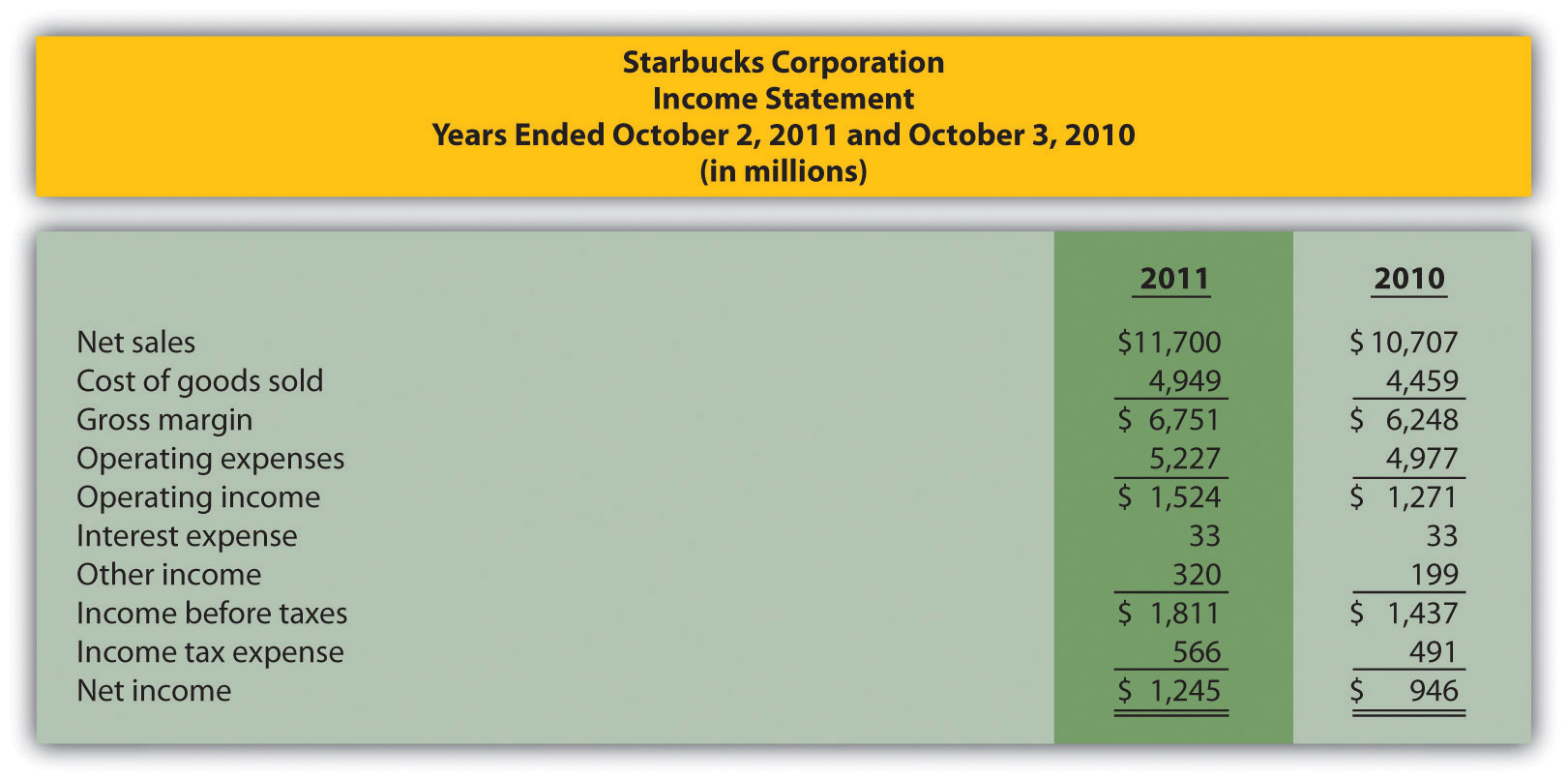

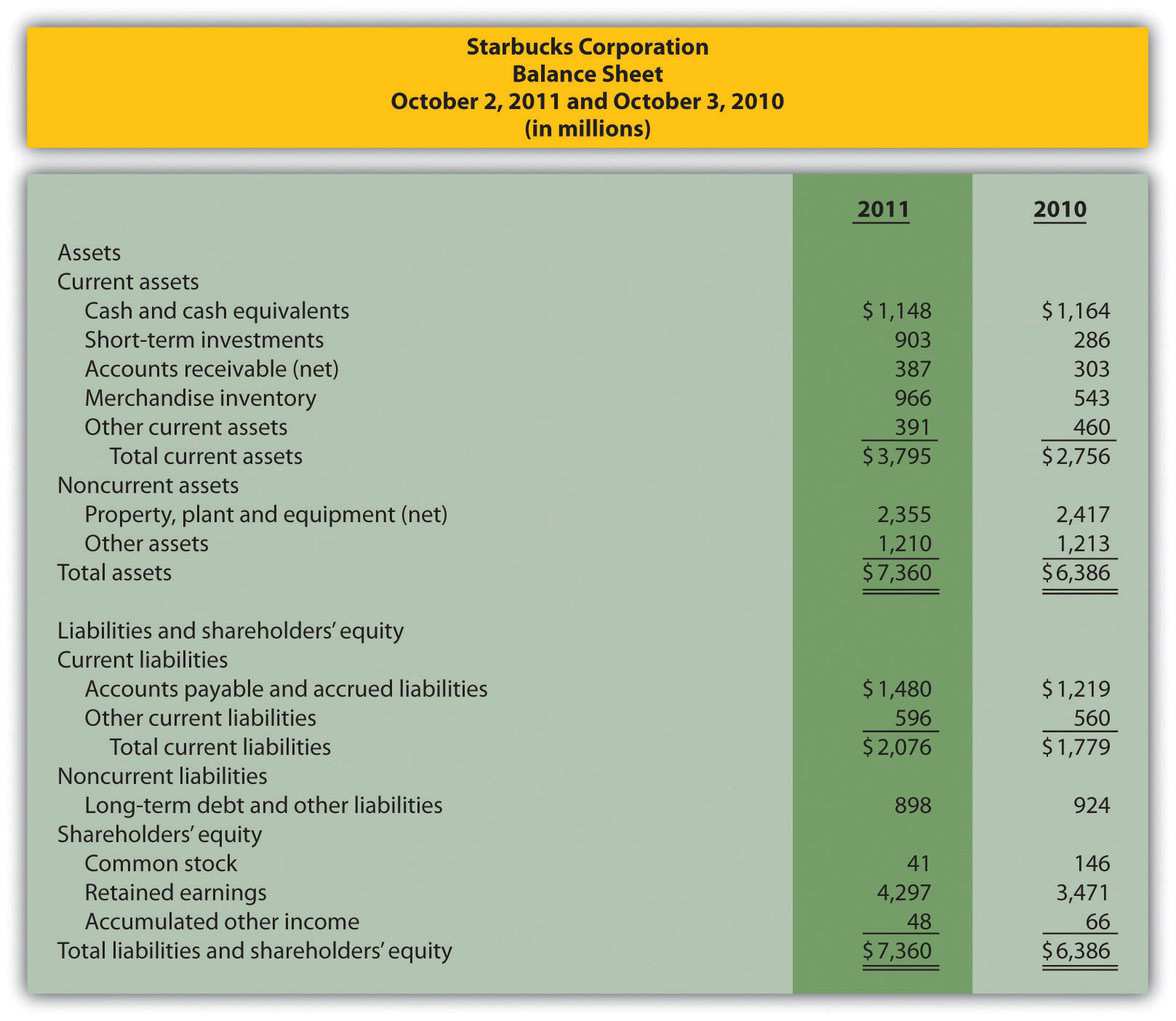

Income Statement Trend, Common-Size, and Profitability Analysis. The following condensed income statement and balance sheet are for Starbucks Corporation, a large retailer of specialty coffee with stores throughout the world.

Required:

- Prepare a trend analysis of the income statements from 2010 to 2011. Use the format shown in Figure 13.1 "Income Statement Trend Analysis for " as a guide. (Round computations to one decimal place.)

- Identify all items that changed by more than 20 percent in the trend analysis prepared in requirement a, and briefly comment on the results.

- Prepare a common-size analysis of the income statements for 2011 and 2010. Use the format shown in Figure 13.5 "Common-Size Income Statement Analysis for " as a guide. (Round computations to one decimal place.)

- What does the common-size analysis prepared in requirement c tell you about the company?

-

Compute the following profitability ratios for 2011, and provide a brief explanation after each ratio (round percentage computations to one decimal place and earnings per share to two decimal places):

- Gross margin ratio

- Profit margin ratio

- Return on assets

- Return on common shareholders’ equity

- Earnings per share (assume weighted average shares outstanding totaled 748,300,000 shares)

-

Short-Term Liquidity, Long-Term Solvency, and Market Valuation. Refer to the information presented in Problem 38 for Starbucks.

Required:

-

Compute the following short-term liquidity ratios for 2011, and provide a brief explanation after each ratio (round computations to two decimal places):

- Current ratio

- Quick ratio

- Receivables turnover ratio and average collection period (assume all sales are on account)

- Inventory turnover ratio and average sale period

-

Compute the following long-term solvency ratios for 2011, and provide a brief explanation after each ratio (round computations to two decimal places):

- Debt to assets

- Debt to equity

- Times interest earned

-

Compute the following market valuation measures for 2011, and provide a brief explanation after each measure (state market capitalization in billions, and round price-earnings ratio to two decimal places):

- Market capitalization (assume 744,800,000 shares were issued and outstanding at October 2, 2011, and the market price was $37.14 per share)

- Price-earnings ratio (assume the earnings per share amount was $1.66)

-

-

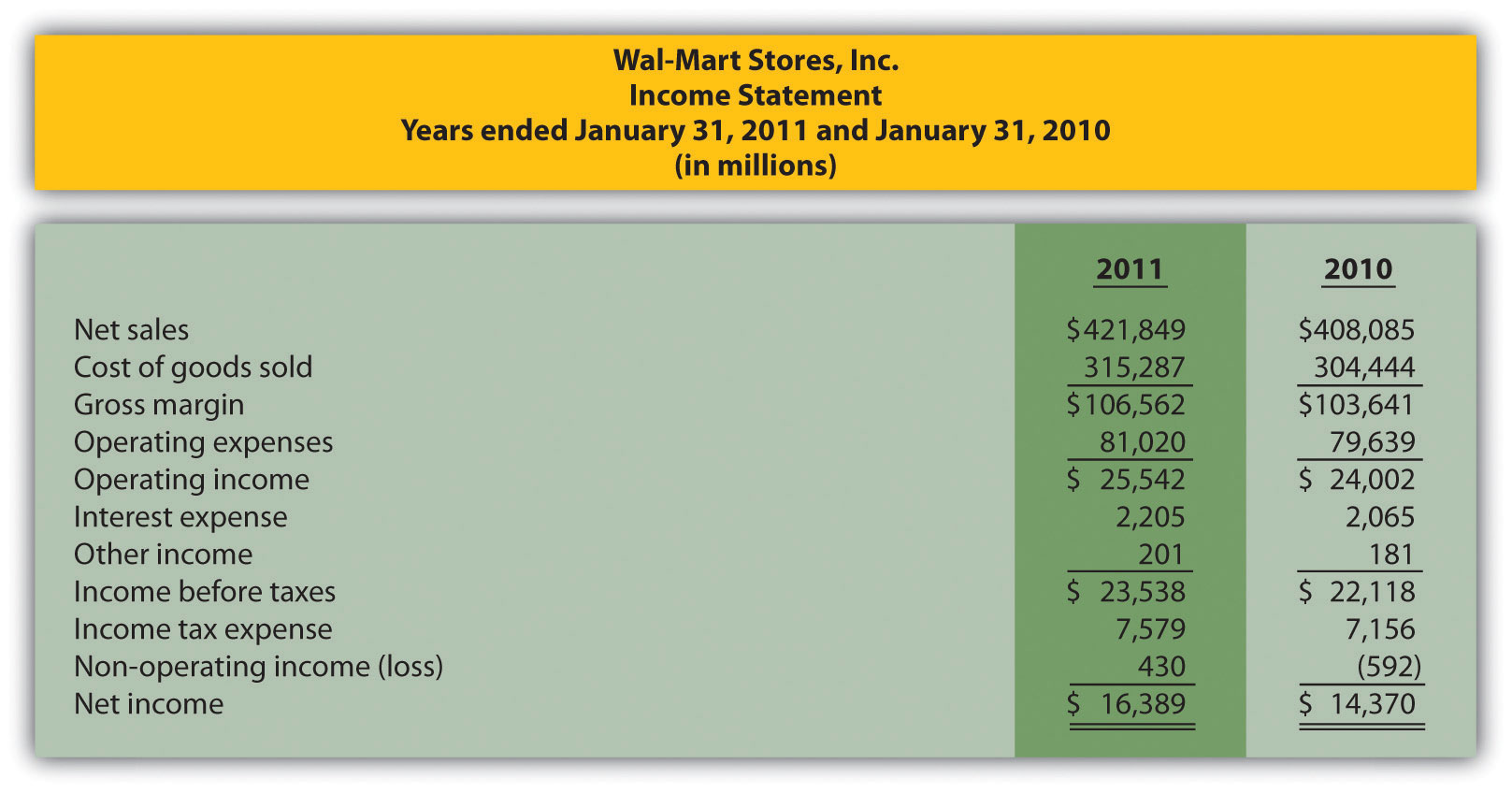

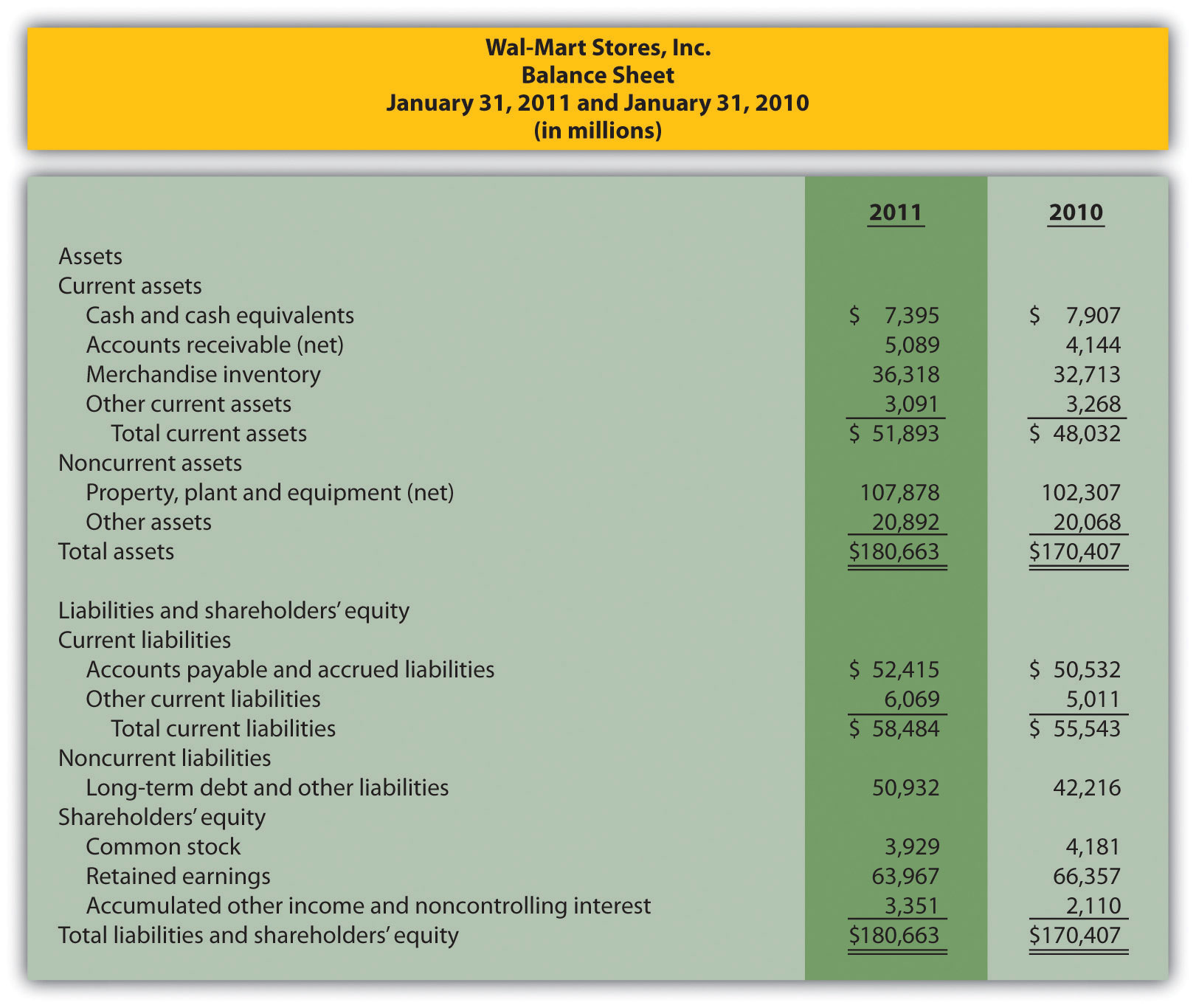

Balance Sheet Trend and Common-Size Analysis. The following condensed income statement and balance sheet are for Wal-Mart Stores, Inc. (note that Wal-Mart’s 2010 fiscal year ends on January 31, 2011. This is called the 2010 fiscal year because only one month is in 2011, the other 11 months of the fiscal year are in 2010, and the company has chosen to refer to this as the 2010 fiscal year. This same concept applies to fiscal year 2009.)

Required:

- Prepare a trend analysis of the balance sheets from 2009 to 2010. Use the format shown in Figure 13.2 "Balance Sheet Trend Analysis for " as a guide. (Round computations to one decimal place.)

- Prepare a common-size analysis of the balance sheets for 2010 and 2009. Use the format shown in Figure 13.6 "Common-Size Balance Sheet Analysis for " as a guide. (Round computations to one decimal place.)

- What does the balance sheet common-size analysis prepared in requirement b tell you about the company?

-

Income Statement Trend and Common-Size Analysis; Profitability Ratios. Refer to the information presented in Problem 40 for Wal-Mart.

Required:

- Prepare a trend analysis of the income statements from 2009 to 2010. Use the format shown in Figure 13.1 "Income Statement Trend Analysis for " as a guide. (Round computations to one decimal place.)

- Based on the income statement trend analysis prepared in requirement a, describe what caused the increase in operating income from 2009 to 2010.

- Prepare a common-size analysis of the income statements for 2010 and 2009. Use the format shown in Figure 13.5 "Common-Size Income Statement Analysis for " as a guide. (Round computations to one decimal place.)

- What does the income statement common-size analysis prepared in requirement c tell you about the company?

-

Compute the following profitability ratios for 2010, and provide a brief explanation after each ratio (round percentage computations to one decimal place and earnings per share to two decimal places):

- Gross margin ratio

- Profit margin ratio

- Return on assets

- Return on common shareholders’ equity

- Earnings per share (assume weighted average shares outstanding totaled 3,656,000,000 shares)

-

Short-Term Liquidity, Long-Term Solvency, Market Valuation, and Balanced Scorecard. Refer to the information presented in Problem 40 for Wal-Mart.

Required:

-

Compute the following short-term liquidity ratios for 2010, and provide a brief explanation after each ratio (round computations to two decimal places):

- Current ratio

- Quick ratio

- Receivables turnover ratio and average collection period (assume all sales are on account)

- Inventory turnover ratio and average sale period

-

Compute the following long-term solvency ratios for 2010, and provide a brief explanation after each ratio (round computations to two decimal places):

- Debt to assets

- Debt to equity

- Times interest earned

-

Compute the following market valuation measures for 2010, and provide a brief explanation after each measure (state market capitalization in billions, and round price-earnings ratio to two decimal places):

- Market capitalization (assume 3,516,000,000 shares were issued and outstanding at January 31, 2011, and the market price was $54.58 per share)

- Price-earnings ratio (assume the earnings per share amount was $4.48)

- Assume Wal-Mart uses a balanced scorecard to assess performance. Provide at least two learning and growth measures the company can use on its balanced scorecard.

-

One Step Further: Skill-Building Cases

- Trend Information in Annual Reports. Refer to Note 13.9 "Business in Action 13.1" Why is trend information important to shareholders?

- Earnings per Share. Refer to Note 13.28 "Business in Action 13.3" Was AnnTaylor Stores’ earnings per share higher or lower than analysts expected? Explain whether you would expect the company’s stock price to increase or decrease as a result of the press release.

- Inventory Turnover in the Computer Industry. Refer to Note 13.42 "Business in Action 13.4" Why do you think inventory turnover for the computer hardware industry is so quick?

- Financial Leverage in the Auto Industry. Refer to Note 13.48 "Business in Action 13.5" Why do most investors consider GM to be highly leveraged?

- Market Capitalization Categories. Refer to Note 13.54 "Business in Action 13.6" Define what is meant by small-cap, midcap, and large-cap. In which category does Coca-Cola belong? Explain.

-

Internet Project: Financial Statement Analysis. Using the Internet, find the most recent annual report (or form 10K) for a manufacturing or retail company of your choice. Most companies have links to the information at their Web sites under titles, such as investor relations or financial reports. Print the income statement and balance sheet for the company selected and include these documents with your response to the following requirements.

Required:

-

Compute the following profitability ratios for the most current year, and provide a brief explanation after each ratio (round percentage computations to one decimal place):

- Gross margin ratio

- Profit margin ratio

- Return on assets

- Return on common shareholders’ equity

-

Compute the following short-term liquidity ratios for the most current year, and provide a brief explanation after each ratio (round computations to two decimal places):

- Current ratio

- Quick ratio

- Receivables turnover ratio and average collection period (assume all sales are on account)

- Inventory turnover ratio and average sale period

-

Compute the following long-term solvency ratios for the most current year, and provide a brief explanation after each ratio (round computations to two decimal places):

- Debt to assets

- Debt to equity

- Provide a one-page written report summarizing your results in requirements a, b, and c. Identify any areas of concern as well as areas of strength for the company.

-

-

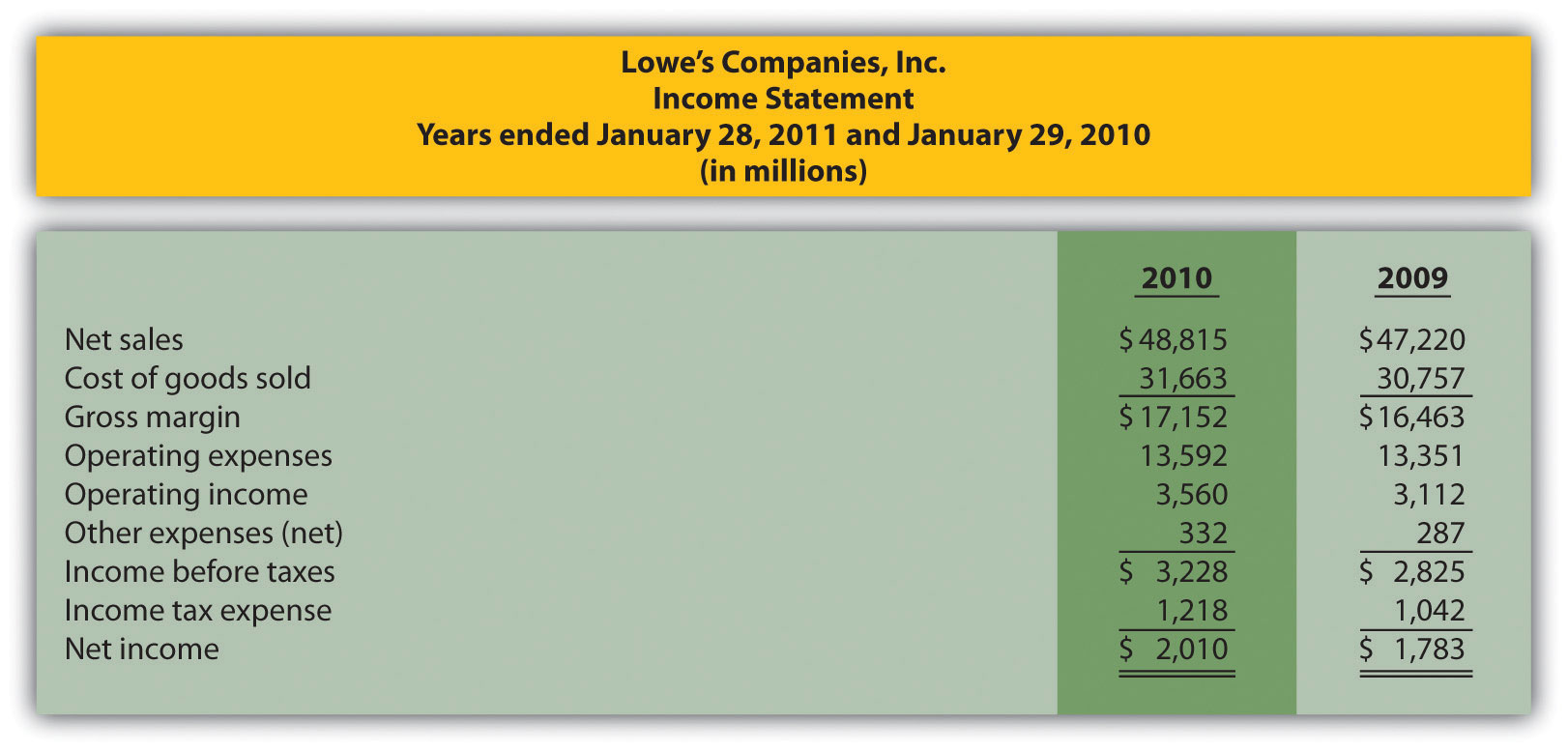

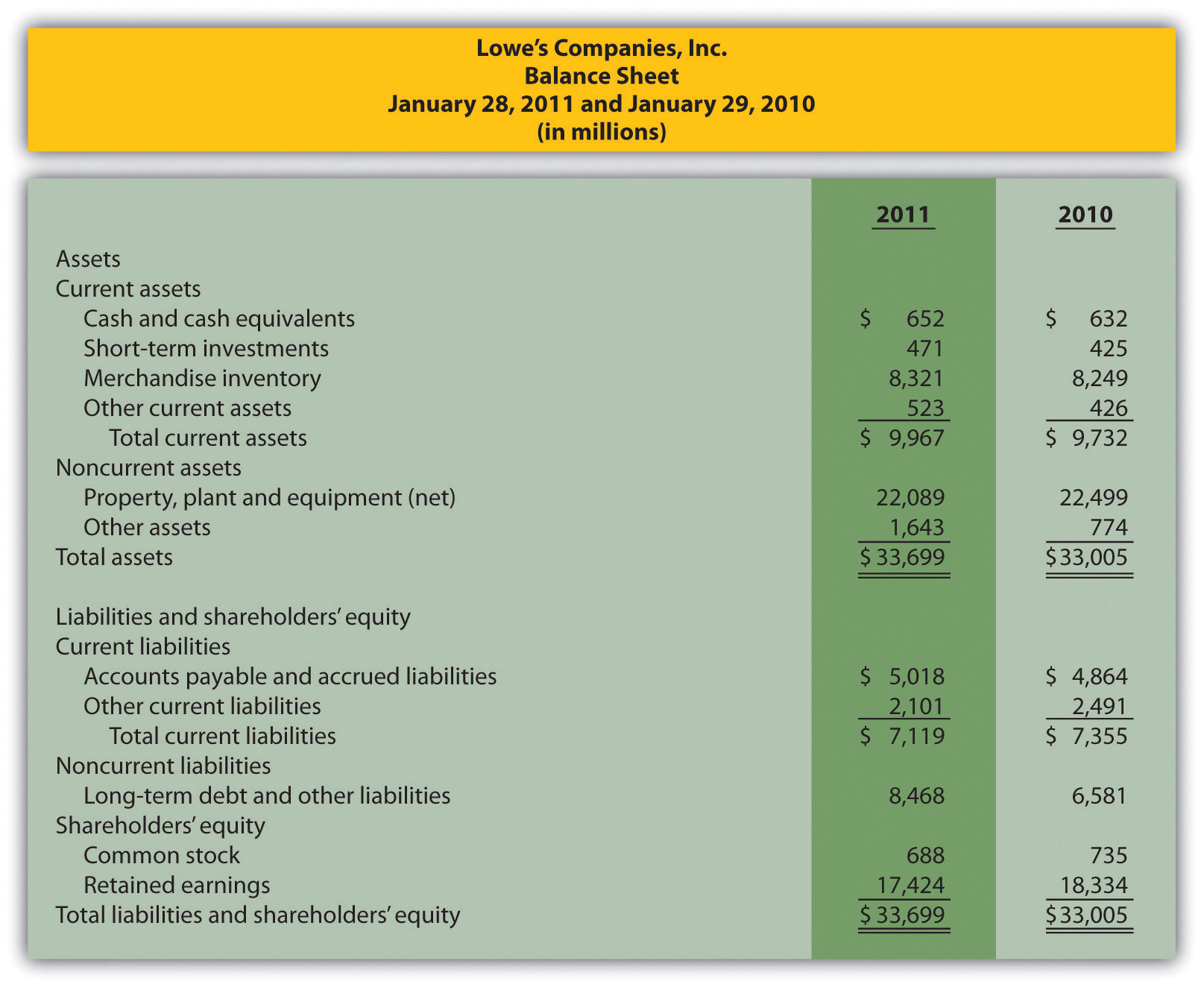

Group Activity: Analyzing Lowe’s Companies, Inc. The condensed income statement and balance sheet information provided as follows is for Lowe’s Companies, Inc., a large retail company that sells building materials and supplies. Lowe’s had 1,354,000,000 shares issued and outstanding at January 28, 2011, and the market price per share on that date was $24.83. (Note that Lowe’s 2010 fiscal year ends on January 28, 2011. This is called the 2010 fiscal year because only one month is in 2011, the other 11 months of the fiscal year are in 2010, and the company has chosen to refer to this as the 2010 fiscal year. This same concept applies to fiscal year 2009.)

Form groups of two to four students. Each group is to be assigned one of the following three categories of financial measures:

-

Profitability measures

- Gross margin ratio

- Profit margin ratio

- Return on assets

- Return on common shareholders’ equity

-

Short-term liquidity measures

- Current ratio

- Quick ratio

- Inventory turnover ratio and average sales period

-

Long-term solvency and market valuation measures

- Debt to assets

- Debt to equity

- Market capitalization

Required:

- Calculate the financial measures assigned to your group. Round all computations to two decimal places, except the market capitalization measure, which can be rounded to the nearest billion dollars.

- Provide a brief explanation of each measure your group calculated in requirement a.

- Discuss the results of your group with the class.

-

-

Performing Income Statement Trend Analysis Using Excel. Review the information for Apple, Inc., in Brief Exercise 14.

Required:

Perform income statement trend analysis for Apple, Inc., using an Excel spreadsheet. The format should be similar to the one in Figure 13.1 "Income Statement Trend Analysis for ". Round percent computations to one decimal place.

Comprehensive Cases

-

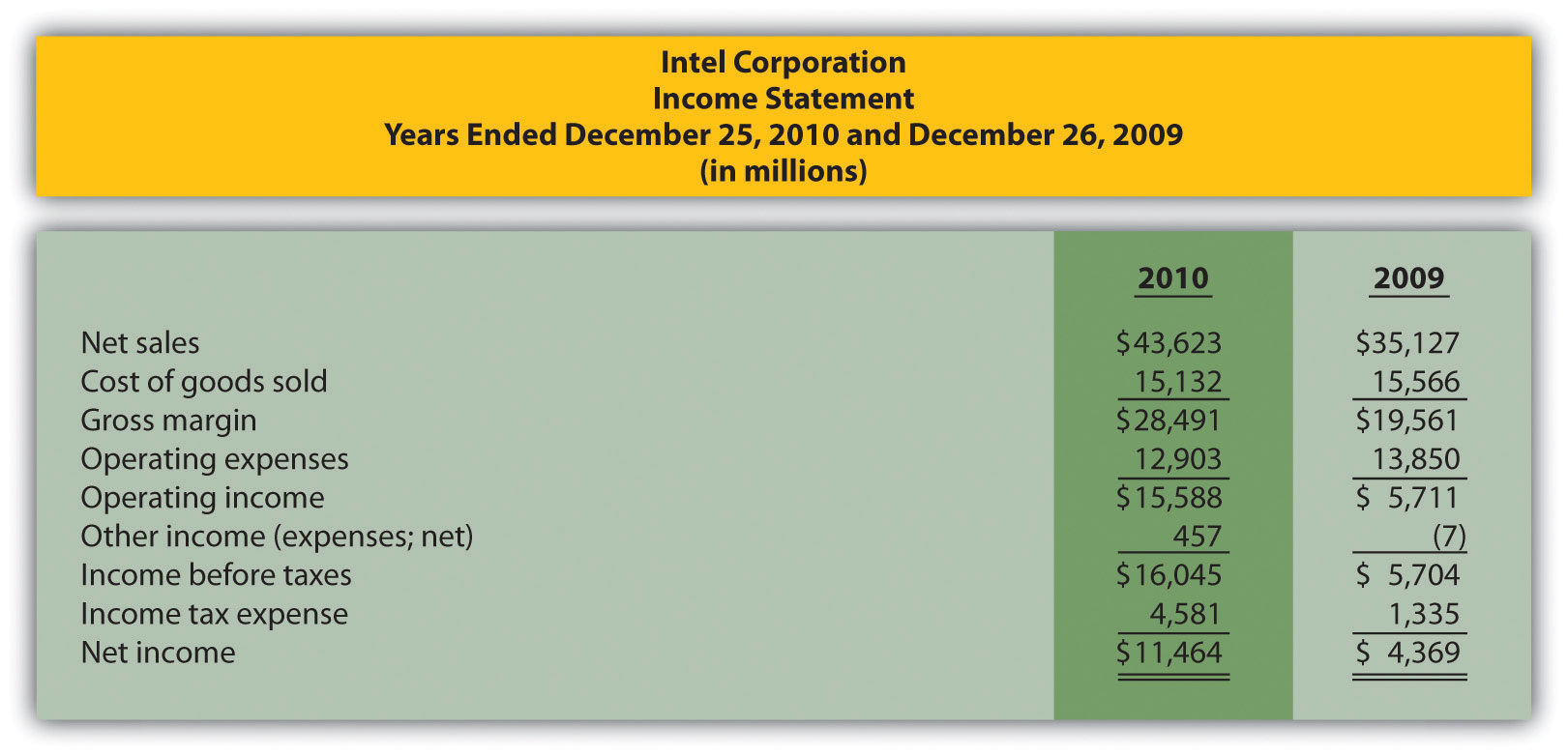

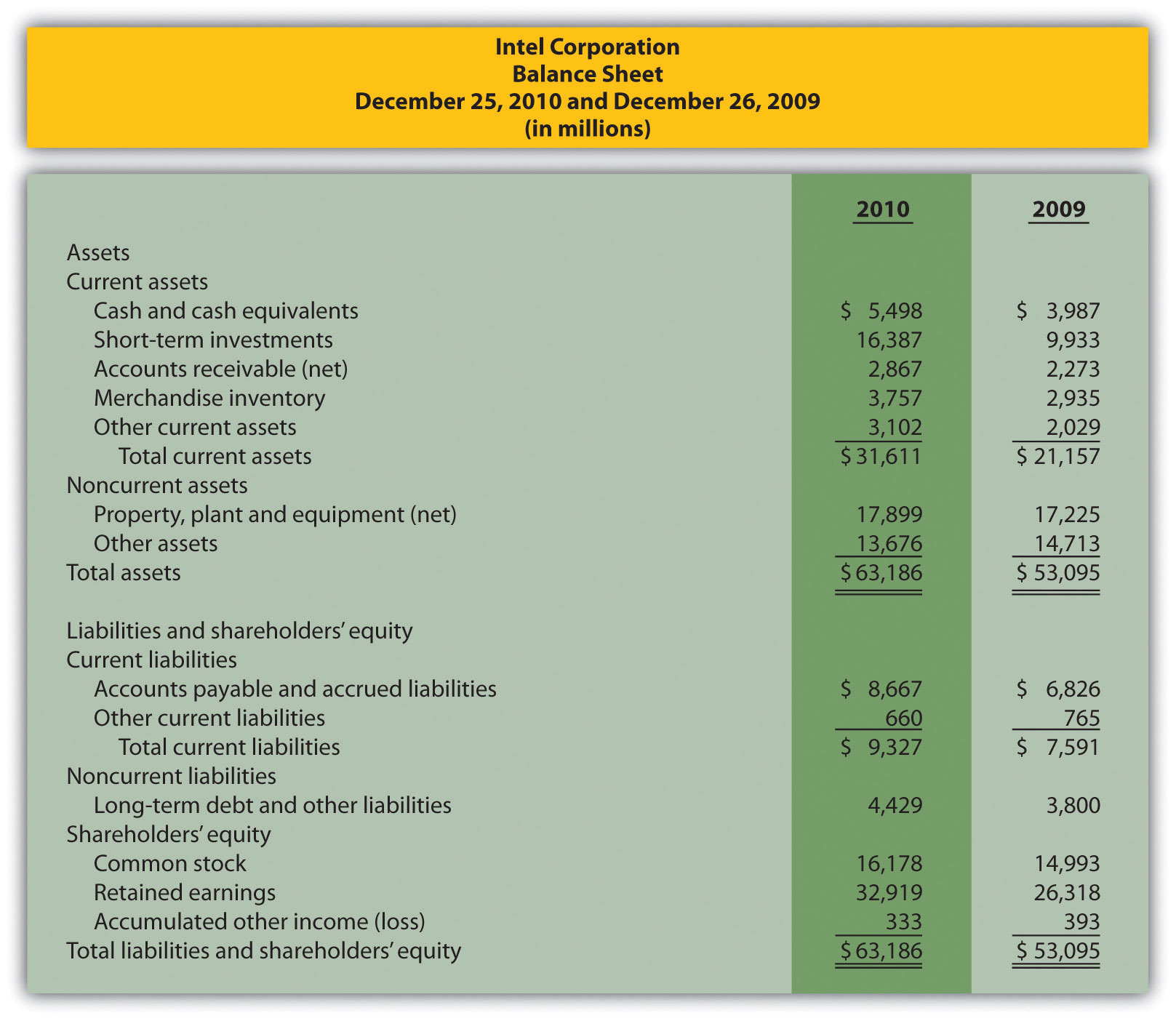

Financial Statement Analysis and Industry Standards; Manufacturing Company. Susan Hartford is the president and CEO of Computer Makers, Inc. The company is in the process of looking for a supplier of computer chips, and Susan has asked her staff to review the financial stability of Intel Corporation, the world’s largest maker of computer chips. Susan’s staff began by collecting industry average information, which is shown as follows, and would like your help in calculating and evaluating these measures for Intel.

Measure Industry Average Intel Gross margin 57.7 percent ? Profit margin 21.9 percent ? Return on assets 17.7 percent ? Return on common shareholders’ equity 21.5 percent ? Current ratio 2.3 to 1 ? Quick ratio 1.9 to 1 ? Receivables turnover 12.8 times ? Inventory turnover 4.8 times ? Debt to assets 0.21 to 1 ? Debt to equity 0.26 to 1 ? Market capitalization $80,000,000,000 ? Intel’s income statement and balance sheet are provided as follows. The price for 1 share of common stock at December 25, 2010, the end of Intel’s fiscal year, was $20.13. The number of shares issued and outstanding at December 25, 2010, totaled 5,581,000,000. Assume all sales were on account.

Required:

- Using the industry average measures provided, compute the same measures for Intel for its fiscal year ended December 25, 2010. (State your results in the same format used for industry averages.)

-

Summarize your results in requirement a by completing a table using the following headings:

Measure Industry Average Intel Corporation Immediately following each measure, indicate whether Intel’s financial condition is better or worse than the industry average.

- Using your answers to requirements a and b to support your position, determine whether Intel is financially stable.

-

Ethics: Manipulating Data to Meet Loan Requirements. Custom Tech, Inc., designs and produces computers for a variety of customers. The company has encountered a cash shortage resulting from collection problems with several customers. If Custom Tech is unable to collect a significant portion of its receivables relatively soon, the company will not be able to pay suppliers and employees next quarter. As a result, Custom Tech’s president, Don Lardner, began discussions with a local bank about obtaining a short-term loan. Don did not mention the cause of the cash flow shortage other than to say, “This happens the same time every year due to the cyclical nature of our business.”

In a meeting with the bank’s loan officer, Jan Johnson, Don was told the loan should not be a problem as long as Custom Tech maintains a profit margin ratio above 10 percent, quick ratio above 1.0 to 1, and debt to equity ratio below 1.4 to 1. Don indicated this was in line with his company’s performance and agreed to provide financial statements for the most recent year at their next meeting.

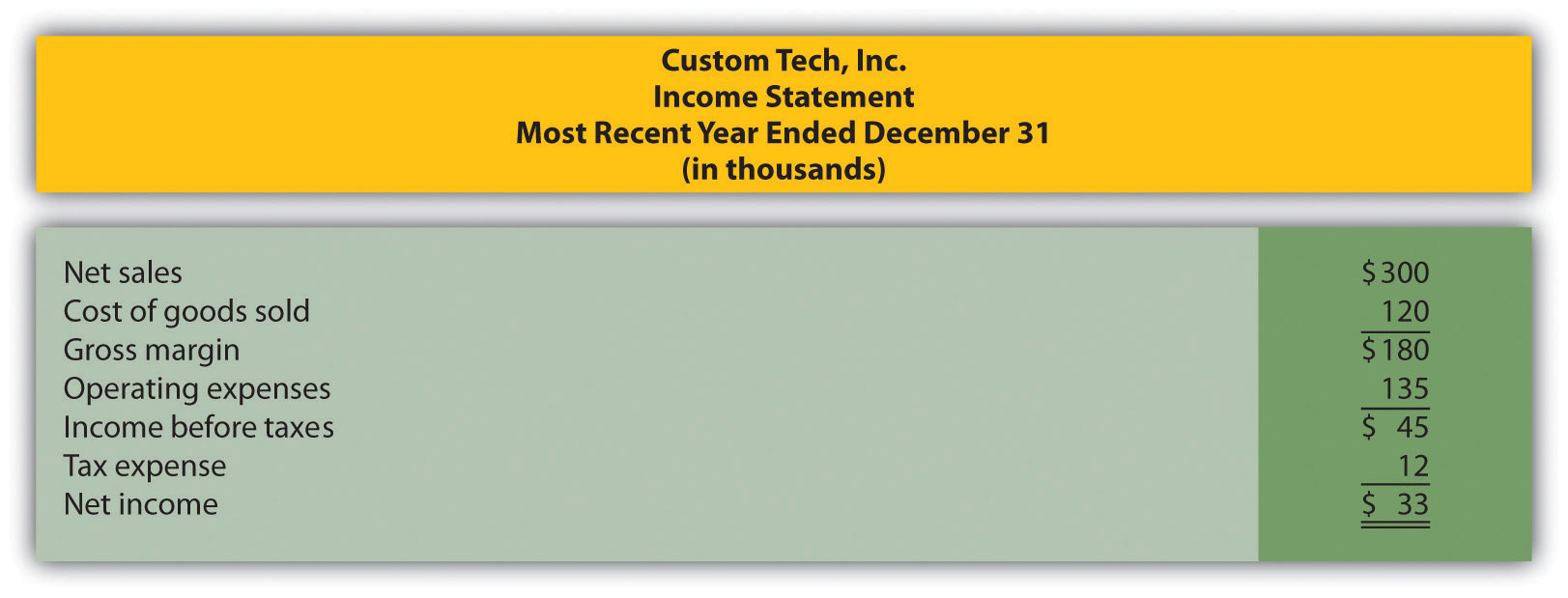

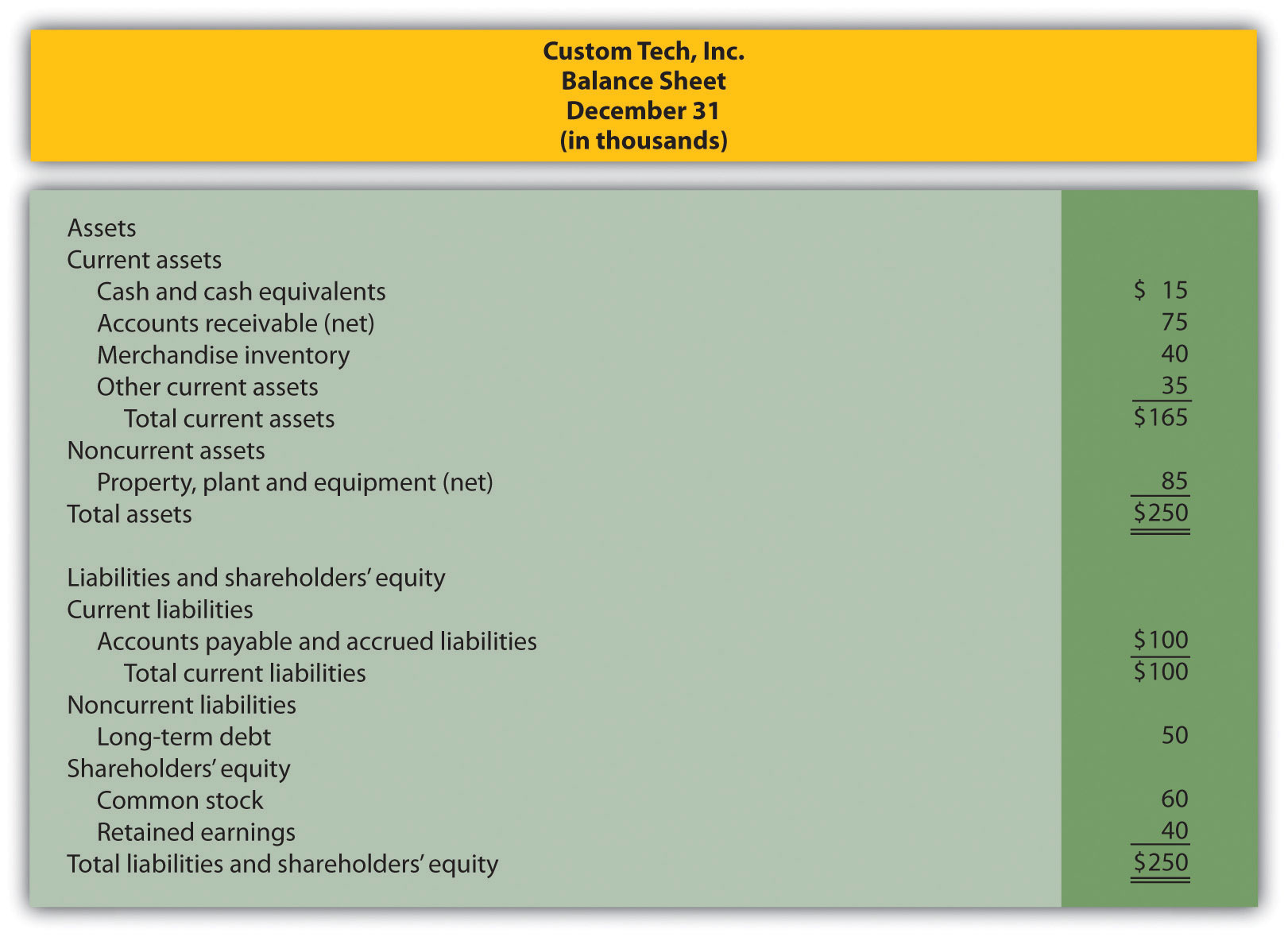

The financial statements shown as follows are for Custom Tech’s most recent year ended December 31. This information has not yet been provided to the bank.

Required:

- Calculate the ratios required by the bank and determine whether Custom Tech will qualify for the loan.

- Assume you are the CFO for Custom Tech. Don Lardner asks you to reclassify $30,000 in current liabilities to common stock. Don states, “We owe it to our shareholders and employees to do whatever it takes to get this loan! Without it, we may have to file for bankruptcy and let our employees go. Once we get this loan and collect our outstanding receivables we’ll be in good shape.” Prepare a revised balance sheet after making the $30,000 reclassification, recalculate the ratios required by the bank, and determine whether Custom Tech will qualify for the loan with the revised numbers.

- Are the president’s actions ethical? If you were the CFO, how would you handle the president’s request? (To answer these questions, you may want to review the presentation of ethics in Chapter 1 "What Is Managerial Accounting?".)