This is “Maintaining Control over Decentralized Organizations”, section 11.2 from the book Accounting for Managers (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

11.2 Maintaining Control over Decentralized Organizations

Learning Objective

- Define three types of responsibility centers.

Question: To evaluate performance, organizations often divide operations into segments. Segments responsible for revenues, costs, and investments in assets are called responsibility centersSegments of the organization responsible for revenues, costs, and/or investments in assets and typically defined as cost centers, profit centers, or investment centers.. Responsibility centers can be based on such attributes as sales regions, product lines, or services offered. Why do organizations establish responsibility centers?

Answer: The purpose of establishing responsibility centers within organizations is to hold managers responsible for only the assets, revenues, and costs they can control. For example, a factory manager typically has control over production costs, but not sales. This manager’s responsibility center would only include production costs. A retail store manager typically has control over sales prices and costs. This manager’s responsibility center would only include revenues and costs. The level of control a manager has over a segment’s assets, revenues, and costs will help determine the type of responsibility center used for each manager.

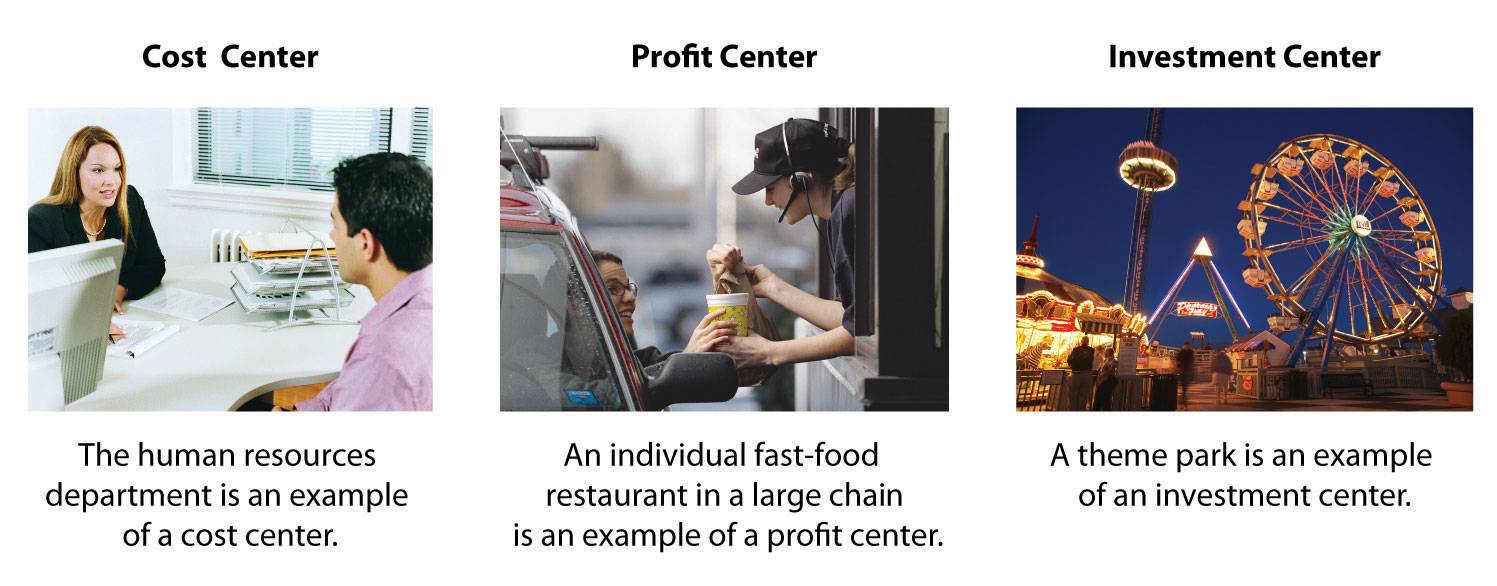

Figure 11.2 "Three Types of Responsibility Centers" illustrates the three types of responsibility centers commonly used to evaluate segments: cost centers, profit centers, and investment centers. Each type is described in the following sections.

Figure 11.2 Three Types of Responsibility Centers

Cost Center

Question: What is a cost center, and what measures are used to evaluate this type of responsibility center?

Answer: A cost centerA segment of an organization responsible only for costs, but not for revenue or investments in assets. is an organizational segment that is responsible for costs, but not revenue or investments in assets. Service departments, such as accounting, marketing, computer support, and human resources, are cost centers. Managers of these departments are evaluated based on providing a certain level of services for the company at a reasonable cost.

Production departments within a manufacturing firm are also treated as cost centers. Production managers are evaluated based on meeting cost budgets for producing a certain level of goods. Chapter 10 "How Do Managers Evaluate Performance Using Cost Variance Analysis?" describes the use of cost variance analysis to evaluate cost centers within a manufacturing firm.

Profit Center

Question: What is a profit center, and what measures are used to evaluate this type of responsibility center?

Answer: A profit centerA segment of an organization responsible for costs and revenues, but not investments in assets. is an organizational segment that is responsible for costs and revenues (and therefore, profit), but not investments in assets. Retail stores for companies, such as Macy’s or Kmart, are treated as profit centers. Individual fast food restaurants for McDonald’s or Kentucky Fried Chicken are also examples of profit centers. Managers of profit centers are responsible for revenues, costs, and resulting profits. (Some individual retail stores and fast food restaurants may be considered investment centers if the store manager is also responsible for large investment decisions, such as enlarging the building and purchasing more equipment to accommodate additional customers. Profit center determination must be made on a case-by-case basis, and it depends on the level of responsibility assigned to the store manager.)

Methods of performance evaluation for profit centers vary. Some organizations compare actual profit to budgeted profit. Others compare one profit center to another. Also, some organizations use segmented income statement ratios, such as gross margin or operating profit, to compare current profit center performance to prior periods and to other profit centers. Chapter 13 "How Do Managers Use Financial and Nonfinancial Performance Measures?" explains how companies can use financial ratios to evaluate profit center performance.

Investment Center

Question: What is an investment center, and what measures are used to evaluate this type of responsibility center?

Answer: An investment centerA segment of an organization responsible for costs, revenues, and investments in assets. is an organizational segment that is responsible for costs, revenues, and investments in assets. Investment center managers have control over asset investment decisions. In many cases, investment centers are treated as stand-alone businesses. Examples of investment centers include the Chevrolet division of General Motors and the printer division of Hewlett Packard.

Several measures can be used to evaluate the performance of investment center managers, including segmented net income, ROI, RI, and economic value added (EVA). The remainder of this chapter will focus on these measures using Game Products, Inc., as the example company. Before turning to these topics, however, look at Note 11.12 "Business in Action 11.3" which indicates the challenges that accountants and managers at Hewlett-Packard face when preparing the company’s annual report.

Business in Action 11.3

© Thinkstock

Segment Reporting at Hewlett-Packard Company

Hewlett-Packard Company provides financial information for seven segments in its annual report. Examples of segments and related revenues (in millions) include HP Services ($15,617), Personal Systems Group ($29,166), and Imaging and Printing Group ($26,786). These segments are likely treated as investment centers where segment managers are responsible for costs, revenues, and investments in assets.

Source: Hewlett-Packard Company, “2006 Annual Report,” http://www.hp.com.

Key Takeaway

- Responsibility centers are categorized depending on the level of control over revenues, costs, or investments. A segment responsible only for costs is called a cost center. A segment responsible for costs and revenues is called a profit center. A segment responsible for costs, revenues, and investment in assets is called an investment center. Performance measures used to evaluate managers depend on the type of responsibility center being managed.

Review Problem 11.2

For each of the organizational segments listed, determine whether it is a cost center, profit center, or investment center. Explain your answer.

- Individual retail store at Home Depot

- Accounting department at Ford Motor Company

- Saturn division of General Motors

- Human resources department at IBM

- Production department at Sony

- Jet engine division of General Electric

- Computer support department at Nike

Solution to Review Problem 11.2

- Profit center. The manager is responsible for costs and revenues, but not investments in assets. (A case might be made that if the manager has control over significant purchases of assets for the store, this would be an investment center.)

- Cost center. The manager is responsible for costs only, not revenues or investments in assets.

- Investment center. The manager is responsible for costs, revenues, and investment decisions.

- Cost center. The manager is responsible for costs only, not revenues or investments in assets.

- Cost center. The manager is responsible for costs only, not revenues or investments in assets.

- Investment center. The manager is responsible for costs, revenues, and investment decisions.

- Cost center. The manager is responsible for costs only, not revenues or investments in assets.