This is “Ethical Issues in Creating Operating Budgets”, section 9.5 from the book Accounting for Managers (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

9.5 Ethical Issues in Creating Operating Budgets

Learning Objective

- Understand ethical issues associated with budgeting.

Question: Although bottom-up budgeting, in which management elicits input from employees throughout the company, is effective in actively engaging those who have to achieve the budgeted goals, this type of budgeting is not free from problems. Ethical issues often arise in the budgeting process, particularly when employees and managers are evaluated by comparing their actual results to the budget. How might ethical issues arise in the budgeting process?

Answer: To demonstrate how ethical dilemmas might arise, assume you are a manager and you help upper management establish the master budget (this is the planning phase). Furthermore, you are evaluated based on achieving budgeted profit on a quarterly basis (this is the control phase). In fact, you will receive a $10,000 quarterly bonus, in addition to your base salary, if you meet or exceed budgeted profit. There is an inherent conflict between the planning and control phases of this process. You are helping the company plan, but you also want to be sure budgeted profit is as low as possible so you can get the $10,000 bonus.

Establishing a sales and profit budget that is considerably lower than what will likely happen causes problems for the entire organization. Production may be short of materials and labor, causing inefficiencies in the production process. Selling and administrative support may be lacking due to underestimating sales. Customers will not be satisfied if they must wait for the product. The dilemma you face as a manager in this situation is whether to do what is best for you (set a low profit estimate to earn the bonus) or do what is best for the company (estimate accurately so the budget reflects true sales and production needs).

Organizations must recognize this conflict and have processes in place to ensure both the interests of individual employees and the interests of the organization as a whole are served. For example, employees can be rewarded not just for meeting goals but also for providing accurate estimates. Perhaps a long-term stock option incentive system would provide motivation to do what is best for the organization, thereby increasing shareholder value. Whatever incentive system is implemented, organizations must promote honest employee input and beware of fraudulent reporting to achieve financial targets.

Key Takeaway

- An inherent conflict often exists between the planning and control phases of budgeting. During the planning phase, organizations are most concerned about getting accurate estimates that lead to positive results. The control phase requires evaluating performance of employees by comparing actual results to the operating budget. Employees often must decide between doing what is best for the individual employee and what is best for the organization.

Review Problem 9.9

Assume you are the manager of the computer division of High Tech Retail, Inc. You are asked to help the company prepare a budgeted income statement for the computer division before the start of each fiscal year. At the completion of each fiscal year, division managers receive a bonus equal to 10 percent of actual net income in excess of budgeted net income.

Describe the ethical conflict facing you as division manager when asked to help create the budgeted income statement for your division.

Solution to Review Problem 9.9

Employees who are evaluated in the control phase by comparing actual results to budgeted information have an incentive to create a budget that is easy to achieve, and perhaps unrealistic. This can create problems for the organization as a whole since inventory purchases are made based on budgeted sales. If each of the division managers submits a sales budget that significantly underestimates sales, the company will likely have a shortage of inventory and lose out on sales as customers go elsewhere to find the product. Although the managers will have an easier time achieving sales and profit goals, the company as a whole will suffer. The ethical dilemma of choosing between doing what is best for the division manager and what is best for the organization can ultimately lead to lower sales and dissatisfied customers.

End-of-Chapter Exercises

Questions

- Describe the planning phase of budgeting.

- Describe the control phase of budgeting.

- Refer to Note 9.4 "Business in Action 9.1" Describe two characteristics that make budgeting difficult for multinational companies.

- Why do successful companies tend to use the bottom-up approach to budgeting?

- Briefly describe the components of a master budget for a manufacturing organization.

- Why is the sales budget the most important component of the master budget?

- Describe the information used by companies to estimate sales.

- Describe how units to be produced is calculated in the production budget.

- How does a production budget help the production manager plan for the future?

- Why is depreciation deducted at the bottom of the manufacturing overhead budget?

- Why do companies that prepare a budgeted income statement also prepare a cash budget?

- Refer to Business in Action 9.2 titled “Moving from Spreadsheets to Intranet Budgeting.” What are the advantages of using intranet budgeting? What are some possible disadvantages?

- How does the master budget for a merchandising organization differ from the master budget for a manufacturing organization?

- Describe the difference between service organization budgets and manufacturing organization budgets.

- Refer to Note 9.35 "Business in Action 9.3" Describe the two procedures that the symphony uses in the control phase of budgeting.

- Describe the ethical conflict that can occur between the planning and control phases of the budgeting process.

- Why might a sales budget that intentionally underestimates sales have a negative impact on the organization?

Brief Exercises

-

Budgeting at Jerry’s Ice Cream. Refer to the dialogue for Jerry’s Ice Cream presented at the beginning of the chapter and the follow-up dialogue after Note 9.31 "Review Problem 9.7".

Required:

- In the opening dialogue, why is Jerry Feltz concerned about the sales growth expected for the coming year?

- In the follow-up dialogue, why is the company’s treasurer and controller concerned about the third quarter?

-

Budget Sequence. Indicate the order in which the following budget schedules are prepared.

- Direct materials purchases

- Manufacturing overhead

- Income statement

- Direct labor

- Selling and administrative

- Cash

- Production

- Balance sheet

- Sales

- Capital expenditures

- Sales Budget. Schwartz and Company expects to sell 100 units in the first quarter, 90 units in the second quarter, 150 units in the third quarter, and 160 units in the fourth quarter. The average sales price per unit is expected to be $3,000. Prepare a sales budget for each quarter and include a column for the year ending December 31.

- Production Budget. Schwartz and Company expects to sell 100 units in the first quarter and 90 units in the second quarter. Assuming the company prefers to maintain finished goods inventory equal to 10 percent of the next quarter’s sales, prepare a production budget for the first quarter using Figure 9.4 "Production Budget for Jerry’s Ice Cream" as a guide. (Hint: you are preparing a production budget for the first quarter only.)

- Direct Materials Purchases Budget. The production budget for Kaminski Products shows the company expects to produce 500 units in the first quarter and 600 units in the second quarter. Each unit requires 10 pounds of direct materials at a cost of $2 per pound. The company prefers to maintain raw materials inventory equal to 20 percent of next quarter’s materials needed in production. Prepare a direct materials purchases budget using Figure 9.5 "Direct Materials Purchases Budget for Jerry’s Ice Cream" as a guide. (Hint: you are preparing a direct materials purchases budget for the first quarter only.)

- Direct Labor Budget. The production budget for Kaminski Products shows the company expects to produce 500 units in the first quarter. Assuming each unit of product requires 3 direct labor hours at a cost of $13 per hour, prepare a direct labor budget for the first quarter using Figure 9.6 "Direct Labor Budget for Jerry’s Ice Cream" as a guide. (Hint: you are preparing a direct labor budget for the first quarter only.)

- Manufacturing Overhead Budget. The production budget for Kaminski Products shows the company expects to produce 500 units in the first quarter. Assume variable overhead cost per unit is $5 for indirect materials, $8 for indirect labor, and $3 for other items. Fixed overhead cost per quarter is $30,000 for salaries, $20,000 for rent, and $8,000 for depreciation. Prepare a manufacturing overhead budget for the first quarter using Figure 9.7 "Manufacturing Overhead Budget for Jerry’s Ice Cream" as a guide (Hint: you are preparing a manufacturing overhead budget for the first quarter only.)

- Sales Cash Collections Budget. All sales for Malik and Associates are on credit. Accounts receivable at the end of last quarter totaled $100,000. Credit sales for the first quarter of the upcoming period are expected to be $300,000. The company expects to collect 70 percent of sales in the quarter of the sale, and 30 percent the quarter following the sale. Prepare a sales cash collections budget for the first quarter of the upcoming period using the top of Figure 9.11 "Cash Budget for Jerry’s Ice Cream" as a guide. (Hint: you are preparing a sales cash collections budget for the first quarter only.)

- Purchases Cash Payments Budget. All direct material purchases made by Keen and Company are on credit. Accounts payable at the end of last quarter totaled $50,000. Purchases for the first quarter of the upcoming period are expected to be $200,000. The company expects to pay 40 percent of purchases in the quarter of purchase and 60 percent the quarter following the purchase. Prepare a purchases cash payments budget for the first quarter of the upcoming period using the middle of Figure 9.11 "Cash Budget for Jerry’s Ice Cream" as a guide. (Hint: you are preparing a purchases cash payments budget for the first quarter only.)

-

Sales Budget for Service Organization; Ethical Issues. Rami and Associates is an accounting firm that estimates revenues based on billable hours. The company expects to charge 8,000 hours to clients in the first quarter, 9,000 hours in the second quarter, 7,000 hours in the third quarter and 8,500 hours in the fourth quarter. The average hourly billing rate is expected to be $100.

Required:

- Prepare a services revenue budget for each quarter and include a column for the year ending December 31. (Hint: this is similar to a sales budget except sales are measured in labor hours rather than in units, and revenue is measured as an average hourly billing rate rather than a sales price per unit.)

- Since the manager of the company is given a bonus if actual billable hours exceed budgeted billable hours, the manager intentionally underestimated the number of expected billable hours for each quarter. How might this underestimate affect the company?

Exercises: Set A

-

Sales and Production Budgets. Templeton Corporation produces windows used in residential construction. Unit sales last year, ending December 31, are as follow:

First quarter 40,000 Second quarter 50,000 Third quarter 52,000 Fourth quarter 48,000 Unit sales are expected to increase 10 percent this coming year over the same quarter last year. Average sales price per window will remain at $200.

Assume finished goods inventory is maintained at a level equal to 5 percent of the next quarter’s sales. Finished goods inventory at the end of the fourth quarter budget period is estimated to be 2,300 units.

Required:

- Prepare a sales budget for Templeton Corporation using a format similar to Figure 9.3 "Sales Budget for Jerry’s Ice Cream". (Hint: be sure to increase last year’s unit sales by 10 percent.)

- Prepare a production budget for Templeton Corporation using a format similar to Figure 9.4 "Production Budget for Jerry’s Ice Cream".

-

Direct Materials Purchases and Direct Labor Budgets. Templeton Corporation produces windows used in residential construction. The company expects to produce 44,550 units in the first quarter, 55,110 units in the second quarter, 56,980 units in the third quarter, and 52,460 units in the fourth quarter. (This information is derived from the previous exercise for Templeton Corporation.)

With regards to direct materials, each unit of product requires 12 square feet of glass at a cost of $1.50 per square foot. Management prefers to maintain ending raw materials inventory equal to 10 percent of next quarter’s materials needed in production. Raw materials inventory at the end of the fourth quarter budget period is estimated to be 65,000 square feet.

With regards to direct labor, each unit of product requires 2 labor hours at a cost of $15 per hour.

Required:

- Prepare a direct materials purchases budget for Templeton Corporation using a format similar to Figure 9.5 "Direct Materials Purchases Budget for Jerry’s Ice Cream".

- Prepare a direct labor budget for Templeton Corporation using a format similar to Figure 9.6 "Direct Labor Budget for Jerry’s Ice Cream".

-

Manufacturing Overhead Budget. Templeton Corporation produces windows used in residential construction. The company expects to produce 44,550 units in the first quarter, 55,110 units in the second quarter, 56,980 units in the third quarter, and 52,460 units in the fourth quarter. (This information is the same as in the previous exercise for Templeton Corporation.) The following information relates to the manufacturing overhead budget.

Variable Overhead Costs Indirect materials $2.50 per unit Indirect labor $3.20 per unit Other $1.70 per unit Fixed Overhead Costs per Quarter Salaries $50,000 Rent $60,000 Depreciation $36,370 Required:

Prepare a manufacturing overhead budget for Templeton Corporation using a format similar to Figure 9.7 "Manufacturing Overhead Budget for Jerry’s Ice Cream".

-

Budgets for Cash Collections from Sales and Cash Payments for Purchases. Templeton Corporation produces windows used in residential construction. The dollar amount of the company’s quarterly sales and direct materials purchases are projected to be as follows (this information is derived from the previous exercises for Templeton Corporation):

1st 2nd 3rd 4th Sales $8,800,000 $11,000,000 $11,440,000 $10,560,000 Direct materials purchases $ 820,908 $ 995,346 $ 1,017,504 $ 947,352 Assume all sales are made on credit. The company expects to collect 60 percent of sales in the quarter of sale and 40 percent the quarter following the sale. Accounts receivable at the end of last year totaled $3,000,000, all of which will be collected in the first quarter of the coming year.

Assume all direct materials purchases are on credit. The company expects to pay 70 percent of purchases in the quarter of purchase and 30 percent the following quarter. Accounts payable at the end of last year totaled $325,000, all of which will be paid in the first quarter of this coming year.

Required:

- Prepare a budget for cash collections from sales. Use a format similar to the top section of Figure 9.11 "Cash Budget for Jerry’s Ice Cream".

- Prepare a budget for cash payments for purchases of materials. Use a format similar to the middle section of Figure 9.11 "Cash Budget for Jerry’s Ice Cream". Round to the nearest dollar.

-

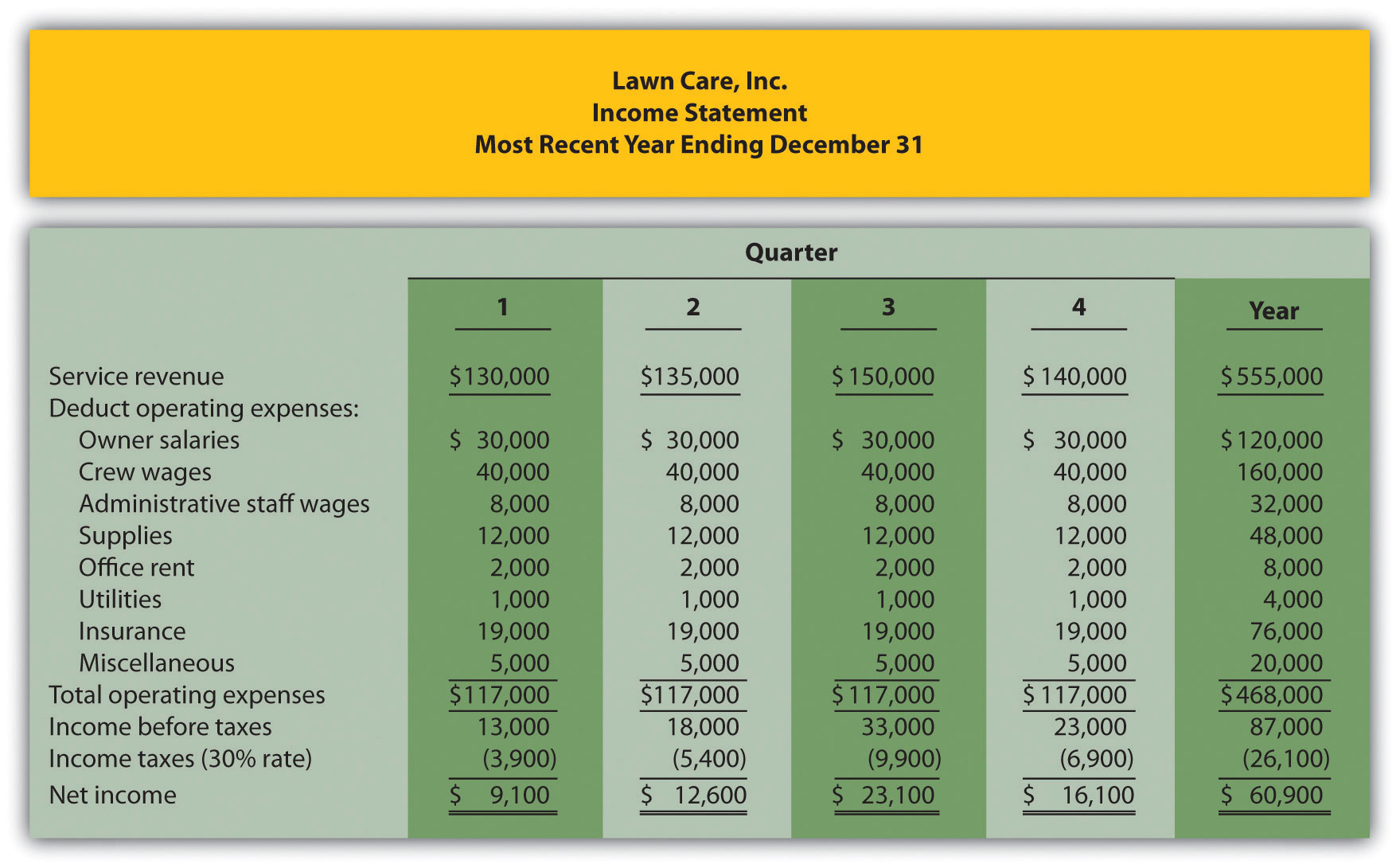

Service Company Budgeted Income Statement and Ethical Issues. Lawn Care, Inc., has two owners who maintain lawns for residential customers. The company had the following net income for the most current year.

The following information was gathered from the owners to help prepare this coming year’s budgeted income statement:

- Service revenue will increase 15 percent (e.g., first quarter service revenue for this coming year will be 15 percent higher than the first quarter shown previously).

- Owner salaries will increase 8 percent.

- Crew wages will increase 12 percent.

- Administrative staff wages will increase 5 percent, and a new staff member will be hired at the beginning of the third quarter at a quarterly rate of $7,000.

- Supplies will increase 9 percent.

- Office rent, utilities, and miscellaneous expenses will remain the same.

- Insurance will increase 18 percent.

- The tax rate will remain at 30 percent.

Required:

- Prepare a quarterly budgeted income statement for Lawn Care, Inc., and include a column summarizing the year.

- The owners of Lawn Care, Inc., have decided to expand and are in need of additional cash to expand operations. Unknown to the owners, the company’s accountant intentionally inflated the revenue projections for this coming year to make the company look better when applying for a loan. Is this behavior ethical? Explain. (It may be helpful to review the presentation of ethics in Chapter 1 "What Is Managerial Accounting?".)

Exercises: Set B

-

Sales and Production Budgets. Catalina, Inc., produces tents used for camping. Unit sales last year, ending December 31, follow.

First quarter 6,000 Second quarter 10,000 Third quarter 12,000 Fourth quarter 8,000 Unit sales are expected to increase 30 percent this coming year over the same quarter last year. Average sales price per tent will remain at $300.

Assume finished goods inventory is maintained at a level equal to 10 percent of the next quarter’s sales. Finished goods inventory at the end of the fourth quarter budget period is estimated to be 1,900 units.

Required:

- Prepare a sales budget for Catalina, Inc., using a format similar to Figure 9.3 "Sales Budget for Jerry’s Ice Cream". (Hint: be sure to increase last year’s unit sales by 30 percent.)

- Prepare a production budget for Catalina, Inc., using a format similar to Figure 9.4 "Production Budget for Jerry’s Ice Cream".

-

Direct Materials Purchases and Direct Labor Budgets. Catalina, Inc., produces tents used for camping. The company expects to produce 8,320 units in the first quarter, 13,260 units in the second quarter, 15,080 units in the third quarter, and 11,260 units in the fourth quarter (this information is derived from the previous exercise for Catalina, Inc.).

With regards to direct materials, each unit of product requires 8 yards of material, at a cost of $4 per yard. Management prefers to maintain ending raw materials inventory equal to 15 percent of next quarter’s materials needed in production. Raw materials inventory at the end of the fourth quarter budget period is estimated to be 14,000 yards.

With regards to direct labor, each unit of product requires 3 labor hours at a cost of $16 per hour.

Required:

- Prepare a direct materials purchases budget for Catalina, Inc., using a format similar to Figure 9.5 "Direct Materials Purchases Budget for Jerry’s Ice Cream".

- Prepare a direct labor budget for Catalina, Inc., using a format similar to Figure 9.6 "Direct Labor Budget for Jerry’s Ice Cream".

-

Manufacturing Overhead Budget. Catalina, Inc., produces tents used for camping. The company expects to produce 8,320 units in the first quarter, 13,260 units in the second quarter, 15,080 units in the third quarter, and 11,260 units in the fourth quarter. (This information is the same as in the previous exercise for Catalina, Inc.) The following information relates to the manufacturing overhead budget.

Variable Overhead Costs Indirect materials $0.20 per unit Indirect labor $4.20 per unit Other $2.70 per unit Fixed Overhead Costs per Quarter Salaries $100,000 Rent $ 30,000 Depreciation $ 44,908 Required:

Prepare a manufacturing overhead budget for Catalina, Inc., using a format similar to Figure 9.7 "Manufacturing Overhead Budget for Jerry’s Ice Cream".

-

Budgets for Cash Collections from Sales and Cash Payments for Purchases. Catalina, Inc., produces tents used for camping. The dollar amount of the company’s quarterly sales and direct materials purchases are projected to be as follows (this information is derived from the previous exercises for Catalina, Inc.):

1st 2nd 3rd 4th Sales $2,340,000 $3,900,000 $4,680,000 $3,120,000 Direct materials purchases $ 289,952 $ 433,056 $ 464,224 $ 362,272 Assume all sales are made on credit. The company expects to collect 80 percent of sales in the quarter of sale and 20 percent the quarter following the sale. Accounts receivable at the end of last year totaled $400,000, all of which will be collected in the first quarter of the coming year.

Assume all direct materials purchases are on credit. The company expects to pay 90 percent of purchases in the quarter of purchase and 10 percent the following quarter. Accounts payable at the end of last year totaled $30,000, all of which will be paid in the first quarter of this coming year.

Required:

- Prepare a budget for cash collections from sales. Use a format similar to the top section of Figure 9.11 "Cash Budget for Jerry’s Ice Cream".

- Prepare a budget for cash payments for purchases of materials. Use a format similar to the middle section of Figure 9.11 "Cash Budget for Jerry’s Ice Cream". Round to the nearest dollar.

-

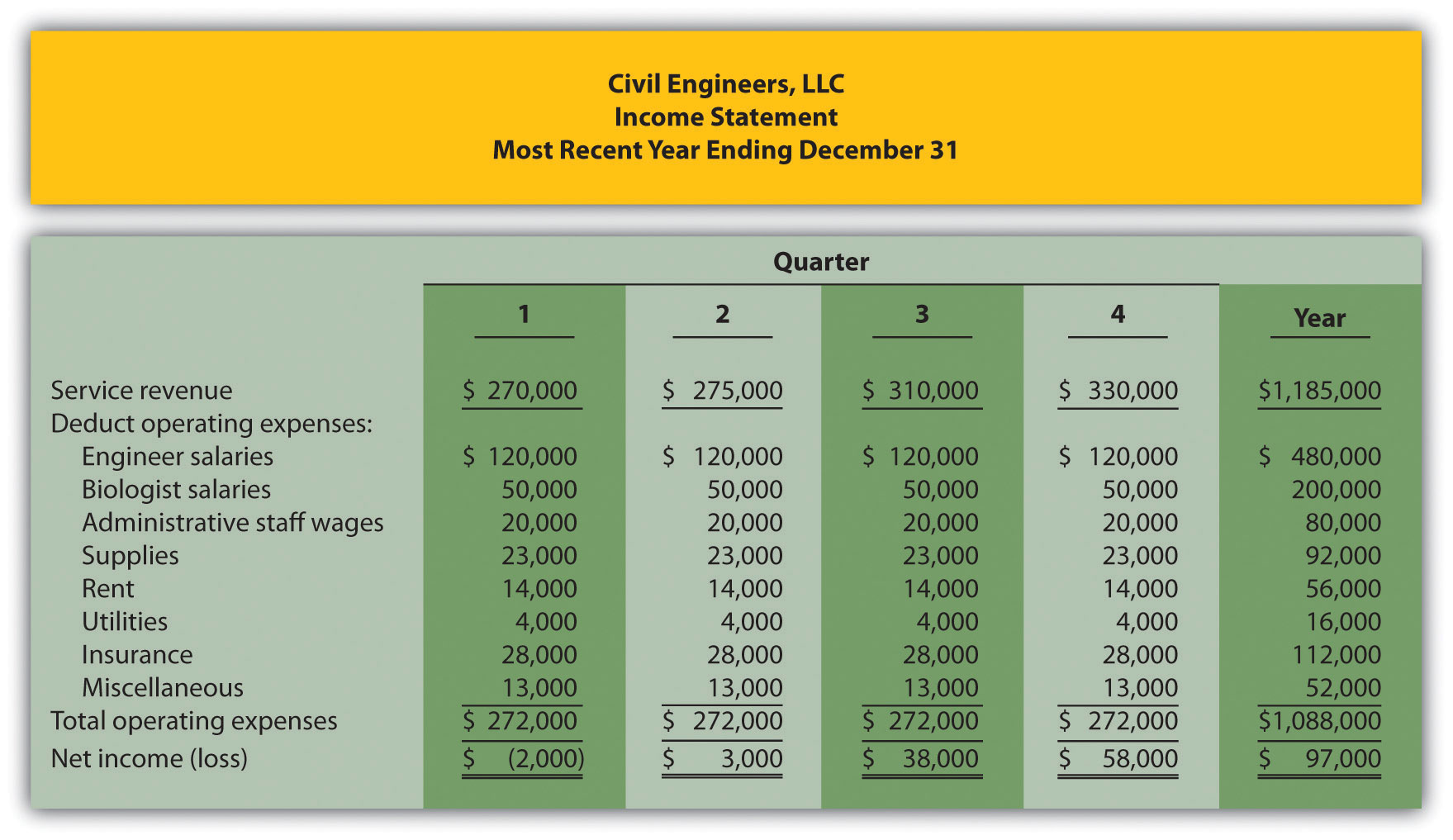

Service Company Budgeted Income Statement. Civil Engineers, LLC, has five engineers who design and maintain wetlands. The company had the following net income for the most current year.

The following information was gathered from management to help prepare this coming year’s budgeted income statement:

- Service revenue will increase 3 percent (e.g., first quarter service revenue for this coming year will be 3 percent higher than the first quarter shown previously).

- Existing engineer and biologist salaries will increase 5 percent, and a new biologist will be hired at the beginning of the second quarter at a quarterly salary of $10,000.

- Administrative staff wages will increase 15 percent.

- Supplies and rent will remain the same.

- Utilities will increase 8 percent.

- Insurance will increase 20 percent.

- Miscellaneous expenses will decrease 5 percent.

Required:

Prepare a quarterly budgeted income statement for Civil Engineers, LLC, and include a column summarizing the year.

Problems

-

Budgeting for Sales, Production, Direct Materials, Direct Labor, and Manufacturing Overhead; Ethical Issues. Sanders Swimwear, Inc., produces swimsuits. The following information is to be used for the operating budget this coming year.

-

Average sales price for each swimsuit is estimated to be $50. Unit sales for this coming year ending December 31 are expected to be as follows:

First quarter 3,000 Second quarter 5,000 Third quarter 20,000 Fourth quarter 6,000 - Finished goods inventory is maintained at a level equal to 10 percent of the next quarter’s sales. Finished goods inventory at the end of the fourth quarter budget period is estimated to be 400 units.

- Each unit of product requires 3 yards of direct materials, at a cost of $4 per yard. Management prefers to maintain ending raw materials inventory equal to 20 percent of next quarter’s materials needed in production. Raw materials inventory at the end of the fourth quarter budget period is estimated to be 9,500 yards.

- Each unit of product requires 0.5 direct labor hours at a cost of $12 per hour.

-

Variable manufacturing overhead costs are

Indirect materials $0.60 per unit Indirect labor $3.50 per unit Other $2.80 per unit -

Fixed manufacturing overhead costs per quarter are

Salaries $30,000 Other $ 5,000 Depreciation $ 9,330

Required:

- Prepare a sales budget using the format shown in Figure 9.3 "Sales Budget for Jerry’s Ice Cream".

- Prepare a production budget using the format shown in Figure 9.4 "Production Budget for Jerry’s Ice Cream".

- Prepare a direct materials purchases budget using the format shown in Figure 9.5 "Direct Materials Purchases Budget for Jerry’s Ice Cream".

- Prepare a direct labor budget using the format shown in Figure 9.6 "Direct Labor Budget for Jerry’s Ice Cream".

- Prepare a manufacturing overhead budget using the format shown in Figure 9.7 "Manufacturing Overhead Budget for Jerry’s Ice Cream".

- As the production manager, what concerns, if any, do you have about production requirements for each of the four quarters?

- Assume the sales budget was developed based on input provided by the company’s vice president of sales. The vice president is paid a base salary plus a bonus if actual sales exceed budgeted sales. How might this influence the vice president’s estimate of quarterly sales? What effect might this have on the company?

-

-

Budgeting for Sales, Production, Direct Materials, Direct Labor, and Manufacturing Overhead. Hershel’s Chocolate produces chocolate bars and sells them by the case (1 unit = 1 case). Information to be used for the operating budget this coming year follows:

-

Average sales price for each case is estimated to be $25. Unit sales for this coming year, ending December 31, are expected to be as follows:

First quarter 80,000 Second quarter 84,000 Third quarter 88,000 Fourth quarter 97,000 - Finished goods inventory is maintained at a level equal to 15 percent of the next quarter’s sales. Finished goods inventory at the end of the fourth quarter budget period is estimated to be 13,000 units.

- Each unit of product requires 5 pounds of cocoa beans for direct materials, at a cost of $3 per pound. Management prefers to maintain ending raw materials inventory equal to 10 percent of next quarter’s materials needed in production. Raw materials inventory at the end of the fourth quarter budget period is estimated to be 43,000 pounds.

- Each unit of product requires 0.10 direct labor hours at a cost of $14 per hour.

-

Variable manufacturing overhead costs are

Indirect materials $0.20 per unit Indirect labor $0.15 per unit Other $0.10 per unit -

Fixed manufacturing overhead costs per quarter are

Salaries $80,000 Other $70,000 Depreciation $55,625

Required:

- Prepare a sales budget using the format shown in Figure 9.3 "Sales Budget for Jerry’s Ice Cream".

- Prepare a production budget using the format shown in Figure 9.4 "Production Budget for Jerry’s Ice Cream".

- Prepare a direct materials purchases budget using the format shown in Figure 9.5 "Direct Materials Purchases Budget for Jerry’s Ice Cream".

- Prepare a direct labor budget using the format shown in Figure 9.6 "Direct Labor Budget for Jerry’s Ice Cream".

- Prepare a manufacturing overhead budget using the format shown in Figure 9.7 "Manufacturing Overhead Budget for Jerry’s Ice Cream". Round to the nearest dollar.

- As the production manager, what concerns, if any, do you have about production requirements for each of the four quarters?

-

-

Selling and Administrative Budget and Budgeted Income Statement. (The previous problem must be completed before working this problem.) Hershel’s Chocolate produces chocolate bars. Management estimates all selling and administrative costs are fixed. Quarterly selling and administrative cost estimates for the coming year follow.

Salaries $170,000 Rent $ 65,000 Advertising $120,000 Depreciation $ 75,000 Other $ 36,000 Required:

- Use the information presented previously to prepare a selling and administrative budget. Refer to the format shown in Figure 9.8 "Selling and Administrative Budget for Jerry’s Ice Cream".

- Use the information from the previous problem and from requirement a of this problem to prepare a budgeted income statement. Refer to the format shown in Figure 9.9 "Budgeted Income Statement for Jerry’s Ice Cream".

- How will management use the information presented in the budgeted income statement?

-

Budgeting for Cash Collections and Cash Payments. Hershel’s Chocolate produces chocolate bars. The treasurer at Hershel’s Chocolate is preparing the cash budget and would like to know when cash collections from sales and cash payments for materials will occur. The dollar amount of the company’s quarterly sales and direct materials purchases are projected to be as follows (this information is the result of working the previous problems for Hershel’s Chocolate):

1st 2nd 3rd 4th Sales $2,000,000 $2,100,000 $2,200,000 $2,425,000 Direct materials purchases $1,215,000 $1,276,125 $1,349,400 $1,417,575 - All sales are made on credit. The company expects to collect 60 percent of sales in the quarter of sale and 40 percent the quarter following the sale. Accounts receivable at the end of last year totaled $770,000, all of which will be collected during the first quarter of this coming year.

- All direct materials purchases are on credit. The company expects to pay 80 percent of purchases in the quarter of purchase and 20 percent the following quarter. Accounts payable at the end of last year totaled $257,000, all of which will be paid during the first quarter of this coming year.

Required:

- Prepare a budget for cash collections from sales. Refer to the format shown at the top of Figure 9.11 "Cash Budget for Jerry’s Ice Cream".

- Prepare a budget for cash payments for purchases of materials. Refer to the format shown in the middle section of Figure 9.11 "Cash Budget for Jerry’s Ice Cream".

- How will the treasurer use this information?

-

Services Revenue and Direct Labor Budgets for Service Organization; Ethical Issues. Engineering, Inc., provides structural engineering services for its clients. Billable hours for each month of the first quarter of this coming budget period are expected to be as follows:

January 2,000 February 2,200 March 3,000 The average hourly billing rate is estimated to be $150.

Required:

- Prepare a services revenue budget for Engineering, Inc., for each month of the first quarter and include a total column for the quarter. (Hint: this is similar to a sales budget except sales are measured in labor hours rather than in units, and revenue is measured as an average hourly billing rate rather than a sales price per unit.)

- The average cost for each hour of direct labor is expected to be $50. Assume total direct labor hours are expected to be 20 percent higher than billable direct labor hours presented previously. This is caused by employees working on projects that are not billable to clients (e.g., recruiting and community work). Prepare a direct labor budget for each month of the first quarter and include a total column for the quarter. (Hint: this budget will have three lines: projected direct labor hours, labor rate per hour, and total direct labor cost.)

- Assume the manager of the company is given a monthly bonus if actual billable hours exceed budgeted billable hours. How might this influence the manager’s estimate of monthly billable hours for budgeting purposes? What effect might this have on the company?

-

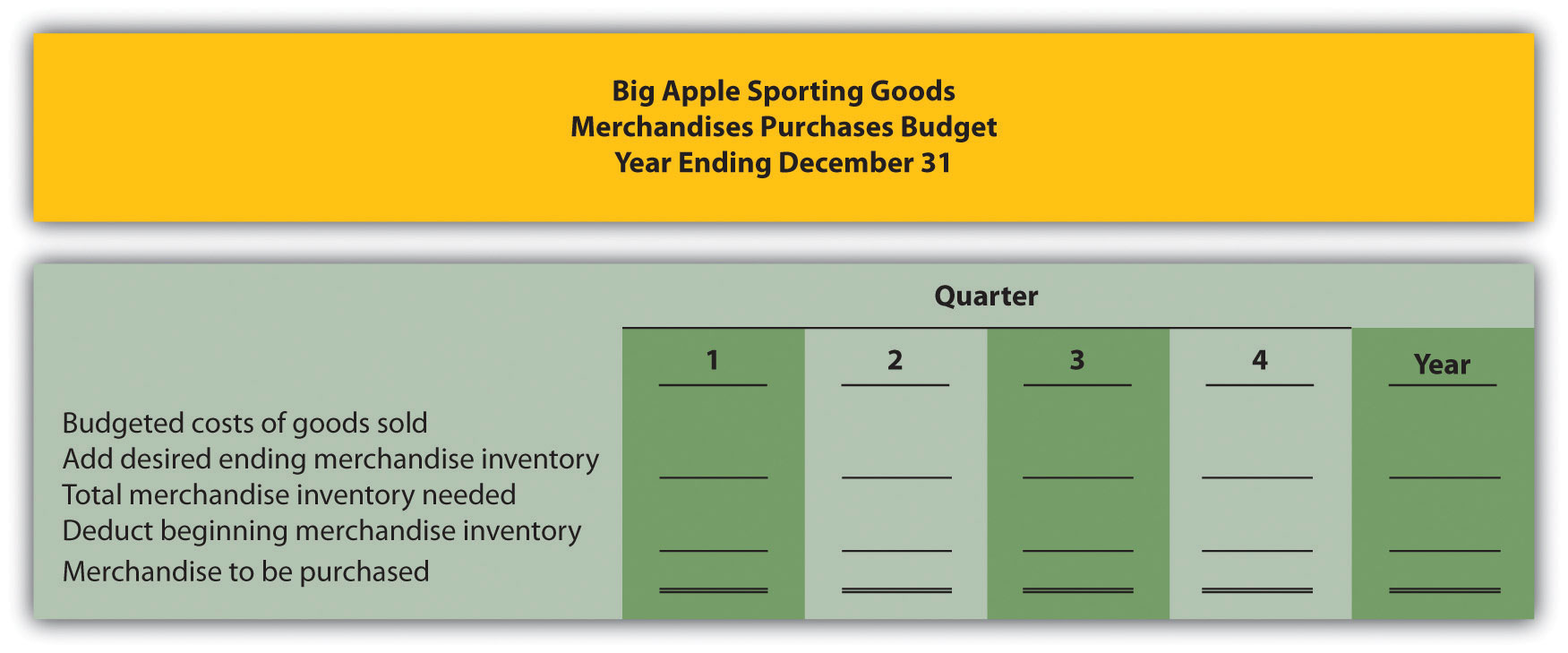

Merchandising Company Master Budget. Big Apple Sporting Goods is a retail store that sells a variety of sports equipment. The company’s fiscal year ends on December 31. Information to be used for the operating budget this coming year follows.

Sales and Merchandise Purchases Budget Information

-

Sales for this coming year ending December 31 are expected to be as follows:

First quarter $600,000 Second quarter $650,000 Third quarter $660,000 Fourth quarter $800,000 - Cost of goods sold is 40 percent of sales (this is the first line of the merchandise purchases budget). Merchandise inventory is maintained at a level equal to 20 percent of the next quarter’s cost of goods sold. Merchandise inventory at the end of the fourth quarter budget period is estimated to be $55,000.

Selling and Administrative Budget Information

- Management estimates all selling and administrative costs are fixed.

-

Quarterly selling and administrative cost estimates for the coming year are

Salaries $150,000 Rent $ 25,000 Advertising $ 40,000 Depreciation $ 18,000 Other $ 12,000

Capital Expenditure and Cash Budget Information

- The company plans to pay cash for property, plant, and equipment totaling $35,000 at the end of the fourth quarter. This purchase will not affect depreciation expense for the coming year.

- The company expects to collect 70 percent of sales in the quarter of sale and 30 percent the quarter following the sale. Accounts receivable at the end of last year totaled $200,000, all of which will be collected during the first quarter of this coming year.

- All inventory purchases are on credit. The company expects to pay 80 percent of inventory purchases in the quarter of purchase and 20 percent the following quarter. Accounts payable at the end of last year totaled $68,000, all of which will be paid during the first quarter of this coming year.

- The cash balance at the beginning of this coming year is expected to be $90,000.

Budgeted Balance Sheet Information

- Assume 30 percent of fourth quarter budgeted sales will be collected in full the following year (this represents accounts receivable at the end of the fourth quarter).

-

Expected account balances at the end of the fourth quarter are

Property, plant, and equipment (net) $120,000 Common stock $175,000 - Actual retained earnings at the end of the last year totaled $252,000, and no cash dividends will be paid during the current budget period ending December 31.

Required:

- Prepare a quarterly sales budget. (Hint: this budget will not have any units of product, only total sales revenue.)

-

Prepare a quarterly merchandise purchases budget using the following format. All amounts are in dollars.

- Prepare a quarterly selling and administrative budget using the format shown in Figure 9.8 "Selling and Administrative Budget for Jerry’s Ice Cream".

- Prepare a quarterly budgeted income statement using the format shown in Figure 9.9 "Budgeted Income Statement for Jerry’s Ice Cream". (Hint: cost of goods sold will be based on a percent of sales rather than a cost per unit.)

- Prepare a quarterly capital expenditure budget using the format shown in Figure 9.10 "Capital Expenditures Budget for Jerry’s Ice Cream".

- Prepare a quarterly cash budget using the format shown in Figure 9.11 "Cash Budget for Jerry’s Ice Cream". (Hint: Merchandising companies have merchandise purchases rather than direct materials purchases. Merchandising companies do not have direct labor or manufacturing overhead.)

- Prepare a budgeted balance sheet at December 31 using the format shown in Figure 9.12 "Budgeted Balance Sheet for Jerry’s Ice Cream". (Hint: merchandising companies have merchandise inventory rather than raw materials inventory or finished goods inventory.)

-

One Step Further: Skill-Building Cases

-

Ethics in Budgeting. SportsMax sells sporting goods equipment at 100 stores throughout North America. Robert Manning is the manager of one SportsMax retail store in Chicago. The company is in the planning phase of establishing its operating budget for this coming year and has asked that all store managers submit their estimates of sales revenue, costs, and resulting profit. During the control phase, each store manager is evaluated by comparing budgeted profit with actual profit. Store managers who exceed budgeted profit are given a bonus equal to 10 percent of actual profit in excess of budgeted profit.

Required:

- Describe the ethical conflict that Robert Manning is facing.

- As the president and CEO of SportsMax, how might you motivate Robert Manning to provide an accurate operating budget?

-

Group Activity: Creating a Budget. Form groups of two to four students. Each group is to complete the following requirements.

Required:

- Assume you are a full-time student living in an apartment near your college campus. Create a personal budget that includes the typical monthly expenses you would expect to incur.

- Explain how the control phase of budgeting would be implemented for the personal budget created in requirement a.

- Discuss the findings of your group with the class. (Optional: your instructor may ask you to submit your findings in writing.)

- Creating a Sales Budget and Production Budget Using Excel. Review the information for Templeton Corporation in Exercise 28. Prepare an Excel spreadsheet similar to Figure 9.3 "Sales Budget for Jerry’s Ice Cream" and Figure 9.4 "Production Budget for Jerry’s Ice Cream" showing Templeton’s sales budget and production budget.

- Internet Project: Budgeting. Go to The New York Times’ Web site (http://www.nytimes.com), or a similar reputable Internet source, and find an article about budgeting. Summarize the article in a one-page report, and indicate how the budget described in the article is used for planning purposes. Submit a printed copy of the article with your report.

Comprehensive Cases

-

Comprehensive Master Budget. Creative Shirts, Inc., produces T-shirts. The company’s fiscal year ends on December 31. Information to be used for the operating budget this coming year follows.

Sales and Production-Related Budget Information

-

Average sales price for each T-shirt is estimated to be $15. Unit sales for this coming year, ending December 31, are expected to be as follows:

First quarter 20,000 Second quarter 24,000 Third quarter 28,000 Fourth quarter 18,000 - Finished goods inventory is maintained at a level equal to 10 percent of the next quarter’s sales. Finished goods inventory at the end of the fourth quarter budget period is estimated to be 2,000 units.

- Each unit of product requires 3 yards of direct materials, at a cost of $2 per yard. Management prefers to maintain ending raw materials inventory equal to 20 percent of next quarter’s materials needed in production. Raw materials inventory at the end of the fourth quarter budget period is estimated to be 12,200 yards.

- Each unit of product requires 0.1 direct labor hours at a cost of $14 per hour.

-

Variable manufacturing overhead costs are

Indirect materials $0.70 per unit Indirect labor $0.90 per unit Other $0.50 per unit -

Fixed manufacturing overhead costs per quarter are

Salaries $18,000 Other $20,000 Depreciation $11,950

Selling and Administrative Budget Information

- Management estimates all selling and administrative costs are fixed.

-

Quarterly selling and administrative cost estimates for the coming year are

Salaries $15,000 Rent $ 5,000 Advertising $ 4,000 Depreciation $ 9,000 Other $10,000

Capital Expenditures and Cash Budget Information

- The company plans to pay cash for selling and administrative equipment totaling $15,000 and production equipment totaling $9,000. Both will be purchased at the end of the fourth quarter and will not affect depreciation expense for the coming year.

- All sales are made on credit. The company expects to collect 70 percent of sales in the quarter of sale and 30 percent the quarter following the sale. Accounts receivable at the end of last year totaled $80,000, all of which will be collected during the first quarter of this coming year.

- All direct materials purchases are on credit. The company expects to pay 80 percent of purchases in the quarter of purchase and 20 percent the following quarter. Accounts payable at the end of last year totaled $25,000, all of which will be paid during the first quarter of this coming year.

- The cash balance at the beginning of this coming year is expected to be $30,000.

Budgeted Balance Sheet Information

- Assume 30 percent of fourth quarter budgeted sales will be collected in full the following year (this represents accounts receivable at the end of the fourth quarter).

-

Expected account balances at the end of the fourth quarter are

Property, plant, and equipment (net) $100,000 Common stock $250,000 - Actual retained earnings at the end of last year totaled $42,720, and no cash dividends will be paid during the current budget period ending December 31.

Required:

-

Prepare the quarterly sales and production-related budgets using the figure formats referenced here:

- Sales budget (Figure 9.3 "Sales Budget for Jerry’s Ice Cream")

- Production budget (Figure 9.4 "Production Budget for Jerry’s Ice Cream")

- Direct materials purchases budget (Figure 9.5 "Direct Materials Purchases Budget for Jerry’s Ice Cream")

- Direct labor budget (Figure 9.6 "Direct Labor Budget for Jerry’s Ice Cream")

- Manufacturing overhead budget (Figure 9.7 "Manufacturing Overhead Budget for Jerry’s Ice Cream")

- Prepare a quarterly selling and administrative budget using the format shown in Figure 9.8 "Selling and Administrative Budget for Jerry’s Ice Cream".

- Prepare a quarterly budgeted income statement using the format shown in Figure 9.9 "Budgeted Income Statement for Jerry’s Ice Cream".

- Prepare a quarterly capital expenditures budget using the format shown in Figure 9.10 "Capital Expenditures Budget for Jerry’s Ice Cream".

- Prepare a quarterly cash budget using the format shown in Figure 9.11 "Cash Budget for Jerry’s Ice Cream".

- Prepare a budgeted balance sheet at December 31 using the format shown in Figure 9.12 "Budgeted Balance Sheet for Jerry’s Ice Cream".

- Why does management at Creative Shirts, Inc., prepare a master budget? Explain.

-

-

Comprehensive Master Budget with Cash Flow Issues. Air Boats, Inc., produces small inflatable boats. The company’s fiscal year ends on December 31. Information to be used for the operating budget this coming year follows.

Sales and Production-Related Budget Information

-

Average sales price for each boat is estimated to be $150. Unit sales for this coming year, ending December 31, are expected to be as follows:

First quarter 100,000 Second quarter 110,000 Third quarter 125,000 Fourth quarter 90,000 - Finished goods inventory is maintained at a level equal to 15 percent of the next quarter’s sales. Finished goods inventory at the end of the fourth quarter budget period is estimated to be 13,000 units.

- Each unit of product requires 4 pounds of direct materials, at a cost of $5 per pound. The management prefers to maintain ending raw materials inventory equal to 8 percent of next quarter’s materials needed in production. Raw materials inventory at the end of the fourth quarter budget period is estimated to be 30,000 pounds.

- Each unit of product requires 0.5 direct labor hours at a cost of $15 per hour.

-

Variable manufacturing overhead costs are

Indirect materials $2.10 per unit Indirect labor $1.10 per unit Other $1.70 per unit -

Fixed manufacturing overhead costs per quarter are

Salaries $250,000 Other $300,000 Depreciation $613,250

Selling and Administrative Budget Information

- Management estimates all selling and administrative costs are fixed.

-

Quarterly selling and administrative cost estimates for the coming year are

Salaries $3,000,000 Rent $1,000,000 Advertising $ 900,000 Depreciation $1,200,000 Other $1,600,000

Capital Expenditures and Cash Budget Information

- The company plans to pay cash for selling and administrative equipment totaling $5,000,000 and production equipment totaling $20,000,000 (management plans to fully automate production with new machinery). Both will be purchased at the end of the fourth quarter and will not affect depreciation expense for the coming year.

- All sales are made on credit. The company expects to collect 90 percent of sales in the quarter of sale and 10 percent the quarter following the sale. Accounts receivable at the end of last year totaled $1,400,000, all of which will be collected during the first quarter of this coming year.

- All direct materials purchases are on credit. The company expects to pay 80 percent of purchases in the quarter of purchase and 20 percent the following quarter. Accounts payable at the end of last year totaled $400,000, all of which will be paid during the first quarter of this coming year.

- The cash balance at the beginning of this coming year is expected to be $75,000.

Budgeted Balance Sheet Information

- Assume 10 percent of fourth quarter budgeted sales will be collected in full the following year (this represents accounts receivable at the end of the fourth quarter).

-

Expected account balances at the end of the fourth quarter are

Property, plant, and equipment (net) $32,000,000 Common stock $13,500,000 - Actual retained earnings at the end of last year totaled $2,641,400, and no cash dividends will be paid during the current budget period ending December 31.

Required:

-

Prepare the quarterly sales and production-related budgets using the figure formats referenced here:

- Sales budget (Figure 9.3 "Sales Budget for Jerry’s Ice Cream")

- Production budget (Figure 9.4 "Production Budget for Jerry’s Ice Cream")

- Direct materials purchases budget (Figure 9.5 "Direct Materials Purchases Budget for Jerry’s Ice Cream")

- Direct labor budget (Figure 9.6 "Direct Labor Budget for Jerry’s Ice Cream")

- Manufacturing overhead budget (Figure 9.7 "Manufacturing Overhead Budget for Jerry’s Ice Cream")

- Prepare a quarterly selling and administrative budget using the format shown in Figure 9.8 "Selling and Administrative Budget for Jerry’s Ice Cream".

- Prepare a quarterly budgeted income statement using the format shown in Figure 9.9 "Budgeted Income Statement for Jerry’s Ice Cream".

- Prepare a quarterly capital expenditures budget using the format shown in Figure 9.10 "Capital Expenditures Budget for Jerry’s Ice Cream".

- Prepare a quarterly cash budget using the format shown in Figure 9.11 "Cash Budget for Jerry’s Ice Cream".

- Prepare a budgeted balance sheet at December 31 using the format shown in Figure 9.12 "Budgeted Balance Sheet for Jerry’s Ice Cream". (Hint: cash will have a negative balance.)

- Review the cash budget for Air Boats, Inc. What issue is facing the treasurer, and how might this issue be resolved?

-

-

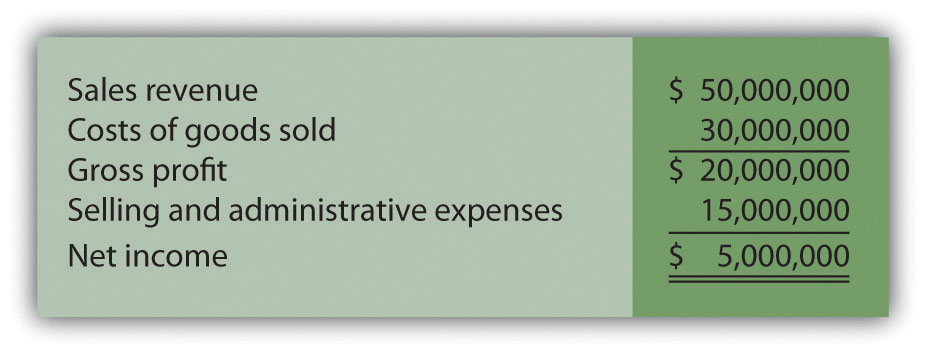

Ethics in Budgeting. Carol Chadwick is the manager of the toys division at Matteler, Inc. Carol is in the process of establishing the budgeted income statement for this coming year, which will be submitted to the company president for approval. The division’s current year actual results were slightly higher than the 5 percent growth Carol had anticipated. These results are shown as follows.

Division managers receive a 20 percent bonus for actual net income in excess of budgeted net income. Carol believes growth in sales this year will be approximately 12 percent. She is considering submitting a budget showing an increase of 5 percent, which will increase her chances of receiving a significant bonus at the end of this coming year. Assume cost of goods sold are variable costs and will increase in proportion with sales revenue. That is, cost of goods sold will always be 60 percent of sales revenue. Assume selling and administrative expenses are fixed costs.

Required:

- Prepare a budgeted income statement for the toys division assuming sales revenue will increase 5 percent.

- Prepare a budgeted income statement for the toys division assuming sales revenue will increase 12 percent.

- How much will Carol potentially have to gain in bonus compensation by submitting a budget showing a 5 percent increase in sales revenue if actual growth turns out to be 12 percent?

- As the president and CEO of Matteler, how might you motivate Carol Chadwick to provide an accurate budgeted income statement?