This is “Customer Decisions”, section 7.4 from the book Accounting for Managers (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

7.4 Customer Decisions

Learning Objective

- Use differential analysis to decide whether to keep or drop customers.

Question: Much like product line decisions, managers often use profitability as a determining factor to decide whether to keep or drop customers. This is an issue for all types of organizations, including manufacturers, retailers, and service companies. How does the differential analysis format differ for customer decisions compared to product line decisions?

Answer: Instead of tracing revenues, variable costs, and fixed costs directly to product lines, we track this information by customer. Fixed costs that cannot be traced directly to customers are allocated to customers. Let’s look at an example for a company called Colony Landscape Maintenance to identify the similarities and differences between the two formats.

Evaluating Customer Information

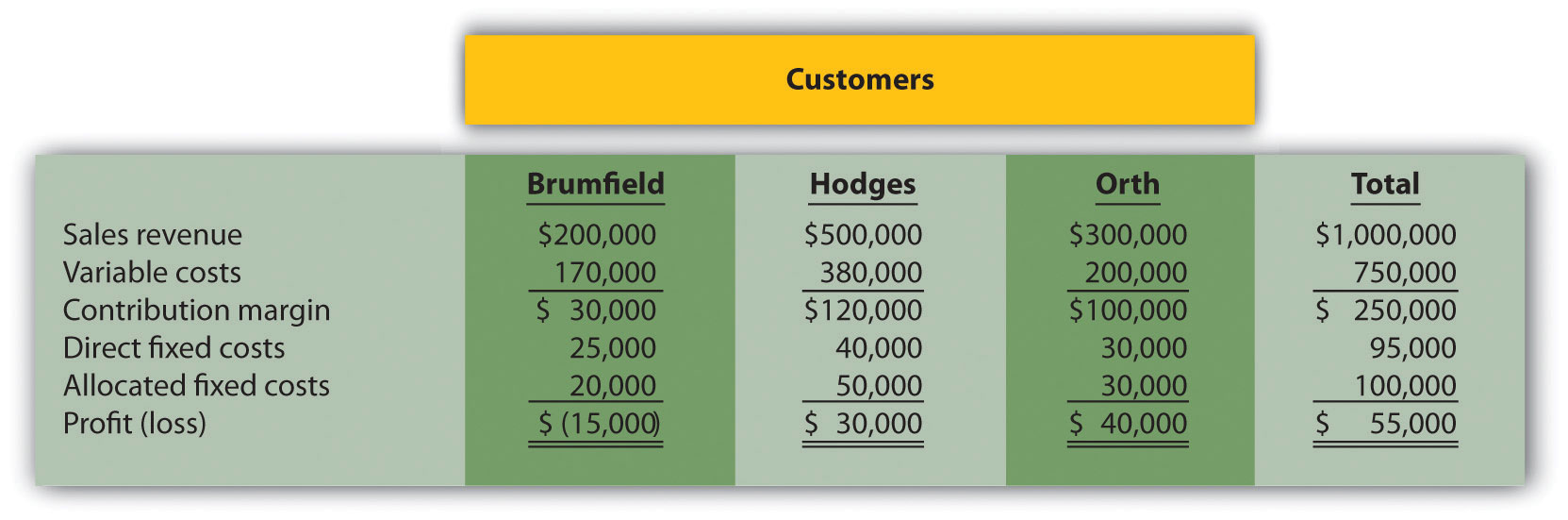

Question: Colony Landscape Maintenance provides services to three large customers: Brumfield, Hodges, and Orth. The segmented income statement in Figure 7.9 "Income Statement for Colony Landscape Maintenance" provides annual revenue and cost information by customer. Notice that this information is formatted similarly to the product line information in Figure 7.8 "Differential Analysis with Opportunity Cost for Barbeque Company". However, instead of tracking information by product line, here we track information by customer. Examine Figure 7.9 "Income Statement for Colony Landscape Maintenance" carefully and notice that the Brumfield account shows a loss for the year of $15,000. Should Colony Landscape Maintenance drop the Brumfield account?

Answer: To answer this question we must take a closer look at the information in Figure 7.9 "Income Statement for Colony Landscape Maintenance". The variable costs and direct fixed costs are related directly to each customer, and thus are eliminated if Colony eliminates the Brumfield account. That is, all variable costs and direct fixed costs are differential costs for the two alternatives facing Colony. Colony assigns the allocated fixed costs of $20,000 to Brumfield based on sales revenue, and those costs will continue regardless of Colony’s decision. Thus allocated fixed costs are not differential costs.

Figure 7.9 Income Statement for Colony Landscape Maintenance

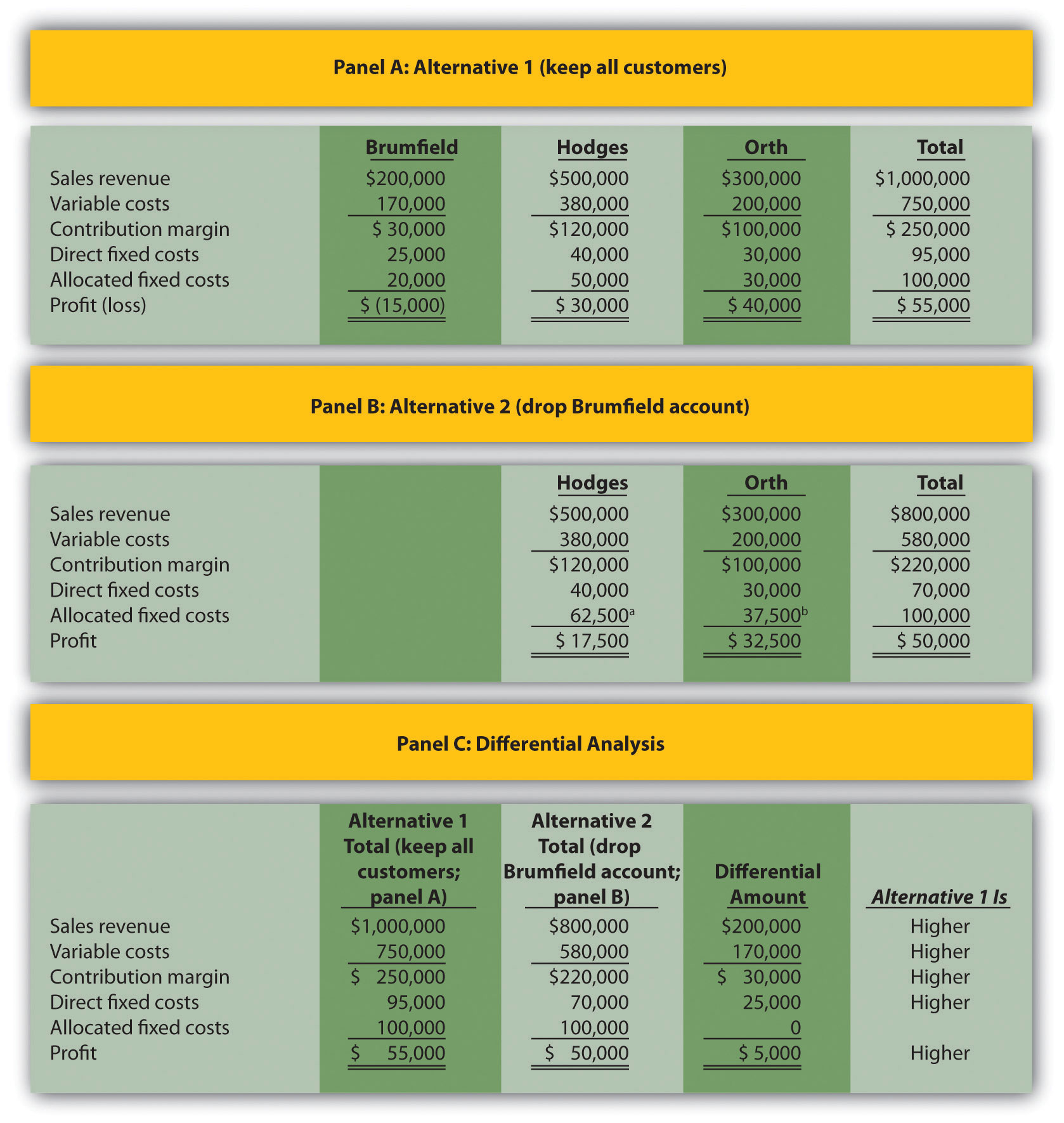

Management of Colony Landscape Maintenance would like to know if dropping the Brumfield account would increase overall company profit. The differential analysis presented in Figure 7.10 "Customer Differential Analysis for Colony Landscape Maintenance" provides the answer. Panel A shows the income statement for Alternative 1: keeping all three customers. Panel B shows the income statement for Alternative 2: dropping the Brumfield account. And panel C presents the differential analysis for both alternatives. The differential analysis presented in panel C shows that overall profit will decrease by $5,000 if Colony drops the Brumfield account.

Figure 7.10 Customer Differential Analysis for Colony Landscape Maintenance

a $62,500 = ($500,000 ÷ $800,000) × $100,000.

b $37,500 = ($300,000 ÷ $800,000) × $100,000.

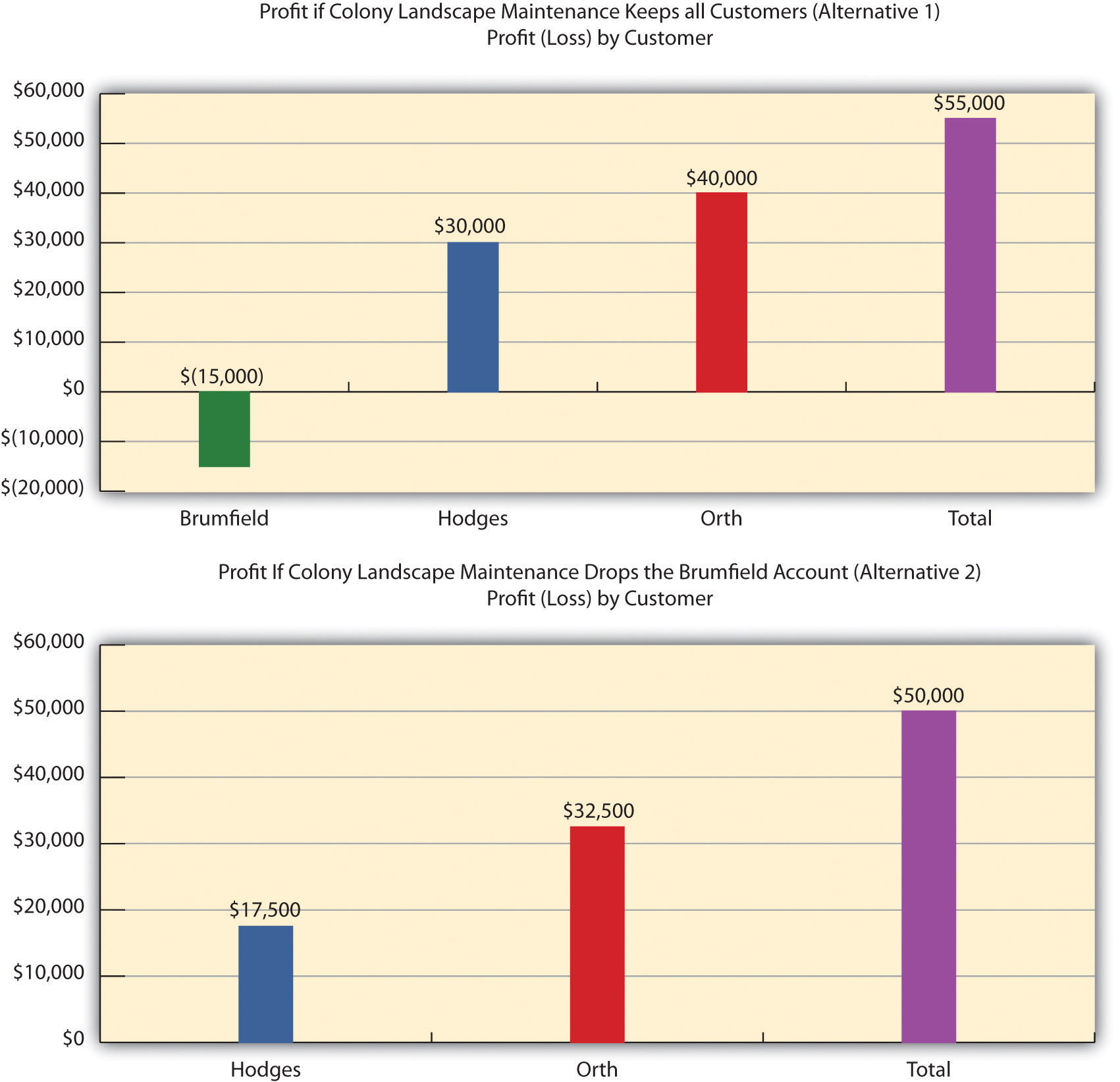

Figure 7.11 "Keep or Drop Customer" provides a bar chart summarizing how total profit will decrease if the Brumfield account is dropped. This information comes from the bottom of panels A and B in Figure 7.10 "Customer Differential Analysis for Colony Landscape Maintenance".

Figure 7.11 Keep or Drop Customer

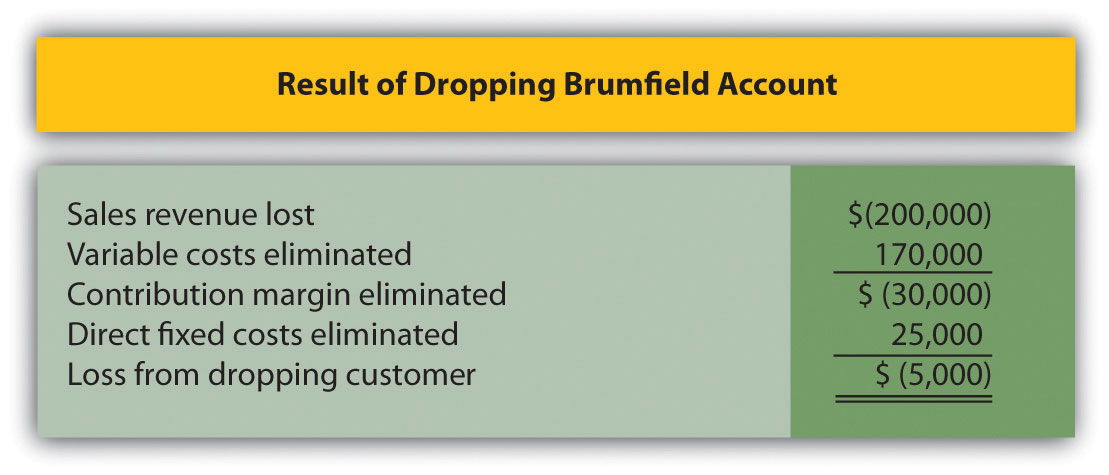

We show a more concise explanation in Figure 7.12 "Summary of Differential Analysis for Colony Landscape Maintenance", which presents the Differential Amount column shown in panel C of Figure 7.10 "Customer Differential Analysis for Colony Landscape Maintenance" along with a brief description of each item.

Figure 7.12 Summary of Differential Analysis for Colony Landscape Maintenance

Note: Amounts shown in parentheses indicate a negative impact on profit, and amounts without parentheses indicate a positive impact on profit.

An alternative way of handling the decision facing Colony Landscape Maintenance is simply to calculate profitability of the Brumfield account before deducting allocated fixed costs. Figure 7.12 "Summary of Differential Analysis for Colony Landscape Maintenance" shows a contribution margin of $30,000 for the Brumfield account. Deduct direct fixed costs of $25,000 and the customer has a remaining profit of $5,000. This explains why Colony’s overall profit would be $5,000 lower if it eliminated the Brumfield account.

Business in Action 7.3

Engineering Firm Fires Its Biggest Customer

The president of ABCO Automation, Inc., a 120-person engineering firm in North Carolina, decided it was time to fire the firm’s biggest client. Although the client provided close to 60 percent of the firm’s annual revenue, ABCO decided that firing this client was necessary. The president of ABCO stated, “We cannot be a great place to work without employees, and this client was bullying my employees. Its demands for turnaround were impossible to meet even with people working seven days a week. No client is worth losing my valued employees.”

The initial impact on revenues was significant. However, ABCO was able to cut costs and obtain new customers to fill the void. In addition, the fired client later gave ABCO two new projects on more equitable terms.

The lesson from this is that dropping customers is not always a financial decision. ABCO’s client was profitable, but in the long run, the firm was at risk of losing valuable employees. This was a risk ABCO was not willing to take.

Source: Roger Herman and Joyce Gioia, “Herman Trend Alert,” Strategic Business Futurists 2004 (http://www.hermangroup.com).

Using Activity-Based Costing to Assess Customer Profitability

Question: Activity-based costing, which we discussed in Chapter 3 "How Does an Organization Use Activity-Based Costing to Allocate Overhead Costs?", is a refined approach to allocating costs to products or customers. Activity-based costing first assigns costs to activities and then to products or customers based on their use of the activities. The cost information provided by activity-based costing is generally regarded as more accurate than most traditional costing methods. How can using activity-based costing information with differential analysis lead to better decisions in areas such as product lines and customer profitability?

Answer: Let’s look at a brief example of how activity-based costing can help with customer profitability. When assessing customer profitability, costs can be assigned to customers based on each customer’s use of activities. Consultants from PricewaterhouseCoopers suggest that customer costs are measurable across four categories of activities:Joseph A. Ness, Michael J. Schroeck, Rick A. Letendre, and Willmar J. Douglas, “The Role of ABM in Measuring Customer Value—Part 2,” Strategic Finance (April 2001): 44–49.

- Cost to acquire customers: Consists of activities such as advertising and promotional materials.

- Cost to provide goods and services: Consists of activities such as processing customer orders and delivering goods.

- Cost to serve customers: Consists of activities such as technical support and processing customer payments.

- Cost to retain customers: Consists of activities such as offering discounts and building relationships.

With the help of activity-based costing, costs can be assigned to activities within each category. These costs are then allocated to customers based on each customer’s use of activities. A significant advantage of using activity-based costing is having accurate data for decision-making purposes, particularly in the area of differential analysis.

Key Takeaway

- Managers use differential analysis to determine whether to keep or drop a customer. The format is similar to the differential analysis format used for making product line decisions. However, sales revenue, variable costs, and fixed costs are traced directly to customers rather than to product lines.

Review Problem 7.4

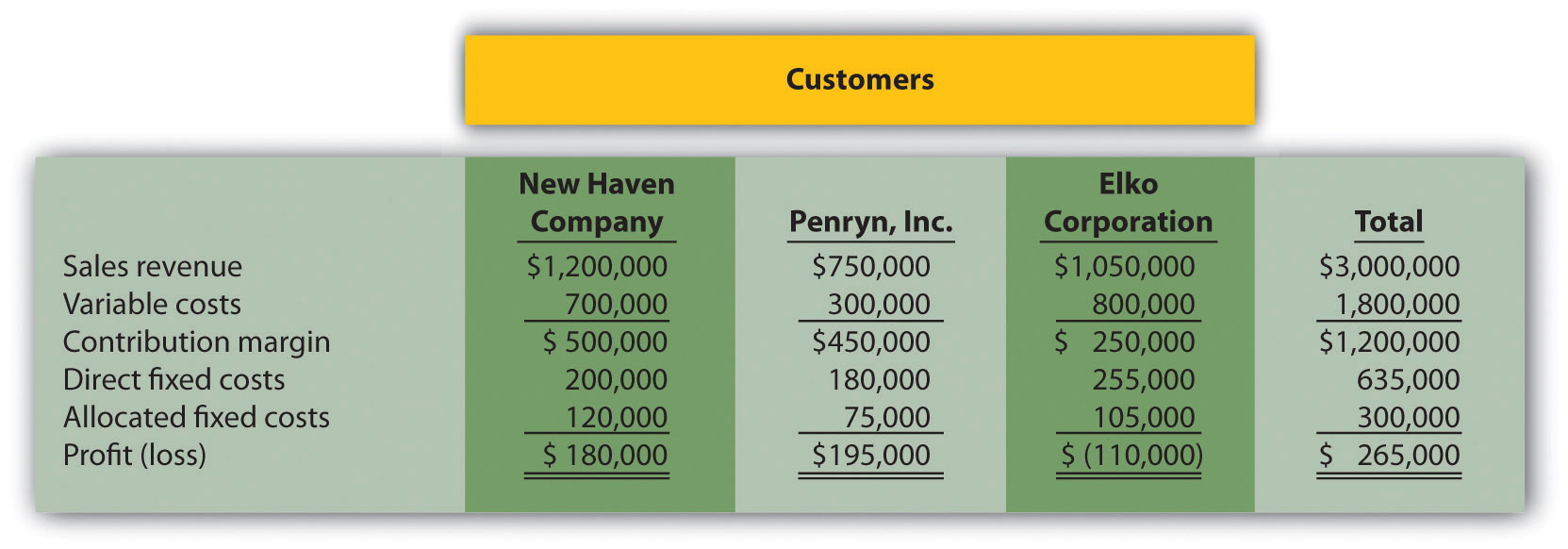

The following annual income statement is for Tatum & Associates, a firm that provides legal services to its customers.

Tatum & Associates is concerned about the losses associated with the Elko Corporation account and is considering dropping this customer. Allocated fixed costs are assigned to customers based on sales. For example, $105,000 in allocated fixed costs is assigned to Elko based on this customer’s sales as a percent of total sales [$105,000 = $300,000 × ($1,050,000 ÷ $3,000,000)]. If a customer is dropped, total allocated fixed costs are assigned to the remaining customers. All variable costs and direct fixed costs are differential costs.

- Using the differential analysis format presented in Figure 7.10 "Customer Differential Analysis for Colony Landscape Maintenance", determine whether Tatum & Associates would be better off dropping the Elko Corporation account or keeping the account. Explain your conclusion.

- Summarize the result of dropping the Elko Corporation account using the differential analysis format presented in Figure 7.12 "Summary of Differential Analysis for Colony Landscape Maintenance".

Solution to Review Problem 7.4

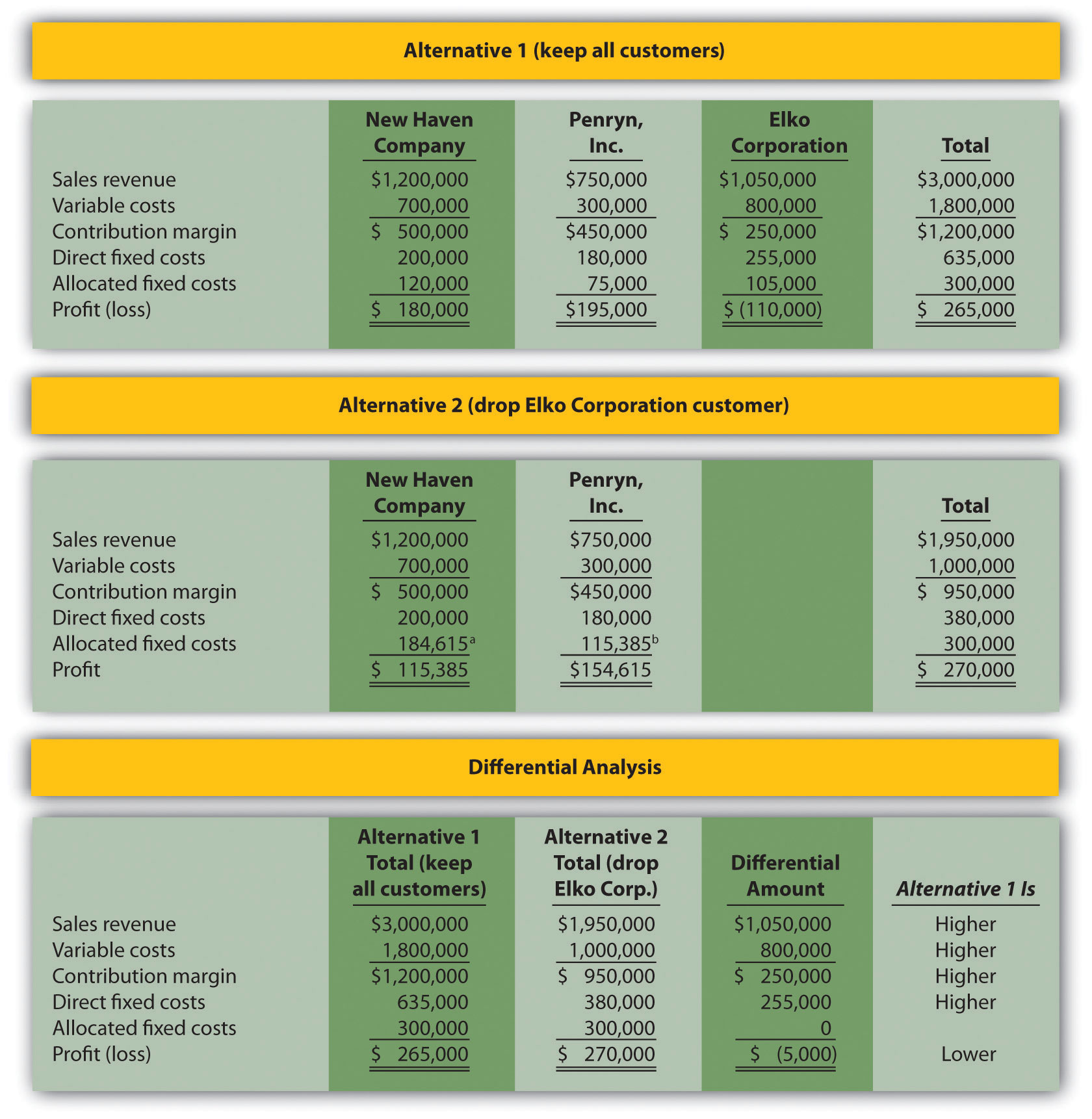

-

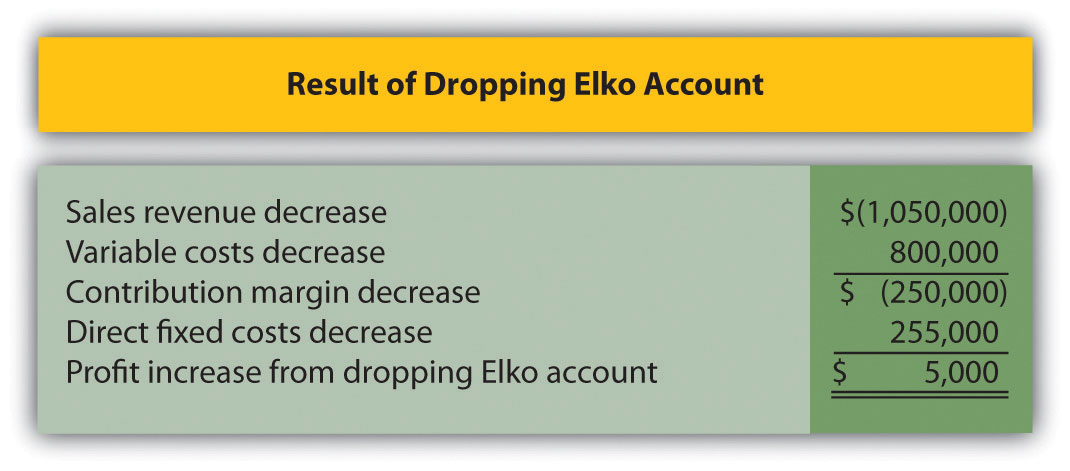

As shown in the differential analysis provided, Tatum & Associates would be better off dropping the Elko Corporation account. Profit is $5,000 lower if the Elko account is retained.

a $184,615 rounded = ($1,200,000 ÷ $1,950,000) × $300,000.

b $115,385 rounded = ($750,000 ÷ $1,950,000) × $300,000.

-

Note: Amounts shown in parentheses indicate a negative impact on profit, and amounts without parentheses indicate a positive impact on profit.