This is “Ethical Issues Facing the Accounting Industry”, section 1.4 from the book Accounting for Managers (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

1.4 Ethical Issues Facing the Accounting Industry

Learning Objective

- Use standards of ethical conduct to resolve ethical conflicts facing accountants.

Imagine you are the accountant for Drive Write, a company that produces computer disk drives, and you are in charge of all accounting functions within the company. The president has informed you that if the company’s profits grow by 20 percent this year, you will receive a $20,000 bonus, and she will receive a $50,000 bonus. No bonuses will be awarded if profit growth is less than 20 percent. Because the company’s profits have grown 20 percent annually for the last 10 years, investors have come to expect significant growth from one year to the next. Near the end of this fiscal year, the president and you have the following conversation:

| President: | We are awfully close to hitting our numbers and getting to the 20 percent target. With two weeks remaining, projections show we will come in at 18 percent for the year. What can we do on the accounting side to increase current year profits? |

| Accountant: | Well, I’m not sure there is anything we can do. Our accounting is squeaky clean, as confirmed by our independent auditors. Perhaps our sales will improve next year. |

| President: | There has to be something we can do—I could sure use the bonus money, and our investors would appreciate an increase in their investment! I know we have a large customer order to be filled the first week of next year. Why not include that sale in this year’s numbers? |

| Accountant: | I’m not comfortable recording sales in the wrong fiscal year. |

| President: | We’re only talking about moving sales by a few days! I would like you to consider this carefully. If you can’t do this, I may have to find an accountant who can! Let’s talk about our options later this week. |

Question: The situation at Drive Write creates a serious ethical dilemma. (The Drive Write example is based on a real company called MiniScribe Corporation, subsequently purchased by a competitor.) Companies are constantly under pressure to meet sales and profit goals. Employees who succeed in meeting these goals often reap huge monetary rewards; those who fail may be penalized with lower pay or may even lose their jobs. What would you do if asked to record information in a way that distorts the company’s financial results?

Answer: As the accountant for Drive Write, your response to the president’s request would likely affect your reputation as a professional and your future as an accountant. The unethical behavior at corporations like Xerox, Enron, and WorldCom in recent years makes it imperative that we know both how to act ethically and how to resolve ethical conflicts.

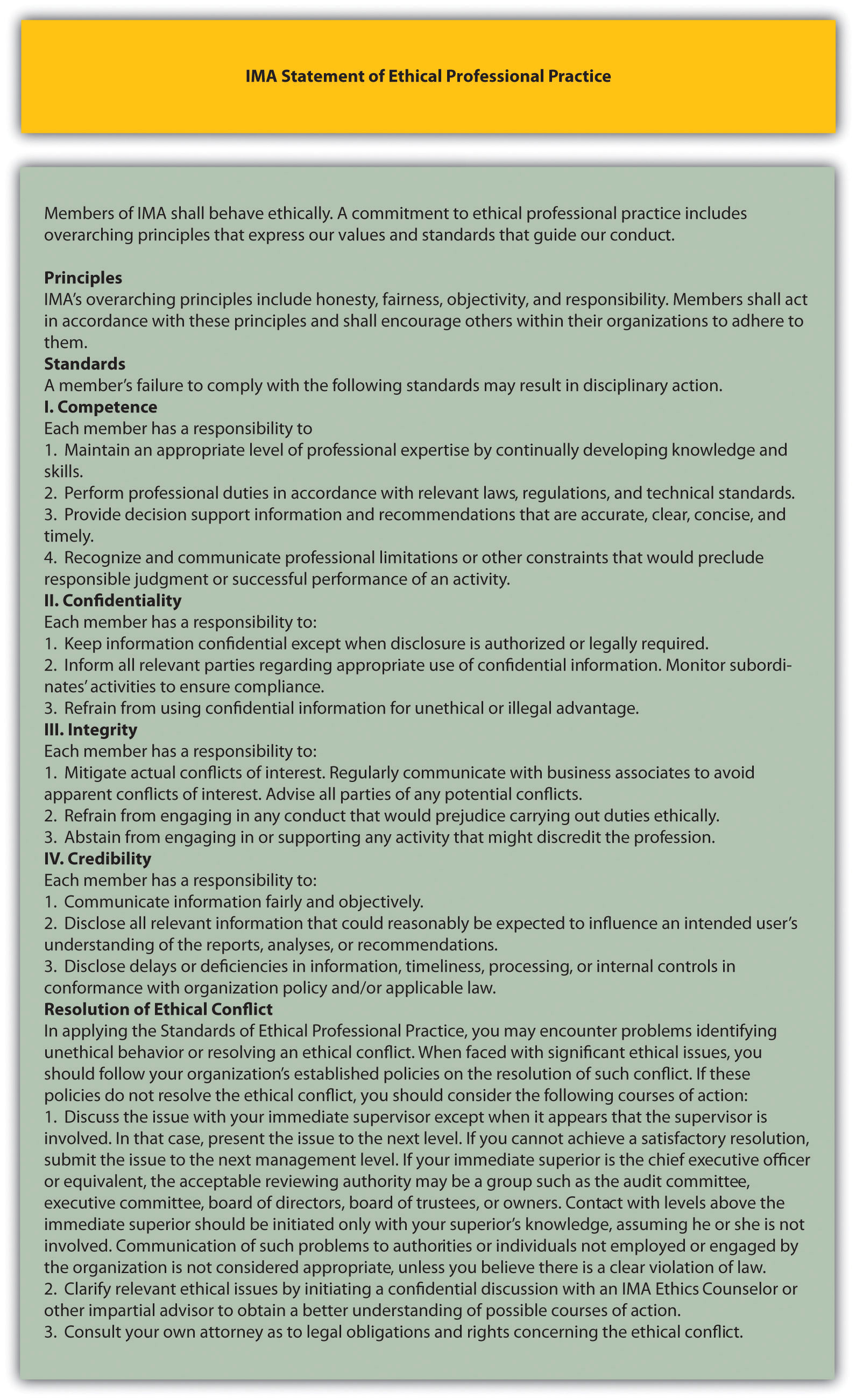

To help guide accounting professionals through ethical dilemmas like the one at Drive Write, the Institute of Management Accountants (IMA) has established a Statement of Ethical Professional Practice, which appears in Figure 1.2 "IMA Statement of Ethical Professional Practice". The standards outlined in this statement are guidelines that can help accountants choose an ethically acceptable course of action. As you review Figure 1.2 "IMA Statement of Ethical Professional Practice", notice that the IMA specifies four core responsibilities (competence, confidentiality, integrity, and credibility) as well as guidelines on how to resolve ethical conflicts. The “Resolution of Ethical Conflict” section provides specific guidance on how to resolve the conflict at Drive Write.

Figure 1.2 IMA Statement of Ethical Professional Practice

Source: Adapted from the Institute of Management Accountants, http://www.imanet.org.

Question: The IMA is just one of many professional accounting organizations. Do other professional accounting organizations also provide guidance regarding ethics in accounting?

Answer: Yes, other professional organizations do provide ethical guidance. Several are listed as follows:

- The American Institute for Certified Public Accountants (AICPA) has a Code of Professional Conduct (see http://www.aicpa.org).

- Financial Executives International provides a Model Code of Ethical Conduct for Financial Managers (see http://www.financialexecutives.org).

- The International Federation of Accountants has a Code of Ethics and Statement of Policy Implementation & Enforcement of Ethical Requirements (see http://www.ifac.org).

- The Securities and Exchange Commission (SEC), in compliance with the Sarbanes-Oxley Act of 2002, requires a company to disclose whether it has adopted a code of ethics (see http://www.sec.gov).

- The Institute of Management Accountants even provides an ethics help line to give financial professionals a resource to provide guidance in making the right decisions (see http://www.imanet.org).

Because of alleged wrongdoing, such as that reported in the Note 1.27 "Business in Action 1.3", improving ethics is a top priority for most businesses as shown in the Note 1.28 "Business in Action 1.4". As a result, professional organizations like those we have cited have become instrumental in providing ethical guidelines.

Business in Action 1.3

Production Firm Employees Charged with Fraud

The Securities and Exchange Commission (SEC) filed three actions against Diebold, Inc., a manufacturer and seller of automated teller machines, for improperly inflating earnings over a five-year period. Three former employees—the CFO, controller, and director of accounting—were accused of improperly inflating revenue on factory orders, improperly recognizing revenue on a lease transaction, manipulating reserves and accruals, improperly capitalizing expenses, and improperly increasing the value of inventory. These actions allegedly resulted in over 40 misstated annual, quarterly, and other reports filed with the SEC, along with numerous inaccurate press releases.

The company agreed to pay a $25,000,000 civil penalty, and the three former employees remain in litigation. Although the CEO was not accused of wrongdoing, he settled with the SEC and agreed to pay back cash bonuses, stock, and stock options received during the periods when the financial fraud was committed.

Source: Securities and Exchange Commission, “SEC Charges Diebold and Former Executives with Accounting Fraud,” news release, June 2, 2010.

Business in Action 1.4

The Code of Ethics at Home Depot and Hewlett-Packard

Ethics policies are becoming increasingly important to organizations. Home Depot, Inc., has an ethics code that “provides the basic principles for associates to make business decisions consistent with how Home Depot operates” and “forms the groundwork for our ethical behavior.”

Hewlett-Packard Company has established “business ethics guided by enduring values.” The company states it is committed to the following principles: honesty, excellence, responsibility, compassion, citizenship, fairness, and respect.

Sources: Home Depot, “Home Page,” http://www.homedepot.com; Hewlett-Packard, “Home Page,” http://www.hp.com.

Key Takeaway

- Should you encounter ethical conflicts during your career, use the resources provided by internal company policies, by professional organizations such as the IMA and AICPA, and by governmental organizations such as the SEC as a guide to ethical behavior and the resolution of ethical conflicts.

Review Problem 1.4

- Describe the four key standards of ethical conduct for IMA members outlined in Figure 1.2 "IMA Statement of Ethical Professional Practice".

- What steps does the IMA recommend for resolving ethical conflicts?

- Using Figure 1.2 "IMA Statement of Ethical Professional Practice" as a guide, discuss your options as the accountant at Drive Write.

Solution to Review Problem 1.4

-

The four key standards shown in Figure 1.2 "IMA Statement of Ethical Professional Practice" are outlined as follows:

- Competence. Members of the IMA must maintain an adequate level of skill to perform duties in an accurate and professional manner.

- Confidentiality. Members of the IMA must not disclose confidential information for any reason unless legally obligated to do so.

- Integrity. Members of the IMA must avoid any actual or apparent conflict of interest, including receiving gifts or favors, and must not engage in any activity that would discredit the profession.

- Credibility. Members of the IMA must disclose all relevant information fairly and objectively.

-

Several options exist for resolving ethical conflicts. The IMA suggests the following courses of action:

- Follow the policies of the organization involving the resolution of ethical conflicts.

- If following the organization’s policies does not effectively resolve the conflict, discuss the problem with your immediate supervisor unless the supervisor is involved.

- If the immediate superior cannot reach a satisfactory resolution, the problem should be presented to the next higher managerial level.

- If all higher levels of management do not reach a satisfactory resolution, an acceptable reviewing authority may be a group, such as the audit committee, executive committee, board of directors, board of trustees, or owners.

- Another option includes consulting an objective advisor (e.g., IMA ethics counseling service or an attorney).

- Several options are available. The IMA suggests first following the organization’s policies with regard to resolving ethical conflicts. If Drive Write does not have policies in place or if following the organization’s policies does not resolve the conflict, the next step is to discuss the conflict with the immediate supervisor. However, the president of Drive Write (the immediate supervisor) is involved in the conflict, so approaching the president’s superiors would be best. This could be the audit committee, executive committee, board of directors, or owners. If after pursuing these different courses of action the ethical conflict still exists, it may be appropriate to consult an objective advisor (e.g., the IMA helpline) and perhaps consult an attorney as to legal obligations and rights concerning the ethical conflict. (Many would argue that regardless of the outcome, one would not want to work for a company where this type of unethical behavior occurs at the top, or anywhere within the organization, and that resigning is the best course of action.)