This is “Introduction to Sales and Leases”, chapter 8 from the book The Legal Environment and Advanced Business Law (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 8 Introduction to Sales and Leases

Learning Objectives

After reading this chapter, you should understand the following:

- Why the law of commercial transactions is separate from the common law

- What is meant by “commercial transactions” and how the Uniform Commercial Code (UCC) deals with them in general

- The scope of Article 2, Article 2A, and the Convention on Contracts for the International Sale of Goods

- What obligations similar to the common law’s are imposed on parties to a UCC contract, and what obligations different from the common law’s are imposed

- The difference between a consumer lease and a finance lease

8.1 Commercial Transactions: the Uniform Commercial Code

Learning Objectives

- Understand why there is a separate body of law governing commercial transactions.

- Be aware of the scope of the Uniform Commercial Code.

- Have a sense of this text’s presentation of the law of commercial transactions.

History of the UCC

In (Reference mayer_1.0-ch08 not found in Book) we introduced the Uniform Commercial Code. As we noted, the UCC has become a national law, adopted in every state—although Louisiana has not enacted Article 2, and differences in the law exist from state to state. Of all the uniform laws related to commercial transactions, the UCC is by far the most successful, and its history goes back to feudal times.

In a mostly agricultural, self-sufficient society there is little need for trade, and almost all law deals with things related to land (real estate): its sale, lease, and devising (transmission of ownership by inheritance); services performed on the land; and damages to the land or to things related to it or to its productive capacity (torts). Such trade as existed in England before the late fourteenth century was dominated by foreigners. But after the pandemic of the Black Death in 1348–49 (when something like 30 percent to 40 percent of the English population died), the self-sufficient feudal manors began to break down. There was a shortage of labor. People could move off the manors to find better work, and no longer tied immediately to the old estates, they migrated to towns. Urban centers—cities—began to develop. Urbanization inevitably reached the point where citizens’ needs could not be met locally. Enterprising people recognized that some places had a surplus of a product and that other places were in need of that surplus and had a surplus of their own to exchange for it. So then, by necessity, people developed the means to transport the surpluses. Enter ships, roads, some medium of exchange, standardized weights and measures, accountants, lawyers, and rules governing merchandising. And enter merchants.

The power of merchants was expressed through franchises obtained from the government which entitled merchants to create their own rules of law and to enforce these rules through their own courts. Franchises to hold fairs [retail exchanges] were temporary; but the franchises of the staple cities, empowered to deal in certain basic commodities [and to have mercantile courts], were permanent.…Many trading towns had their own adaptations of commercial law.… The seventeenth century movement toward national governments resulted in a decline of separate mercantile franchises and their courts. The staple towns…had outlived their usefulness. When the law merchant became incorporated into a national system of laws enforced by national courts of general jurisdiction, the local codes were finally extinguished. But national systems of law necessarily depended upon the older codes for their stock of ideas and on the changing customs of merchants for new developments.Frederick G. Kempin Jr., Historical Introduction to Anglo-American Law (Eagan, MN: West, 1973), 217–18, 219–20, 221.

When the American colonies declared independence from Britain, they continued to use British law, including the laws related to commercial transactions. By the early twentieth century, the states had inconsistent rules, making interstate commerce difficult and problematic. Several uniform laws affecting commercial transactions were floated in the late nineteenth century, but few were widely adopted. In 1942, the American Law Institute (ALI)American Law Insitute, “ALI Overview,” accessed March 1, 2011, http://www.ali.org/index.cfm?fuseaction=about.overview. hired staff to begin work on a rationalized, simplified, and harmonized national body of modern commercial law. The ALI’s first draft of the UCC was completed in 1951.The UCC was adopted by Pennsylvania two years later, and other states followed in the 1950s and 1960s.

In the 1980s and 1990s, the leasing of personal property became a significant factor in commercial transactions, and although the UCC had some sections that were applicable to leases, the law regarding the sale of goods was inadequate to address leases. Article 2A governing the leasing of goods was approved by the ALI in 1987. It essentially repeats Article 2 but applies to leases instead of sales. In 2001, amendments to Article 1—which applies to the entire UCC—were proposed and subsequently have been adopted by over half the states. No state has yet adopted the modernizing amendments to Article 2 and 2A that the ALI proposed in 2003.

That’s the short history of why the body of commercial transaction law is separate from the common law.

Scope of the UCC and This Text’s Presentation of the UCC

The UCC embraces the law of commercial transactions, a term of some ambiguity. A commercial transaction may seem to be a series of separate transactions; it may include, for example, the making of a contract for the sale of goods, the signing of a check, the endorsement of the check, the shipment of goods under a bill of lading, and so on. However, the UCC presupposes that each of these transactions is a facet of one single transaction: the lease or sale of, and payment for, goods. The code deals with phases of this transaction from start to finish. These phases are organized according to the following articles:

- Sales (Article 2)

- Leases (Article 2A)

- Commercial Paper (Article 3)

- Bank Deposits and Collections (Article 4)

- Funds Transfers (Article 4A)

- Letters of Credit (Article 5)

- Bulk Transfers (Article 6)

- Warehouse Receipts, Bills of Lading, and Other Documents of Title (Article 7)

- Investment Securities (Article 8)

- Secured Transactions; Sales of Accounts and Chattel Paper (Article 9)

Although the UCC comprehensively covers commercial transactions, it does not deal with every aspect of commercial law. Among the subjects not covered are the sale of real property, mortgages, insurance contracts, suretyship transactions (unless the surety is party to a negotiable instrument), and bankruptcy. Moreover, common-law principles of contract law that were examined in previous chapters continue to apply to many transactions covered in a particular way by the UCC. These principles include capacity to contract, misrepresentation, coercion, and mistake. Many federal laws supersede the UCC; these include the Bills of Lading Act, the Consumer Credit Protection Act, the warranty provisions of the Magnuson-Moss Act, and other regulatory statutes.

We follow the general outlines of the UCC in this chapter and in Chapter 9 "Title and Risk of Loss" and Chapter 10 "Performance and Remedies". In this chapter, we cover the law governing sales (Article 2) and make some reference to leases (Article 2A), though space constraints preclude an exhaustive analysis of leases. The use of documents of title to ship and store goods is closely related to sales, and so we cover documents of title (Article 7) as well as the law of bailments in Chapter 12 "Bailments and the Storage, Shipment, and Leasing of Goods".

In Chapter 13 "Nature and Form of Commercial Paper", Chapter 14 "Negotiation of Commercial Paper", Chapter 15 "Holder in Due Course and Defenses", and Chapter 16 "Liability and Discharge", we cover the giving of a check, draft, or note (commercial paper) for part or all of the purchase price and the negotiation of the commercial paper (Article 3). Related matters, such as bank deposits and collections (Article 4), funds transfers (Article 4A), and letters of credit (Article 5), are also covered there.

In Chapter 19 "Secured Transactions and Suretyship" we turn to acceptance of security by the seller or lender for financing the balance of the payment due. Key to this area is the law of secured transactions (Article 9), but other types of security (e.g., mortgages and suretyship) not covered in the UCC will also be discussed in Chapter 20 "Mortgages and Nonconsensual Liens". Chapter 18 "Consumer Credit Transactions" covers consumer credit transactions and Chapter 21 "Bankruptcy" covers bankruptcy law; these topics are important for all creditors, even those lacking some form of security.

Finally, the specialized topic of Article 8, investment securities (e.g., corporate stocks and bonds), is treated in (Reference mayer_1.0-ch43 not found in Book).

We now turn our attention to the sale—the first facet, and the cornerstone, of the commercial transaction.

Key Takeaway

In the development of the English legal system, commercial transactions were originally of such little importance that the rules governing them were left to the merchants themselves. They had their own courts and adopted their own rules based on their customary usage. By the 1700s, the separate courts had been absorbed into the English common law, but the distinct rules applicable to commercial transactions remained and have carried over to the modern UCC. The UCC treats commercial transactions in phases, and this text basically traces those phases.

Exercises

- Why were medieval merchants compelled to develop their own rules about commercial transactions?

- Why was the UCC developed, and when was the period of its initial adoption by states?

8.2 Introduction to Sales and Lease Law, and the Convention on Contracts for the International Sale of Goods

Learning Objectives

- Understand that the law of sales not only incorporates many aspects of common-law contract but also addresses some distinct issues that do not occur in contracts for the sale of real estate or services.

- Understand the scope of Article 2 and the definitions of sale and goods.

- Learn how courts deal with hybrid situations: mixtures of the sale of goods and of real estate, mixtures of goods and services.

- Recognize the scope of Article 2A and the definitions of lease, consumer lease, and finance lease.

- Learn about the Convention on Contracts for the International Sale of Goods and why it is relevant to our discussion of Article 2.

Scope of Articles 2 and 2A and Definitions

In dealing with any statute, it is of course very important to understand the statute’s scope or coverage.

Article 2 does not govern all commercial transactions, only sales. It does not cover all sales, only the sale of goods. Article 2A governs leases, but only of personal property (goods), not real estate. The Convention on Contracts for the International Sale of Goods (CISG)—kind of an international Article 2—“applies to contracts of sale of goods between parties whose places of business are in different States [i.e., countries]” (CISG, Article 1). So we need to consider the definitions of sale, goods, and lease.

Definition of Sale

A saleAn arrangement whereby the lessee comes to own the leased goods after the term of the lease for little additional consideration. “consists in the passing of title from the seller to the buyer for a price.”Uniform Commercial Code, Section 2-106.

Sales are distinguished from gifts, bailments, leases, and secured transactions. Article 2 sales should be distinguished from gifts, bailments, leases, and secured transactions. A giftA thing bestowed on another gratuitously as a present. is the transfer of title without consideration, and a “contract” for a gift of goods is unenforceable under the Uniform Commercial Code (UCC) or otherwise (with some exceptions). A bailmentThe rightful possession of goods by one not their owner. is the transfer of possession but not title or use; parking your car in a commercial garage often creates a bailment with the garage owner. A lease (see the formal definition later in this chapter) is a fixed-term arrangement for possession and use of something—computer equipment, for example—and does not transfer title. In a secured transactionA mortgage on personal property so that the creditor may repossess it in case the debtor-owner defaults., the owner-debtor gives a security interest in collateral to a creditor that allows the creditor to repossess the collateral if the owner defaults.

Definition of Goods

Even if the transaction is considered a sale, the question still remains whether the contract concerns the sale of goods. Article 2 applies only to goods; sales of real estate and services are governed by non-UCC law. Section 2-105(1) of the UCC defines goodsUnder the UCC, all things movable at the time of the contract. as “all things…which are movable at the time of identification to the contract for sale other than the money in which the price is to be paid.” Money can be considered goods subject to Article 2 if it is the object of the contract—for example, foreign currency.

In certain cases, the courts have difficulty applying this definition because the item in question can also be viewed as realty or service. Most borderline cases raise one of two general questions:

- Is the contract for the sale of the real estate, or is it for the sale of goods?

- Is the contract for the sale of goods, or is it for services?

Real Estate versus Goods

The dilemma is this: A landowner enters into a contract to sell crops, timber, minerals, oil, or gas. If the items have already been detached from the land—for example, timber has been cut and the seller agrees to sell logs—they are goods, and the UCC governs the sale. But what if, at the time the contract is made, the items are still part of the land? Is a contract for the sale of uncut timber governed by the UCC or by real estate law?

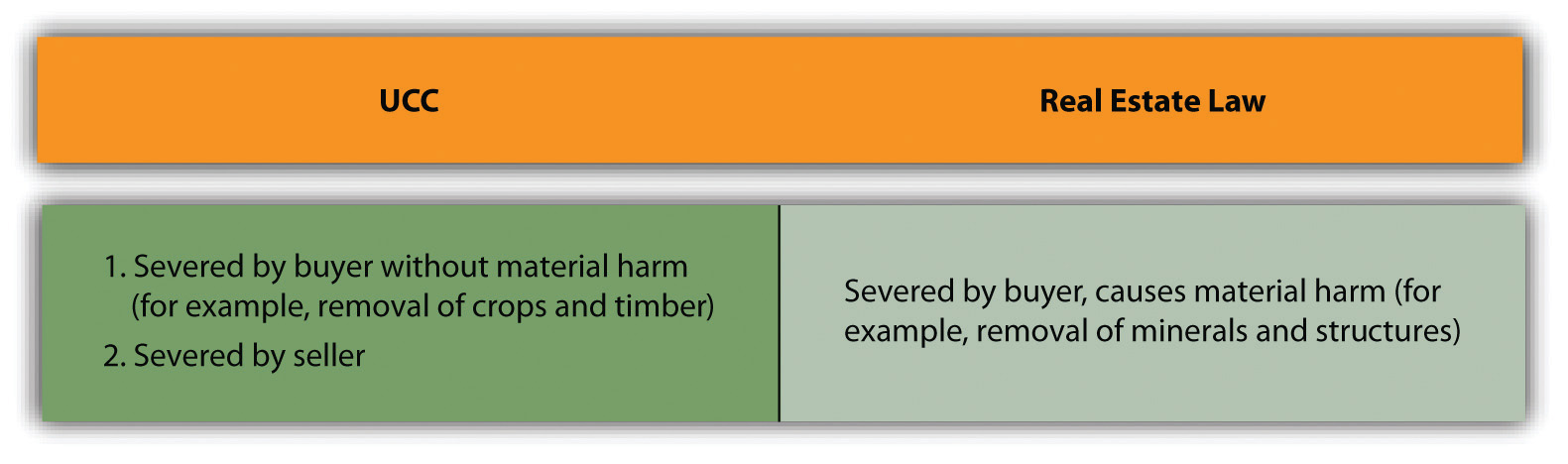

The UCC governs under either of two circumstances: (1) if the contract calls for the seller to sever the items or (2) if the contract calls for the buyer to sever the items and if the goods can be severed without material harm to the real estate.Uniform Commercial Code, Section 2-107. The second provision specifically includes growing crops and timber. By contrast, the law of real property governs if the buyer’s severance of the items will materially harm the real estate; for example, the removal of minerals, oil, gas, and structures by the buyer will cause the law of real property to govern. (See Figure 8.1 "Governing Law".)

Figure 8.1 Governing Law

Goods versus Services

Distinguishing goods from services is the other major difficulty that arises in determining the nature of the object of a sales contract. The problem: how can goods and services be separated in contracts calling for the seller to deliver a combination of goods and services? That issue is examined in Section 8.5.1 "Mixed Goods and Services Contracts: The “Predominant Factor” Test" (Pittsley v. Houser), where the court applied the common “predominant factor” (also sometimes “predominate purpose” or “predominant thrust”) test—that is, it asked whether the transaction was predominantly a contract for goods or for services. However, the results of this analysis are not always consistent. Compare Epstein v. Giannattasio, in which the court held that no sale of goods had been made because the plaintiff received a treatment in which the cosmetics were only incidentally used, with Newmark v. Gimble’s, Inc., in which the court said “[i]f the permanent wave lotion were sold…for home consumption…unquestionably an implied warranty of fitness for that purpose would have been an integral incident of the sale.”Epstein v. Giannattasio 197 A.2d 342 (Conn. 1963); Newmark v. Gimble’s, Inc., 258 A.2d 697 (N.J. 1969). The New Jersey court rejected the defendant’s argument that by actually applying the lotion to the patron’s head, the salon lessened the liability it otherwise would have had if it had simply sold her the lotion.

In two areas, state legislatures have taken the goods-versus-services issue out of the courts’ hands and resolved the issue through legislation. Food sold in restaurants is a sale of goods, whether it is to be consumed on or off the premises. Blood transfusions (really the sale of blood) in hospitals have been legislatively declared a service, not a sale of goods, in more than forty states, thus relieving the suppliers and hospitals of an onerous burden for liability from selling blood tainted with the undetectable hepatitis virus.

Definition of Lease

Section 2A-103(j) of the UCC defines a leaseThe transfer of right of possession and use for a price. as “a transfer of the right to possession and use of goods for a term in return for consideration.” The lessorOne who gives possession of leased goods to another for a price. is the one who transfers the right to possession to the lesseeOne who takes possession of and uses leased goods for a price.. If Alice rents a party canopy from Equipment Supply, Equipment Supply is the lessor and Alice is the lessee.

Two Types of Leases

The UCC recognizes two kinds of leases: consumer leases and finance leases. A consumer leaseA lease of goods by a lessor to a lessee for household uses. is used when a lessor leases goods to “an individual…primarily for personal, family, or household purposes,” where total lease payments are less than $25,000.Uniform Commercial Code, Section 2A-103(e). The UCC grants some special protections to consumer lessees. A finance leaseA lease by a lessor who buys or obtains the goods from a supplier for the purpose of leasing them to a commercial lessee. is used when a lessor “acquires the goods or the right to [them]” and leases them to the lessee.Uniform Commercial Code, Section 2A-103(g). The person from whom the lessor acquires the goods is a supplier, and the lessor is simply financing the deal. Jack wants to lease a boom lift (personnel aerial lift, also known as a cherry picker) for a commercial roof renovation. First Bank agrees to buy (or itself lease) the machine from Equipment Supply and in turn lease it to Jack. First Bank is the lessor, Jack is the lessee, and Equipment Supply is the supplier.

International Sales of Goods

The UCC is, of course, American law, adopted by the states of the United States. The reason it has been adopted is because of the inconvenience of doing interstate business when each state had a different law for the sale of goods. The same problem presents itself in international transactions. As a result, the United Nations Commission on International Trade Law developed an international equivalent of the UCC, the Convention on Contracts for the International Sale of Goods (CISG), first mentioned in (Reference mayer_1.0-ch08 not found in Book). It was promulgated in Vienna in 1980. As of July 2010, the convention (a type of treaty) has been adopted by seventy-six countries, including the United States and all its major trading partners except the United Kingdom. One commentator opined on why the United Kingdom is an odd country out: it is “perhaps because of pride in its longstanding common law legal imperialism or in its long-treasured feeling of the superiority of English law to anything else that could even challenge it.”A. F. M. Maniruzzaman, quoted by Albert H. Kritzer, Pace Law School Institute of International Commercial Law, CISG: Table of Contracting States, accessed March 1, 2011, http://www.cisg.law.pace.edu/cisg/countries/cntries.html.

The CISG is interesting for two reasons. First, assuming globalization continues, the CISG will become increasingly important around the world as the law governing international sale contracts. Its preamble states, “The adoption of uniform rules which govern contracts for the international sale of goods and take into account the different social, economic and legal systems [will] contribute to the removal of legal barriers in international trade and promote the development of international trade.” Second, it is interesting to compare the legal culture informing the common law to that informing the CISG, which is not of the English common-law tradition. Throughout our discussion of Article 2, we will make reference to the CISG, the complete text of which is available online.Pace Law School, “United Nations Convention on Contracts for the International Sale of Goods (1980) [CISG]” CISG Database, accessed March 1, 2011, http://www.cisg.law.pace.edu/cisg/text/treaty.html. References to the CISG are in bold.

As to the CISG’s scope, CISG Article 1 provides that it “applies to contracts of sale of goods between parties whose places of business are in different States [i.e., countries]; it “governs only the formation of the contract of sale and the rights and obligations of the seller and the buyer arising from such a contract,” and has nothing to do “with the validity of the contract or of any of its provisions or of any usage” (Article 4). It excludes sales (a) of goods bought for personal, family or household use, unless the seller, at any time before or at the conclusion of the contract, neither knew nor ought to have known that the goods were bought for any such use; (b) by auction; (c) on execution or otherwise by authority of law; (d) of stocks, shares, investment securities, negotiable instruments or money; (e) of ships, vessels, hovercraft or aircraft; (f) of electricity (Article 2).

Parties are free to exclude the application of the Convention or, with a limited exception, vary the effect of any of its provisions (Article 6).

Key Takeaway

Article 2 of the UCC deals with the sale of goods. Sale and goods have defined meanings. Article 2A of the UCC deals with the leasing of goods. Lease has a defined meaning, and the UCC recognizes two types of leases: consumer leases and finance leases. Similar in purpose to the UCC of the United States is the Convention on Contracts for the International Sale of Goods, which has been widely adopted around the world.

Exercises

- Why is there a separate body of statutory law governing contracts for the sale of goods as opposed to the common law, which governs contracts affecting real estate and services?

- What is a consumer lease? A finance lease?

- What is the Convention on Contracts for the International Sale of Goods?

8.3 Sales Law Compared with Common-Law Contracts and the CISG

Learning Objective

-

Recognize the differences and similarities among the Uniform Commercial Code (UCC), common-law contracts, and the CISG as related to the following contract issues:

- Offer and acceptance

- Revocability

- Consideration

- The requirement of a writing and contractual interpretation (form and meaning)

Sales law deals with the sale of goods. Sales law is a special type of contract law, but the common law informs much of Article 2 of the UCC—with some differences, however. Some of the similarities and differences were discussed in previous chapters that covered common-law contracts, but a review here is appropriate, and we can refer briefly to the CISG’s treatment of similar issues.

Mutual Assent: Offer and Acceptance

Definiteness of the Offer

The common law requires more definiteness than the UCC. Under the UCC, a contractual obligation may arise even if the agreement has open termsUnder the UCC, a term that has not been expressed in the contract.. Under Section 2-204(3), such an agreement for sale is not voidable for indefiniteness, as in the common law, if the parties have intended to make a contract and the court can find a reasonably certain basis for giving an appropriate remedy. Perhaps the most important example is the open price term.

The open price term is covered in detail in Section 2-305. At common law, a contract that fails to specify price or a means of accurately ascertaining price will almost always fail. This is not so under the UCC provision regarding open price terms. If the contract says nothing about price, or if it permits the parties to agree on price but they fail to agree, or if it delegates the power to fix price to a third person who fails to do so, then Section 2-305(1) “plugs” the open term and decrees that the price to be awarded is a “reasonable price at the time for delivery.” When one party is permitted to fix the price, Section 2-305(2) requires that it be fixed in good faith. However, if the parties intend not to be bound unless the price is first fixed or agreed on, and it is not fixed or agreed on, then no contract results.Uniform Commercial Code, Section 2-305(4).

Another illustration of the open term is in regard to particulars of performance. Section 2-311(1) provides that a contract for sale of goods is not invalid just because it leaves to one of the parties the power to specify a particular means of performing. However, “any such specification must be made in good faith and within limits set by commercial reasonableness.” (Performance will be covered in greater detail in Chapter 9 "Title and Risk of Loss".)

The CISG (Article 14) provides the following: “A proposal for concluding a contract addressed to one or more specific persons constitutes an offer if it is sufficiently definite and indicates the intention of the offeror to be bound in case of acceptance. A proposal is sufficiently definite if it indicates the goods and expressly or implicitly fixes or makes provision for determining the quantity and the price.”

Acceptance Varying from Offer: Battle of the Forms

The concepts of offer and acceptance are basic to any agreement, but the UCC makes a change from the common law in its treatment of an acceptance that varies from the offer (this was discussed in (Reference mayer_1.0-ch08 not found in Book)). At common law, where the “mirror image rule” reigns, if the acceptance differs from the offer, no contract results. If that were the rule for sales contracts, with the pervasive use of form contracts—where each side’s form tends to favor that side—it would be very problematic.

Section 2-207 of the UCC attempts to resolve this “battle of the forms” by providing that additional terms or conditions in an acceptance operate as such unless the acceptance is conditioned on the offeror’s consent to the new or different terms. The new terms are construed as offers but are automatically incorporated in any contract between merchants for the sale of goods unless “(a) the offer expressly limits acceptance to the terms of the offer; (b) [the terms] materially alter it; or (c) notification of objection to them has already been given or is given within a reasonable time after notice of them is received.” In any case, Section 2-207 goes on like this: “Conduct by both parties which recognizes the existence of a contract is sufficient to establish a contract for sale although the writings of the parties do not otherwise establish a contract. In such case the terms of the particular contract consist of those terms on which the writings of the parties agree, together with any supplementary terms incorporated under any other provisions of this Act.”This section of the UCC is one of the most confusing and fiercely litigated sections; Professor Grant Gilmore once called it a “miserable, bungled, patched-up job” and “arguably the greatest statutory mess of all time.” Mark E. Roszkowski, “Symposium on Revised Article 2 of the Uniform Commercial Code—Section-by-Section Analysis,” SMU Law Review 54 (Spring 2001): 927, 932, quoting Professor Grant Gilmore to Professor Robert Summers, Cornell University School of Law, September 10, 1980, in Teaching Materials on Commercial and Consumer Law, ed. Richard E. Speidel, Robert S Summers, and James J White, 3rd ed. (St. Paul, MN: West. 1981), pp. 54–55. In 2003 the UCC revisioners presented an amendment to this section in an attempt to fix Section 2-207, but no state has adopted this section’s revision. See Commercial Law, “UCC Legislative Update,” March 2, 2010, accessed March 1, 2011, http://ucclaw.blogspot.com/2010/03/ucc-legislative-update.html.

As to international contracts, the CISG says this about an acceptance that varies from the offer (Article 19), and it’s pretty much the same as the UCC:

(1) A reply to an offer which purports to be an acceptance but contains additions, limitations or other modifications is a rejection of the offer and constitutes a counter-offer.

(2) However, a reply to an offer which purports to be an acceptance but contains additional or different terms which do not materially alter the terms of the offer constitutes an acceptance, unless the offeror, without undue delay, objects orally to the discrepancy or dispatches a notice to that effect. If he does not so object, the terms of the contract are the terms of the offer with the modifications contained in the acceptance.

(3) Additional or different terms relating, among other things, to the price, payment, quality and quantity of the goods, place and time of delivery, extent of one party’s liability to the other or the settlement of disputes are considered to alter the terms of the offer materially.

Revocation of Offer

Under both common law and the UCC, an offer can be revoked at any time prior to acceptance unless the offeror has given the offeree an option (supported by consideration); under the UCC, an offer can be revoked at any time prior to acceptance unless a merchant gives a “firm offerA promise by a merchant to buy or sell goods in a signed (or “authenticated”) writing that is not revocable during the time stated or for a reasonable time not to exceed six months (UCC 2-205).” (for which no consideration is needed). The CISG (Article 17) provides that an offer is revocable before it is accepted unless, however, “it indicates…that it is irrevocable” or if the offeree reasonably relied on its irrevocability.

Reality of Consent

There is no particular difference between the common law and the UCC on issues of duress, misrepresentation, undue influence, or mistake. As for international sales contracts, the CISG provides (Article 4(a)) that it “governs only the formation of the contract of sale and the rights and obligations of the seller and the buyer arising from such a contract and is not concerned with the validity of the contract or of any of its provisions.”

Consideration

The UCC

The UCC requires no consideration for modification of a sales contract made in good faith; at common law, consideration is required to modify a contract.Uniform Commercial Code, Section 2-209(1). The UCC requires no consideration if one party wants to forgive another’s breach by written waiver or renunciation signed and delivered by the aggrieved party; under common law, consideration is required to discharge a breaching party.Uniform Commercial Code, Section 1–107. The UCC requires no consideration for a “firm offer”—a writing signed by a merchant promising to hold an offer open for some period of time; at common law an option requires consideration. (Note, however, the person can give an option under either common law or the code.)

Under the CISG (Article 29), “A contract may be modified or terminated by the mere agreement of the parties.” No consideration is needed.

Form and Meaning

Requirement of a Writing

The common law has a Statute of Frauds, and so does the UCC. It requires a writing to enforce a contract for the sale of goods worth $500 or more, with some exceptions, as discussed in (Reference mayer_1.0-ch13 not found in Book).Proposed amendments by UCC revisioners presented in 2003 would have raised the amount of money—to take into account inflation since the mid-fifties—to $5,000, but no state has yet adopted this amendment; Uniform Commercial Code, Section 2-201.

The CISG provides (Article 11), “A contract of sale need not be concluded in or evidenced by writing and is not subject to any other requirement as to form. It may be proved by any means, including witnesses.” But Article 29 provides, “A contract in writing which contains a provision requiring any modification or termination by agreement to be in writing may not be otherwise modified or terminated by agreement.”

Parol Evidence

Section 2-202 of the UCC provides pretty much the same as the common law: if the parties have a writing intended to be their final agreement, it “may not be contradicted by evidence of any prior agreement or of a contemporaneous oral agreement.” However, it may be explained by “course of dealing or usage of trade or by course of performance” and “by evidence of consistent additional terms.”

The CISG provides (Article 8) the following: “In determining the intent of a party or the understanding a reasonable person would have had, due consideration is to be given to all relevant circumstances of the case including the negotiations, any practices which the parties have established between themselves, usages and any subsequent conduct of the parties.”

Key Takeaway

The UCC modernizes and simplifies some common-law strictures. Under the UCC, the mirror image rule is abolished: an acceptance may sometimes differ from the offer, and the UCC can “plug” open terms in many cases. No consideration is required under the UCC to modify or terminate a contract or for a merchant’s “firm offer,” which makes the offer irrevocable according to its terms. The UCC has a Statute of Frauds analogous to the common law, and its parol evidence rule is similar as well. The CISG compares fairly closely to the UCC.

Exercises

- Why does the UCC change the common-law mirror image rule, and how?

- What is meant by “open terms,” and how does the UCC handle them?

- The requirement for consideration is relaxed under the UCC compared with common law. In what circumstances is no consideration necessary under the UCC?

- On issues so far discussed, is the CISG more aligned with the common law or with the UCC? Explain your answer.

8.4 General Obligations under UCC Article 2

Learning Objectives

- Know that the Uniform Commercial Code (UCC) imposes a general obligation to act in good faith and that it makes unconscionable contracts or parts of a contract unenforceable.

- Recognize that though the UCC applies to all sales contracts, merchants have special obligations.

- See that the UCC is the “default position”—that within limits, parties are free to put anything they want to in their contract.

Article 2 of the UCC of course has rules governing the obligations of parties specifically as to the offer, acceptance, performance of sales contracts, and so on. But it also imposes some general obligations on the parties. Two are called out here: one deals with unfair contract terms, and the second with obligations imposed on merchants.

Obligation of Good-Faith Dealings in General

Under the UCC

Section 1-203 of the UCC provides, “Every contract or duty within this Act imposes an obligation of good faith in its performance or enforcement.” Good faith is defined at Section 2-103(j) as “honesty in fact and the observance of reasonable commercial standards of fair dealing.” This is pretty much the same as what is held by common law, which “imposes a duty of good faith and fair dealing upon the parties in performing and enforcing the contract.”Restatement (Second) of Contracts, Section 205.

The UCC’s good faith in “performance or enforcement” of the contract is one thing, but what if the terms of the contract itself are unfair? Under Section 2-302(1), the courts may tinker with a contract if they determine that it is particularly unfair. The provision reads as follows: “If the court as a matter of law finds the contract or any clause of the contract to have been unconscionable at the time it was made the court may refuse to enforce the contract, or it may enforce the remainder of the contract without the unconscionable clause, or it may so limit the application of any unconscionable clause as to avoid any unconscionable result.”

The court thus has considerable flexibility. It may refuse to enforce the entire contract, strike a particular clause or set of clauses, or limit the application of a particular clause or set of clauses.

And what does “unconscionable” mean? The UCC provides little guidance on this crucial question. According to Section 2-302(1), the test is “whether, in the light of the general commercial background and the commercial needs of the particular trade or case, the clauses involved are so one-sided as to be unconscionable under the circumstances existing at the time of the making of the contract.…The principle is one of the prevention of oppression and unfair surprise and not of disturbance of allocation of risks because of superior bargaining power.”

The definition is somewhat circular. For the most part, judges have had to develop the concept with little help from the statutory language. Unconscionability is much like US Supreme Court Justice Potter Stewart’s famous statement about obscenity: “I can’t define it, but I know it when I see it.” In the leading case, Williams v. Walker-Thomas Furniture Co. ((Reference mayer_1.0-ch12_s05_s03 not found in Book), set out in (Reference mayer_1.0-ch12 not found in Book)), Judge J. Skelly Wright attempted to develop a framework for analysis. He refined the meaning of unconscionability by focusing on “absence of meaningful choice” (often referred to as procedural unconscionabilityUnfairness in the process of contract making, as when the contract is in such fine print it cannot be read.) and on terms that are “unreasonably favorable” (commonly referred to as substantive unconscionabilityContract terms so harsh and one-sided as to be unacceptably unfair.). An example of procedural unconscionability is the salesperson who says, “Don’t worry about all that little type on the back of this form.” Substantive unconscionability is the harsh term—the provision that permits the “taking of a pound of flesh” if the contract is not honored.

Despite its fuzziness, the concept of unconscionability has had a dramatic impact on American law. In many cases, in fact, the traditional notion of caveat emptor (Latin for “buyer beware”) has changed to caveat venditor (“let the seller beware”). So important is this provision that courts in recent years have applied the doctrine in cases not involving the sale of goods.

Under the CISG, Article 7: “Regard is to be had…to the observance of good faith in international trade.”

Obligations Owed by Merchants

“Merchant” Sellers

Although the UCC applies to all sales of goods (even when you sell your used car to your neighbor), merchants often have special obligations or are governed by special rules.

As between Merchants

The UCC assumes that merchants should be held to particular standards because they are more experienced and have or should have special knowledge. Rules applicable to professionals ought not apply to the casual or inexperienced buyer or seller. For example, we noted previously that the UCC relaxes the mirror image rule and provides that as “between merchants” additional terms in an acceptance become part of the contract, and we have discussed the “ten-day-reply doctrine” that says that, again “as between merchants,” a writing signed and sent to the other binds the recipient as an exception to the Statute of Frauds.Uniform Commercial Code, Sections 2-205 and 2A–205. There are other sections of the UCC applicable “as between merchants,” too.

Article 1 of the CISG abolishes any distinction between merchants and nonmerchants: “Neither the nationality of the parties nor the civil or commercial character of the parties or of the contract is to be taken into consideration in determining the application of this Convention.”

Merchant to Nonmerchant

In addition to duties imposed between merchants, the UCC imposes certain duties on a merchant when she sells to a nonmerchant. A merchant who sells her merchandise makes an important implied warranty of merchantabilityAn unexpressed promise that goods bought from a merchant are suitable for the purposes for which such goods are normally intended.. That is, she promises that goods sold will be fit for the purpose for which such goods are normally intended. A nonmerchant makes no such promise, nor does a merchant who is not selling merchandise—for example, a supermarket selling a display case is not a “merchant” in display cases.

In Sheeskin v. Giant Foods, Inc., the problem of whether a merchant made an implied warranty of merchantability was nicely presented. Mr. Seigel, the plaintiff, was carrying a six-pack carton of Coca-Cola from a display bin to his shopping cart when one or more of the bottles exploded. He lost his footing and was injured. When he sued the supermarket and the bottler for breach of the implied warranty of fitness, the defendants denied there had been a sale: he never paid for the soda pop, thus no sale by a merchant and thus no warranty. The court said that Mr. Seigel’s act of reaching for the soda to put it in his cart was a “reasonable manner of acceptance” (quoting UCC, Section 2-206(1)).Sheeskin v. Giant Food, Inc., 318 A.2d 874 (Md. Ct. App. 1974).

Who Is a Merchant?

Section 2-104(1) of the UCC defines a merchant as one “who deals in goods of the kind or otherwise by his occupation holds himself out as having knowledge or skill peculiar to the practices or goods involved in the transaction.” A phrase that recurs throughout Article 2—“between merchants”—refers to any transaction in which both parties are chargeable with the knowledge or skill of merchants.Uniform Commercial Code, Section 2-104(3). Not every businessperson is a merchant with respect to every possible transaction. But a person or institution normally not considered a merchant can be one under Article 2 if he employs an agent or broker who holds himself out as having such knowledge or skill. (Thus a university with a purchasing office can be a merchant with respect to transactions handled by that department.)

Determining whether a particular person operating a business is a merchant under Article 2-104 is a common problem for the courts. Goldkist, Inc. v. Brownlee, Section 8.5.2 "“Merchants” under the UCC", shows that making the determination is difficult and contentious, with significant public policy implications.

Obligations May Be Determined by Parties

Under the UCC

Under the UCC, the parties to a contract are free to put into their contract pretty much anything they want. Article 1-102 states that “the effect of provisions of this Act may be varied by agreement…except that the obligations of good faith, diligence, reasonableness and care prescribed by this Act may not be disclaimed by agreement but the parties may by agreement determine the standards by which the performance of such obligations is to be measure if such standards are not manifestly unreasonable.” Thus the UCC is the “default” position: if the parties want the contract to operate in a specific way, they can provide for that. If they don’t put anything in their agreement about some aspect of their contract’s operation, the UCC applies. For example, if they do not state where “delivery” will occur, the UCC provides that term. (Section 2-308 says it would be at the “seller’s place of business or if he has none, his residence.”)

Article 6 of the CISG similarly gives the parties freedom to contract. It provides, “The parties may exclude the application of this Convention or…vary the effect of any of its provisions.”

Key Takeaway

The UCC imposes some general obligations on parties to a sales contract. They must act in good faith, and unconscionable contracts or terms thereof will not be enforced. The UCC applies to any sale of goods, but sometimes special obligations are imposed on merchants. While the UCC imposes various general (and more specific) obligations on the parties, they are free, within limits, to make up their own contract terms and obligations; if they do not, the UCC applies. The CISG tends to follow the basic thrust of the UCC.

Exercises

- What does the UCC say about the standard duty parties to a contract owe each other?

- Why are merchants treated specially by the UCC in some circumstances?

- Give an example of a merchant-to-merchant duty imposed by the UCC and of a merchant-to-nonmerchant duty.

- What does it mean to say the UCC is the “default” contract term?

8.5 Cases

Mixed Goods and Services Contracts: The “Predominant Factor” Test

Pittsley v. Houser

875 P.2d 232 (Idaho App. 1994)

Swanstrom, J.

In September of 1988, Jane Pittsley contracted with Hilton Contract Carpet Co. (Hilton) for the installation of carpet in her home. The total contract price was $4,402 [about $7,900 in 2010 dollars]. Hilton paid the installers $700 to put the carpet in Pittsley’s home. Following installation, Pittsley complained to Hilton that some seams were visible, that gaps appeared, that the carpet did not lay flat in all areas, and that it failed to reach the wall in certain locations. Although Hilton made various attempts to fix the installation, by attempting to stretch the carpet and other methods, Pittsley was not satisfied with the work. Eventually, Pittsley refused any further efforts to fix the carpet. Pittsley initially paid Hilton $3,500 on the contract, but refused to pay the remaining balance of $902.

Pittsley later filed suit, seeking rescission of the contract, return of the $3,500 and incidental damages. Hilton answered and counterclaimed for the balance remaining on the contract. The matter was heard by a magistrate sitting without a jury. The magistrate found that there were defects in the installation and that the carpet had been installed in an unworkmanlike manner. The magistrate also found that there was a lack of evidence on damages. The trial was continued to allow the parties to procure evidence on the amount of damages incurred by Pittsley. Following this continuance, Pittsley did not introduce any further evidence of damages, though witnesses for Hilton estimated repair costs at $250.

Although Pittsley had asked for rescission of the contract and a refund of her money, the magistrate determined that rescission, as an equitable remedy, was only available when one party committed a breach so material that it destroyed the entire purpose of the contract. Because the only estimate of damages was for $250, the magistrate ruled rescission would not be a proper remedy. Instead, the magistrate awarded Pittsley $250 damages plus $150 she expended in moving furniture prior to Hilton’s attempt to repair the carpet. On the counterclaim, the magistrate awarded Hilton the $902 remaining on the contract. Additionally, both parties had requested attorney fees in the action. The magistrate determined that both parties had prevailed and therefore awarded both parties their attorney fees.

Following this decision, Pittsley appealed to the district court, claiming that the transaction involved was governed by the Idaho Uniform Commercial Code (UCC), [Citation]. Pittsley argued that if the UCC had been properly applied, a different result would have been reached. The district court agreed with Pittsley’s argument, reversing and remanding the case to the magistrate to make additional findings of fact and to apply the UCC to the transaction.…

Hilton now appeals the decision of the district court. Hilton claims that Pittsley failed to allege or argue the UCC in either her pleadings or at trial. Even if application of the UCC was properly raised, Hilton argues that there were no defects in the goods that were the subject of the transaction, only in the installation, making application of the UCC inappropriate.…

The single question upon which this appeal depends is whether the UCC is applicable to the subject transaction. If the underlying transaction involved the sale of “goods,” then the UCC would apply. If the transaction did not involve goods, but rather was for services, then application of the UCC would be erroneous.

Idaho Code § 28–2-105(1) defines “goods” as “all things (including specially manufactured goods) which are movable at the time of identification to the contract for sale.…” Although there is little dispute that carpets are “goods,” the transaction in this case also involved installation, a service. Such hybrid transactions, involving both goods and services, raise difficult questions about the applicability of the UCC. Two lines of authority have emerged to deal with such situations.

The first line of authority, and the majority position, utilizes the “predominant factor” test. The Ninth Circuit, applying the Idaho Uniform Commercial Code to the subject transaction, restated the predominant factor test as:

The test for inclusion or exclusion is not whether they are mixed, but, granting that they are mixed, whether their predominant factor, their thrust, their purpose, reasonably stated, is the rendition of service, with goods incidentally involved (e.g., contract with artist for painting) or is a transaction of sale, with labor incidentally involved (e.g., installation of a water heater in a bathroom).

[Citations]. This test essentially involves consideration of the contract in its entirety, applying the UCC to the entire contract or not at all.

The second line of authority, which Hilton urges us to adopt, allows the contract to be severed into different parts, applying the UCC to the goods involved in the contract, but not to the non-goods involved, including services as well as other non-goods assets and property. Thus, an action focusing on defects or problems with the goods themselves would be covered by the UCC, while a suit based on the service provided or some other non-goods aspect would not be covered by the UCC.…

We believe the predominant factor test is the more prudent rule. Severing contracts into various parts, attempting to label each as goods or non-goods and applying different law to each separate part clearly contravenes the UCC’s declared purpose “to simplify, clarify and modernize the law governing commercial transactions.” I.C. § 28–1–102(2)(a). As the Supreme Court of Tennessee suggested in [Citation], such a rule would, in many contexts, present “difficult and in some instances insurmountable problems of proof in segregating assets and determining their respective values at the time of the original contract and at the time of resale, in order to apply two different measures of damages.”

Applying the predominant factor test to the case before us, we conclude that the UCC was applicable to the subject transaction. The record indicates that the contract between the parties called for “175 yds Masterpiece # 2122-Installed” for a price of $4319.50. There was an additional charge for removing the existing carpet. The record indicates that Hilton paid the installers $700 for the work done in laying Pittsley’s carpet. It appears that Pittsley entered into this contract for the purpose of obtaining carpet of a certain quality and color. It does not appear that the installation, either who would provide it or the nature of the work, was a factor in inducing Pittsley to choose Hilton as the carpet supplier. On these facts, we conclude that the sale of the carpet was the predominant factor in the contract, with the installation being merely incidental to the purchase. Therefore, in failing to consider the UCC, the magistrate did not apply the correct legal principles to the facts as found. We must therefore vacate the judgment and remand for further findings of fact and application of the UCC to the subject transaction.

Case Questions

- You may recall in (Reference mayer_1.0-ch15 not found in Book) the discussion of the “substantial performance” doctrine. It says that if a common-law contract is not completely, but still “substantially,” performed, the nonbreaching party still owes something on the contract. And it was noted there that under the UCC, there is no such doctrine. Instead, the “perfect tender” rule applies: the goods delivered by the seller must be exactly right. Does the distinction between the substantial performance doctrine and the perfect tender rule shed light on what difference applying the common law or the UCC would make in this case?

- If Pittsley won on remand, what would she get?

- In discussing the predominant factor test, the court here quotes from the Ninth Circuit, a federal court of appeals. What is a federal court doing making rules for a state court?

“Merchants” under the UCC

Goldkist, Inc. v. Brownlee

355 S.E.2d 773 (Ga. App. 1987)

Beasley, J.

The question is whether the two defendant farmers, who as a partnership both grew and sold their crops, were established by the undisputed facts as not being “merchants” as a matter of law, according to the definition in [Georgia UCC 2-104(1)].…

Appellees admit that their crops are “goods” as defined in [2-105]. The record establishes the following facts. The partnership had been operating the row crop farming business for 14 years, producing peanuts, soybeans, corn, milo, and wheat on 1,350 acres, and selling the crops.

It is also established without dispute that Barney Brownlee, whose deposition was taken, was familiar with the marketing procedure of “booking” crops, which sometimes occurred over the phone between the farmer and the buyer, rather than in person, and a written contract would be signed later. He periodically called plaintiff’s agent to check the price, which fluctuated. If the price met his approval, he sold soybeans. At this time the partnership still had some of its 1982 crop in storage, and the price was rising slowly. Mr. Brownlee received a written confirmation in the mail concerning a sale of soybeans and did not contact plaintiff to contest it but simply did nothing. In addition to the agricultural business, Brownlee operated a gasoline service station.…

In dispute are the facts with respect to whether or not an oral contract was made between Barney Brownlee for the partnership and agent Harrell for the buyer in a July 22 telephone conversation. The plaintiff’s evidence was that it occurred and that it was discussed soon thereafter with Brownlee at the service station on two different occasions, when he acknowledged it, albeit reluctantly, because the market price of soybeans had risen. Mr. Brownlee denies booking the soybeans and denies the nature of the conversations at his service station with Harrell and the buyer’s manager.…

Whether or not the farmers in this case are “merchants” as a matter of law, which is not before us, the evidence does not demand a conclusion that they are outside of that category which is excepted from the requirement of a signed writing to bind a buyer and seller of goods.…To allow a farmer who deals in crops of the kind at issue, or who otherwise comes within the definition of “merchant” in [UCC] 2-104(1), to renege on a confirmed oral booking for the sale of crops, would result in a fraud on the buyer. The farmer could abide by the booking if the price thereafter declined but reject it if the price rose; the buyer, on the other hand, would be forced to sell the crop following the booking at its peril, or wait until the farmer decides whether to honor the booking or not.

Defendants’ narrow construction of “merchant” would, given the booking procedure used for the sale of farm products, thus guarantee to the farmers the best of both possible worlds (fulfill booking if price goes down after booking and reject it if price improves) and to the buyers the worst of both possible worlds. On the other hand, construing “merchants” in [UCC] 2-104(1) as not excluding as a matter of law farmers such as the ones in this case, protects them equally as well as the buyer. If the market price declines after the booking, they are assured of the higher booking price; the buyer cannot renege, as [UCC]2-201(2) would apply.

In giving this construction to the statute, we are persuaded by [Citation], supra, and the analyses provided in the following cases from other states: [Citations]. By the same token, we reject the narrow construction given in other states’ cases: [Citations]. We believe this is the proper construction to give the two statutes, [UCC 2-104(1) and 2-201(2)], as taken together they are thus further branches stemming from the centuries-old simple legal idea pacta servanda sunt—agreements are to be kept. So construed, they evince the legislative intent to enforce the accepted practices of the marketplace among those who frequent it.

Judgment reversed. [Four justices concurred with Justice Beasley].

Benham, J., dissenting.

Because I cannot agree with the majority’s conclusion that appellees are merchants, I must respectfully dissent.

…The validity of [plaintiff’s] argument, that sending a confirmation within a reasonable time makes enforceable a contract even though the statute of frauds has not been satisfied, rests upon a showing that the contract was “[b]etween merchants.” “Between merchants” is statutorily defined in the Uniform Commercial Code as meaning “any transaction with respect to which both parties are chargeable with the knowledge or skill of merchants” [2-104(3)]. “‘Merchant’ means a person [1] who deals in goods of the kind or [2] otherwise by his occupation holds himself out as having knowledge or skill peculiar to the practices or goods involved in the transaction or [3] to whom such knowledge or skill may be attributed by his employment of an agent or broker or other intermediary who by his occupation holds himself out as having such knowledge or skill” [Citation]. Whether [plaintiff] is a merchant is not questioned here; the question is whether, under the facts in the record, [defendant]/farmers are merchants.…

The Official Comment to § 2-104 of the U.C.C. (codified in Georgia)…states: “This Article assumes that transactions between professionals in a given field require special and clear rules which may not apply to a casual or inexperienced seller or buyer…This section lays the foundation of this policy by defining those who are to be regarded as professionals or ‘merchants’ and by stating when a transaction is deemed to be ‘between merchants.’ The term ‘merchant’ as defined here roots in the ‘law merchant’ concept of a professional in business.” As noted by the Supreme Court of Kansas in [Citation] (1976): “The concept of professionalism is heavy in determining who is a merchant under the statute. The writers of the official UCC comment virtually equate professionals with merchants—the casual or inexperienced buyer or seller is not to be held to the standard set for the professional in business. The defined term ‘between merchants,’ used in the exception proviso to the statute of frauds, contemplates the knowledge and skill of professionals on each side of the transaction.” The Supreme Court of Iowa [concurs in cases cited]. Where, as here, the undisputed evidence is that the farmer’s sole experience in the marketplace consists of selling the crops he has grown, the courts of several of our sister states have concluded that the farmer is not a merchant. [Citations]. Just because appellee Barney Brownlee kept “conversant with the current price of [soybeans] and planned to market it to his advantage does not necessarily make him a ‘merchant.’ It is but natural for anyone who desires to sell anything he owns to negotiate and get the best price obtainable. If this would make one a ‘merchant,’ then practically anyone who sold anything would be deemed a merchant, hence would be an exception under the statute[,] and the need for a contract in writing could be eliminated in most any kind of a sale.” [Citation].

It is also my opinion that the record does not reflect that appellees “dealt” in soybeans, or that through their occupation, they held themselves out as having knowledge or skill peculiar to the practices or goods involved in the transaction. See [UCC] 2-104(1). “[A]lthough a farmer may well possess special knowledge or skill with respect to the production of a crop, the term ‘merchant,’ as used in the Uniform Commercial Code, contemplates special knowledge and skill associated with the marketplace. As to the area of farm crops, this special skill or knowledge means, for instance, special skill or knowledge associated with the operation of the commodities market. It is inconceivable that the drafters of the Uniform Commercial Code intended to place the average farmer, who merely grows his yearly crop and sells it to the local elevator, etc., on equal footing with the professional commodities dealer whose sole business is the buying and selling of farm commodities” [Citations]. If one who buys or sells something on an annual basis is a merchant, then the annual purchaser of a new automobile is a merchant who need not sign a contract for the purchase in order for the contract to be enforceable.…

If these farmers are not merchants, a contract signed by both parties is necessary for enforcement. If the farmer signs a contract, he is liable for breach of contract if he fails to live up to its terms. If he does not sign the contract, he cannot seek enforcement of the terms of the purchaser’s offer to buy.…

Because I find no evidence in the record that appellees meet the statutory qualifications as merchants, I would affirm the decision of the trial court. I am authorized to state that [three other justices] join in this dissent.

Case Questions

- How is the UCC’s ten-day-reply doctrine in issue here?

- Five justices thought the farmers here should be classified as “merchants,” and four of them thought otherwise. What argument did the majority have against calling the farmers “merchants”? What argument did the dissent have as to why they should not be called merchants?

- Each side marshaled persuasive precedent from other jurisdictions to support its contention. As a matter of public policy, is one argument better than another?

- What does the court mean when it says the defendants are not excluded from the definition of merchants “as a matter of law”?

Unconscionability in Finance Lease Contracts

Info. Leasing Corp. v. GDR Investments, Inc.

787 N.E.2d 652 (Ohio App. 2003)

Gorman, J.

The plaintiff-appellant, Information Leasing Corporation (“ILC”), appeals from the order of the trial court rendering judgment in favor of the defendants-appellees…GDR Investments, Inc. [defendant Arora’s corporation], Pinnacle Exxon, and Avtar S. Arora, in an action to recover $15,877.37 on a five-year commercial lease of an Automated Teller Machine (“ATM”).…

This is one of many cases involving ILC that have been recently before this court. ILC is an Ohio corporation wholly owned by the Provident Bank. ILC is in the business of leasing ATMs through a third party, or vendor. In all of these cases, the vendor has been…Credit Card Center (“CCC”). CCC was in the business of finding lessees for the machines and then providing the services necessary to operate them, offering the lessees attractive commissions. Essentially, CCC would find a customer, usually a small business interested in having an ATM available on its premises, arrange for its customer to sign a lease with ILC, and then agree to service the machine, keeping it stocked with cash and paying the customer a certain monthly commission. Usually, as in the case of [defendants], the owner of the business was required to sign as a personal guarantor of the lease. The twist in this story is that CCC soon went bankrupt, leaving its customers stuck with ATMs under the terms of leases with ILC but with no service provider. Rather than seeking to find another company to service the ATMs, many of CCC’s former customers, like [defendants], simply decided that they no longer wanted the ATMs and were no longer going to make lease payments to ILC. The terms of each lease, however, prohibited cancellation. The pertinent section read,

LEASE NON-CANCELABLE AND NO WARRANTY. THIS LEASE CANNOT BE CANCELED BY YOU FOR ANY REASON, INCLUDING EQUIPMENT FAILURE, LOSS OR DAMAGE. YOU MAY NOT REVOKE ACCEPTANCE OF THE EQUIPMENT. YOU, NOT WE, SELECTED THE EQUIPMENT AND THE VENDOR. WE ARE NOT RESPONSIBLE FOR EQUIPMENT FAILURE OR THE VENDOR’S ACTS. YOU ARE LEASING THE EQUIPMENT ‘AS IS’, [sic] AND WE DISCLAIM ALL WARRANTIES, EXPRESS OR IMPLIED. WE ARE NOT RESPONSIBLE FOR SERVICE OR REPAIRS.

Either out of a sense of fair play or a further desire to make enforcement of the lease ironclad, ILC put a notice on the top of the lease that stated,

NOTICE: THIS IS A NON-CANCELABLE, BINDING CONTRACT. THIS CONTRACT WAS WRITTEN IN PLAIN LANGUAGE FOR YOUR BENEFIT. IT CONTAINS IMPORTANT TERMS AND CONDITIONS AND HAS LEGAL AND FINANCIAL CONSEQUENCES TO YOU. PLEASE READ IT CAREFULLY; FEEL FREE TO ASK QUESTIONS BEFORE SIGNING BY CALLING THE LEASING COMPANY AT 1-513-421-9191.

Arora, the owner of [defendant corporation], was a resident alien with degrees in commerce and economics from the University of Delhi, India. Arora wished to have an ATM on the premises of his Exxon station in the hope of increasing business. He made the mistake of arranging acquisition of the ATM through CCC. According to his testimony, a representative of CCC showed up at the station one day and gave him “formality papers” to sign before the ATM could be delivered. Arora stated that he was busy with other customers when the CCC representative asked him to sign the papers. He testified that when he informed the CCC representative that he needed time to read the documents before signing them, he was told not to worry and…that the papers did not need his attention and that his signature was a mere formality. Arora signed the ILC lease, having never read it.

Within days, CCC went into bankruptcy. Arora found himself with an ATM that he no longer wanted.…According to his testimony, he tried unsuccessfully to contact ILC to take back the ATM. Soon Arora suffered a mild heart attack, the gas station went out of business, and the ATM, which had been in place for approximately eighteen days, was left sitting in the garage, no longer in use until ILC came and removed it several months later.

Unfortunately for Arora, the lease also had an acceleration clause that read,

DEFAULT. If you fail to pay us or perform as agreed, we will have the right to (i) terminate this lease, (ii) sue you for all past due payment AND ALL FUTURE PAYMENTS UNDER THIS LEASE, plus the Residual Value we have placed on the equipment and other charges you owe us, (iii) repossess the equipment at your expense and (iv) exercise any other right or remedy which may be available under applicable law or proceed by court act.

The trial court listened to the evidence in this case, which was awkwardly presented due in large part to Arora’s decision to act as his own trial counsel. Obviously impressed with Arora’s honesty and sympathetic to his situation, the trial court found that Arora owed ILC nothing. In so ruling, the court stated that ILC “ha[d] not complied with any of its contractual obligations and that [Arora] appropriately canceled any obligations by him, if there really were any.” The court also found that ILC, “if they did have a contract, failed to mitigate any damages by timely picking up the machine after [Arora] gave them notice to pick up the machine.”…

ILC contends, and we do not disagree, that the lease in question satisfied the definition of a “finance lease” under [UCC 2A-407]. A finance lease is considerably different from an ordinary lease in that it adds a third party, the equipment supplier or manufacturer (in this case, the now defunct CCC). As noted by White and Summers, “In effect, the finance lessee * * * is relying upon the manufacturer * * * to provide the promised goods and stand by its promises and warranties; the [lessee] does not look to the [lessor] for these. The [lessor] is only a finance lessor and deals largely in paper, rather than goods.” [Citation].

One notorious feature of a finance lease is its typically noncancelable nature, which is specifically authorized by statute [UCC 2A-407]. [UCC 2A-407(1)] provides in the case of a finance lease that is not a consumer lease, “[T]he lessee’s promises under the lease contract become irrevocable and independent upon the lessee’s acceptance of the goods.” The same statutory section also makes clear that the finance lease is “not subject to cancellation, termination, modification, repudiation, excuse, or substitution without the consent of the party to whom it runs.” [Citation]

Because of their noncancelable nature, finance leases enjoy somewhat of a reputation. The titles of law review articles written about them reveal more than a little cynicism regarding their fairness: [Citations].

…As described by Professors White and Summers, “The parties can draft a lease agreement that carefully excludes warranty and promissory liability of the finance lessor to the lessee, and that sets out what is known in the trade as a ‘hell or high water clause,’ namely, a clause that requires the lessee to continue to make rent payments to the finance lessor even though the [equipment] is unsuitable, defective, or destroyed.”…“The lessor’s responsibility is merely to provide the money, not to instruct the lessee like a wayward child concerning a suitable purchase * * *. Absent contrary agreement, even if [, for example, a finance-leased] Boeing 747 explodes into small pieces in flight and is completely uninsured, lessee’s obligation to pay continues.”

…Some people complain about being stuck with the bill; Arora’s complaint was that he was stuck with the ATM.…

To begin the proper legal analysis, we note first that this was not a “consumer lease” expressly excepted from [UCC 2A-407]. A “consumer lease” is defined in [UCC 2A-103(e)] as one in which the lessee is “an individual and who takes under the lease primarily for a personal, family, or household purpose.” This would definitely not apply here, where the ATM was placed on the business premises of the Exxon station, and where the lessee was [Arora’s corporation] and not Arora individually. (Arora was liable individually as the personal guarantor of [his corporation]’s obligations under the lease.)…

Certain defenses do remain, however. First, the UCC expressly allows for the application of the doctrine of unconscionability to finance leases, both consumer and commercial. [Citation] authorizes the trial court to find “any clause of a lease contract to have been unconscionable at the time it was made * * *.” If it so finds, the court is given the power to “refuse to enforce the lease contract, * * * enforce the remainder of the lease contract without the unconscionable clause, or * * * limit the application of the unconscionable clause as to avoid any unconscionable result.” [Citation]

In this case, the trial court made no findings as to whether the finance lease was unconscionable. The primary purpose of the doctrine of unconscionability is to prevent oppression and unfair surprise. [Citation] “Oppression” refers to substantive unconscionability and arises from overly burdensome or punitive terms of a contract, whereas “unfair surprise” refers to procedural unconscionability and is implicated in the formation of a contract, when one of the parties is either overborne by a lack of equal bargaining power or otherwise unfairly or unjustly drawn into a contract. [Citation]

It should be pointed that, although harsh, many characteristics of a finance lease are not inherently unconscionable and, as we have discussed, are specifically authorized by statute. Simply because a finance lease has a “hell or high water clause” does not make it unconscionable. As noted, a finance lease is a separate animal—it is supposed to secure minimal risk to the lessor. At least one court has rejected the argument that an acceleration clause in a commercial finance lease is punitive and unconscionable in the context of parties of relatively equal bargaining power. See [Citation]

At the heart of Arora’s defense in this case was his claim that he was misled into signing the finance lease by the CCC representative and was unfairly surprised to find himself the unwitting signatory of an oppressive lease. This is clearly an argument that implicated procedural unconscionability. His claim of being an unwitting signatory, however, must be carefully balanced against the law in Ohio that places upon a person a duty to read any contract before signing it, a duty that is not excused simply because a person willingly gives into the encouragement to “just go ahead and sign.” See [Citation]

Moreover, we note that courts have also recognized that the lessor may give, through word or conduct, the lessee consent to cancel an otherwise noncancelable lease. [UCC 2A-40792)(b)] makes a finance lease “not subject to cancellation, termination, modification, repudiation, excuse, or substitution without the consent of the party to whom it runs.” (Emphasis supplied.) As noted by the court in Colonial Court [Citation], the UCC does not say anything with respect to the form or content of the consent. The Colonial Pacific court concluded, therefore, “that the consent may be oral and may be established by conduct that reasonably manifests an intent. * * * Any manifestations that the obligation of the lessee will not be enforced independently of the obligation that runs to the consenting party is sufficient.” The question whether consent has been given to a cancellation is a question of fact for the trier of fact.

We raise this point because the evidence indicates that there was some communication between Arora and ILC before ILC retrieved the ATM. It is unclear whether ILC removed the ATM at Arora’s request, or whether the company was forcibly repossessing the equipment pursuant to the default provision of the lease. In view of the murkiness of the testimony, it is unclear when the ATM was taken back and when the final lease payment was made. One interesting question that arises from ILC’s retrieval of the ATM, not addressed in the record, is what ILC did with the equipment afterward. Did ILC warehouse the equipment for the next four and one-half years (conduct that would appear unprofitable and therefore unlikely) or did the company then turn around and lease the ATM to someone else? If there was another lease, was ILC actually seeking a double recovery on the ATM’s rental value? In this regard, we note that the trial court ruled that ILC had failed to mitigate its damages, a finding that is not supported by the current record, but may well prove to be true upon further trial of the matter.

In sum, this is a case that requires a much more elaborate presentation of evidence by the parties, and much more detailed findings of fact and conclusions of law than those actually made by the trial court. We sustain ILC’s assignment of error upon the basis that the trial court did not apply the correct legal analysis, and that the evidence of record did not mandate a judgment in Arora’s favor. Because of the number of outstanding issues and unresolved factual questions, we reverse the trial court’s judgment and remand this case for a new trial consistent with the law set forth in this opinion.

Judgment reversed and cause remanded.

Case Questions

- Why would a finance lease have such an iron-clad, “hell or high water” noncancellation clause as is apparently common and demonstrated here?

- On what basis did the lower court rule in the defendant’s favor?

- What is an acceleration clause?

- What was Mr. Arora’s main defense? What concern did the court have with it?

- The appeals court helpfully suggested several arguments the defendant might make on remand to be relieved of his contract obligations. What were they?

8.6 Summary and Exercises

Summary

Sales law is a special type of contract law, governed by Article 2 of the Uniform Commercial Code (UCC), adopted in every state but Louisiana. Article 2 governs the sale of goods only, defined as things movable at the time of identification to the contract for sale. Article 2A, a more recent offering, deals with the leasing of goods, including finance leases and consumer leases. The Convention on Contracts for the International Sale of Goods (CISG) is an international equivalent of Article 2.

Difficult questions sometimes arise when the subject of the contract is a hybrid of goods and real estate or goods and services. If the seller is called on to sever crops, timber, or minerals from the land, or the buyer is required to sever and can do so without material harm to the land, then the items are goods subject to Article 2. When the goods are “sold” incidental to a service, the “predominant factor” test is used, but with inconsistent results. For two categories of goods, legislation specifically answers the question: foodstuffs served by a restaurant are goods; blood supplied for transfusions is not.

Although they are kin, in some areas Article 2 differs from the common law. As regards mutual assent, the UCC abolishes the mirror image rule; it allows for more indefiniteness and open terms. The UCC does away with some requirements for consideration. It sometimes imposes special obligations on merchants (though defining a merchant is problematic), those who deal in goods of the kind, or who by their occupations hold themselves out as experts in the use of the goods as between other merchants and in selling to nonmerchants. Article 2 gives courts greater leeway than under the common law to modify contracts at the request of a party, if a clause is found to have been unconscionable at the time made.

Exercises

- Ben owns fifty acres of timberland. He enters into a contract with Bunyan under which Bunyan is to cut and remove the timber from Ben’s land. Bunyan enters into a contract to sell the logs to Log Cabin, Inc., a homebuilder. Are these two contracts governed by the UCC? Why?

- Clarence agreed to sell his farm to Jud in exchange for five antique cars owned by Jud. Is this contract governed by the UCC? Why?