This is “Net Working Capital Basics”, section 17.2 from the book Finance for Managers (v. 0.1). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

17.2 Net Working Capital Basics

PLEASE NOTE: This book is currently in draft form; material is not final.

Learning Objectives

- Identify working capital and why working capital is needed.

- Explain different strategies for determining the level of working capital.

Related to cash is net working capital. Net working capital is not specifically cash but instead the diference between what we currently owe and what we currently own. These are our immediate sources and uses of cash. To see if we can pay our bills we need to manage our current assets and liabilities; as these will all come due within a year. Working capital management is the creation of a working capital policy and the day to day management of cash, inventories, receivables, accruals and payables and is a large part of a financial manager’s job. It includes the determinination of the level of each of these items and also the financing of these items. Working capital policy impacts a firm’s balance sheet, financial ratios and possibly credit rating. Businesses risk defaulting if they don’t have enough cash to pay their debts.

Net working capitalThe difference between current assets and current liabilities. is the difference between current assets and current liabilities. Change in net working capital is most simply the change in current assets minus the change in current liabilities.

If Current Assets > Current Liabilties, then Net Working Capital is positive If Current Assets < Current Liabilities, then Net Working Capital is negativeSo is it better to have more or less Net Working Capital? It depends. If we are growing revenues, then our accounts receivable will probably increase as we loan more to our customers, thus increasing Net Working Capital (if we maintain the same levels for all of our other current items). On the other hand, if our customers are taking longer to pay us, accounts receivable will also increase (thus increasing Net Working Capital). In both cases, Net Working Capital increases, but the story is much better for our company in the former case.

Negative Net Working Capital = Good?

Negative net working capital can be good. Since current liabilities are money owed but not paid, it means that your business is effectively using other people’s money to run day-to-day operations. Walmart, for example, routinely has negative net working capital; it takes its time paying its suppliers (large accounts payable) but receives payment from most of its customers at the time of sale (small accounts receivable). Not a bad position to be in.

Risk and Net Working Capital

There is always a tradeoff between risk and return. Businesses want to minimize risk and maximixe return. Holding cash on the balance sheet provides a safety net, since the more cash available, the lower the chance of not having enough to pay bills as they come due. But cash is a terrible investment: it does not earn a return. Investing cash in projects, other business, securities, etc. can earn a return, but then we risk not having it available when it is needed. Companies try to maximize their return with minimum risk by making sure they hold enough cast to remain solvent, but investing excess cash.

External Funding of Working Capital

Our company’s investment in current assets has to come from somewhere; funding of current assets can be either with short-term or long-term debt, equity, or the sale of long-term assets. Primary sources include bank loans, credit terms from suppliers, accrued liabilities, bonds, and common equity. Each of these sources has advantages and disadvantages. Short-term loans need to be paid sooner, and are typically more sensitive to fluctuations in interest rates. Longer term debt is more predictable, but also typically more expensive.

Seasonal Requirements

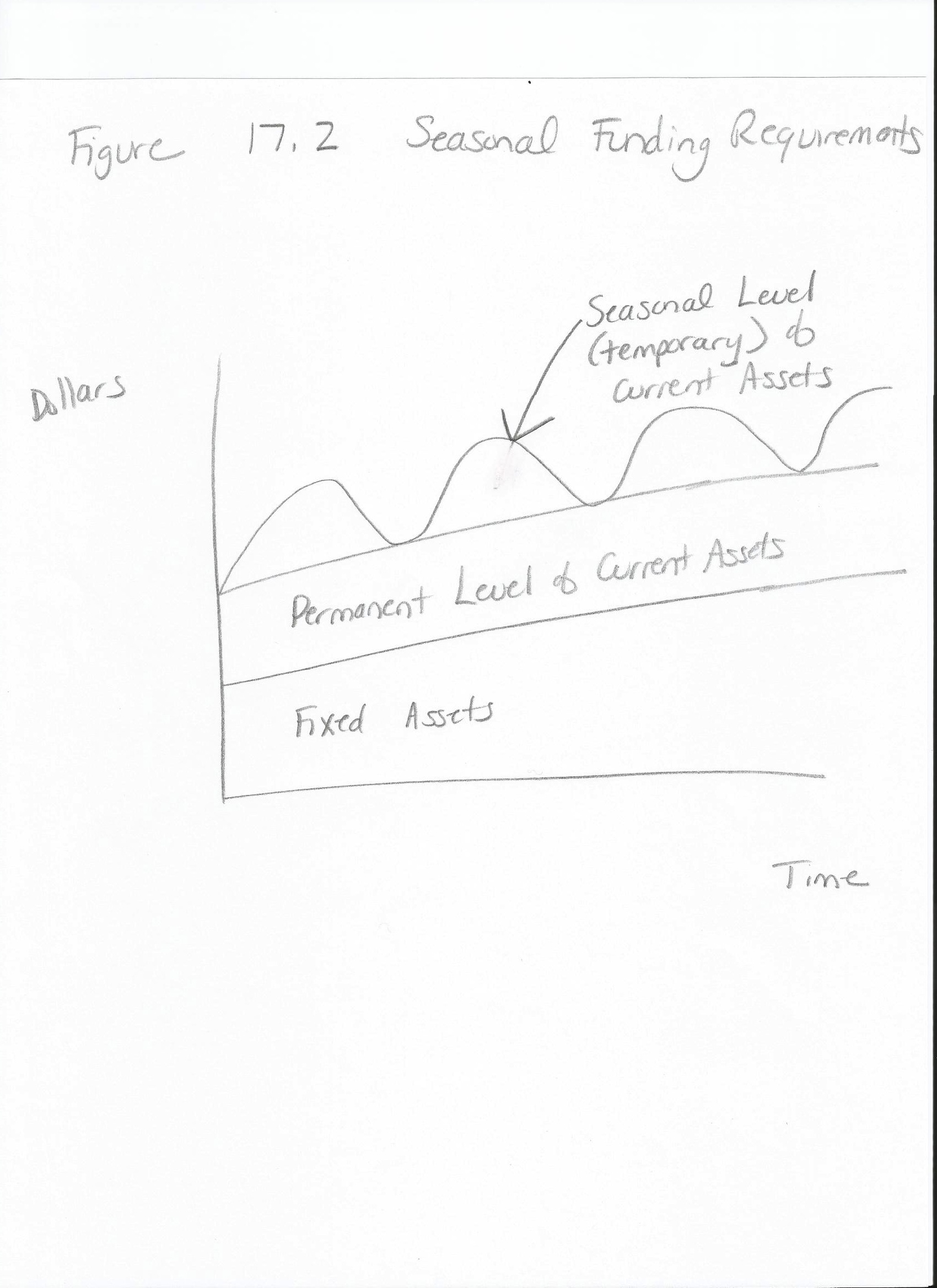

Demand for working capital is not constant. We’ve discussed how net working capital can increase due to growth or new projects, but companies can also have seasonal current asset requirements. Ski resorts, ice cream shops, department stores, and many tourist businesses have seasonal funding requirements: they may have different levels of current assets at different times of the year.

Figure 17.2 Seasonal Funding Requirements

Jack Co. and Johnny Co. Seasonal Funding Example

Jack Co. has $25,000 in cash, $100,000 in inventory and $80,000 in Accounts Receivable (A/R). Their Accounts Payable (A/P) is stable at $55,000. What is their permanent funding requirement?

$25,000 + $100,000 + $80,000 = $205,000 − $55,000 = $150,000

Johnny Co. has the same current asset requirements for part of the year. The other part of the year their inventory peaks at $140,000 and their A/R peaks at $135,000. All other variables remain constant. Their permanent funding need is $150,000 (same as Jack Co.), but what is their seasonal funding need?

$25,000 + $140,000 + $135,000 = $300,000 − $55,000 = $245,000

Thus, Johnny Co. needs to have access to $245,000 − $135,000 = $110,000 of extra funding during the peak season.

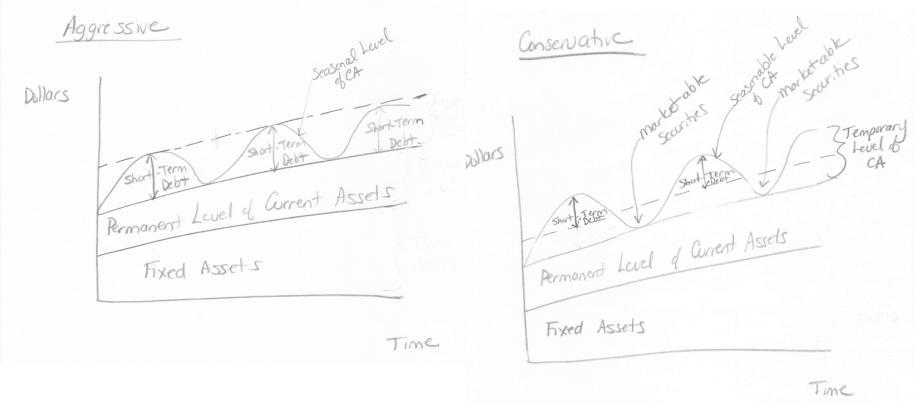

Aggressive vs. Conservative Strategies

Different people hold their money in different ways. Jane might have $10,000 in her checking account because she frequently travels for work and may need access to a lot of cash. Tim, however, holds only the minimum balance required by his bank in his checking account because he has invested in the stock market. Businesses too have different management strategies. Firms can be aggressive or conservative in their approach to the amount of cash they hold. Firms can follow aggressive (also called tight, restricted or lean) policies where holdings of current assets are minimized. Or they can follow a conservative (relaxed) policy where they hold more current assets. A ‘tight’ current assets policy is riskier, as a company may need to resort to scrambling for cash if unexpected expenses arise. Relaxed assures there is enough cash, but potentially trades off higher profitability due to the extra cash being “unproductive”. Many companies split the difference, using a more moderate or a maturity-matching policy, where fixed assets are financed with long-term debt and equity, and current assets are paid for with short-term financing.

Seasonal funding requirements will also differ by strategy. Conservative companies fund both seasonal and long-term requirements with long-term financing, keeping the extra cash on hand when it isn’t needed. Aggressive companies fund seasonal requirements with short-term financing as needed.

Figure 17.3 Aggressive vs. Conservative Strategies

Key Takeaways

- Working capital is the difference between current assets and current liabilities.

- There are different strategies to manage working capital including aggressive and conservative.

Exercises

-

Determine the net working capital funding needs, given the following:

Cash = $15,000

Inventory = $30,000

A/R = $20,000

A/P = $25,000

-

Determine the seasonal funding needs, given the permanent NWC funding in problem 1 and the following peak needs:

Cash = $15,000

Inventory = $55,000

A/R = $45,000

A/P = $25,000

- How might an aggressive strategy backfire? How might a conservative strategy backfire? When is it best to use each type of strategy?