This is “Global Entrepreneurship and Intrapreneurship”, chapter 11 from the book Challenges and Opportunities in International Business (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 11 Global Entrepreneurship and Intrapreneurship

What’s in It for Me?

- Who is an entrepreneur, and what is entrepreneurship?

- What do entrepreneurs do?

- What is entrepreneurship across borders?

- How does entrepreneurship lead to global start-ups?

- What is intrapreneurship?

This chapter will explore the subjects of entrepreneurship and intrapreneurship in international business. It is through both the differences across countries and the flatteners that are reducing such differences that entrepreneurial and intrapreneurial opportunities are created or identified. For instance, countries have different average income levels, but regardless of income level the people in those countries have medical care needs. An entrepreneurial or intrapreneurial move in this setting would be the introduction of a low-cost medical treatment for an ailment common to both high- and low-income countries. As a business student, you may be able to take electives in entrepreneurship, so view this information as sensitizing you to the field, rather than making you an expert. You will gain more knowledge of both entrepreneurial process and its related field, intrapreneurship. Whereas entrepreneurship is concerned with starting new businesses, intrapreneurship is concerned with starting something new, like a new product or service, in an existing, established business. Intrapreneurs may take on more risk than a traditional line-management employee; but it’s risk within parameters or within course boundaries—to use sports as an analogy. Entrepreneurship, on the other hand, is more like helicopter skiing—there’s no safety net and no safe path or course boundaries. Intrapreneurs who fail are very likely to still have a job, perhaps moving into a new role in their company. Entrepreneurs, most of whom aren’t funded, don’t have a guaranteed monthly paycheck; failure means complete failure. Throughout this chapter, you’ll also learn how entrepreneurship and intrapreneurship are important in global markets.

Opening Case: eSys Technologies

Why Go Global? Because It’s What Entrepreneurs Do!

Entrepreneurs are go-getters who seize opportunities and work tirelessly to overcome obstacles. Entrepreneurs who expand internationally face even more risks and challenges, but many of them thrive on those very challenges because those challenges bring previously unseen new opportunities. Our opening vignette, which is about eSys Technologies LLC, provides one case in point. eSys founder Vikas Goel used the global playing field to his advantage to build his company in creative ways.

Vikas, in Sanskrit, Means Growth

Vikas Goel grew eSys at an astonishingly fast rate from very humble beginnings. Goel launched his company in 2000, during the time when companies were cratering due to the dot-com economic crash of tech companies. Few would have bet that Goel’s eSys, which aimed to distribute hard disk drives (HDDs), stood a chance in the down environment. But Goel saw things differently.

Source: “Singapore-CIA WFB Map.png,” Wikimedia Commons, accessed June 3, 2011, http://en.wikipedia.org/wiki/File:Singapore-CIA_WFB_Map.png.

Seeing and Doing Things Differently

“An exceptional entrepreneur is able to identify a threat which nobody wants to touch and convert it into an opportunity,” said Goel.eSys Information Technologies, “Ernst & Young Entrepreneur of the Year 2005 Award Goes to Mr. Vikas Goel of eSys Technologies,” news release, March 10, 2006, accessed June 16, 2010, http://www.esys.in/NewsDisplay.php?ID=141. Goel succeeded in the early years by bootstrapping his success. Operating in Singapore, he went to the Bank of India to ask for a loan, making a presentation directly to the CEO of the bank. Goel’s passion and plan garnered him a loan of US $3.5 million, which he immediately put to work. Goel’s first job after graduating with his MBA had been with American Components, for whom he distributed (very successfully) Seagate HDDs in India.

Rekindling former ties, Goel offered to distribute Seagate HDDs through eSys. Seagate agreed and, having developed trust and confidence in Goel, gave him rights to distribute Seagate HDDs in other countries as well.

Seagate’s competitors, seeing the success Seagate was having through eSys, signed on with eSys as well. By 2004, eSys was distributing Seagate, Maxtor, and Western Digital HDDs to the tune of 20 million disk drive unit sales, making eSys arguably the largest HDD distributor in the world.Vikas Goel, “Vikas Goel and eSys,” July 7, 2010, accessed December 23, 2010, http://www.vikas-goel-esys.com/index.php/vikasgoel/vikas-goel-and-esys.html.

A big contributor to Goel’s success is his local sales-force approach. Despite operating in twenty-five countries, each eSys sales team is an in-country local team that understands local culture.

Building on the success of his distribution business, Goel next decided to expand into manufacturing. In particular, Goel’s vision was to manufacture and sell a PC under the eSys brand that would retail for $250, making it affordable to a broader range of consumers. The price point of $250 was aggressive—none of eSys’s competitors could profitably sell a PC for that low a price. To succeed in his goal, Goel would have to be very creative in taking out all unnecessary costs. Goel was able to achieve the $250 PC goal by cleverly taking advantage of country-specific differences. For example, eSys set up manufacturing plants next to its regional logistics hubs. The move seems counter-intuitive. Most firms would set up manufacturing in China to get the lowest cost, but Goel thought through the distribution and tax implications that his costs would be even lower. Labor may be cheap in China, but physically moving inventory from remote places takes time. In addition, China levies a 17 percent value-added tax. Singapore, in contrast, has no such tax and is a logistics hub with fast, easy shipment to all of Asia and beyond. Accordingly, Goel set up manufacturing plants in the hub locations (Singapore, Dubai, Los Angeles, and New Delhi), taking advantage of low inventory costs and building state-of-the-art software-controlled facilities to reduce labor cost.

Goel also made innovative use of financing. For example, he bought insurance on the credit he borrowed, making his lenders the beneficiaries of that insurance. Going the extra step made his lenders and vendors even more comfortable extending credit to eSys, which saved Goel the equivalent of about 2 percent annual interest.Jack Stack and Bo Burlingham, “My Awakening,” Inc., April 1, 2007, accessed December 23, 2010, http://www.inc.com/magazine/20070401/features-my-awakening.html.

And the Winner Is?

Goel’s smart moves won him Ernst & Young’s Singapore Entrepreneur of the Year award in 2005 and put him in contention for Ernst & Young’s World Entrepreneur of the Year award in 2006. In the end, the E&Y judges didn’t choose Goel as the World Entrepreneur of the Year. That honor went to Bill Lynch of South Africa, who, after arriving from Ireland in 1971 with a village-school education, few prospects, and 2,000 British pounds, turned a money-losing car dealership into a $6 billion transport and mobility empire. Thirty years later, Lynch’s business was enormous and thriving. Whether Goel’s venture could last that long remained to be seen. Some of the E&Y judges questioned the staying power of any company operating with a pretax margin of less than 1 percent. But longevity aside, Goel had already demonstrated that it was possible to improve efficiency and cut costs in just about every area of a business by taking advantage of the technological tools of the new world economy and operating on a truly global scale.

From day one, eSys was the prototypical born-global firm—one that has been defined as “a business organization that, from inception, seeks to derive significant competitive advantage from the use of resources and the sale of outputs in multiple countries.”Benjamin M. Oviatt and Patricia Phillips McDougall, “Toward a Theory of International New Ventures,” Journal of International Business Studies, First Quarter 1994, 49, accessed December 24, 2010, http://aib.msu.edu/awards/25_1_94_45.pdf.

Even though Goel did not win World Entrepreneur of the Year, Jack Stack, legendary CEO in his own right and a judge at the E&Y World Entrepreneur competition, was truly impressed when he met Goel, calling eSys “the first truly global start-up I’d ever seen. By that I mean it was the first company I knew of to operate worldwide almost from day one, taking advantage of the cost savings available in different countries.”Jack Stack and Bo Burlingham, “My Awakening,” Inc., April 1, 2007, accessed December 23, 2010, http://www.inc.com/magazine/20070401/features-my-awakening.html.

Stack praised Goel for the following:

- Locating eSys distribution hubs in country locations to reduce inventory costs

- Buying insurance from Switzerland and Germany to get the best rates

- Setting up back-office and IT operations in India for lowest wages coupled with high skills

- Handling finances out of Singapore, which has the lowest effective tax rate in the worldJack Stack and Bo Burlingham, “My Awakening,” Inc., April 1, 2007, accessed December 23, 2010, http://www.inc.com/magazine/20070401/features-my-awakening.html.

In 2007, Goel sold a majority interest in eSys to India’s Chennai-based Teledata Informatics Ltd. for $105 million.Gabriel Chen, “eSys Lays Off Staff ahead of Teledata Merger,” Strait Times, February 22, 2007, accessed December 23, 2010, http://www.sg-electronics.com/Singlenews.aspx?DirID=77&rec_code=60181. Teledata and eSys also announced their likely investment of $20 million in Chandigarh, India, to open a total-business-offshoring/outsourcing (TBO) unit, with at least 1,000 employees. Teledata’s CEO explained the rationale behind the acquisition: “Every year we buy 3,000–4,000 personal computers for several e-governance projects. This year, we plan to buy 15,000 PCs. The eSys acquisition will now make these projects cost effective.”“Teledata Buys Singapore Firm for $105mn,” Business Standard, February 19, 2007, accessed June 16, 2010, http://www.business-standard.com/india/news/teledata-buys-singapore-firm-for-105mn/275156/. With the acquisition, Goel assumed the title of CEO of Teledata Technologies and will hold 49 percent ownership in that company. eSys already has a PC-manufacturing unit in Delhi and is in the process of setting up another unit in Himachal Pradesh, India, to produce 1 million units per year. Consistent with his track record of cutting costs, Goel noted, “We might shut down the Delhi plant and shift the entire manufacturing capabilities to the new centre.”“Teledata Buys Singapore Firm for $105mn,” Business Standard, February 19, 2007, accessed June 16, 2010, http://www.business-standard.com/india/news/teledata-buys-singapore-firm-for-105mn/275156/. When asked what work means to him, Goel’s answer was simple but powerful, “It’s about making your business your passion, rather than making your passion your business.”eSys Information Technologies, “Ernst & Young Entrepreneur of the Year 2005 Award Goes to Mr. Vikas Goel of eSys Technologies,” news release, March 10, 2006, accessed June 16, 2010, http://www.esys.in/NewsDisplay.php?ID=141.

Opening Case Exercises

(AACSB: Ethical Reasoning, Multiculturalism, Reflective Thinking, Analytical Skills)

- What kind of people would do well working for eSys? Do you think, for instance, that you would need a good understanding of international business to do well in eSys?

- Goel’s business model might make some people and certain stakeholder groups uncomfortable. What if every company were able to set up operations globally so as to minimize expenses, including taxes? Where would governments get the money for essential functions? What would happen to standards of living around the world? The eSys model is clearly great for eSys, but what if everybody adopted it? Is this a practice the business world should encourage?

- How should government policymakers work with companies like eSys? Should this type of cross-border arbitrage be entirely unregulated? (For instance, there is no law in the United States regulating whether a US company locates its tax headquarters in the United States or a more tax-favorable country like Bermuda.) Can we rely on each nation to set up its own laws and regulations, or is this an example of why we need supranational governments like the Organisation for Economic Co-operation (OECD), the European Union, and trading blocs?

11.1 Entrepreneurship

Learning Objectives

- Identify what entrepreneurship is.

- Understand who an entrepreneur is.

- Recognize some of the myths of entrepreneurship.

Entrepreneurship and Entrepreneurs

Entrepreneur is a French word that means “to undertake.” In the business world, this term applies to someone who wants to start a business or enterprise. As you may recall, entrepreneurshipThe recognition of opportunities (needs, wants, problems, and challenges) and the use or creation of resources to implement innovative ideas for new, thoughtfully planned ventures. is defined as “the recognition of opportunities (needs, wants, problems, and challenges) and the use or creation of resources to implement innovative ideas for new, thoughtfully planned ventures.”Mason Carpenter, Talya Bauer, and Berrin Erdogan, Principles of Management (Nyack, NY: Flat World Knowledge, 2009), accessed January 5, 2011, http://www.flatworldknowledge.com/printed-book/127834. An entrepreneurA person who engages in entrepreneurship. is a person who engages in entrepreneurship. Entrepreneurs are typically go-getters with high levels of skill and energy. Webster’s defines an entrepreneur as “the organizer of an economic venture; especially one who organizes, owns, manages, and assumes the risks of a business.”Webster’s Third New International Dictionary, Unabridged, s.v. “entrepreneur,” accessed November 7, 2010, http://unabridged.merriam-webster.com/cgi-bin/unabridged?va=entrepreneur&x=0&y=0. Entrepreneurship, like strategic management, will help you think about the opportunities available when you connect new ideas with new markets.

Entrepreneurs are distinct from small-business owners in that entrepreneurs often rely on innovation—new products, methods, or markets—to grow their business quickly and broadly. Entrepreneurs rely on innovation and speed to a much greater extent than small-business owners. Small-business owners typically enter established markets, providing a more traditional product or service to a local market. For example, a local dry cleaner may be a small business, whereas a company that develops a revolutionary new way to do dry cleaning and seeks to expand that new method nationally and internationally would be considered entrepreneurial.

Prior to the end of the last century, most people equated the word entrepreneurship with risk takers and nonconformists who were usually unable to work in a corporate environment. It was that small segment of the population that was willing to take what most perceive as very high risks. In truth, that is far from the reality. Entrepreneurs are certainly an adventurous group, but most wouldn’t describe themselves as aggressive risk takers. More often, they are passionate about an idea and carefully plan how to put it into effect. Most entrepreneurs are more comfortable with managed risk than with dangerous get-rich-quick schemes.

Did You Know?

How do entrepreneurs identify opportunities for new business ventures? First, they actively search for opportunities. That is, they don’t just passively wait for an idea to hit them, and they don’t just look at traditional sources of information, like news and trade publications. Instead, they search out more unusual sources, such as specialized publications or conversations with personal contacts, to get hints of new opportunities. Second, entrepreneurs are particularly alert to opportunities. Specifically, they look for “changed conditions or overlooked possibilities.”Robert A. Baron, “Opportunity Recognition as Pattern Recognition: How Entrepreneurs ‘Connect the Dots’ to Identify New Business Opportunities,” Academy of Management Perspectives, February 2006, 105. Third, research confirms that prior knowledge—information gathered from prior experience—helps entrepreneurs identify potentially profitable opportunities.Scott Shane, “Prior Knowledge and the Discovery of Entrepreneurial Opportunities,” Organization Science 11, no. 4: 448–69. For example, having prior industry or market experience with customers’ needs or struggles to solve particular problems greatly aids entrepreneurs in being able to create innovative new solutions to those problems. The latest research in human cognition shows that these three factors—active search, alertness, and prior experience—combine to help entrepreneurs see patterns among seemingly unrelated events or trends in the external world. As Robert Baron says, these factors help entrepreneurs “connect the dots” between changes in technology, demographics, markets, government policies, and other factors.Robert A. Baron, “Opportunity Recognition as Pattern Recognition: How Entrepreneurs ‘Connect the Dots’ to Identify New Business Opportunities,” Academy of Management Perspectives, February 2006, 104.

Entrepreneurship became a high-profile subject in the 1990s with the dot-com era, which created a whole new breed of “wannabe” entrepreneurs. Entrepreneurship was in vogue, and everyone wanted to be an entrepreneur. That period shaped the expectations and perceptions of an entire generation of potential entrepreneurs. It also made the world of venture capital more commonplace and accessible. Eventually—as with most business cycles—the Internet bubble burst, and the shift reversed. People sought the surety of corporate life once again. Nevertheless, the allure of entrepreneurship has continued to tempt many people.

So You Want to Be an Entrepreneur?

Many people are surprised to learn that successful entrepreneurs do not always have a perfect business plan and marketing and sales strategy in place before launching their businesses. In fact, many often deviate so significantly from the original plan that the business is unrecognizable. Instead, the mark of a successful entrepreneur is the ability to adeptly navigate the daily, weekly, and monthly bumps, twists, and turns in the life of a young or small company. We live in a world of instant gratification. People want immediate success along with everything else. However, there are no prepackaged, absolutely certain paths to successful entrepreneurship. Successful entrepreneurs start a business for what they can get out of it this year, not three to five years down the road—because they’re not likely to make it to that future point if they can’t take care of today. Pay yourself a salary and strive for profitability.Sanjyot P. Dunung, Starting Your Business (New York: Business Expert Press, 2010), 4–5.

Truths and Myths about Entrepreneurs

The late Jeffry Timmons, one of the early leaders in entrepreneurship education and an early advisor of Flat World Knowledge—the entrepreneurial organization that brings you this book—noted that there are few truths about entrepreneurs but many myths. Among those truths, he said,

Entrepreneurs work hard and are driven by an intense commitment and determined perseverance; they see the cup half full, rather than half empty; they strive for integrity; they burn with the competitive desire to excel and win; they are dissatisfied with the status quo and seek opportunities to improve almost any situation they encounter; they use failure as a tool for learning and eschew perfection in favor of effectiveness; and they believe they can personally make an enormous difference in the final outcome of their ventures and their lives.Jeffry A. Timmons, New Venture Creation: Entrepreneurship for the 21st Century, 5th ed. (New York: McGraw-Hill, 1999), 44.

The myths, however, are many. The following five entrepreneurship myths are among the most prevalent:

- Entrepreneurs are born, not made. The most prevalent myth about entrepreneurs is that they are born with the skills that will make them successful and that anyone who’s not born with those skills will not succeed. In reality, entrepreneurism is a skill that, like any other skill, can be learned.

- Entrepreneurs make more money. Surprisingly, the typical entrepreneur earns less than he or she would earn if working as an employee. Only the top 10 percent of entrepreneurs earn more than employees.Scott Shane, “Top Ten Myths of Entrepreneurship,” How to Change the World (blog), January 10, 2008, accessed January 2, 2011, http://blog.guykawasaki.com/2008/01/top-ten-myths-o.html#tp.

- Being original is essential. Another entrepreneurial myth is that entrepreneurs who get to the market first gain the most. Research by Joe Tabet, presented at INSEAD’s Global Entrepreneurship Forum, has shown that the so-called first mover advantage is a myth: Google, eBay, and Swatch are examples of successful businesses that entered markets later. The key, Tabet says, is to find your niche and serve your customers well.“Debunking Myths about Entrepreneurs,” Knowledge (blog), INSEAD, June 10, 2009, accessed January 2, 2011, http://knowledge.insead.edu/Debunkingmythsaboutentrepreneurs090615.cfm.

- It takes a lot of money to start a business. Research by Scott Shane of Case Western Reserve University has shown that the average new business needs only $25,000 in financing and that most of that money can be raised through debt.Scott Shane, “Top Ten Myths of Entrepreneurship,” How to Change the World (blog), January 10, 2008, accessed January 2, 2011, http://blog.guykawasaki.com/2008/01/top-ten-myths-o.html#tp.

- Entrepreneurs must be risk takers. According to this myth, entrepreneurs are good at starting businesses but can’t manage them once they grow. Research by Babson College professor Joel Shulman shows that the stocks of publicly traded companies run by entrepreneurs significantly outperform those run by nonentrepreneurs and continue to do so even after adjusting by market cap size, sector, geography, or time period.Jeff Cornwall, “Another Entrepreneurial Myth Busted,” The Entrepreneurial Mind (blog), December 17, 2009, accessed January 1, 2011, http://www.drjeffcornwall.com/entrepreneurial-myths.

Should You Become an Entrepreneur?

Whatever your reasons for becoming an entrepreneur, understand and be clear about your personal motivations. This will help you make decisions and choices along the way. The short survey that follows this section might provide you with helpful insights, though keep in mind that—as the survey says—“no reliable predictive model or entrepreneurial character has successfully been developed.”

Beyond such self-assessment and reflection, as you go through the personal decision-making process, try to talk to as many people as you possibly can. Seek out others who have tried entrepreneurship—both those who have been successful and those who have not. Talk to people in your industry, including colleagues, friends, and potential advisors. You’d be surprised how open people can be about their experiences—good and bad. Read lots of books and get a variety of opinions. You’re not trying to get people’s “permission” to be an entrepreneur, nor are you looking to give yourself permission to try. What you should strive for is to understand the factors critical to success and see if you’re comfortable with them. There are no right or wrong answers. Only another entrepreneur can tell you what it’s like to lie awake at night stressing about whether you’ll make payroll that month. But at the same time, it’s that entrepreneur who can tell you what strategy worked to make payroll that month. It’s not the issues that define you as an entrepreneur but how you respond to those issues.

As you consider entrepreneurship, you need to assess whether it will provide you with the ability to support and sustain yourself and your family, both in the beginning and later on, when you eventually achieve your personal financial goals. Are you comfortable with the time it may take to grow and sustain your business? Many people start companies expecting to grow them aggressively (in financial terms), only to find that they are actually quite content with a profitable lifestyle business that allows them the ability to pursue other personal goals. Think about what kind of growth you’re comfortable with. Do you want a lifestyle business or an aggressive-growth business? Both are commendable choices, but only you can make that decision.

If you decide to become an entrepreneur, take a look at your professional and personal support systems—particularly the latter. Are they supporting you or thinking you’re off your rocker? Even if you are comfortable with the risks, uncertainties, and challenges, a spouse or other key family member may not be. Negative whisperings can rock the very confidence that’s required for entrepreneurship. Be wary not only of your own demons but also those of others around you.

Attitude is a key factor. For example, if deep down you’re happiest as a sole proprietor but are talking about growing a company because it sounds so much better, then guess what? You’re likely to stay a sole proprietor and defeat yourself subconsciously. You will not grow your company, and you’ll also be unhappy and unfulfilled, even if your company is successful by financial and market definition. Get in touch with what you really want and how you define success. Be comfortable and confident with your own answers. Confidence is a key component—it will bring customers, investors, and supporters to you.

You also need to assess how you handle stress. How determined are you to succeed? Starting a business isn’t always easy. You may have more naysayers than coaches around you. Many businesses fold in the second year despite the fact that the next year might have been the turning point. Most entrepreneurs will tell you that they hit a key milestone of sustainability around the third year of their business. If you can make it to that point, you can keep going, barring any unforeseen problems inside or outside the company. For example, you could be doing great, and then in the fifth year, your largest customer stumbles badly, creating a ripple effect in your company. If you’ve been astute enough to diversify, it should be no problem—if not, you’ll drown, too. Diversification in terms of your customer base is essential.

If you’re choosing entrepreneurship as a response to a personal or professional transition, think through your motivations thoroughly. If you’re starting a company because you were laid off from your last job, do you see it as a life-changing opportunity, or are you treading water until a suitable full-time position becomes available? If a personal situation or crisis is motivating you to consider entrepreneurship as a way to balance your obligations, you may want to focus on being a sole proprietor for a while, as growing a company of any size is a very time- and energy-consuming endeavor.Sanjyot P. Dunung, Starting Your Business (New York: Business Expert Press, 2010), 17–19.

Entrepreneurship and the Changing Nature of “Corporate” Life

As corporate life continues to offer less and less security, more people are considering entrepreneurship. Some leave, taking their former corporate employer as their first customer. For others, it’s an opportunity to enter an entirely new industry. For most of us, we’re hoping to capitalize on our experience and know-how or on a new idea or market to fill a gap in our own industry.

Many entrepreneurs have actually discovered their vision and opportunity through a former employer. If you’ve spent your professional life in the corporate world, then you can recognize that the early years of an entrepreneurial venture demand very hands-on involvement. It’s not a joke when we say that you should be ready to take out the garbage. Most entrepreneurs have in the early days.

When you make the leap from corporate life to entrepreneurship, it involves major changes. The biggest difference is that entrepreneurs don’t have a buffer between a mistake and total failure. When a large company makes a bad bet on a product or market, the damage gets absorbed, perhaps with a hit to earnings or the stock price. In the early stages of company growth, a bad bet can destroy everything. There are no shock absorbers.

Many large companies attempt to create the spirit of entrepreneurship inside their organizations. These internal groups, or intrapreneurs, may spur more innovation, but this intrapreneurship is a far cry from the realities of entrepreneurship. These groups have far more resources than most new ventures. They are protected from feeling the immediate impact of failures and mistakes, and there’s no immediate risk of losing a paycheck.Sanjyot P. Dunung, Starting Your Business (New York: Business Expert Press, 2010), 19–20.

Surveying Your Entrepreneurial Character Traits

The survey below was developed by analyzing the character traits of entrepreneurs. It measures entrepreneurial readiness—whether one considers himself or herself an entrepreneur.

Rate each of the eleven characteristics using the following scale:

+2 = I’m very strong in this characteristic.

+1 = I possess this characteristic.

0 = I don’t know.

−1 = I have very little of this characteristic.

−2 = I don’t possess this characteristic.

| TRAIT | CIRCLE ONE CHOICE IN EACH TRAIT | |||||

|---|---|---|---|---|---|---|

| Creativity | +2 | +1 | 0 | −1 | −2 | |

| Calculated Risk Taker | +2 | +1 | 0 | −1 | −2 | |

| Self-confident | +2 | +1 | 0 | −1 | −2 | |

| Dynamic | +2 | +1 | 0 | −1 | −2 | |

| Like to Lead Others | +2 | +1 | 0 | −1 | −2 | |

| Market Savvy | +2 | +1 | 0 | −1 | −2 | |

| Resourceful | +2 | +1 | 0 | −1 | −2 | |

| Perseverant/Determined | +2 | +1 | 0 | −1 | −2 | |

| Optimistic | +2 | +1 | 0 | −1 | −2 | |

| Knowledgeable | +2 | +1 | 0 | −1 | −2 | |

| Energetic | +2 | +1 | 0 | −1 | −2 | |

| TOTAL SCORE______ | ||||||

Despite all the academic research around the world covering entrepreneurship, no reliable predictive model exists to identify who could be a successful entrepreneur. Having the traits in the chart doesn’t guarantee success, but the higher your total score, the more characteristics you possess that are similar to successful entrepreneurs.Adapted from Center for Ethics in Free Enterprise, 21st Century Entrepreneurship, Entrepreneurship Course Workbook (Jacksonville: University of North Florida Press, 1997–99), chap. 1.

Key Takeaways

- Entrepreneurship is defined as the recognition of opportunities (i.e., needs, wants, problems, and challenges) and the use or creation of resources to implement innovative ideas for new, thoughtfully planned ventures.

- The entrepreneur is a person who engages in entrepreneurship. Entrepreneurs are sometimes seen as people of very high aptitude who pioneer change. Webster’s defines an entrepreneur as “one who organizes, manages, and assumes the risks of a business or enterprise.”Webster’s Third New International Dictionary, Unabridged, s.v. “entrepreneur,” accessed November 7, 2010, http://unabridged.merriam-webster.com/cgi-bin/unabridged?va=entrepreneur&x=0&y=0.

- There are many myths about entrepreneurs—often emphasizing their luck and ability to take risks. The reality is that entrepreneurship is a skill that can be learned (not a trait that you’re born with), and that you don’t need a lot of money to start a business.

Exercises

(AACSB: Reflective Thinking, Analytical Skills)

- What is entrepreneurship?

- Who is an entrepreneur?

- What are some key characteristics of entrepreneurs?

- What are some common myths about entrepreneurs?

- What questions would you want to explore to help you better understand whether or not you want to be an entrepreneur?

11.2 What Do Entrepreneurs Do?

Learning Objectives

- Understand the different contexts in which entrepreneurship takes place.

- Know the three facets of the entrepreneurial process.

- Be able to apply the levers of opportunity identification.

What Do Entrepreneurs Do?

Entrepreneurs build for-profit and nonprofit ventures. The most well-known type of enterpreneurial venture is the for-profit, or commercial, venture, which sells products or services for a profit. Entrepreneurs can also launch a nonprofit venture whose purpose is to fulfill a social mission rather than to make money. For example, nonprofits often work to improve societal issues such as health care, the environment, and underserved populations. Entrepreneurs who launch these kinds of nonprofit ventures are often referred to as social entrepreneurs. Social entrepreneursA person who founds an organization (either for-profit or nonprofit) whose focus is to implement innovative solutions to societal problems. Social entreprenurs aim to create large-scale social change through the ventures they create. look for and implement innovative solutions to societal problems. Social entrepreneurs apply the same tools and skill sets as other entrepreneurs—seizing opportunities, organizing and managing tasks and people, improving how something is done—but their focus is to solve a social problem or create a benefit to humanity.

Entrepreneurial ventures can grow large or stay small, and they can operate at any level: local, national, or international.

Ethics in Action

Camila Batmanghelidjh

Being an entrepreneur doesn’t mean that the only option open to you is building a successful commercial business. Social entrepreneurs focus on improving people’s lives by giving them new opportunities or resources. In that sense, Camila Batmanghelidjh is a social entrepreneur.

Batmanghelidjh was honored with the United Kingdom’s Social Entrepreneur of the Year award from Ernst & Young (E&Y). She explained what drove her to found one of the United Kingdom’s most remarkable social enterprises:

I founded the Kids Company in 1996 to create a place for children who struggle against relentless deprivation and trauma. Some of these children are homeless; some have parents with drug or alcohol addictions. Some have reached the point of desperation. In some cases, their emotional exhaustion leads to passively suicidal behavior, not caring if they live, die or kill.

All manner of horrors will have been witnessed by these children. One had swallowed her mother’s methadone as a toddler. Three years later, her mother took her to a dealer’s house to collect her fix when a man burst in with a gun and threw the dealer out of a multi-storey window. The older sister of this child, barely an adolescent, was already bringing home money from prostitution.

We now look after around 5,000 children a year. We have in-school therapeutic services [and] after-school homework clubs and offer sheets and blankets for homeless children. We take them to the doctor and to sexual health clinics and support the children if they get into legal trouble. Above all, we encourage their personal and spiritual development using the arts. This is a vocational organization. We will always strive for excellence. Our workers don’t just turn up to a job; they turn up to fulfill a vision.“It’s Not Just Business, It’s Life and Death,” Ernst & Young, accessed December 24, 2010, http://www.ey.com/GL/en/About-us/Entrepreneurship/Entrepreneur-Of-The-Year/Entrepreneur-Of-The-Year---SEOY---Camila-Batmanghelidjh.

What Is the Entrepreneurial Process?

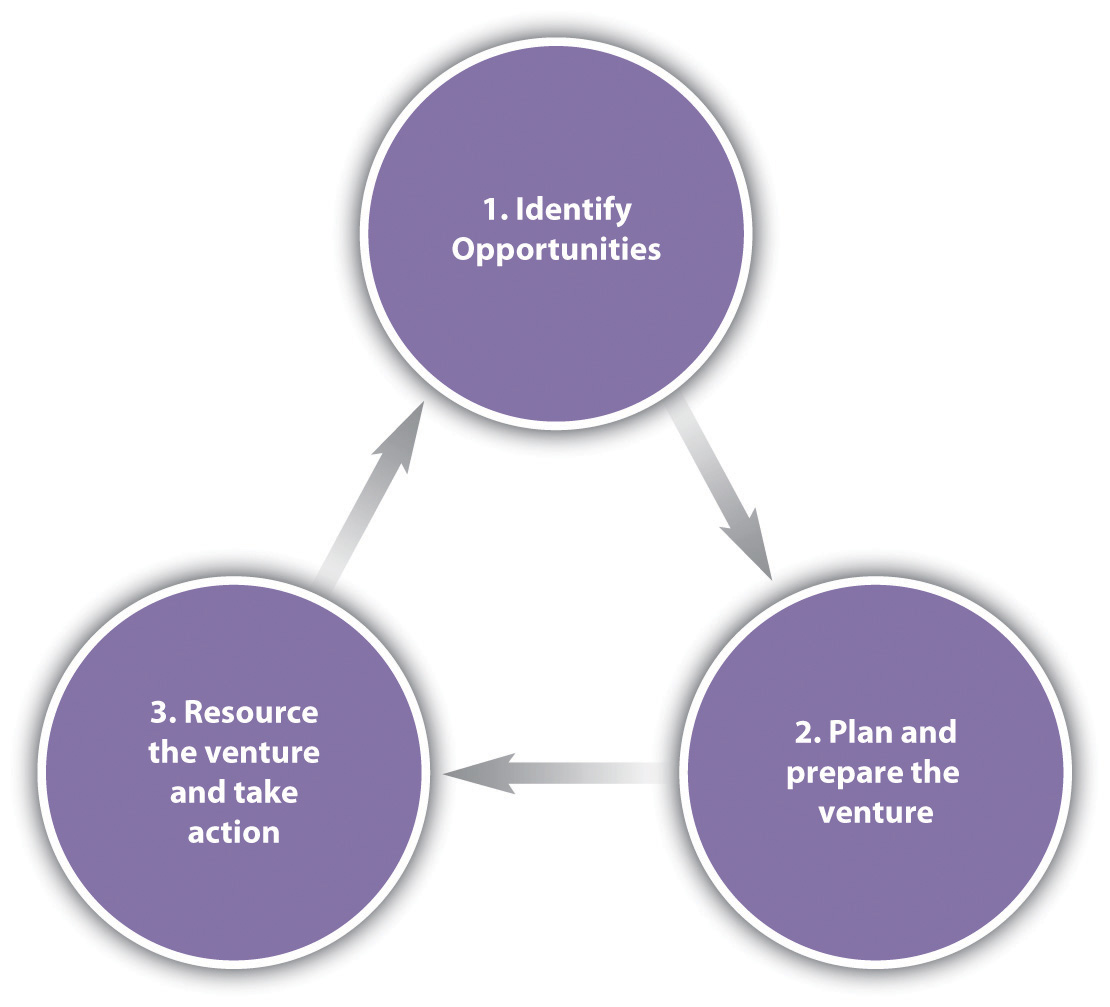

There are three essential parts of the entrepreneurial processConsists of (1) identifying entrepreneurial opportunities, (2) planning and preparing the venture, and (3) resourcing the venture and taking action.: (1) opportunity identification, (2) plan and prepare the venture, and (3) resource the venture and take action. Sometimes the process unfolds as depicted in Figure 11.1 "The Entrepreneurial Process", though there are many examples where a formal plan is never put forth, or where a plan and resources lead to the identification of a completely different opportunity. 3M’s Post-it self-adhesive notes or W. L. Gore’s Glide dental floss are examples of the latter scenario.“Inventor of the Week: Robert Gore,” MIT School of Engineering, September 2006, accessed May 5, 2011, http://web.mit.edu/invent/iow/gore.html. However, for simplicity, you’ll look at the process in the common 1-2-3 order of identifying the opportunity, planning the venture, and funding and staffing it.

Figure 11.1 The Entrepreneurial Process

Taking the Opportunity

Perhaps the biggest difference between strategy in existing firms and new ventures is the starting point. Most researchers agree that the starting point for new ventures is opportunity, while the strategy for existing firms usually begins with some assessment of the firm’s underlying resources and capabilities.Jonathan T. Eckhardt and Scott A. Shane, “Opportunities and Entrepreneurship,” Journal of Management 29, no. 3 (June 2003): 333–49; Jonathan T. Eckhardt and Scott A. Shane, “The Individual-Opportunity Nexus: A New Perspective on Entrepreneurship,” in Handbook of Entrepreneurship Research: An Interdisciplinary Survey and Introduction, ed. Zoltan J. Acs and David B. Audretsch (Boston: Kluwer, 2003), 161–91.

How Do People Find Opportunities?

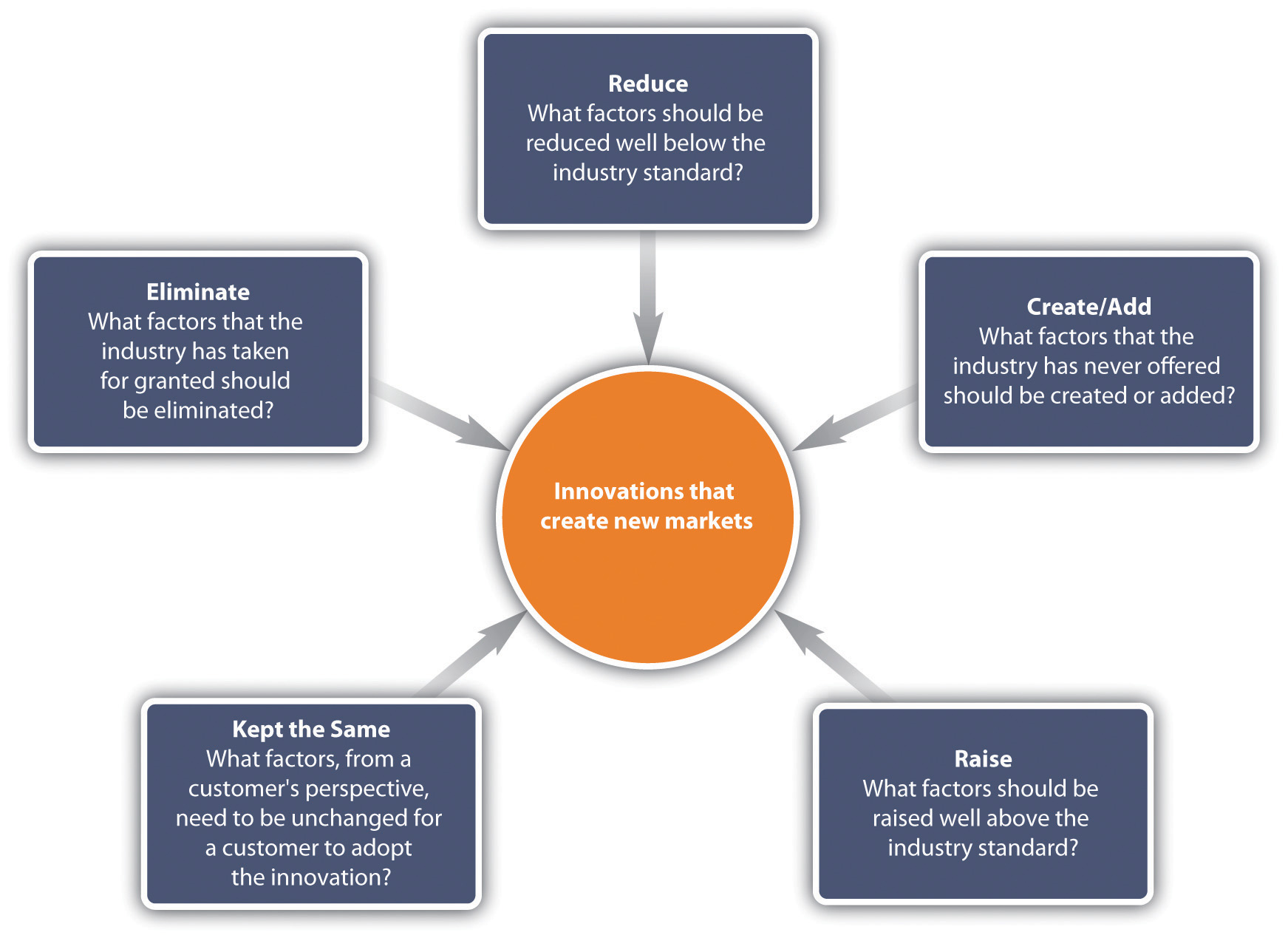

You might be surprised to learn that you already possess at least two tools that might help you unearth a valuable business opportunity. One way to think about opportunities is through a tool shown in Figure 11.2 "Levers That Lead to Opportunity Identification". The first four levers—eliminate, reduce, create, and raise—are summarized in the Blue Ocean Strategy framework made popular by strategy researchers W. Chan Kim and Renée Mauborgne.W. Chan Kim and Renée Mauborgne, “Blue Ocean Strategy: From Theory to Practice,” California Management Review 47, no. 3 (Spring 2005): 105–21. The fifth characteristic was developed through the work of their colleagues, Mason Carpenter and W. Gerry Sanders, authors of the best-selling textbook Strategic Management: A Dynamic Perspective.Mason Carpenter and William G. Sanders, Strategic Management: A Dynamic Perspective, Concepts and Cases (Upper Saddle River, NJ: Prentice Hall, 2009). The general idea behind the first four changes is that an entrepreneurial opportunity will offer something new but not necessarily because it is simply adding more features or costs. For instance, Amazon became successful because it provided a greater selection of books than any other store on the planet (increase), allowed greater convenience when shopping for books (reduced time needed), developed a logistics and software infrastructure to manage the process (create/add), and threatened to make brick-and-mortar stores obsolete (eliminate).

New markets can be created when innovations are based on these four characteristics alone. However, experience has shown that the more customers need to change their behaviors, the more slowly they will adopt an innovation. For this reason, the fifth characteristic—what stays the same—becomes a differentiating factor between innovations that take hold and those that don’t or do so more slowly. For instance, e-books have taken a long time to gain adoption, even though there are an increasing number of ways for them to be purchased and read. In contrast, Amazon’s strategy of selling printed books through an online store has worked largely because the book—the basic product—remained unchanged and thus required less change on the part of the consumer.

Research suggests that new venture opportunities tend to fall into one of three categories—new-market disruptions, low-end disruptions, or hybrid.

Figure 11.2 Levers That Lead to Opportunity Identification

Mason A. Carpenter, Managing Effectively Through Tough Times (Pearson: Upper Saddle River, NJ: Pearson, 2010).

Low-End Disruption

A disruptive technologyA technology that can make prior technologies obsolete. is a technology that can make prior technologies obsolete. For instance, the automobile was a disruptive technology for the horse-and-buggy; CD players and MP3 players were disruptive technologies for the phonograph, or record player; and the computer was a disruptive technology for the typewriter. Some disruptive technologies appear at the low end of an industry offering and are referred to as low-end disruptionsA disruptive technology that appears at the low end of an industry offering and usually does not lure customers away until it improves and becomes better than the incumbent offering.. Current players tend to ignore such new entrants because they target the least valuable of their customers. These low-end disruptions rarely offer features that satisfy the best customers in the industry. In fact, the new low-end disruptive technologies usually perform worse than the existing technology at first.Clayton Christensen, The Innovator’s Dilemma (New York: HarperBusiness, 2000), xv. For example, early automobiles were less reliable than the horse-and-buggy until improvements made them vastly better. New entrants often use low-end entry to gain a foothold to move into the attractive market once their products or services improve. Indeed, by the time they do improve, these low-end disruptions often satisfy the needs of the center of the market better than incumbents’ products do, because the new entrants have been making incremental improvements to satisfy their best clients’ demands. Southwest Airlines began as a very successful low-end disrupter, satisfying only the most basic travel needs and eliminating many services that had been taken for granted by established airlines. Over time, Southwest’s offerings improved, and its on-time arrival percentage and customer service became the best in the industry. As a result, Southwest Airlines now appeals to more than just low-end customers.

Southwest has expanded into travel for business and special events, such as NBA Legends with Slam Dunk One.

© 2011, Southwest Airlines. All rights reserved.

New-Market Disruption

A new-market disruptionA new-market disruption targets noncustomers rather than low-end customers, thus creating a new market that was previously ignored by the dominant players of the existing market. targets noncustomers rather than low-end customers. Thus, the technology creates a new market in a niche that larger players ignored because it was too small or was considered unprofitable with existing technology.

Hybrid-Disruption Strategies

As you might expect, most newcomers adopt some combination of new-market and low-end disruption strategies; these are hybrid-disruption strategiesA combination of new-market and low-end disruption strategies.. Today, it may look as if Amazon has pursued a single-minded, low-end disruption strategy, but along the way, it has also created some new markets, mainly by bringing more buyers into the market for books. Many Amazon customers buy in the quantities they do because of the information that the site makes available. The strategies of such companies as JetBlue, Charles Schwab, and the University of Phoenix are also hybrids of new-market and low-cost disruption strategies.These examples are drawn from an extensive and detailed list provided by Clayton M. Christensen and Michael E. Raynor, The Innovator’s Solution: Creating and Sustaining Successful Growth (Boston: Harvard Business School Press, 2003). JetBlue’s focused, low-cost strategy, for instance, has been able to achieve the lowest cost position in the industry by eliminating many services (a business model it borrowed from Southwest). However, it has also targeted overpriced but underserved markets, thereby stimulating net new demand. Thus, JetBlue has both taken a portion of the existing market and created a new market by attracting consumers who couldn’t ordinarily afford air travel. Schwab is another example; it pioneered discount brokerage as a new market but has since captured many clients from full-service brokers, such as Merrill Lynch. The University of Phoenix is taking a strategic path in higher education much like the one blazed by Schwab in the investment market.

All three of these disruption strategies provide you with a solid basis for identifying market opportunities.

Under all these strategies, an entrepreneur identifies an opportunity and then seeks to cobble together the resources and opportunities to exploit it. Individuals in close contact with scientific breakthroughs can also identify opportunities. In fact, scientific, technological, or process discoveries often inspire people to seek market opportunities. This is one reason why universities are increasing investments to support research faculty in the protection of intellectual property and identification of commercial opportunities. The University of Wisconsin–Madison, for instance, maintains its Office of Corporate Relations, which, among other services, assists individual researchers in the creation of new ventures. After all, faculty and staff members who create early-stage technology are often in the best position to develop it. Not only do they possess unsurpassed technical knowledge about their discoveries, but they’re also in a position to appreciate the promise that they hold.

The Business Plan

In order to secure start-up financing and launch the new product, many entrepreneurs draw up a formal business planA formal statement of a set of business goals, the reasons why they are believed attainable, and the plan for reaching those goals; it may also contain background information about the organization or team attempting to reach those goals. that brings all the elements of the new venture together for a specific purpose—namely, to ensure key stakeholders that the firm has a well-considered strategy and managerial expertise. A business plan is a formal statement of business goals, the reasons why they are attainable, and the plan for reaching those goals. It may also contain background information about the organization or team attempting to reach the goals. Even if such a plan isn’t necessary for communicating with external stakeholders, preparing one is still a good idea. At the very least, it will help you reexamine the five elements of your strategy and prompt you to look for ways to bring them together in order to create a viable and profitable firm. In addition, a business plan provides a vehicle for sharing your goals and objectives—and your plans for implementing them—with members of your entrepreneurial team. Focusing on the staging component of the five elements of strategy, for example, is a good way to set milestones and timelines and otherwise manage the scale and pace of your company’s growth. Finally, when it does come time to seek external funding to support the firm’s growth, the plan provides a solid basis for engaging professionals who can both help you get financing and advise you on strengthening customer relationships and finding strategic suppliers.

Familiarity with the five elements of strategy, implementation levers, and frameworks for analyzing external organizational context can prepare you to draw up a business plan. Although there are variations on form, the content of most plans covers the same topics. You can find a multitude of examples on the web in addition to software packages for creating a detailed and professional-looking document.See, for example, Business Plans website, accessed November 1, 2010, http://www.bplans.com; U.S. Small Business Administration website, accessed November 1, 2010, http://www.sba.gov/category/navigation-structure/starting-managing-business/starting-business/writing-business-plan; More Business website, accessed November 1, 2010, http://www.morebusiness.com; Center for Business Planning website, accessed November 1, 2010, http://www.businessplans.org. For more information, see the sidebar below for a summary of what is normally contained in a comprehensive business plan.

Contents of a Typical Business Plan

- Executive summary. This summary is one to three pages in length and highlights all the key points of the plan in a way that captures the reader’s interest. This section stresses the business concept and not the numbers. It’s the unique value proposition and business model that really matters.

- Company description. This short section describes the company’s business, form of organization, location, structure, and strategy. It provides a summary of the company’s capabilities and its goals and plans for the next five years.

- Products and services. This overview explains what products or services the company will sell; it also discusses why customers will want the products or services, what problems the offerings will solve and what benefits they will deliver, and how much customers are likely to pay for them (i.e., the willingness-to-pay criteria).

- Market analysis. This section identifies the need or demand for the product, who the target customers will be, and why the customers will buy the product. The section also includes a discussion of the company’s competitors or potential competitors, and why the product or service will have a competitive advantage over similar offerings from competitors. It also addresses the barriers to entry in this market that may prevent the entry of new competitors, such as high capital costs, difficulty in reaching customers or persuading them to switch loyalties, hard-to-get employee skills, and so forth.

- Proprietary position. If the new venture will rely on patents or licenses to patents, this section discusses how these patents will contribute to the company’s competitive position and assesses whether other patents (i.e., competitors or otherwise) might limit the company’s ability to market its products. If similar products don’t already exist, it discusses the alternative means by which customers are likely to meet the needs the product addresses.

- Marketing and sales plan. This part shows how the company plans to attract and maintain customers and discusses product pricing promotion and positioning strategy.

- Management team. The plan also describes the members of the management team, emphasizing its track record at accomplishing tasks similar to those the company will face. Investors view the management team as the most important asset that will lead to company growth and help respond to unexpected changes.

- Operations plan. Next, the plan describes how the business will operate on a day-to-day basis, explaining how the key assets (labor, processes, and tools) will be used to produce and deliver the products and services. This section includes a description of where the company will be located and where it will do business.

- Finances. This section identifies the capital that will be required to build the business and how it will be used. It includes projections of revenues and expenses that show investors how they will get their money back and what return they can expect on their investment.

Finally, a word of warning: All too often, would-be entrepreneurs tend to equate a good business plan with the probability of success in running a business. Needless to say, however, a well-crafted plan doesn’t ensure a successful business. At this point in the process, your probability of success depends more heavily on the strength of the three elements with which you started the process—a good opportunity (including the right timing), the right entrepreneurial team, and the necessary resources and capabilities. A business plan is no substitute for strategy and strong execution. That’s why consultants often suggest that entrepreneurs think of the business plan not only as a helpful and necessary starting point but also as a continuous work in progress.Jeffry A. Timmons, New Venture Creation: Entrepreneurship for the 21st Century, 5th ed. (New York: McGraw-Hill, 1999).

Resourcing the New Venture Plan with People, Money, and Action People

There is no litmus test for determining the characteristics of successful entrepreneurs or those people who make the best members of an entrepreneurial team. However, without them, a new venture will never get off the ground. Sometimes, as you might imagine, key people are among the intangible resources and capabilities that distinguish the potential new venture as an opportunity, rather than just another good idea. As a practical matter, it’s the entrepreneur who drives the entrepreneurial process and ensures that all three elements—opportunity, resources and capabilities, and people—are in place and balanced. Because individuals have limits, team members are often selected because they bring skills that complement those of the lead entrepreneur and ensure that the firm has the necessary human capital to achieve its objectives.

Money

Beyond the opportunity and the people, most entrepreneurs would identify money and access to money as one of the scarcest resources. The financing activity of the new venture can take many forms with sources ranging from credit cards to venture capitalists to banks. You might expect most successful ventures to have access to adequate capital, but you’d be surprised. In fact, many successful entrepreneurs (and their investors) suspect that too much money too early does more damage than good.Jeffry A. Timmons, New Venture Creation: Entrepreneurship for the 21st Century, 5th ed. (New York: McGraw-Hill, 1999); Amar V. Bhide, “Bootstrap Finance: The Art of Start-Ups,” Harvard Business Review, 70, no. 66 (November–December 1992): 109–17. How can excess cash possibly be a problem? Remember, first of all, that financing rarely comes without strings attached. Entrepreneurs who depend on significant cash flow from loans or investor capital often find that their flexibility is considerably reduced. Second, ample funding can obscure potential problems until the consequences are irreversible.

Perhaps most importantly, deep financial pockets shelter the new firm from the need to innovate in all aspects of its business. For example, the best new opportunities are often created by firms that have both new ideas and new, sometimes less costly ways to put those ideas work. Dell’s sustained dominance in the personal computer (PC) market, for instance, can be credited to the combination of a new direct-sales model (a new-market opportunity using catalogs and then the Internet) and the direct manufacturing model (a cheaper way of putting together the equipment sold through direct means) that it fostered. Similarly, Amazon’s prowess is equally a function of its introduction of an online book business (again, a new opportunity) and the patented online logistical expertise that the company developed to put the idea into practice (i.e., a cheaper way to merchandise).

The book you are reading (in your hands or on a screen—or “reading” through your headphones) is the most recent product of this marriage of opportunity and a new Flat World Knowledge way of doing things. Flat World is the first company to successfully seize the opportunity to develop leading-edge college textbooks and provide them simultaneously in online, portable electronic, and print-on-demand formats. Flat World has a much less costly structure per book category than competitors because it provides one title in broad categories such as principles of management, international business, entrepreneurship, marketing, and accounting. In contrast, traditional textbook publishers may have ten to fifteen titles in these categories, hoping that many small slices of the market will add up to big revenues—albeit at a much higher cost per category than what is experienced by Flat World Knowledge.

BootstrappingExploiting a new business opportunity with limited funds. means exploiting a new business opportunity with limited funds. A lot of new ventures are bootstrapped; a recent study of the five hundred fastest-growing small companies in the United States found median start-up capital to be around $20,000 in real terms.Amar V. Bhide, “Bootstrap Finance: The Art of Start-Ups,” Harvard Business Review, 70, no. 66 (November–December 1992): 109–17. Ironically, the fastest-growing firms typically require the most money because they have to support increases in inventories, accounts receivable, staffing, and production and service facilities. The most common form of bootstrapping is simply to use a personal credit card and then pay off the incurred debt. Despite the risk that taking on personal debt has, founders may opt for this method because it gives them more freedom to grow the company their own way and not have to share any equity. Many successful companies, including Dell, were founded this way.

There are different types of bootstrapping, including the following:Jay Ebbens and Alec Johnson, “Bootstrapping in Small Firms: An Empirical Analysis of Change over Time,” Journal of Business Venturing 21, no. 6 (November 2006): 851–65.

- Owner financing

- Sweat equity

- Minimization of the accounts receivable

- Joint utilization

- Delaying payment

- Minimizing inventory

- Subsidy finance

- Personal debt

Despite bootstrapping’s advantages, it may not be enough by itself. Entrepreneurs will bring in outside investors if they need a larger sum of capital than they can obtain through personal credit cards or second mortgages. In addition, outside investors can bring useful contacts, experience and accountability to the new venture. Outsiders can range from individuals like angel investorsAn affluent individual who provides capital for a business start-up. to professionals like venture capitalistsA person or investment firm that makes venture investments and brings managerial and technical expertise as well as capital to their investments., insurance companies, and public and private pension funds.

Action

One thing that does separate successful ventures (and entrepreneurs) from unsuccessful ones is a bias for actionThe propensity to act or decide without customary analysis or sufficient information., or a “propensity to act or decide without customary analysis or sufficient information” (i.e., a just-do-it-and-contemplate-later mentality). Tom Peters and Robert Waterman, authors of In Search of Excellence, identified this as a distinguishing feature of agile, entrepreneurial firms.Thomas J. Peters and Robert Waterman Jr., In Search of Excellence (New York: Grand Central Publishing, 1988), 119. This perspective is clearly articulated in the following quote from the Babson Entrepreneurship Club:

There is no substitute for action. Until you form the company and attempt to land your first partners and customers, all you really have is a paper-napkin idea. I hate to break it to you, but this country’s chock full of paper napkins. It’s short on people who will believe in themselves and give it a try. You’ll be surprised how much and how quickly you learn once the company’s up and running. For a measly few hours of your time, you’ll springboard into the category of “business owner” and become part of the select few.Babson Entrepreneurship Club, “LLC Workshop FAQ,” accessed July 1, 2010, http://life.babson.edu/organization/bec.

It’s important to note that this bias for action relates to activities guided by the business plan or core idea. The plan helps the entrepreneur make choices that make things happen, revise assumptions, and make midcourse corrections in light of new information. Without action, however, there will be no new sources of information to inform these latter parts of the entrepreneurial process.

Key Takeaways

- Entrepreneurs operate in both for-profit and nonprofit organizations.

- Entrepreneurship takes place through some combination of opportunity identification, the venture’s preparation and plan, and the resources that convert the venture plan into action. Action is a vital component; there is no substitute for action. Until the entrepreneur forms the company and attempts to land the first partners and customers, all the entrepreneur really has is an idea.

-

The levers of opportunity identification include the following:

- New-market-creation strategies that are designed to eliminate, reduce, create, or raise some previously assumed dimension of product/market supply and demand

- New-market-disruption strategies that are designed to allow a firm that has created a new market to grow into a dominant player in a new but huge industry

- Low-end-disruption strategies that identify a business that will let you shift customers from a high-cost-to-serve to a low-cost-to-serve business model

Exercises

(AACSB: Reflective Thinking, Analytical Skills)

- In what contexts does entrepreneurship take place?

- Why would entrepreneurship be important in the context of government or nonprofits?

- What is social entrepreneurship?

- What are the three facets of the entrepreneurial process?

- How might a firm disrupt an existing market?

11.3 Business Entrepreneurship across Borders

Learning Objectives

- Understand why entrepreneurship can vary across borders.

- Recognize how entrepreneurship differs from country to country.

- Access and utilize the Doing Business and Global Entrepreneurship Monitor resources.

How the Ease of Doing Business Affects Entrepreneurship across Countries

There are a number of factors that explain why the level of business entrepreneurship varies so much across countries. In 1776, Adam Smith argued in The Wealth of Nations that the free-enterprise economic system, regardless of whether it’s in the United States, Russia, or anywhere else in the world, encourages entrepreneurship because it permits individuals freedom to create and produce.Adam Smith, An Inquiry into the Nature and Causes of the Wealth of Nations (London: W. Strahan and T. Cadell, 1776). Recent versions have been edited by scholars and economists. Such a system makes it easier for entrepreneurs to acquire opportunity. Smith was focused mostly on for-profit businesses. However, constraints on the ownership of property might not necessarily constrain other types of entrepreneurship, such as social entrepreneurship.

Business entrepreneurship and social entrepreneurship are clearly related. Researchers have observed that in countries where it’s relatively easy to start a business—that is, to engage in business entrepreneurship—then it’s also comparatively easier to be a social entrepreneur as well. One useful information resource in this regard is the World Bank’s annual rankings of “doing business”—that is, the Doing Business report provides a quantitative measure of all the regulations associated with starting a business, such as hiring employees, paying taxes, enforcing contracts, getting construction permits, obtaining credit, registering property and trading across borders.Doing Business website, accessed July 2, 2010, http://www.doingbusiness.org.

Doing Business is based on the concept that economic activity requires good rules. For businesses to operate effectively, they need to know that contracts are binding, that their property and intellectual property rights are protected, and that there is a fair system for handling disputes. The rules need to be clear yet simple to follow so that things like permits can be obtained efficiently.

The World Bank’s Doing Business Project looks at laws and regulations, but it also examines time and motion indicators. Time and motion indicators measure how long it takes to complete a regulatory goal (e.g., getting a permit to operate a business).

Thanks to ten years of Doing Business data, scholars have found that lower costs of entry encourage entrepreneurship, enhance firm productivity, and reduce corruption.For example, Levon Barseghyan, “Entry Costs and Cross-Country Productivity and Output,” Journal of Economic Growth 12, no. 2 (2008): 145–67; and Leora F. Klapper, Anat Lewin, and Juan Manuel Quesada Delgado, “The Impact of the Business Environment on the Business Creation Process,” World Bank Policy Research Working Paper No. 4937, May 1, 2009. Simpler start-up regulations also translate into greater employment opportunities.For example, Roberto Chang, Linda Kaltani, and Norman V. Loayza, “Openness Can Be Good for Growth: The Role of Policy Complementarities,” Journal of Development Economics 90, no. 1 (September 2009): 33–49; Elhanan Helpman, Marc Melitz, and Yona Rubinstein, “Estimating Trade Flows: Trading Partners and Trading Volumes,” The Quarterly Journal of Economics, 123, no. 2 (May 2008): 441–87.

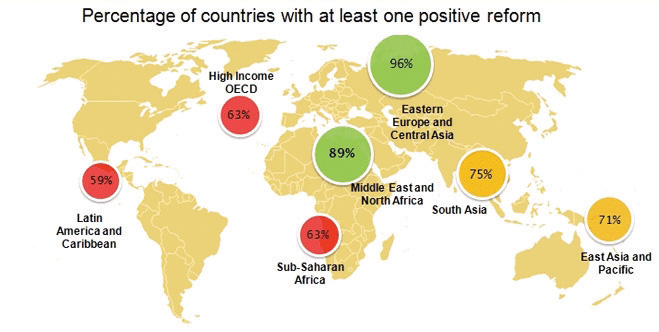

Beyond describing local business practices, one of the key objectives of the Doing Business Project is to make it easier for entrepreneurship to flourish around the world. Considerable progress has been made each year in this regard, with 2010 being noted as a record year in regard to business-regulation reform. The countries with at least one positive reform are shown in the following figure.

Source: “Percentage of Countries with at Least One Positive Reform,” Doing Business, accessed June 3, 2011, http://www.doingbusiness.org/reforms/events/~/media/FPDKM/Doing%20Business/Documents/Reforms/Events/DB10-Presentation-Arab-World.pdf.

Among the most populated countries, the World Bank suggests it’s easiest to do business in the United States, the United Kingdom, Canada, Australia, and Thailand; the most difficult large countries are Côte d’Ivoire, Angola, Cameroon, Venezuela, and the Republic of the Congo. Among the less populated countries, the easiest-to-do-business rankings go to Iceland, Mauritius, Bahrain, Estonia, and Lithuania; the most difficult are Mauritania, Equatorial Guinea, São Tomé and Príncipe, and Guinea-Bissau. You can experiment with sorting the rankings yourself by region, income, and population at http://www.doingbusiness.org/economyrankings.

Differing Attitudes about Entrepreneurship around the World

Entrepreneurship takes place depending on the economic and political climate, as summarized in the World Bank’s Doing Business surveys. However, culture also plays an important role—as well as the apparent interest among a nation’s people in becoming entrepreneurs. This interest is, of course, partly related to the ease of doing business, but the cultural facet is somewhat deeper.

Turkey, for instance, seems a ripe location for entrepreneurship because the country has relatively stable political and economic conditions. Turkey also has a variety of industries that are performing well in the strong domestic market. Third, Turkey has enough consumers who are early adopters, meaning that they will buy technologies ahead of the curve. Again, this attitude would seem to support entrepreneurism. Yet, as Jonathan Ortmans reports in his Policy Forum Blog, currently only 6 percent workers are entrepreneurs—a surprisingly low rate given the country’s favorable conditions and high level of development.Jonathan Ortmans, “Entrepreneurship in Turkey,” Policy Forum Blog, April 5, 2010, accessed July 2, 2010, http://www.entrepreneurship.org/en/Blogs/Policy-Forum-Blog/2010/April/Entrepreneurship-in-Turkey.aspx. The answer to the mystery can be found in the World Bank’s most recent report, which shows Turkey to be among the most difficult countries in which to do business. The Kauffman Foundation, on the basis of its own assessment, likewise identified many hurdles to entrepreneurship in Turkey, such as limited access to capital and a large, ponderous bureaucracy that has a tangle of regulations that are often inconsistently applied and interpreted. Despite all the regulations, intellectual property rights are poorly enforced and big established businesses strong-arm smaller suppliers.Jonathan Ortmans, “Entrepreneurship in Turkey,” Policy Forum Blog, April 5, 2010, accessed July 2, 2010, http://www.entrepreneurship.org/en/Blogs/Policy-Forum-Blog/2010/April/Entrepreneurship-in-Turkey.aspx.

However, the Kauffman study also suggests that perhaps the most difficult problem is Turkey’s culture regarding entrepreneurship and entrepreneurs. Although entrepreneurs “by necessity” are generally respected for their work ethic, entrepreneurs “by choice” (i.e., entrepreneurs who could be pursuing other employment) are often discouraged by their families and urged not to become entrepreneurs. The entrepreneurs who succeed are considered “lucky” rather than having earned their position through hard work and skill. In addition, the business and social culture does not have a concept of “win-win,” which results in larger businesses simply muscling in on smaller ones rather than encouraging their growth or rewarding them through acquisition that would provide entrepreneurs with a profitable exit. The Kauffman report concludes that Turkey is in as much need of cultural capital as financial capital.

Did You Know?

The late entrepreneur and philanthropist Ewing Marion Kauffman established the Ewing Marion Kauffman Foundation in the mid-1960s. Based in Kansas City, Missouri, the Kauffman Foundation is among the thirty largest foundations in the United States, with an asset base of approximately $2 billion.“Foundation Overview,” Ewing Marion Kauffman Foundation, accessed July 2, 2010, http://www.kauffman.org/about-foundation/foundation-overview.aspx. Here’s how Kauffman Foundation CEO Carl Schram describes the vision of the foundation and its activities:

Our vision is to foster “a society of economically independent individuals who are engaged citizens, contributing to the improvement of their communities.” In service of this vision and in keeping with our founder’s wishes, we focus our grant making and operations on two areas: advancing entrepreneurship and improving the education of children and youth. We carry out our mission through four programmatic areas: Entrepreneurship, Advancing Innovation, Education, and Research and Policy.

Though all major foundation donors were entrepreneurs, Ewing Kauffman was the first such donor to direct his foundation to support entrepreneurship, recognizing that his path to success could and should be achieved by many more people. Today, the Kauffman Foundation is the largest American foundation to focus on entrepreneurship and has more than fifteen years of in-depth experience in the field. Leaders from around the world look to us for entrepreneurship expertise and guidance to help grow their economies and expand human welfare. Our Entrepreneurship team works to catalyze an entrepreneurial society in which job creation, innovation, and the economy flourish. We work with leading educators, researchers, and other partners to further understanding of the powerful economic impact of entrepreneurship, to train the nation’s next generation of entrepreneurial leaders, to develop and disseminate proven programs that enhance entrepreneurial skills and abilities, and to improve the environment in which entrepreneurs start and grow businesses. In late 2008, the Foundation embarked on a long-term, multimillion-dollar initiative known as Kauffman Laboratories for Enterprise Creation, which, through a set of innovative programs, is seeking to accelerate the number and success of high-growth, scale firms.

In the area of Advancing Innovation, our research suggests that many innovations residing in universities are slow getting to market, and that many will never reach the market. As we look to improve this complex task, we work to research the reasons why the system is not more productive, explore ways to partner with universities, philanthropists, and industry to ensure greater output, and ultimately foster higher levels of innovative entrepreneurship through the commercialization of university-based technologies.

We believe, as did Mr. Kauffman, that investments in education should lead students on a path to self-sufficiency, preparing them to hold good-paying jobs, raise their families, and become productive citizens. Toward that end, the Foundation’s Education team focuses on providing high-quality educational opportunities that prepare urban students for success in college and life beyond; and, advancing student achievement in science, technology, engineering and math.

The Kauffman Foundation has an extensive Research and Policy program that is ultimately aimed at helping us develop effective programs and inform policy that will best advance entrepreneurship and education. To do so, our researchers must determine what we know, commit to finding the answers to what we don’t, and then apply that knowledge to how we operate as a Foundation. Kauffman partners with top-tier scholars and is the nation’s largest private funder of economic research focused on growth. Our research is contributing to a broader and more in-depth understanding of what drives innovation and economic growth in an entrepreneurial world.“Foundation Overview,” Ewing Marion Kauffman Foundation, accessed July 2, 2010, http://www.kauffman.org/about-foundation/foundation-overview.aspx.

(Click the following link to view Schram’s discussion with Charlie Rose about entrepreneurship and education: http://www.charlierose.com/view/interview/11026.)

Is there a way for you to gain insights into a country’s entrepreneurial culture and therefore better explain why entrepreneurship varies so much? While there’s no perfect answer to this—just as it’s impossible to provide you with a survey telling you whether you will be a success or a failure as an entrepreneur—you may find it of interest to compare the motivations for engaging in entrepreneurship across countries. The Global Entrepreneurship Monitor (GEM)An annual assessment of the national level of entrepreneurial activity across countries, started as a partnership between London Business School and Babson College. is a research program begun in 1999 by London Business School and Babson College. GEM does an annual standardized assessment of the national level of entrepreneurial activity in fifty-six countries. The GEM reports are available at http://www.gemconsortium.org.

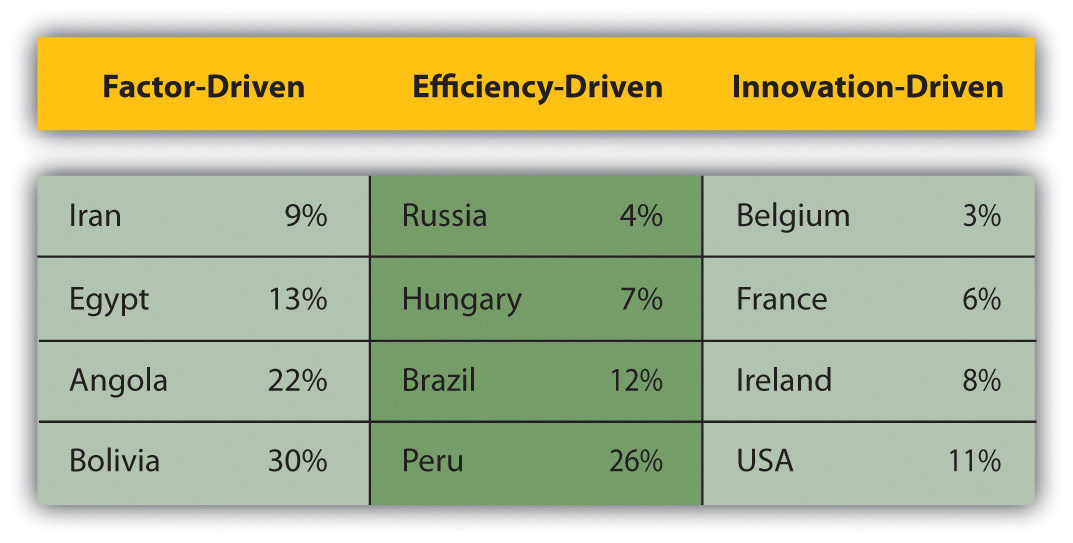

GEM shows that there are systematic differences between countries in regard to national characteristics that influence entrepreneurial activity. GEM also shows that entrepreneurial countries experience higher economic growth. On the basis of another set of surveys and the corresponding index prepared annually by the World Economic Forum (WEF),World Economic Forum website, accessed July 2, 2010, http://www.weforum.org/en/index.htm. countries are broken out in groups, including factor-driven economies (e.g., Angola, Bolivia, Bosnia and Herzegovina, Colombia, Ecuador, Egypt, India, and Iran), efficiency-driven economies (e.g., Argentina, Brazil, Chile, Croatia, Dominican Republic, Hungary, Jamaica, Latvia, Macedonia, Mexico, Peru, Romania, Russia, Serbia, South Africa, Turkey, and Uruguay), and innovation-driven economies (e.g., Belgium, Denmark, Finland, France, Germany, Greece, Iceland, Ireland, Israel, Italy, Japan, the Netherlands, Norway, Slovenia, South Korea, Spain, the United Kingdom, and the United States). Somewhat like the Doing Business survey, the WEF ranks national competitiveness in the form of a Global Competitiveness Index (GCI)System that ranks nations quantitatively according to a weighted index of twelve assessed pillars: (1) institutions, (2) infrastructure, (3) macroeconomic stability, (4) health and primary education, (5) higher education and training, (6) goods-market efficiency, (7) labor-market efficiency, (8) financial-market sophistication, (9) technological readiness, (10) market size, (11) business sophistication, and (12) innovation.. The GCI defines competitiveness as “the set of institutions, policies, and factors that determine the level of productivity of a country.” The GCI ranks nations on a weighted index of twelve assessed pillars: (1) institutions, (2) infrastructure, (3) macroeconomic stability, (4) health and primary education, (5) higher education and training, (6) goods-market efficiency, (7) labor-market efficiency, (8) financial-market sophistication, (9) technological readiness, (10) market size, (11) business sophistication, and (12) innovation.“The Global Competitiveness Report 2008-2009: US, 2008,” World Economic Forum, accessed January 18, 2011, https://members.weforum.org/pdf/gcr08/United%20States.pdf. Current and past reports are available at http://www.weforum.org/reports.

Factor-driven economiesEconomies that are highly sensitive to world economic cycles, commodity price trends, and exchange rate fluctuations; typical in countries that compete on the basis of unskilled labor and natural resources. are economies that are dependent on natural resources and unskilled labor. For example, Chad is the lowest-ranked country in the GCI, and its economy is dependent on oil reserves. Because its economy is so tied to a commodity, Chad is very sensitive to world economic cycles, commodity prices, and fluctuations in exchange rates. The pillars associated with factor-driven economies are institutions, infrastructure, macroeconomic stability, and health and primary education.

Efficiency-driven economiesEconomies that are typical in countries that compete on the basis of production processes and increased product quality., in contrast, are found in countries that have well-established higher education and training, efficient goods and labor markets, sophisticated financial markets, a large domestic or foreign market, and the capacity to harness existing technologies, which is also known as technological readiness. The economies compete on production and product quality, as Brazil does. Brazil has a per capita gross domestic product (GDP) of about $7,000.