This is “International Expansion and Global Market Opportunity Assessment”, chapter 8 from the book Challenges and Opportunities in International Business (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 8 International Expansion and Global Market Opportunity Assessment

What’s in It for Me?

- What are the inputs into global strategic move choices?

- What are the components of PESTEL analysis and the factors that favor globalization?

- What are the traditional entry modes for international expansion?

- How can you use the CAGE model of market assessment?

- What is the importance of and inputs into scenario analysis?

This chapter pulls together all the information about choosing to expand internationally and possible ways to make that choice. Section 8.1 "Global Strategic Choices" shows that choosing to expand internationally is rarely black and white. A wide variety of internationalization moves are available after choosing to expand. Moreover, some flatteners make global moves easier, while some make them more difficult. Indeed, even importing and outsourcing can be considered stealth, or at least early, steps in internationalization, because they involve doing business across borders. In Section 8.1 "Global Strategic Choices", you will learn the rationale for international expansion and the planning and due diligence it requires.

This chapter also features a richness of analytical frameworks. In Section 8.2 "PESTEL, Globalization, and Importing", you will learn about PESTEL, the framework for analyzing the political, economic, sociocultural, technological, environmental, and legal aspects of different international markets. Section 8.3 "International-Expansion Entry Modes" describes the strategies available to you when entering a new market. Section 8.4 "CAGE Analysis" will demonstrate how globalization and the CAGE (cultural, administrative, geographic, and economic) framework address questions related to the flattening of markets and how the dimensions they help you assess are essentially flatteners. Finally, in Section 8.5 "Scenario Planning and Analysis", you will learn about scenario analysis, which will prepare you to begin an analysis of which international markets might present the greatest opportunities, as well as suggest possible landmines that you could encounter when exploiting them.

Opening Case: The Invisible Global Retailer and Its Reentry into US Markets

Which corporation owns 123 companies, operates in twenty-seven countries, and has been in the mobile-phone business for over a decade? If you don’t know, you’re not alone. Many people haven’t heard of the Otto Group, the German retailing giant that’s second only to Amazon in e-commerce and first in the global mail-order business. The reason you’ve likely never heard of the Otto Group is because the firm stays in the background while giving its brands the spotlight. This strategy has worked over the company’s almost eighty-year history, and Otto continues to apply it to new moves, such as its social media site, Two for Fashion. “They are talking about fashion, not about Otto, unless it suits,” explained Andreas Frenkler, the company’s division manager of new media and e-commerce, about the site’s launch in 2008.Lydia Dishman, “How the Biggest Online Retailer You’ve Never Heard of Will Take the U.S. Market,” BNET, April 16, 2010, accessed August 20, 2010, http://www.bnet.com/blog/publishing-style/how-the-biggest-online-retailer-you-8217ve-never-heard-of-will-take-the-us-market/248. The site is now one of the top fashion blogs in Germany and is an integral part of the retailer’s marketing strategy.

Leading through Passion, Vision, and Strategy

Today, the Otto Group consists of a large number of companies that operate in the major economic zones of the world. The Otto Group’s lines of business include financial services, multichannel retail, and other services. The financial services segment covers an international portfolio of commercial services along the value chain of retail companies, such as information-, collection-, and receivable-management services. The multichannel retail segment covers the Otto Group’s worldwide range of retail offerings; goods are marketed across three distribution channels—catalogs, e-commerce, and over-the-counter (OTC) retail. The third segment combines the Otto Group’s logistics, travel, and other service providers as well as sourcing companies. Logistics service providers and sourcing companies support both the Otto Group’s multichannel retail activities and non-Group clients. Travel service providers offer customers travel offerings across all sales channels. Unique to the Otto Group is the combination of travel agencies, direct marketing, and Internet sites. The combined revenue of these three ventures is growing rapidly, even during the global economic downturn. The travel service revenues for 2010 were 10 billion euros, or about $12 billion.“Otto Group: Private Company Information,” BusinessWeek, accessed February 7, 2011, http://investing.businessweek.com/businessweek/research/stocks/private/snapshot.asp?privcapId=61882597.

Even though it operates in a variety of market segments, business ideas, and distribution channels—not to mention its regional diversity—the Otto Group sees itself as a community built on shared values. Otto’s passion for success is based on four levels of performance, which together represent the true strength of the Otto Group: “Passion for our customers, passion for innovation, passion for sustainability, and passion for integrated networking.” Each one of these performance levels is an integral element of the Otto Group’s guiding principle and self-image.“Accelerating toward New Goals,” Otto Group, accessed August 20, 2010, http://www.ottogroup.com/en/die-otto-group/daten-und-fakten/segmente.php.

Future growth is guided by the Otto Group’s Vision 2020 strategy, which is based on achieving a strong presence in all key markets of the three largest regions—Europe, North America, and Asia. In doing so, the Otto Group relies on innovative concepts in the multichannel business, on current trends in e-commerce, on OTC retail, and on developments in mobile commerce. In keeping with that vision, its focus for near-term expansion is on expanding the Group’s strong position in Russia and increasing market share in other economic areas, such as the Chinese and Brazilian markets. Investment options in core European markets are continually being reviewed to strengthen the multichannel strategy. As a global operating group, Otto aims to have a presence in all major markets and will continue to expand OTC retailing.

© 2011, Otto Group

In 2010, for instance, the Otto Group continued to develop its activities in the growth markets of Central and Eastern Europe. Through takeovers and the acquisition of further shares in various distance-selling concepts, including Quelle Russia, the Otto Group has continued to build on its market leadership in Russian mail order. A further major goal for the future is to expand OTC retail within the multichannel retail segment, making it one of the pillars of Otto alongside its e-commerce and catalog businesses. The foundations of value-oriented corporate management are reflected in the uncompromising customer orientation evident in business activities with both end consumers and corporate clients.

The strategy envisages targeted investments that provide the Otto Group with “Best in Class” business models. Otto not only draws on an excellent range of customer services as the basis for its success in its core business of multichannel retailing but also offers an array of retail-related services for its corporate clients. In the future, the company is looking to expand these services, moving beyond its core business. The buying organization of the Otto Group has been repositioned under the name Otto International and is now a firm fixture in the world’s key sourcing markets. Otto International’s corporate clients stand to benefit directly from the market power of the Otto Group while providing the volumes to make their own contribution to its growth.

The US Market Reentry Initiative

Germany remains the Otto Group’s most-important regional sales market, followed by France, the rest of Europe, North America, and Asia. In the United States, Otto set up a greenfield division called Otto International and quietly launched Field & Stream 1871, a brand of outdoor clothing, outerwear, footwear, and accessories, in 2010. The products are available only on the Field & Stream e-commerce site. As always, the Otto name is almost nowhere on the site, being visible only on the site’s privacy policy page.

Industry experts thought it surprising that Otto launched the clothing line because it had previously left the US market after its acquisition of Eddie Bauer’s parent company, Spiegel, failed in 2009.

Still, the Otto Group has received much acclaim for its innovations in the retail arena. For example, according to a Microsoft case study, Otto was the first company (1) to use telephone ordering, (2) to produce a CD-ROM version of its catalog in the 1990s (to deal with slow dial-up connections), and (3) to build one of the largest collections of online merchandise, at http://www.otto.de.“Microsoft Case Studies,” Microsoft, accessed August 20, 2010, http://www.microsoft.com/casestudies/Case_Study_Detail.aspx?CaseStudyID=200504; and “Otto Group: OTTO,” accessed February 7, 2011, http://www.ottogroup.com/otto.html?&L=0. So the Otto Group may have other innovations planned for Field & Stream. But the US fashion market is saturated with competitors. As WWD reported, Otto may do better to focus on growing its own retail brands and utilizing its impressive in-house manufacturing and logistics divisions, which are now Otto’s fastest-growing segment.Thomas Brenner, “Otto Group: A German Giant Tiptoes Back to the U.S.,” WWD, April 14, 2010, accessed February 7, 2011, http://www.wwd.com/wwd-publications/wwd/2010-04-14?id=3036440&date=today&module=tn/today#/article/retail-news/otto-group-a-german-giant-tiptoes-back-to-the-u-s--3036500?navSection=issues &navId=3036440. Otto could use these divisions to build other retail operations—while keeping a low profile, of course.

Opening Case Exercises

(AACSB: Ethical Reasoning, Multiculturalism, Reflective Thinking, Analytical Skills)

- How do non-German markets figure into the Otto Group’s strategy?

- What do you think the firm has had to do to plan for this level of international expansion?

- Which country-entry modes does the firm appear to prefer? Does it vary these modes?

- After the Otto Group failed in its first effort to enter the US market with Spiegel, why would it try again?

- How does this latest effort to enter the US market differ from its prior attempt?

8.1 Global Strategic Choices

Learning Objectives

- Learn about the rationale and motivations for international expansion.

- Understand the importance of international due diligence.

- Recognize the role of regional differences, consumer preferences, and industry dynamics.

The Why, Where, and How of International Expansion

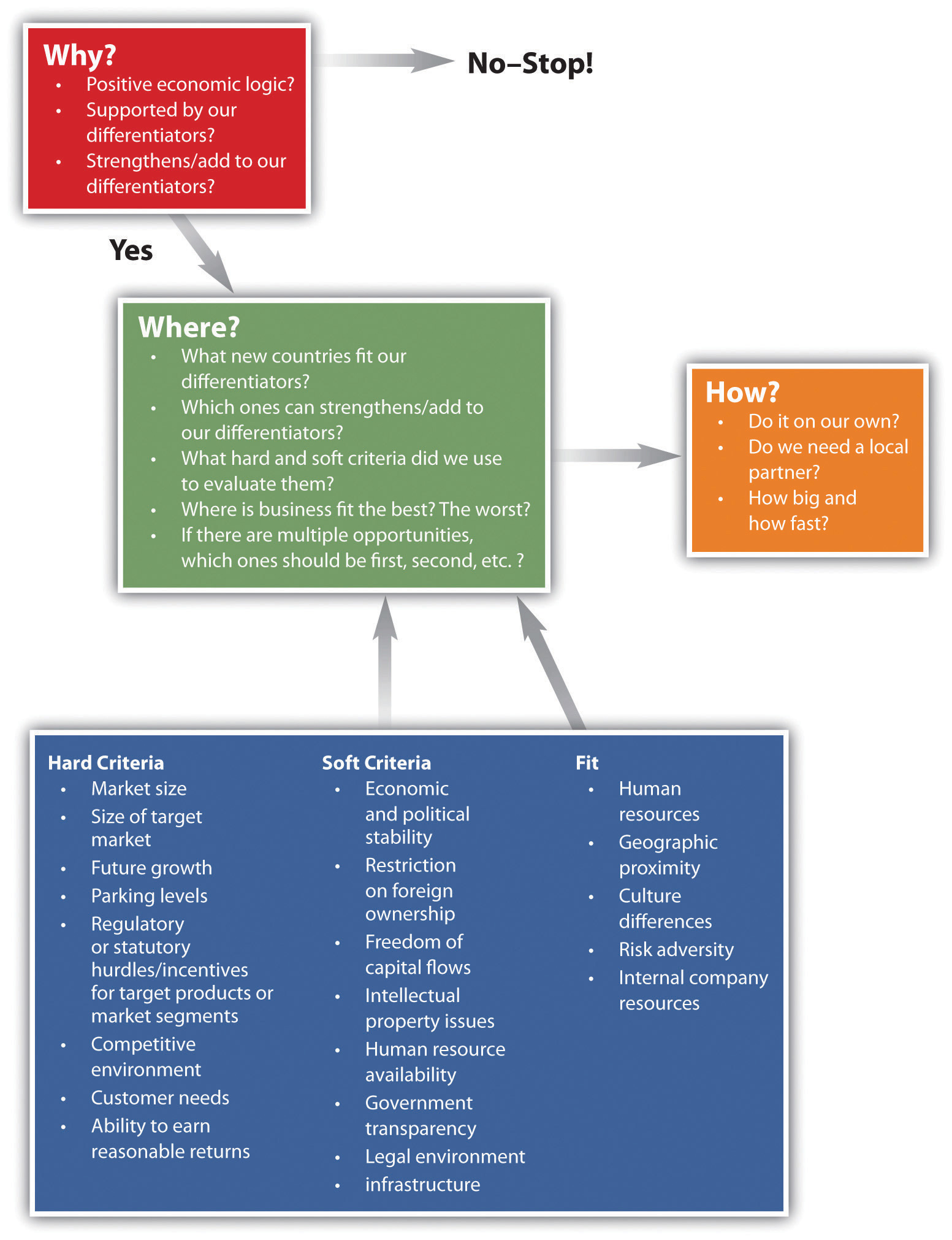

The allure of global markets can be mesmerizing. Companies that operate in highly competitive or nearly saturated markets at home, for instance, are drawn to look overseas for expansion. But overseas expansion is not a decision to be made lightly, and managers must ask themselves whether the expansion will create real value for shareholders. Companies can easily underestimate the costs of entering new markets if they are not familiar with the new regions and the business practices common within the new regions. For some companies, a misstep in a foreign market can put their entire operations in jeopardy, as happened to French retailer Carrefour after their failed entry into Chile, which you’ll see later in this section. In this section, as summarized in the following figure, you will learn about the rationale for international expansion and then how to analyze and evaluate markets for international expansion.

Rationale for International Expansion

Companies embark on an expansion strategy for one or more of the following reasons:

- To improve the cost-effectiveness of their operations

- To expand into new markets for new customers

- To follow global customers

For example, US chemical firm DuPont, Brazilian aerospace conglomerate Embraer, and Finnish mobile-phone maker Nokia are all investing in China to gain new customers. Schneider Logistics, in contrast, initially entered a new market, Germany, not to get new customers but to retain existing customers who needed a third-party logistics firm in Germany. Thus, Schneider followed its customers to Germany. Other companies, like microprocessor maker Intel, are building manufacturing facilities in China to take advantage of the less costly and increasingly sophisticated production capabilities. For example, Intel built a semiconductor manufacturing plant in Dalian, China, for $2.5 billion, whereas a similar state-of-the-art microprocessor plant in the United States can cost $5 billion.“2011 Global R&D Funding Forecast,” R&D Magazine, December 2010, accessed January 2, 2011, http://www.rdmag.com/tags/publications/global-r-and-d-funding-forecast. Intel has also built plants in Chengdu and Shanghai, China, and in other Asian countries (Vietnam and Malaysia) to take advantage of lower costs.

Planning for International Expansion

As companies look for growth in new areas of the world, they typically prioritize which countries to enter. Because many markets look appealing due to their market size or low-cost production, it is important for firms to prioritize which countries to enter first and to evaluate each country’s relative merits. For example, some markets may be smaller in size, but their strategic complexity is lower, which may make them easier to enter and easier from an operations point of view. Sometimes there are even substantial regional differences within a given country, so careful investigation, research, and planning are important to do before entry.

International Market Due Diligence

International market due diligenceInvolves analyzing foreign markets for their potential size, accessibility, cost of operations, and buyer needs and practices to aid the company in deciding whether to invest in entering that market. involves analyzing foreign markets for their potential size, accessibility, cost of operations, and buyer needs and practices to aid the company in deciding whether to invest in entering that market. Market due diligence relies on using not just published research on the markets but also interviews with potential customers and industry experts. A systematic analysis needs to be done, using tools like PESTEL and CAGE, which will be described in Section 8.2 "PESTEL, Globalization, and Importing" and Section 8.4 "CAGE Analysis", respectively. In this section, we begin with an overview.

Evaluating whether to enter a new market is like peeling an onion—there are many layers. For example, when evaluating whether to enter China, the advantage most people see immediately is its large market size. Further analysis shows that the majority of people in that market can’t afford US products, however. But even deeper analysis shows that while many Chinese are poor, the number of people who can afford consumer products is increasing.Art Kleiner, “Getting China Right,” Strategy and Business, March 22, 2010, accessed January 23, 2011, http://www.strategy-business.com/article/00026?pg=al.

Regional Differences

The next part of due diligence is to understand the regional differences within the country and to not view the country as a monolith. For example, although companies are dazzled by China’s large market size, deeper analysis shows that 70 percent of the population lives in rural areas. This presents distribution challenges given China’s vast distances. In addition, consumers in different regions speak different dialects and have different tastes in food. Finally, the purchasing power of consumers varies in the different cities. City dwellers in Shanghai and Tianjin can afford higher prices than villagers in a western province.

Let’s look at a specific example. To achieve the dual goals of reducing operations costs and being closer to a new market of customers, for instance, numerous high-tech companies identify Malaysia as an attractive country to enter. Malaysia is a relatively inexpensive country and the population’s English skills are good, which makes it attractive both for finding local labor and for selling products. But even in a small country like Malaysia, there are regional differences. Companies may be tempted to set up operations in the capital city, Kuala Lumpur, but doing a thorough due diligence reveals that the costs in Kuala Lumpur are rising rapidly. If current trends continue, Kuala Lumpur will be as expensive as London in five years. Therefore, firms seeking primarily a lower-cost advantage would do better to locate to another city in Malaysia, such as Penang, which has many of the same advantages as Kuala Lumpur but does not have its rising costs.Ajay Chamania, Heral Mehta, and Vikas Sehgal, “Five Factors for Finding the Right Site,” Strategy and Business, November 23, 2010, accessed May 17, 2011, http://www.strategy-business.com/article/10403?gko=e029a.

Understanding Local Consumers

Entering a market means understanding the local consumers and what they look for when making a purchase decision. In some markets, price is an important issue. In other markets, such as Japan, consumers pay more attention to details—such as the quality of products and the design and presentation of the product or retail surroundings—than they do to price. The Japanese demand for perfect products means that firms entering Japan might have to spend a lot on quality management. Moreover, real-estate costs are high in Japan, as are freight costs such as fuel and highway charges. In addition, space is limited at retail stores and stockyards, which means that stores can’t hold much inventory, making replenishment of products a challenge. Therefore, when entering a new market, it’s vital for firms to perform full, detailed market research in order to understand the market conditions and take measures to account for them.

How to Learn the Needs of a New Foreign Market

The best way for a company to learn the needs of a new foreign market is to deploy people to immerse themselves in that market. Larger companies, like Intel, employ ethnographers and sociologists to spend months in emerging markets, living in local communities and seeking to understand the latent, unarticulated needs of local consumers. For example, Dr. Genevieve Bell, one of Intel’s anthropologists, traveled extensively across China, observing people in their homes to find out how they use technology and what they want from it. Intel then used her insights to shape its pricing strategies and its partnership plans for the Chinese consumer market.Navi Radjou, “R&D 2.0: Fewer Engineers, More Anthropologists,” Harvard Business Review (blog), June 10, 2009, accessed January 2, 2011, http://blogs.hbr.org/radjou/2009/06/rd-20-fewer-engineers-more-ant.html.

Differentiation and Capability

When entering a new market, companies also need to think critically about how their products and services will be different from what competitors are already offering in the market so that the new offering provides customers value. Companies trying to penetrate a new market must be sure to have some proof that they can deliver to the new market; this proof could be evidence that they have spoken with potential customers and are connected to the market.“How We Do It: Strategic Tests from Four Senior Executives,” McKinsey Quarterly, January 2011, accessed January 22, 2011, https://www.mckinseyquarterly.com/PDFDownload.aspx?ar=2712&srid=27. Related to firm capability, another factor for firms to consider when evaluting which country to enter is that of “corporate fit.” Corporate fitThe degree to which the company’s existing practices, resources, and capabilties fit the new market. is the degree to which the company’s existing practices, resources and capabilties fit the new market. For example, a company accustomed to operating within a detailed, unbiased legal environment would not find a good corporate fit in China because of the current vagaries of Chinese contract law.Carol Wingard, “Ensuring Value Creation through International Expansion,” L.E.K. Consulting Executive Insights 5, no. 3, accessed January 15, 2011, http://www.lek.com/sites/default/files/Volume_V_Issue_3.pdf. Whereas a low corporate fit doesn’t preclude expanding into that country, it does signal that additional resources or caution may be necessary. Two typical dimensions of corporate fit are human resources practices and the firm’s risk tolerance.

Did You Know?

Over the years 2005–09, the number of Global 500 companies headquartered in BRIC countries (Brazil, Russia, India, and China) increased significantly. China grew from 8 headquarters to 43, India doubled from 5 to 10, Brazil rose from 5 to 9, and Russia went from 4 to 6. The United States still leads with 181 company headquarters, but it’s down from 219 in 2005.Jeanne Meister and Karie Willyerd, The 2020 Workplace (New York: HarperBusiness, 2010), 22, citing “FT500 2009,” Financial Times, accessed November 27, 2009, http://www.ft.com/reports/ft500-2009.

Industry Dynamics

In some cases, the decision to enter a new market will depend on the specific circumstances of the industry in which the company operates. For example, companies that help build infrastructure need to enter countries where the government or large companies have a lot of capital, because infrastructure projects are so expensive. The president of Spanish infrastructure company Fomento de Construcciones y Contratas said, “We focus on those countries where there is more money and there is a gap in the infrastructure,” such as China, Singapore, the United States, and Algeria.“Practical Advice for Companies Betting on a Strategy of Globalization,” Knowledge@Wharton, January 12, 2011, accessed February 5, 2011, http://knowledge.wharton.upenn.edu/article.cfm?articleid=2541.

Political stability, legal security, and the “rule of law”—the presence of and adherence to laws related to business contracts, for example—are important considerations prior to market entry regardless of which industry a company is in. Fomento de Construcciones y Contratas learned this the hard way and ended up leaving some countries it had entered. The company’s president, Baldomero Falcones, explained, “When you decide whether or not to invest, one factor to take into account is the rule of law. Our ethical code was considered hard to understand in some countries, so we decided to leave during the early stages of the investment.”“Practical Advice for Companies Betting on a Strategy of Globalization,” Knowledge@Wharton, January 12, 2011, accessed February 5, 2011, http://knowledge.wharton.upenn.edu/article.cfm?articleid=2541.

Ethics in Action

Companies based in China are entering Australia and Africa, primarily to gain access to raw materials. Trade between China and Africa grew an average of 30 percent in the decade up to 2010, reaching $115 billion that year.Paul Redfern, “Africa: Trade between China and Continent at U.S.$115 Billion a Year,” Daily Nation, February 11, 2011, accessed February 14, 2011, http://allafrica.com/stories/201102140779.html. Chinese companies operate in Zambia (mining coal), the Democratic Republic of the Congo (mining cobalt), and Angola (drilling for oil). To get countries to agree to the deals, China had to agree to build new infrastructure, such as roads, railways, hospitals, and schools. Some economists, such as Dambisa Moyo, who wrote Dead Aid: Why Aid Is Not Working and How There Is a Better Way for Africa, believe that the way to help developing countries like those in Africa is not through aid but through trade. Moyo argues that long-term charity is degrading. She advocates business investments and setting up enterprises that employ local workers. Ecobank CEO Arnold Ekpe (whose bank employs 11,000 people in twenty-six African states) says the Chinese look at Africa differently than the West does: “[The Chinese] are not setting out to do good,” he says. “They are setting out to do business. It’s actually much less demeaning.”Alex Perry, “Africa, Business Destination,” Time, March 12, 2009, accessed February 14, 2011, http://www.time.com/time/specials/packages/article/0,28804,1884779_1884782_1884769,00.html#ixzz1DwbdOXvs. Deborah Brautigam, associate professor at the American University’s International Development Program, agrees. In her book, The Dragon’s Gift: The Real Story of China in Africa, she says, “The Chinese understand something very fundamental about state building: new states need to build buildings and dignity, not simply strive to end poverty.”Steve Bloomfield, “China in Africa: Give and Take,” Emerging Markets, May 27, 2010, accessed February 14, 2011, http://www.emergingmarkets.org/Article/2580082/CHINA-IN-AFRICA-Give-and-take.html.

Steps and Missteps in International Expansion

Let’s look at an example of the steps—as well as the missteps—in international expansion. American retailers entered the Chilean market in the mid- to late 1990s. They chose Chile as the market to enter because of the country’s strong economy, the advanced level of the Chilean retail sector, and the free trade agreements signed by Chile. From that standpoint, their due diligence was accurate, but it didn’t go far enough, as we’ll see.

Retailer JCPenney entered Chile in 1995, opening two stores. French retailer Carrefour also entered Chile, in 1998. Neither company entered through an alliance with a local retailer. Both companies were forced to close their Chilean operations due to the losses they were incurring. Analysis by the Aldolfo Ibáñez University in Chile explained the reasons behind the failures: the managers of these companies were not able to connect with the local market, nor did they understand the variables that affected their businesses in Chile.“The Globalization of Chilean Retailing,” Knowledge@Wharton, December 12, 2007, accessed January 5, 2011, http://www.wharton.universia.net/index.cfm?fa=viewfeature&id=1450&language=english. Specifically, the Chilean retailing market was advanced, but it was also very competitive. The new entrants (JCPenney and Carrefour) didn’t realize that the existing major local retailers had their own banks and offered banking services at their retail stores, which was a major reason for their profitability. The outsiders assumed that profitability in this sector was based solely on retail sales. They missed the importance of the bank ties. Another typical mistake that companies make is to assume that a new market has no competition just because the company’s traditional competitors aren’t in that market.

Now let’s continue with the example and watch native Chilean retailers enter a market new to them: Peru.

Figure 8.1 Map of Peru

Source: © 2003-2011, Atma Global, Inc. All Rights Reserved.

The Chilean retailers were successful in their own markets but wanted to expand beyond their borders in order to get new customers in new markets. The Chilean retailers chose to enter Peru, which had the same language.

Figure 8.2 Machu Picchu

Source: © 2003-2011, Atma Global, Inc. All Rights Reserved.

The Peruvian retailing market was not advanced, and it did not offer credit to customers. The Chileans entered the market through partnership with local Peruvian firms, and they introduced the concept of credit cards, which was an innovation in the poorly developed Peruvian market. Entering through a domestic partner helped the Chileans because it eliminated hostility and made the investment process easier. Offering the innovation of credit cards made the Chilean retailers distinctive and offered an advantage over the local offerings.“The Globalization of Chilean Retailing,” Knowledge@Wharton, December 12, 2007, accessed January 5, 2011, http://www.wharton.universia.net/index.cfm?fa=viewfeature&id=1450&language=english.

Key Takeaways

- Companies embark on an expansion strategy for one or more of the following reasons: (1) to improve the cost-effectiveness of their operations, (2) to expand into new markets for new customers, and (3) to follow global customers.

- Planning for international expansion involves doing a thorough due diligence on the potential markets into which the country is considering expanding. This includes understanding the regional differences within markets, the needs of local customers, and the firm’s own capabilities in relation to the dynamics of the industry.

- Common mistakes that firms make when entering a new market include not doing thorough research prior to entry, not understanding the competition, and not offering a truly targeted value proposition for buyers in the new market.

Exercises

(AACSB: Reflective Thinking, Analytical Skills)

- What are some of the common motivators for companies embarking on international expansion?

- Why is international market due diligence important?

- What are some ways in which a company can learn about the needs of local buyers in a new international market?

- Discuss the meaning of “corporate fit” in relation to international market expansion.

- Name two common mistakes firms make when expanding internationally

8.2 PESTEL, Globalization, and Importing

Learning Objectives

- Know the components of PESTEL analysis.

- Recognize how PESTEL is related to the dimensions of globalization.

- Understand why importing might be a stealth form of international entry.

Know the Components of PESTEL Analysis

PESTEL analysisAn important and widely used tool that helps present the big picture of a firm’s external environment in political, economic, sociocultural, technological, environmental, and legal contexts, particularly as related to foreign markets; analyzes for market growth or decline and, therefore, the position, potential, and direction for a business. is an important and widely used tool that helps show the big picture of a firm’s external environment, particularly as related to foreign markets. PESTEL is an acronym for the political, economic, sociocultural, technological, environmental, and legal contexts in which a firm operates. A PESTEL analysis helps managers gain a better understanding of the opportunities and threats they face; consequently, the analysis aids in building a better vision of the future business landscape and how the firm might compete profitably. This useful tool analyzes for market growth or decline and, therefore, the position, potential, and direction for a business. When a firm is considering entry into new markets, these factors are of considerable importance. Moreover, PESTEL analysis provides insight into the status of key market flatteners, both in terms of their present state and future trends.

Firms need to understand the macroenvironment to ensure that their strategy is aligned with the powerful forces of change affecting their business landscape. When firms exploit a change in the environment—rather than simply survive or oppose the change—they are more likely to be successful. A solid understanding of PESTEL also helps managers avoid strategies that may be doomed to fail given the circumstances of the environment. JCPenney’s failed entry into Chile is a case in point.

Finally, understanding PESTEL is critical prior to entry into a new country or region. The fact that a strategy is congruent with PESTEL in the home environment gives no assurance that it will also align in other countries. For example, when Lands’ End, the online clothier, sought to expand its operations into Germany, it ran into local laws prohibiting it from offering unconditional guarantees on its products. In the United States, Lands’ End had built a reputation for quality on its no-questions-asked money-back guarantee. However, this was considered illegal under Germany’s regulations governing incentive offers and price discounts. The political skirmish between Lands’ End and the German government finally ended when the regulations banning unconditional guarantees were abolished. While the restrictive regulations didn’t put Lands’ End out of business in Germany, they did inhibit its growth there until the laws were abolished.

There are three steps in the PESTEL analysis. First, consider the relevance of each of the PESTEL factors to your context. Next, identify and categorize the information that applies to these factors. Finally, analyze the data and draw conclusions. Common mistakes in this analysis include stopping at the second step or assuming that the initial analysis and conclusions are correct without testing the assumptions and investigating alternative scenarios.

The framework for PESTEL analysis is presented below. It’s composed of six sections—one for each of the PESTEL headings.Mason Carpenter, Talya Bauer, and Berrin Erdogan, Principles of Management (Nyack, NY: Flat World Knowledge, 2009), accessed January 5, 2011, http://www.flatworldknowledge.com/printed-book/127834. The framework includes sample questions or prompts, the answers to which can help determine the nature of opportunities and threats in the macroenvironment. These questions are examples of the types of issues that can arise in a PESTEL analysis.

PESTEL Analysis

-

Political

- How stable is the political environment in the prospective country?

- What are the local taxation policies? How do these affect your business?

- Is the government involved in trading agreements, such as the European Union (EU), the North American Free Trade Agreement (NAFTA), or the Association of Southeast Asian Nations (ASEAN)?

- What are the country’s foreign-trade regulations?

- What are the country’s social-welfare policies?

-

Economic

- What are the current and forecast interest rates?

- What is the current level of inflation in the prospective country? What is it forecast to be? How does this affect the possible growth of your market?

- What are local employment levels per capita, and how are they changing?

- What are the long-term prospects for the country’s economy, gross domestic product (GDP) per capita, and other economic factors?

- What are the current exchange rates between critical markets, and how will they affect production and distribution of your goods?

-

Sociocultural

- What are the local lifestyle trends?

- What are the country’s current demographics, and how are they changing?

- What is the level and distribution of education and income?

- What are the dominant local religions, and what influence do they have on consumer attitudes and opinions?

- What is the level of consumerism, and what are the popular attitudes toward it?

- What pending legislation could affect corporate social policies (e.g., domestic-partner benefits or maternity and paternity leave)?

- What are the attitudes toward work and leisure?

-

Technological

- To what level do the local government and industry fund research, and are those levels changing?

- What is the local government’s and industry’s level of interest and focus on technology?

- How mature is the technology?

- What is the status of intellectual property issues in the local environment?

- Are potentially disruptive technologies in adjacent industries creeping in at the edges of the focal industry?

-

Environmental

- What are the local environmental issues?

- Are there any pending ecological or environmental issues relevant to your industry?

- How do the activities of international activist groups (e.g., Greenpeace, Earth First!, and People for the Ethical Treatment of Animals [PETA]) affect your business?

- Are there environmental-protection laws?

- What are the regulations regarding waste disposal and energy consumption?

-

Legal

- What are the local government’s regulations regarding monopolies and private property?

- Does intellectual property have legal protections?

- Are there relevant consumer laws?

- What is the status of employment, health and safety, and product safety laws?

Political Factors

The political environment can have a significant influence on businesses. In addition, political factors affect consumer confidence and consumer and business spending. For instance, how stable is the political environment? This is particularly important for companies entering new markets. Government policies on regulation and taxation can vary from state to state and across national boundaries. Political considerations also encompass trade treaties, such as NAFTA, ASEAN, and EU. Such treaties tend to favor trade among the member countries but impose penalties or less favorable trade terms on nonmembers.

Economic Factors

Managers also need to consider macroeconomic factors that will have near-term and long-term effects on the success of their strategy. Inflation rates, interest rates, tariffs, the growth of the local and foreign national economies, and exchange rates are critical. Unemployment, availability of critical labor, and the local cost of labor also have a strong bearing on strategy, particularly as related to the location of disparate business functions and facilities.

Sociocultural Factors

The social and cultural influences on business vary from country to country. Depending on the type of business, factors such as the local languages, the dominant religions, the cultural views toward leisure time, and the age and lifespan demographics may be critical. Local sociocultural characteristics also include attitudes toward consumerism, environmentalism, and the roles of men and women in society. For example, Coca-Cola and PepsiCo have grown in international markets due to the increasing level of consumerism outside the United States.

Coca-Cola has used its appeal to global consumers throughout its marketing efforts.

© 2011, The Coca-Cola Company, Inc.

Making assumptions about local norms derived from experiences in your home market is a common cause for early failure when entering new markets. However, even home-market norms can change over time, often caused by shifting demographics due to immigration or aging populations.

Technological Factors

The critical role of technology is discussed in more detail later in this section. For now, suffice it to say that technological factors have a major bearing on the threats and opportunities firms encounter. For example, new technology may make it possible for products and services to be made more cheaply and to a better standard of quality. New technology may also provide the opportunity for more innovative products and services, such as online stock trading and remote working. Such changes have the potential to change the face of the business landscape.

Environmental Factors

The environment has long been a factor in firm strategy, primarily from the standpoint of access to raw materials. Increasingly, this factor is best viewed as both a direct and indirect cost for the firm.

Environmental factors are also evaluated on the footprint left by a firm on its respective surroundings. For consumer-product companies like PepsiCo, for instance, this can encompass the waste-management and organic-farming practices used in the countries where raw materials are obtained. Similarly, in consumer markets, it may refer to the degree to which packaging is biodegradable or recyclable.

Legal Factors

Finally, legal factors reflect the laws and regulations relevant to the region and the organization. Legal factors can include whether the rule of law is well established, how easily or quickly laws and regulations may change, and what the costs of regulatory compliance are. For example, Coca-Cola’s market share in Europe is greater than 50 percent; as a result, regulators have asked that the company give shelf space in its coolers to competitive products in order to provide greater consumer choice.“EU Curbs Coca-Cola Market Dominance,” Food & Beverage Reporter, August 2005, accessed February 18, 2011, http://www.developtechnology.co.za/index.php?option=com_content&task=view&id=18464&Itemid=101.

Many of the PESTEL factors are interrelated. For instance, the legal environment is often related to the political environment, where laws and regulations can only change when they’re consistent with the political will.

PESTEL and Globalization

Over the past decade, new markets have been opened to foreign competitors, whole industries have been deregulated, and state-run enterprises have been privatized. So, globalization has become a fact of life in almost every industry.George S. Yip, “Global Strategy in a World of Nations,” Sloan Management Review 31, no. 1 (1989): 29–40. This entails much more than companies simply exporting products to another country. Some industries that aren’t normally considered global do, in fact, have strictly domestic players. But these companies often compete alongside firms with operations in multiple countries; in many cases, both sets of firms are doing equally well. In contrast, in a truly global industry, the core product is standardized, the marketing approach is relatively uniform, and competitive strategies are integrated in different international markets.Michael E. Porter, Competition in Global Industries (Boston: Harvard Business School Press, 1986); George S. Yip, “Global Strategy in a World of Nations,” Sloan Management Review 31, no. 1 (1989): 29–40. In these industries, competitive advantage clearly belongs to the firms that can compete globally.

A number of factors reveal whether an industry has globalized or is in the process of globalizing. The sidebar below groups globalization factors into four categories: markets, costs, governments, and competition. These dimensions correspond well to Thomas Friedman’s flatteners (as described in his book The World Is Flat), though they are not exhaustive.Thomas L. Friedman, The World Is Flat (New York: Farrar, Straus and Giroux, 2005).

Factors Favoring Industry Globalization

-

Markets

- Homogeneous customer needs

- Global customer needs

- Global channels

- Transferable marketing approaches

-

Costs

- Large-scale and large-scope economies

- Learning and experience

- Sourcing efficiencies

- Favorable logistics

- Arbitrage opportunities

- High research-and-development (R&D) costs

-

Governments

- Favorable trade policies

- Common technological standards

- Common manufacturing and marketing regulations

-

Competition

- Interdependent countries

- Global competitorsAdapted from Michael E. Porter, Competition in Global Industries (Boston: Harvard Business School Press, 1986); George S. Yip, “Global Strategy in a World of Nations,” Sloan Management Review 31, no. 1 (1989): 29–40.

Markets

The more similar markets in different regions are, the greater the pressure for an industry to globalize. Coca-Cola and PepsiCo, for example, are fairly uniform around the world because the demand for soft drinks is largely the same in every country. The airframe-manufacturing industry, dominated by Boeing and Airbus, also has a highly uniform market for its products; airlines all over the world have the same needs when it comes to large commercial jets.

Costs

In both of these industries, costs favor globalization. Coca-Cola and PepsiCo realize economies of scope and scale because they make such huge investments in marketing and promotion. Since they’re promoting coherent images and brands, they can leverage their marketing dollars around the world. Similarly, Boeing and Airbus can invest millions in new-product R&D only because the global market for their products is so large.

Governments and Competition

Obviously, favorable trade policies encourage the globalization of markets and industries. Governments, however, can also play a critical role in globalization by determining and regulating technological standards. Railroad gauge—the distance between the two steel tracks—would seem to favor a simple technological standard. In Spain, however, the gauge is wider than in France. Why? Because back in the 1850s, when Spain and neighboring France were hostile to one another, the Spanish government decided that making Spanish railways incompatible with French railways would hinder any French invasion.

These are a few key drivers of industry change. However, there are particular implications of technological and business-model breakthroughs for both the pace and extent of industry change. The rate of change may vary significantly from one industry to the next; for instance, the computing industry changes much faster than the steel industry. Nevertheless, change in both fields has prompted complete reconfigurations of industry structure and the competitive positions of various players. The idea that all industries change over time and that business environments are in a constant state of flux is relatively intuitive. As a strategic decision maker, you need to ask yourself this question: how accurately does current industry structure (which is relatively easy to identify) predict future industry conditions?

Importing as a Stealth Form of Internationalization

Ironically, the drivers of globalization have also given rise to a greater level of imports. Globalization in this sense is a very strong flattener. ImportingThe sale of products or services in one country that are sourced in another country. involves the sale of products or services in one country that are sourced in another country. In many ways, importing is a stealth form of internationalization. Firms often claim that they have no international operations and yet—directly or indirectly—base their production or services on inputs obtained from outside their home country. Firms that engage in importing must learn about customs requirements, informed compliance with customs regulations, entry of goods, invoices, classification and value, determination and assessment of duty, special requirements, fraud, marketing, trade finance and insurance, and foreign trade zones. Importing can take many forms—from the sourcing of components, machinery, and raw materials to the purchase of finished goods for domestic resale and the outsourcing of production or services to nondomestic providers.

OutsourcingContracting with a third party to do some of a company’s work on its behalf. occurs when a company contracts with a third party to do some work on its behalf. The outsourcer may do the work within the same country or may take the work to another country (i.e., offshoring). OffshoringTaking some business function out of the company’s country of orgin to be performed in another country, generally at a lower cost. occurs when you take a function out of your country of residence to be performed in another country, generally at a lower cost. International outsourcingThe term for both outsourcing and offshoring work, or outsourcing to a nondomestic third party., or outsourcing work to a nondomestic third party, has become very visible in business and corporate strategy in recent years. But it’s not a new phenomenon; for decades, Nike has been designing shoes and other apparel that are manufactured abroad. Similarly, Pacific Cycle doesn’t make a single Schwinn or Mongoose bicycle in the United States but instead imports them entirely from manufacturers in Taiwan and China. It may seem as if international outsourcing is new because businesses are now more often outsourcing services, components, and raw materials from countries with developing economies (e.g., China, Brazil, and India).

In addition to factors of production, information technologies (IT)—such as telecommunications and the widespread diffusion of the Internet—have provided the impetus for outsourcing services. Business-process outsourcing (BPO) is the delegation of one or more IT-intensive business processes to an external provider that in turn owns, administers, and manages the selected process on the basis of defined and measurable performance criteria. The firms in service and IT-intensive industries—insurance, banking, pharmaceuticals, telecommunications, automotive, and airlines—are among the early adopters of BPO. Of these, insurance and banking are able to generate the bulk of the savings, purely because of the large proportion of processes that they can outsource (i.e., the processing of claims and loans and providing service through call centers). Among those countries housing BPO operations, India experienced the most dramatic growth in services where language skills and education were important. Research firm Gartner anticipates that the BPO market in India will reach $1.8 billion by 2013.“Indian BPO Market to Grow 25 percent in 2010,” Times of India, March 29, 2010, accessed February 17, 2011, http://timesofindia.indiatimes.com/business/india-business/Indian-BPO-market-to-grow-25-in-2010/articleshow/5739043.cms.

Generally, foreign outsourcing locations tend to be defined by how automated a production process or service can be made and the transportation costs involved. When transportation costs and automation are both high, then the knowledge worker component of the location calculation becomes less important. You can see how you might employ the CAGE framework to evaluate potential outsourcing locations. In some cases, though, firms invest in both plant equipment and the training and development of the local workforce. This becomes important when the broader labor force needs to have a higher level of education to operate complex plant machinery or because a firm’s specific technologies also have a cultural component. Brazil is one case in point; Ford, BMW, Daimler, and Cargill have all made significant investments in the educational infrastructure of this significant, emerging economy.Spencer E. Ante, “IBM Bets on Brazilian Innovation,” BusinessWeek, August 17, 2009, accessed February 18, 2011, http://www.businessweek.com/technology/content/aug2009/tc20090817_998497.htm; “Cargill Annual Report 2006,” Cargill website, accessed October 27, 2010, http://www.cargill.com.br/wcm/groups/public/@csf/@brazil/documents/document/br-2006-annual-rpt.pdf; “Ford to Raise Brazil Investments by $281 Million,” Reuters, April 8, 2010, accessed February 18, 2011, http://www.reuters.com/article/2010/04/08/ford-brazil-idUSN0821323920100408; “Cargill Investing $210 Million in Brazilian Plant,” Forbes, February 2, 2011, accessed February 18, 2011, http://www.forbes.com/feeds/ap/2011/02/02/business-food-retailers-amp-wholesalers-us-cargill-brazil_8289031.htm.

Key Takeaways

- A PESTEL analysis examines a target market’s political, economic, social, technological, environmental, and legal dimensions in terms of both its current state and possible trends.

- An understanding of the dimensions of PESTEL helps you better grasp the dimensions on which a target market or industry may be more global or local.

- Importing is a stealth form of international entry, because the factors that favor globalization can also lead to a higher level of imports, and inputs can be sourced from anywhere they have either the lowest cost, highest quality, or some combination of these characteristics.

Exercises

(AACSB: Reflective Thinking, Analytical Skills)

- What are the components of PESTEL analysis?

- What are the four dimensions of pressures favoring globalization?

- How are the PESTEL and globalization dimensions related to the flatteners (in the context that Thomas Friedman talks about them in his book The World Is Flat)?

- Why might importing be considered a stealth form of internationalization or an internationalization entry mode?

- What is the difference between outsourcing and offshoring?

8.3 International-Expansion Entry Modes

Learning Objectives

- Describe the five common international-expansion entry modes.

- Know the advantages and disadvantages of each entry mode.

- Understand the dynamics among the choice of different entry modes.

The Five Common International-Expansion Entry Modes

In this section, we will explore the traditional international-expansion entry modes. Beyond importing, international expansion is achieved through exporting, licensing arrangements, partnering and strategic alliancesAn international entry mode involving a contractual agreement between two or more enterprises stipulating that the involved parties will cooperate in a certain way for a certain time to achieve a common purpose., acquisitions, and establishing new, wholly owned subsidiaries, also known as greenfield venturesAn international entry mode involving the establishment of a new, wholly owned subsidiary.. These modes of entering international markets and their characteristics are shown in Table 8.1 "International-Expansion Entry Modes".Shaker A. Zahra, R. Duane Ireland, and Michael A. Hitt, “International Expansion by New Venture Firms: International Diversity, Mode of Market Entry, Technological Learning, and Performance,” Academy of Management Journal 43, no. 5 (October 2000): 925–50. Each mode of market entry has advantages and disadvantages. Firms need to evaluate their options to choose the entry mode that best suits their strategy and goals.

Table 8.1 International-Expansion Entry Modes

| Type of Entry | Advantages | Disadvantages |

|---|---|---|

| Exporting | Fast entry, low risk | Low control, low local knowledge, potential negative environmental impact of transportation |

| Licensing and Franchising | Fast entry, low cost, low risk | Less control, licensee may become a competitor, legal and regulatory environment (IP and contract law) must be sound |

| Partnering and Strategic Alliance | Shared costs reduce investment needed, reduced risk, seen as local entity | Higher cost than exporting, licensing, or franchising; integration problems between two corporate cultures |

| Acquisition | Fast entry; known, established operations | High cost, integration issues with home office |

| Greenfield Venture (Launch of a new, wholly owned subsidiary) | Gain local market knowledge; can be seen as insider who employs locals; maximum control | High cost, high risk due to unknowns, slow entry due to setup time |

Exporting

Exporting is a typically the easiest way to enter an international market, and therefore most firms begin their international expansion using this model of entry. Exporting is the sale of products and services in foreign countries that are sourced from the home country. The advantage of this mode of entry is that firms avoid the expense of establishing operations in the new country. Firms must, however, have a way to distribute and market their products in the new country, which they typically do through contractual agreements with a local company or distributor. When exporting, the firm must give thought to labeling, packaging, and pricing the offering appropriately for the market. In terms of marketing and promotion, the firm will need to let potential buyers know of its offerings, be it through advertising, trade shows, or a local sales force.

Amusing Anecdotes

One common factor in exporting is the need to translate something about a product or service into the language of the target country. This requirement may be driven by local regulations or by the company’s wish to market the product or service in a locally friendly fashion. While this may seem to be a simple task, it’s often a source of embarrassment for the company and humor for competitors. David Ricks’s book on international business blunders relates the following anecdote for US companies doing business in the neighboring French-speaking Canadian province of Quebec. A company boasted of lait frais usage, which translates to “used fresh milk,” when it meant to brag of lait frais employé, or “fresh milk used.” The “terrific” pens sold by another company were instead promoted as terrifiantes, or terrifying. In another example, a company intending to say that its appliance could use “any kind of electrical current,” actually stated that the appliance “wore out any kind of liquid.” And imagine how one company felt when its product to “reduce heartburn” was advertised as one that reduced “the warmth of heart”!David A. Ricks, Blunders in International Business (Hoboken, NJ: Wiley-Blackwell, 1999), 101.

Among the disadvantages of exporting are the costs of transporting goods to the country, which can be high and can have a negative impact on the environment. In addition, some countries impose tariffs on incoming goods, which will impact the firm’s profits. In addition, firms that market and distribute products through a contractual agreement have less control over those operations and, naturally, must pay their distribution partner a fee for those services.

Ethics in Action

Companies are starting to consider the environmental impact of where they locate their manufacturing facilities. For example, Olam International, a cashew producer, originally shipped nuts grown in Africa to Asia for processing. Now, however, Olam has opened processing plants in Tanzania, Mozambique, and Nigeria. These locations are close to where the nuts are grown. The result? Olam has lowered its processing and shipping costs by 25 percent while greatly reducing carbon emissions.Michael E. Porter and Mark R. Kramer, “The Big Idea: Creating Shared Value,” Harvard Business Review, January–February 2011, accessed January 23, 2011, http://hbr.org/2011/01/the-big-idea-creating-shared-value/ar/pr.

Likewise, when Walmart enters a new market, it seeks to source produce for its food sections from local farms that are near its warehouses. Walmart has learned that the savings it gets from lower transportation costs and the benefit of being able to restock in smaller quantities more than offset the lower prices it was getting from industrial farms located farther away. This practice is also a win-win for locals, who have the opportunity to sell to Walmart, which can increase their profits and let them grow and hire more people and pay better wages. This, in turn, helps all the businesses in the local community.Michael E. Porter and Mark R. Kramer, “The Big Idea: Creating Shared Value,” Harvard Business Review, January–February 2011, accessed January 23, 2011, http://hbr.org/2011/01/the-big-idea-creating-shared-value/ar/pr.

Firms export mostly to countries that are close to their facilities because of the lower transportation costs and the often greater similarity between geographic neighbors. For example, Mexico accounts for 40 percent of the goods exported from Texas.Andrew J. Cassey, “Analyzing the Export Flow from Texas to Mexico,” StaffPAPERS: Federal Reserve Bank of Dallas, No. 11, October 2010, accessed February 14, 2011, http://www.dallasfed.org/research/staff/2010/staff1003.pdf. The Internet has also made exporting easier. Even small firms can access critical information about foreign markets, examine a target market, research the competition, and create lists of potential customers. Even applying for export and import licenses is becoming easier as more governments use the Internet to facilitate these processes.

Because the cost of exporting is lower than that of the other entry modes, entrepreneurs and small businesses are most likely to use exporting as a way to get their products into markets around the globe. Even with exporting, firms still face the challenges of currency exchange rates. While larger firms have specialists that manage the exchange rates, small businesses rarely have this expertise. One factor that has helped reduce the number of currencies that firms must deal with was the formation of the European Union (EU) and the move to a single currency, the euro, for the first time. As of 2011, seventeen of the twenty-seven EU members use the euro, giving businesses access to 331 million people with that single currency.“The Euro,” European Commission, accessed February 11, 2011, http://ec.europa.eu/euro/index_en.html.

Licensing and Franchising

LicensingAn international entry mode involving the granting of permission by the licenser to the licensee to use intellectual property rights, such as trademarks, patents, or technology, under defined conditions. and franchising are two specialized modes of entry that are discussed in more detail in Chapter 9 "Exporting, Importing, and Global Sourcing". The intellectual property aspects of licensing new technology or patents is discussed in Chapter 13 "Harnessing the Engine of Global Innovation".

Partnerships and Strategic Alliances

Another way to enter a new market is through a strategic alliance with a local partner. A strategic alliance involves a contractual agreement between two or more enterprises stipulating that the involved parties will cooperate in a certain way for a certain time to achieve a common purpose. To determine if the alliance approach is suitable for the firm, the firm must decide what value the partner could bring to the venture in terms of both tangible and intangible aspects. The advantages of partnering with a local firm are that the local firm likely understands the local culture, market, and ways of doing business better than an outside firm. Partners are especially valuable if they have a recognized, reputable brand name in the country or have existing relationships with customers that the firm might want to access. For example, Cisco formed a strategic alliance with Fujitsu to develop routers for Japan. In the alliance, Cisco decided to co-brand with the Fujitsu name so that it could leverage Fujitsu’s reputation in Japan for IT equipment and solutions while still retaining the Cisco name to benefit from Cisco’s global reputation for switches and routers.Steve Steinhilber, Strategic Alliances (Cambridge, MA: Harvard Business School Press, 2008), 113. Similarly, Xerox launched signed strategic alliances to grow sales in emerging markets such as Central and Eastern Europe, India, and Brazil. “ASAP Releases Winners of 2010 Alliance Excellence Awards,” Association for Strategic Alliance Professionals, September 2, 2010, accessed February 12, 2011, http://newslife.us/technology/mobile/ASAP-Releases-Winners-of-2010-Alliance-Excellence-Awards.

Strategic alliances are also advantageous for small entrepreneurial firms that may be too small to make the needed investments to enter the new market themselves. In addition, some countries require foreign-owned companies to partner with a local firm if they want to enter the market. For example, in Saudi Arabia, non-Saudi companies looking to do business in the country are required by law to have a Saudi partner. This requirement is common in many Middle Eastern countries. Even without this type of regulation, a local partner often helps foreign firms bridge the differences that otherwise make doing business locally impossible. Walmart, for example, failed several times over nearly a decade to effectively grow its business in Mexico, until it found a strong domestic partner with similar business values.

The disadvantages of partnering, on the other hand, are lack of direct control and the possibility that the partner’s goals differ from the firm’s goals. David Ricks, who has written a book on blunders in international business, describes the case of a US company eager to enter the Indian market: “It quickly negotiated terms and completed arrangements with its local partners. Certain required documents, however, such as the industrial license, foreign collaboration agreements, capital issues permit, import licenses for machinery and equipment, etc., were slow in being issued. Trying to expedite governmental approval of these items, the US firm agreed to accept a lower royalty fee than originally stipulated. Despite all of this extra effort, the project was not greatly expedited, and the lower royalty fee reduced the firm’s profit by approximately half a million dollars over the life of the agreement.”David A. Ricks, Blunders in International Business (Hoboken, NJ: Wiley-Blackwell, 1999), 101. Failing to consider the values or reliability of a potential partner can be costly, if not disastrous.

To avoid these missteps, Cisco created one globally integrated team to oversee its alliances in emerging markets. Having a dedicated team allows Cisco to invest in training the managers how to manage the complex relationships involved in alliances. The team follows a consistent model, using and sharing best practices for the benefit of all its alliances.Steve Steinhilber, Strategic Alliances (Cambridge, MA: Harvard Business School Press, 2008), 125.

Joint ventures are discussed in depth in Chapter 9 "Exporting, Importing, and Global Sourcing".

Did You Know?

Partnerships in emerging markets can be used for social good as well. For example, pharmaceutical company Novartis crafted multiple partnerships with suppliers and manufacturers to develop, test, and produce antimalaria medicine on a nonprofit basis. The partners included several Chinese suppliers and manufacturing partners as well as a farm in Kenya that grows the medication’s key raw ingredient. To date, the partnership, called the Novartis Malaria Initiative, has saved an estimated 750,000 lives through the delivery of 300 million doses of the medication.“ASAP Releases Winners of 2010 Alliance Excellence Awards,” Association for Strategic Alliance Professionals, September 2, 2010, accessed September 20, 2010, http://newslife.us/technology/mobile/ASAP-Releases-Winners-of-2010-Alliance-Excellence-Awards.

Acquisitions

An acquisitionAn international entry mode in which a firm gains control of another firm by purchasing its stock, exchanging stock, or, in the case of a private firm, paying the owners a purchase price. is a transaction in which a firm gains control of another firm by purchasing its stock, exchanging the stock for its own, or, in the case of a private firm, paying the owners a purchase price. In our increasingly flat world, cross-border acquisitions have risen dramatically. In recent years, cross-border acquisitions have made up over 60 percent of all acquisitions completed worldwide. Acquisitions are appealing because they give the company quick, established access to a new market. However, they are expensive, which in the past had put them out of reach as a strategy for companies in the undeveloped world to pursue. What has changed over the years is the strength of different currencies. The higher interest rates in developing nations has strengthened their currencies relative to the dollar or euro. If the acquiring firm is in a country with a strong currency, the acquisition is comparatively cheaper to make. As Wharton professor Lawrence G. Hrebiniak explains, “Mergers fail because people pay too much of a premium. If your currency is strong, you can get a bargain.”“Playing on a Global Stage: Asian Firms See a New Strategy in Acquisitions Abroad and at Home,” Knowledge@Wharton, April 28, 2010, accessed January 15, 2011, http://knowledge.wharton.upenn.edu/article.cfm?articleid=2473.

When deciding whether to pursue an acquisition strategy, firms examine the laws in the target country. China has many restrictions on foreign ownership, for example, but even a developed-world country like the United States has laws addressing acquisitions. For example, you must be an American citizen to own a TV station in the United States. Likewise, a foreign firm is not allowed to own more than 25 percent of a US airline.“Playing on a Global Stage: Asian Firms See a New Strategy in Acquisitions Abroad and at Home,” Knowledge@Wharton, April 28, 2010, accessed January 15, 2011, http://knowledge.wharton.upenn.edu/article.cfm?articleid=2473.

Acquisition is a good entry strategy to choose when scale is needed, which is particularly the case in certain industries (e.g., wireless telecommunications). Acquisition is also a good strategy when an industry is consolidating. Nonetheless, acquisitions are risky. Many studies have shown that between 40 percent and 60 percent of all acquisitions fail to increase the market value of the acquired company by more than the amount invested.“Playing on a Global Stage: Asian Firms See a New Strategy in Acquisitions Abroad and at Home,” Knowledge@Wharton, April 28, 2010, accessed January 15, 2011, http://knowledge.wharton.upenn.edu/article.cfm?articleid=2473. Additional risks of acquisitions are discussed in Chapter 9 "Exporting, Importing, and Global Sourcing".

New, Wholly Owned Subsidiary

The proess of establishing of a new, wholly owned subsidiary (also called a greenfield venture) is often complex and potentially costly, but it affords the firm maximum control and has the most potential to provide above-average returns. The costs and risks are high given the costs of establishing a new business operation in a new country. The firm may have to acquire the knowledge and expertise of the existing market by hiring either host-country nationals—possibly from competitive firms—or costly consultants. An advantage is that the firm retains control of all its operations. Wholly owned subsidiaries are discussed further in Chapter 9 "Exporting, Importing, and Global Sourcing".

Entrepreneurship and Strategy

The Chinese have a “Why not me?” attitude. As Edward Tse, author of The China Strategy: Harnessing the Power of the World’s Fastest-Growing Economy, explains, this means that “in all corners of China, there will be people asking, ‘If Li Ka-shing [the chairman of Cheung Kong Holdings] can be so wealthy, if Bill Gates or Warren Buffett can be so successful, why not me?’ This cuts across China’s demographic profiles: from people in big cities to people in smaller cities or rural areas, from older to younger people. There is a huge dynamism among them.”Art Kleiner, “Getting China Right,” Strategy and Business, March 22, 2010, accessed January 23, 2011, http://www.strategy-business.com/article/00026?pg=al. Tse sees entrepreneurial China as “entrepreneurial people at the grassroots level who are very independent-minded. They’re very quick on their feet. They’re prone to fearless experimentation: imitating other companies here and there, trying new ideas, and then, if they fail, rapidly adapting and moving on.” As a result, he sees China becoming not only a very large consumer market but also a strong innovator. Therefore, he advises US firms to enter China sooner rather than later so that they can take advantage of the opportunities there. Tse says, “Companies are coming to realize that they need to integrate more and more of their value chains into China and India. They need to be close to these markets, because of their size. They need the ability to understand the needs of their customers in emerging markets, and turn them into product and service offerings quickly.”Art Kleiner, “Getting China Right,” Strategy and Business, March 22, 2010, accessed January 23, 2011, http://www.strategy-business.com/article/00026?pg=al.

Key Takeaways

- The five most common modes of international-market entry are exporting, licensing, partnering, acquisition, and greenfield venturing.

- Each of these entry vehicles has its own particular set of advantages and disadvantages. By choosing to export, a company can avoid the substantial costs of establishing its own operations in the new country, but it must find a way to market and distribute its goods in that country. By choosing to license or franchise its offerings, a firm lowers its financial risks but also gives up control over the manufacturing and marketing of its products in the new country. Partnerships and strategic alliances reduce the amount of investment that a company needs to make because the costs are shared with the partner. Partnerships are also helpful to make the new entrant appear to be more local because it enters the market with a local partner. But the overall costs of partnerships and alliances are higher than exporting, licensing, or franchising, and there is a potential for integration problems between the corporate cultures of the partners. Acquisitions enable fast entry and less risk from the standpoint that the operations are established and known, but they can be expensive and may result in integration issues of the acquired firm to the home office. Greenfield ventures give the firm the best opportunity to retain full control of operations, gain local market knowledge, and be seen as an insider that employs locals. The disadvantages of greenfield ventures are the slow time to enter the market because the firm must set up operations and the high costs of establishing operations from scratch.

- Which entry mode a firm chooses also depends on the firm’s size, financial strength, and the economic and regulatory conditions of the target country. A small firm will likely begin with an export strategy. Large firms or firms with deep pockets might begin with an acquisition to gain quick access or to achieve economies of scale. If the target country has sound rule of law and strong adherence to business contracts, licensing, franchising, or partnerships may be middle-of-the-road approaches that are neither riskier nor more expensive than the other options.

Exercises

(AACSB: Reflective Thinking, Analytical Skills)

- What are five common international entry modes?

- What are the advantages of exporting?

- What is the difference between a strategic alliance and an acquisition?

- What would influence a firm’s choice of the five entry modes?

- What is the possible relationship among the different entry modes?

8.4 CAGE Analysis

Learning Objectives

- Understand the inputs into CAGE analysis.

- Know the reasons why CAGE analysis emphasizes distance.

- See how CAGE analysis can help you identify institutional voids.

The Inputs into CAGE Analysis

Pankaj “Megawatt” Ghemawat is an international strategy guru who developed the CAGE frameworkThe analytical framework used to understand country and regional differences along the distance dimensions of culture, administration, geography, and economics. to offer businesses a way to evaluate countries in terms of the “distance” between them.Pankaj Ghemawat, “Distance Still Matters,” Harvard Business Review 79, no. 8 (September 2001): 1–11. In this case, distance is defined broadly to include not only the physical geographic distance between countries but also the cultural, administrative (currencies, trade agreements), and economic differences between them. As summarized in Table 8.2 "The CAGE Framework", the CAGE (cultural, administrative, geographic, and economic) framework offers a broader view of distance and provides another way of thinking about location and the opportunities and concomitant risks associated with global arbitrage.Pankaj Ghemawat, “The Forgotten Strategy,” Harvard Business Review 81, no. 11 (September 2003).

Table 8.2 The CAGE Framework

| Cultural Distance | Administrative Distance | Geographic Distance | Economic Distance |

|---|---|---|---|

| Attributes Creating Distance | |||

| Different languages | Absence of colonial ties | Physical remoteness | Differences in consumer incomes |

| Different ethnicities; lack of connective ethnic or social networks | Absence of shared monetary or political association | Lack of a common border |

Differences in costs and quality of the following: • Natural resources • Financial resources • Human resources • Infrastructure • Intermediate inputs • Information or knowledge |

| Different religions | Political hostility | Lack of sea or river access | |

| Different social norms | Government policies | Size of country | |

| Institutional weakness | Weak transportation or communication links | ||

| Differences in climates | |||

| Industries or Products Affected by Distance | |||

| Products have high-linguistic content (TV). |

Government involvement is high in industries that are • producers of staple goods (electricity), • producers of other “entitlements” (drugs), • large employers (farming), • large suppliers to government (mass transportation), • national champions (aerospace), • vital to national security (telecommunications), • exploiters of natural resources (oil, mining), and • subject to high-sunk costs (infrastructure). |

Products have a low value-of-weight or bulk ratio (cement). | Nature of demand varies with income level (cars). |

| Products affect cultural or national identity of consumers (foods). | Products are fragile or perishable (glass or fruit). | Economies of standardization or scale are important (mobile phones). | |

| Product features vary in terms of size (cars), standards (electrical appliances), or packaging. | Communications and connectivity are important (financial services). | Labor and other factor cost differences are salient (garments). | |

| Products carry country-specific quality associations (wines). | Local supervision and operational requirements are high (many services). | Distribution or business systems are different (insurance). | |

| Companies need to be responsive and agile (home appliances). | |||

Source: Recreated from Pankaj Ghemawat, “Distance Still Matters,” Harvard Business Review 79, no. 8 (September 2001), accessed February 15, 2011, http://sabanet.unisabana.edu.co/postgrados/finanzas_negocios/Homologacion/negociosint/Distance%20still%20matters.pdf.